Indiana Assessing the Primary Activities in the Value Chain

Description

How to fill out Assessing The Primary Activities In The Value Chain?

If you wish to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online.

Leverage the site’s straightforward and user-friendly search to find the documents you require.

A multitude of templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Process the transaction. You can utilize your credit card or PayPal account to complete the purchase.

Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Indiana Assessing the Primary Activities in the Value Chain. Every legal document template you purchase is your property forever. You have access to every form you acquired in your account. Click the My documents section and choose a form to print or download again. Compete and download, and print the Indiana Assessing the Primary Activities in the Value Chain with US Legal Forms. There are millions of professional and state-specific forms you can use for your personal or business needs.

- Utilize US Legal Forms to locate the Indiana Assessing the Primary Activities in the Value Chain with just a few clicks.

- If you are a current US Legal Forms user, Log In to your account and proceed to click on the Obtain button to retrieve the Indiana Assessing the Primary Activities in the Value Chain.

- You can also access forms you have previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the steps outlined below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Utilize the Review option to assess the form’s material. Remember to check the description.

- Step 3. If you are unsatisfied with the document, use the Lookup field at the top of the screen to find additional forms within the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan that suits you and provide your details to register for an account.

Form popularity

FAQ

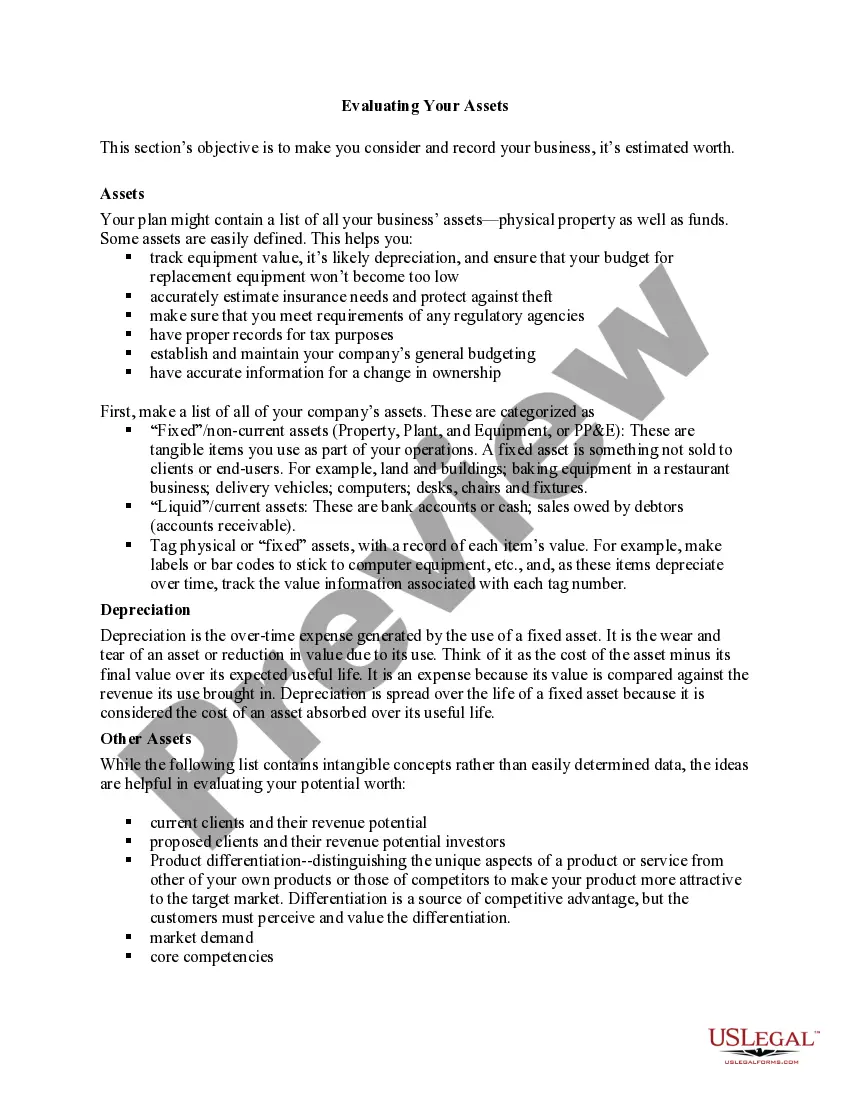

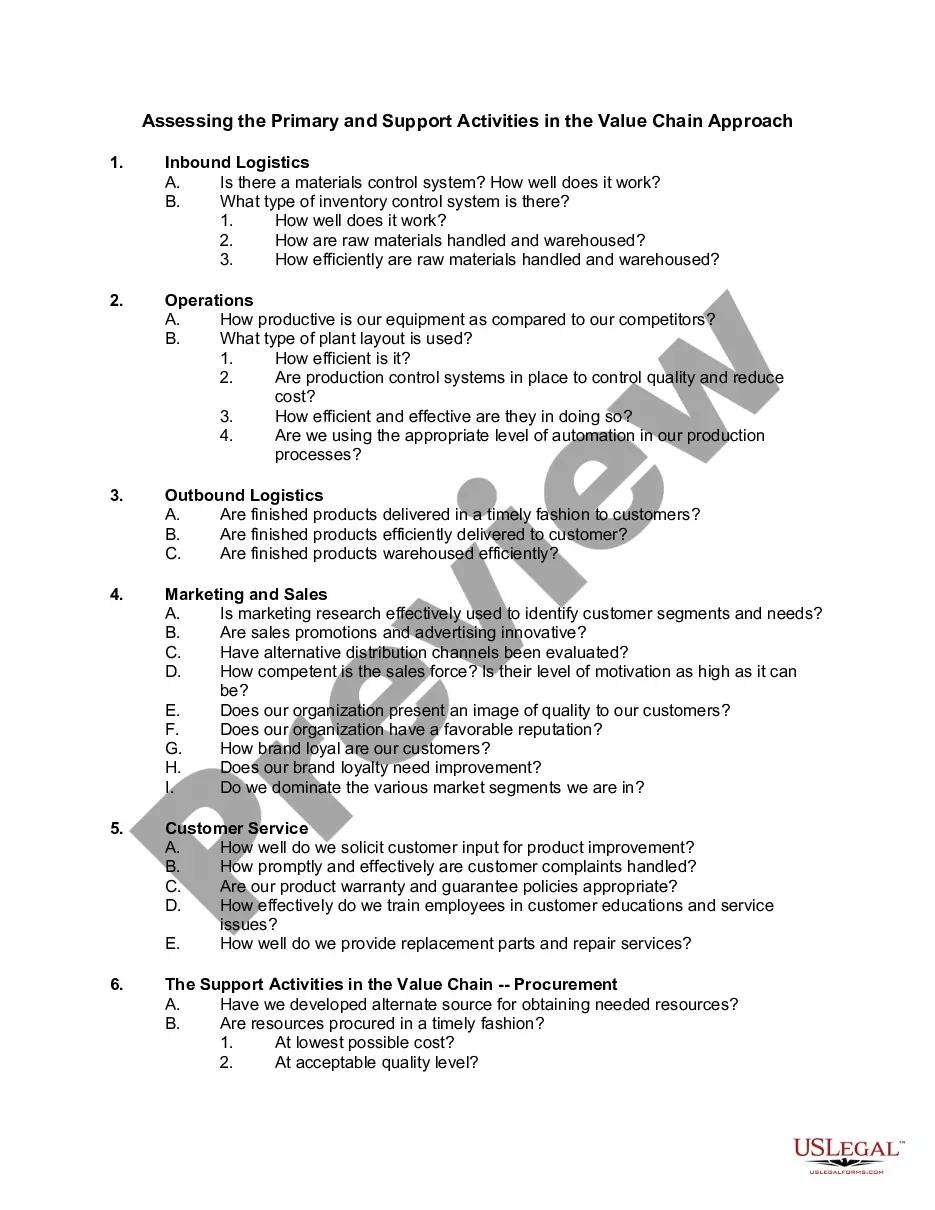

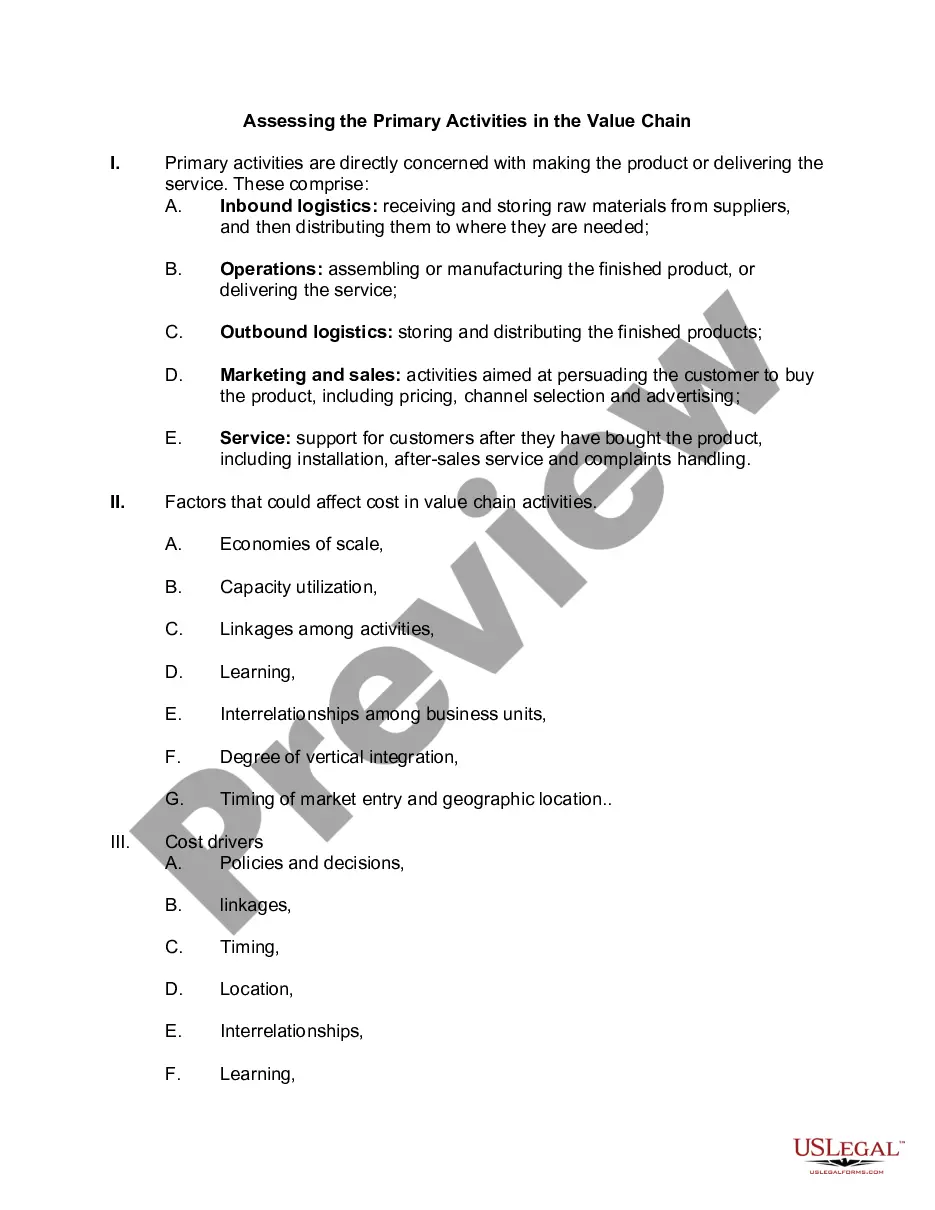

