A Flexible Benefits Plan benefits is a plan that allows employees to select from a pool of choices, some or all of which may be tax-advantaged. Potential choices include cash, retirement plan contributions, vacation days, and insurance. It is also called a cafeteria plan.

Indiana Medical Care Reimbursement Request - Flexible Benefits Plan

Description

How to fill out Medical Care Reimbursement Request - Flexible Benefits Plan?

Selecting the most suitable authentic document template can be a challenge.

Of course, there are numerous templates accessible online, but how do you identify the authentic type you need.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Indiana Medical Care Reimbursement Request - Flexible Benefits Plan, that you can employ for professional and personal purposes.

Firstly, ensure you have selected the correct form for your location/state. You can browse the document using the Review button and examine the document details to confirm it is suitable for you.

- All documents are reviewed by professionals and satisfy state and federal requirements.

- If you are already registered, Log In to your account and click the Acquire button to locate the Indiana Medical Care Reimbursement Request - Flexible Benefits Plan.

- Utilize your account to search for the authentic documents you have previously acquired.

- Visit the My documents section of your account to download another copy of the form you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

Form popularity

FAQ

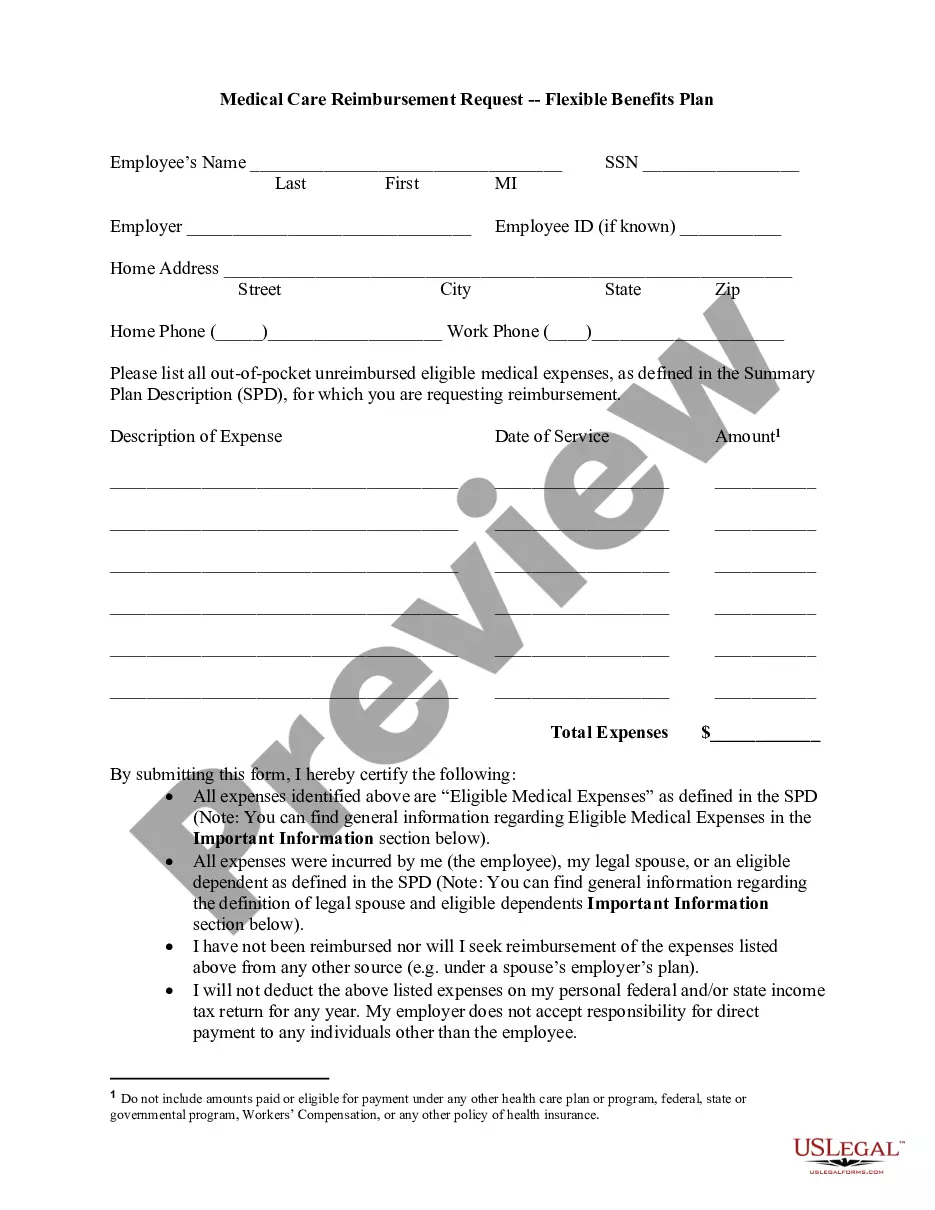

FSA medical reimbursement refers to the funds available in a Flexible Spending Account that can be used for qualified medical expenses. When you submit an Indiana Medical Care Reimbursement Request - Flexible Benefits Plan, you seek reimbursement from your account for eligible expenses such as co-pays, prescriptions, and other medical costs. Utilizing this benefit helps you save on taxes while effectively managing your healthcare expenses. If you're looking to maximize your benefits with a user-friendly process, consider using the USLegalForms platform to streamline your reimbursement requests.

To submit an FSA reimbursement, start by gathering all relevant receipts and filling out the required claim form for your Indiana Medical Care Reimbursement Request - Flexible Benefits Plan. Depending on your FSA provider, you may submit your claim online, via mail, or in person. It's essential to be thorough and accurate to prevent delays in processing. You may find helpful templates and guidance on how to complete the reimbursement process efficiently on the uslegalforms platform.

Yes, submitting receipts for your FSA is generally necessary to validate your Indiana Medical Care Reimbursement Request - Flexible Benefits Plan. These receipts serve as proof that the expenses you claimed are eligible for reimbursement. Your benefits provider may specify what type of documentation they require, so it's wise to check those details beforehand. Keeping organized records will help simplify the process.

