Indiana Equipment Lease Checklist

Description

How to fill out Equipment Lease Checklist?

If you aim to be thorough, download, or create legal document templates, use US Legal Forms, the largest assortment of legal documents available online.

Utilize the site’s easy and user-friendly search to locate the files you need.

A selection of templates for business and personal purposes are organized by categories and states or keywords.

Step 4. Once you’ve found the form you want, click the Purchase Now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Access the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Indiana Equipment Lease Checklist. Every legal document template you buy is yours indefinitely. You have access to every form you acquired in your account. Choose the My documents section and select a form to print or download again. Compete and download, and print the Indiana Equipment Lease Checklist with US Legal Forms. There are many professional and state-specific templates you can use for your business or personal needs.

- Use US Legal Forms to find the Indiana Equipment Lease Checklist in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Indiana Equipment Lease Checklist.

- You can also access documents you've previously obtained from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you've selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form's content. Be sure to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Yes, ASC 842 does apply to equipment leases and impacts how they are recorded on financial statements. This accounting standard requires companies to recognize lease liabilities and right-of-use assets on their balance sheets. For a comprehensive understanding of how this affects your leases, refer to the Indiana Equipment Lease Checklist, which can help guide your compliance.

Yes, a handwritten lease agreement can be legally binding as long as it includes all essential elements and is signed by both parties. However, clarity and detail matter greatly in such cases. Consulting the Indiana Equipment Lease Checklist can help you ensure that your handwritten agreement meets all legal criteria.

In Indiana, leases do not typically require notarization to be enforceable. However, notarization can serve as a safeguard against potential disputes in the future. To navigate this and make informed decisions, reference the Indiana Equipment Lease Checklist for best practices.

Yes, a lease agreement remains legal even if it is not notarized. The essential factor is that both parties must mutually agree to the terms and sign the agreement. While not notarization isn't necessary, following the Indiana Equipment Lease Checklist can help ensure that all critical details are addressed.