The components of the value chain include primary activities such as inbound logistics, operations, outbound logistics, marketing and sales, and service, along with support activities like procurement, technology development, human resource management, and firm infrastructure. Each component plays a significant role in enhancing value and ensuring business success. In Indiana, assessing the primary activities in the value chain aids businesses in pinpointing strengths and weaknesses. By analyzing all components, companies can formulate strategies to improve efficiency and effectiveness.

To fill out a value chain, start by mapping each primary activity and support activity your business engages in during the creation of a product or service. Identify the resources and stakeholders involved at each stage, and evaluate how each activity contributes to overall value. In Indiana, assessing the primary activities in the value chain provides clear insights into what to improve or change. Using tools like US Legal Forms can simplify this process, enabling companies to streamline their value chain effectively.

An example of a primary activity in the value chain is operations, where a company transforms inputs into final products. This step is crucial for delivering value to customers, as it directly affects quality and production efficiency. In Indiana, assessing the primary activities in the value chain can uncover areas for better operational practices. By focusing on this activity, businesses can enhance productivity and customer satisfaction.

The five forces of the value chain include inbound logistics, operations, outbound logistics, marketing and sales, and service. Each of these forces plays a critical role in enhancing overall value. In Indiana, assessing the primary activities in the value chain helps businesses identify opportunities for improvement and efficiency. Understanding these forces allows organizations to optimize their processes and deliver better value to customers.