To receive reimbursement from your FSA, you need to submit an Indiana Medical Care Reimbursement Request - Flexible Benefits Plan claim, along with any required receipts. Once your claim is processed and approved, the funds will be either mailed to you or directly deposited into your bank account, depending on your chosen method. Be sure to check the processing timeline, as it can vary by provider. If you have any questions about the process, consider using the resources available on the uslegalforms platform.

To submit a claim for your Flexible Spending Account (FSA), you need to fill out the claim form provided by your benefits administrator. After completing the form, attach any necessary documentation that supports your Indiana Medical Care Reimbursement Request - Flexible Benefits Plan. Next, submit the form through the designated method, which could be online, by mail, or in person. Ensure you keep copies of everything you send for your records.

Medical flexible spending typically qualifies a range of healthcare costs, including doctor visits, prescriptions, and certain over-the-counter items. It’s important to keep all relevant receipts and documentation of these expenses. The Indiana Medical Care Reimbursement Request - Flexible Benefits Plan can help clarify what expenses are eligible, ensuring you make the most of your flexible spending account.

One potential downside of a flexible benefit plan is the risk of losing unused funds at the end of the plan year. Some plans operate on a 'use-it-or-lose-it' basis, which means careful planning is essential. However, with the Indiana Medical Care Reimbursement Request - Flexible Benefits Plan, you can mitigate this risk by understanding eligible expenses and planning your healthcare spending wisely.

To receive your FSA reimbursement, first, gather your receipts for eligible expenses. Then, submit a reimbursement request through your plan's designated process, which may include an online portal or paper forms. The Indiana Medical Care Reimbursement Request - Flexible Benefits Plan simplifies this process, ensuring you receive your funds quickly and easily.

Flexible medical benefits provide employees with a variety of options for managing their healthcare expenses. These benefits often include health savings accounts, medical reimbursements, and access to a network of providers. The Indiana Medical Care Reimbursement Request - Flexible Benefits Plan enhances your ability to choose how you spend your healthcare dollars.

A flexible spending benefit plan allows you to set aside a portion of your paycheck before taxes to cover out-of-pocket medical expenses. This means you can effectively lower your taxable income while preparing for future medical costs. Enrolling in the Indiana Medical Care Reimbursement Request - Flexible Benefits Plan ensures you utilize this savings strategy effectively.