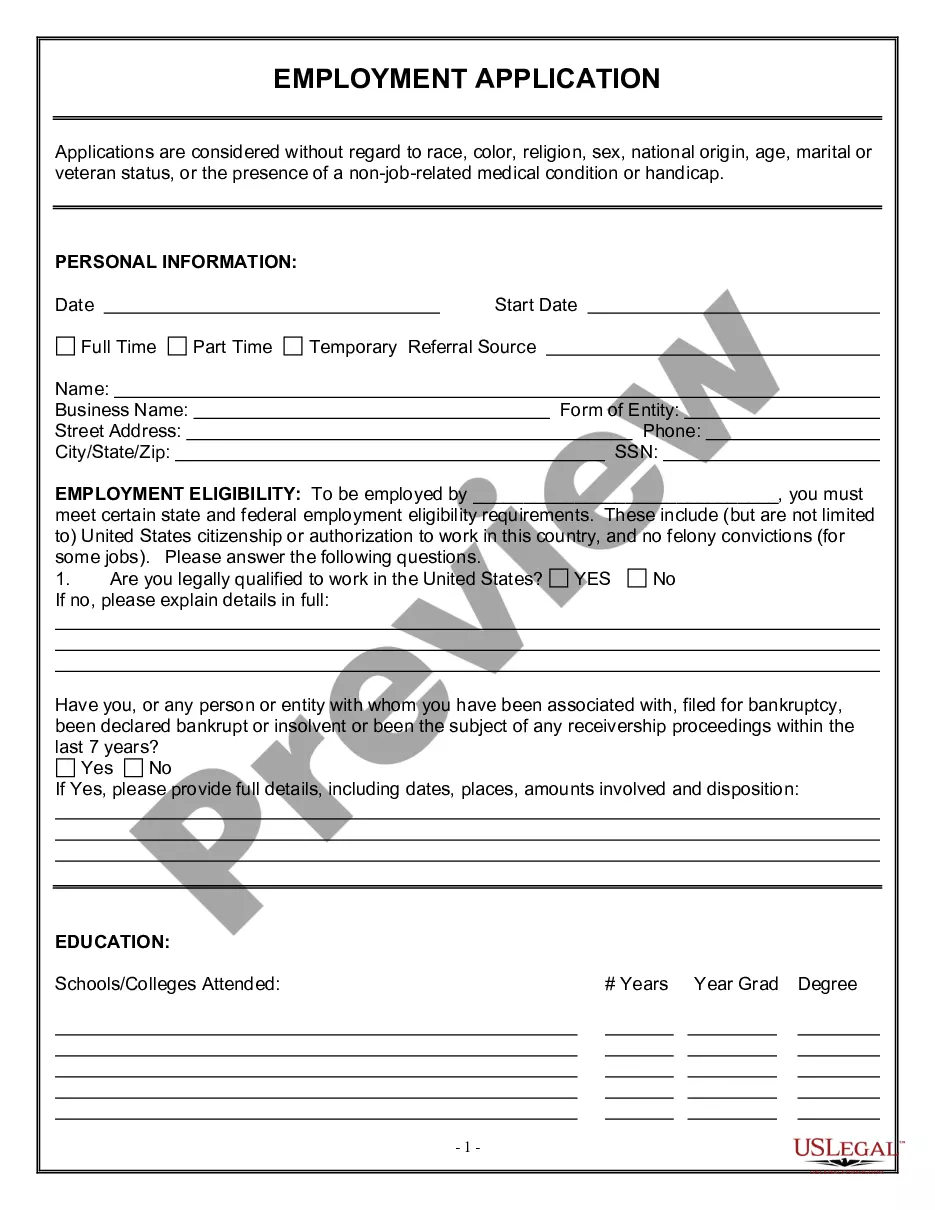

When signing a lease, both parties typically need to provide identification and any relevant documentation verifying their identities and authority to enter into the lease. Additionally, you should review the lease terms carefully. Utilizing the Indiana Equipment Lease Checklist can streamline this process and highlight necessary documents.