No, $80,000 does not qualify as a personal property tax exemption in Indiana. Most exemptions are specific to certain property types or uses, and generally, the taxable personal property is valued above this threshold. Engaging with resources that explain Indiana Assessing the Primary Activities in the Value Chain can clarify your obligations.

In Indiana, personal property tax applies to tangible assets owned by individuals and businesses, such as machinery, tools, and vehicles. However, certain exemptions may apply, depending on the use and nature of the property. Staying informed about these regulations can simplify your understanding of Indiana Assessing the Primary Activities in the Value Chain.

Calculating the amount of $80,000 after taxes in Indiana involves considering the state's tax rates, which can vary based on income and local taxes. Typically, taxpayers can expect to take home a percentage of that amount after state and local taxes are deducted. For accurate estimations, reviewing Indiana Assessing the Primary Activities in the Value Chain can provide invaluable insights.

Personal property tax in Indiana is levied on movable assets that are not real estate, such as vehicles, equipment, and machinery. Businesses and individuals must file a personal property return annually to report these assets. Navigating the intricacies of this tax is part of Indiana Assessing the Primary Activities in the Value Chain, which affects local economies.

A personal property exemption in Indiana refers to specific allowances that reduce the taxable value of personal property. This may apply to individuals or businesses owning tangible assets necessary for daily operations or personal use. Understanding the implications of such exemptions is crucial as it relates to Indiana Assessing the Primary Activities in the Value Chain.

In Indiana, the personal exemption typically allows individuals to deduct a portion of their income from taxable income. The state provides a standard exemption amount for residents, which can be adjusted based on the current tax regulations. This exemption reflects Indiana's commitment to optimizing the value chain in assessing residents' financial responsibilities.