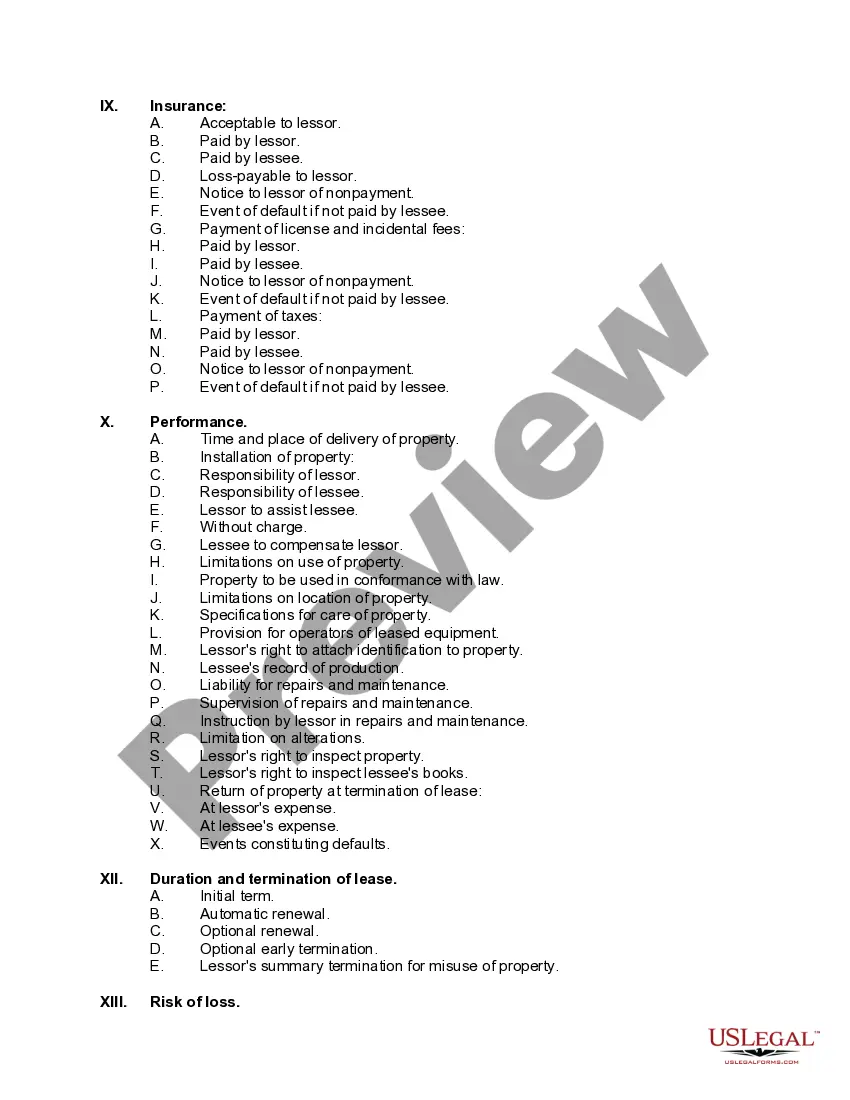

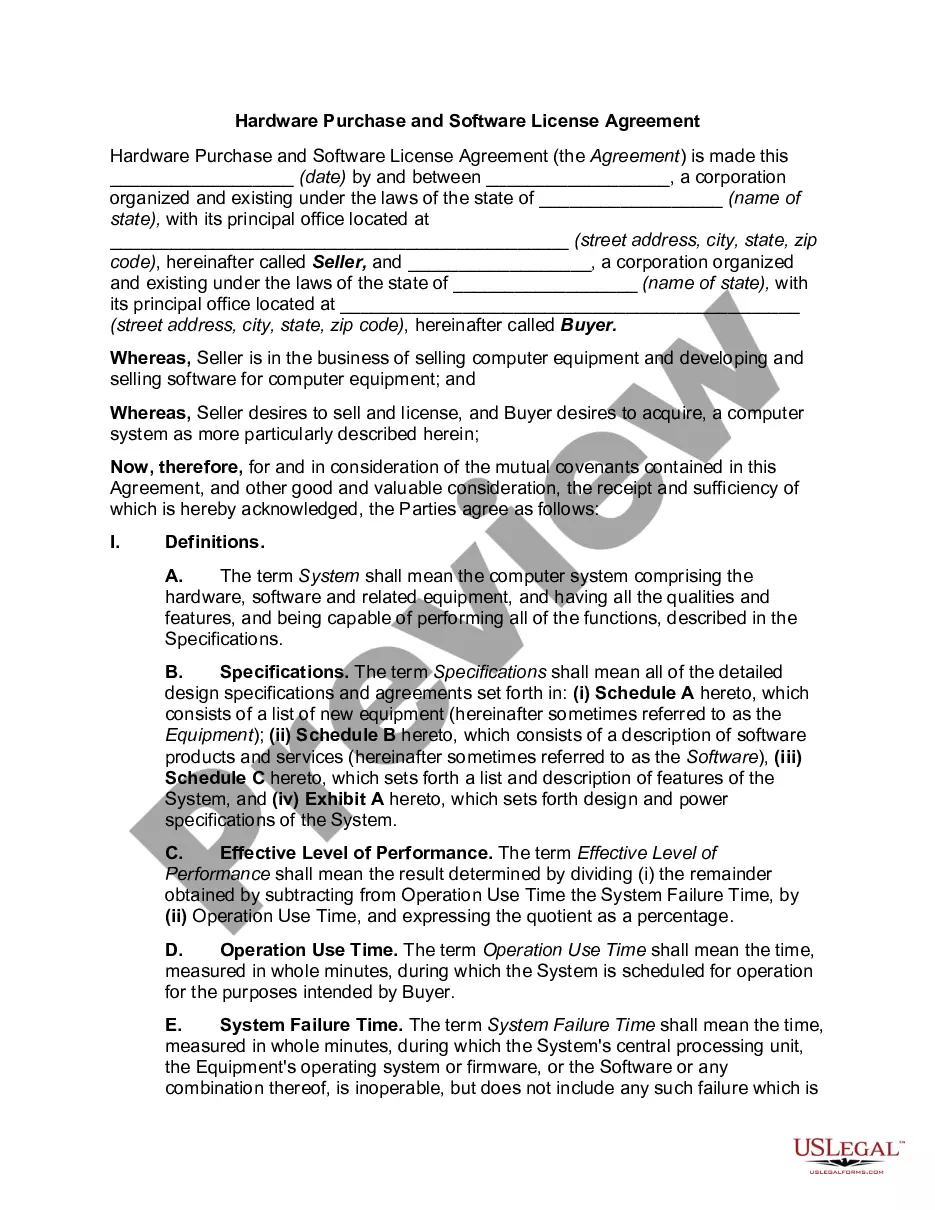

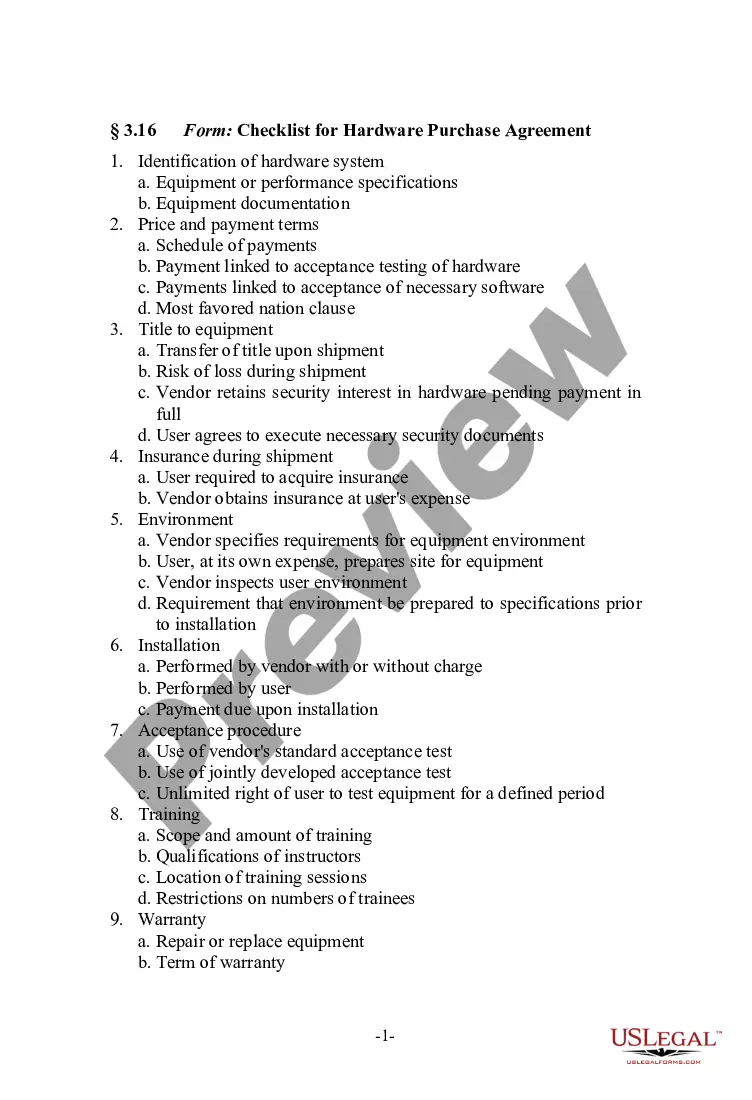

Setting up an equipment lease involves several steps. First, identify the equipment you wish to lease and determine the terms, including payment schedules and duration. Then, draft a lease agreement that includes all relevant details. The Indiana Equipment Lease Checklist can help you ensure that your lease includes all key components for legal compliance.

Leases in Indiana generally do not need to be notarized to be legally binding. However, having a lease agreement notarized can provide an extra layer of protection and help prevent disputes down the line. The Indiana Equipment Lease Checklist can guide you through the necessary steps to ensure your lease meets all legal requirements.

A LOC number in Indiana is a location identifier that helps businesses distinguish their various operating sites. This number is necessary for tax filings and ensuring clear communication with the state regarding your business activities. Ensure you have this number included in your Indiana Equipment Lease Checklist for ease in your administrative tasks.

The BT-1 form in Indiana is a Business Tax application used for registering a new business and obtaining necessary identifying numbers. This form collects essential information from businesses regarding their tax obligations. Completing this form should definitely be part of your Indiana Equipment Lease Checklist to ensure that you're prepared for legal compliance.

To obtain an Indiana withholding account number, you need to register your business with the Indiana Department of Revenue. This registration is essential for businesses that have employees and are required to withhold state income tax. Including the steps for obtaining this number in your Indiana Equipment Lease Checklist will facilitate smooth operations.