US Legal Forms - one of several biggest libraries of legal kinds in the USA - offers a variety of legal papers themes you can download or print. Making use of the website, you can get a large number of kinds for company and individual uses, sorted by classes, suggests, or keywords and phrases.You can get the latest variations of kinds just like the Indiana Beneficiary Deed in seconds.

If you already have a monthly subscription, log in and download Indiana Beneficiary Deed through the US Legal Forms catalogue. The Obtain key will show up on each kind you look at. You get access to all formerly saved kinds in the My Forms tab of your respective bank account.

If you would like use US Legal Forms the very first time, here are straightforward directions to obtain started out:

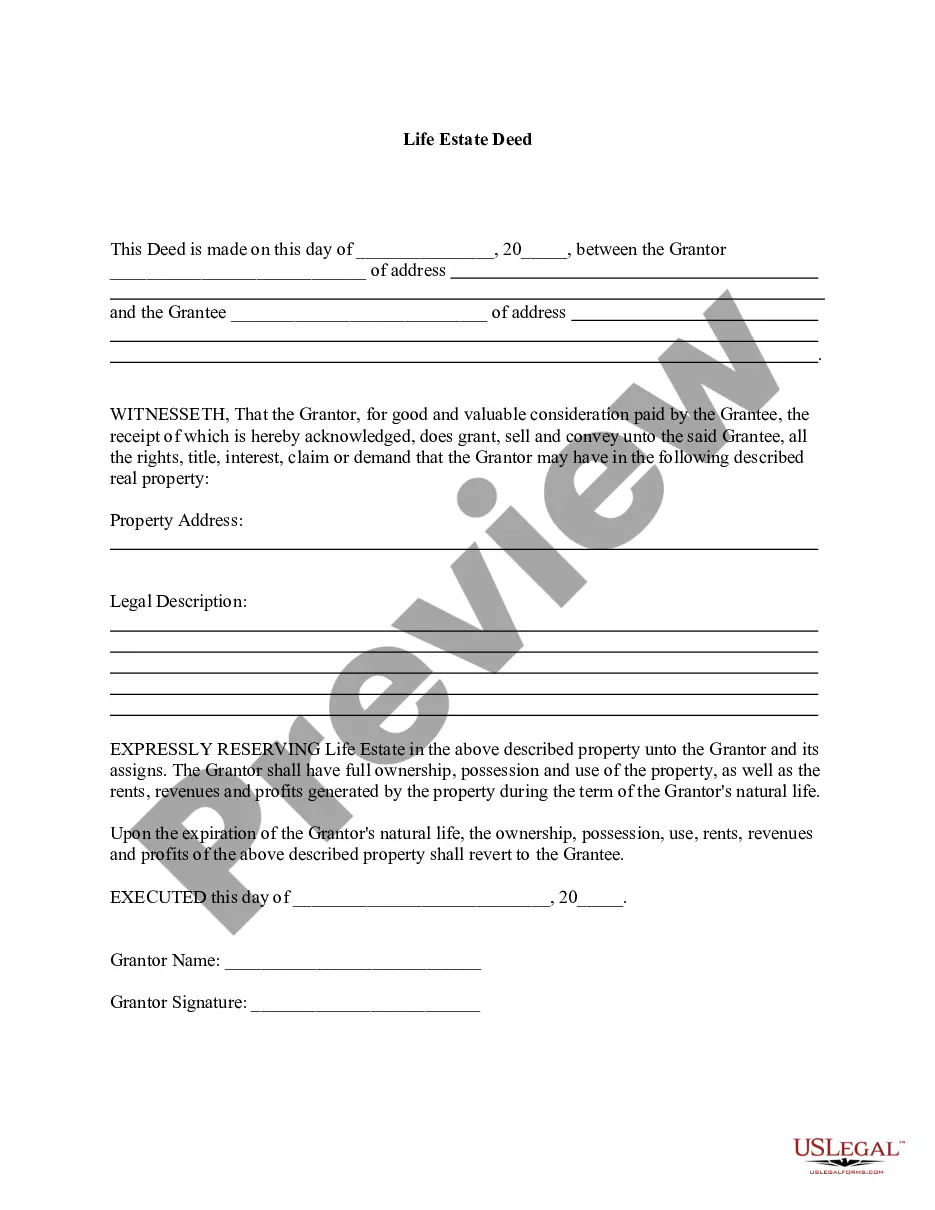

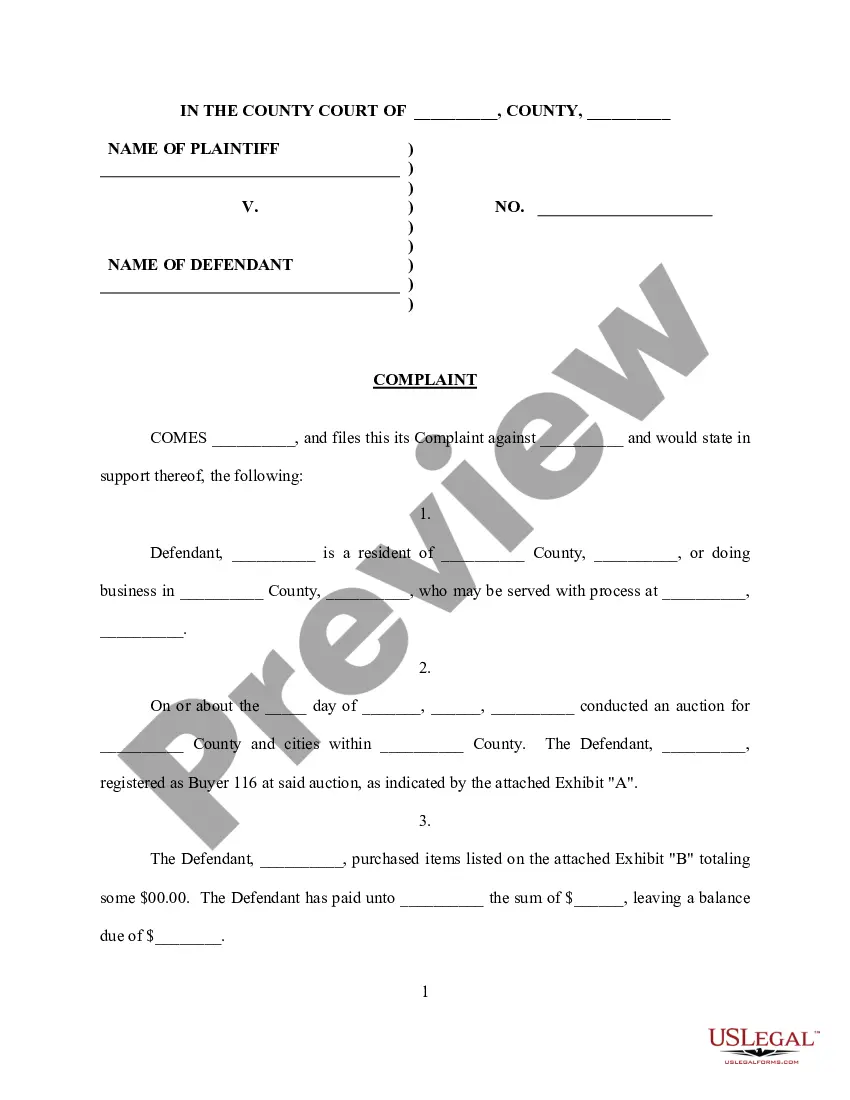

- Ensure you have picked the best kind for the area/state. Go through the Preview key to analyze the form`s information. Browse the kind description to actually have selected the right kind.

- If the kind doesn`t suit your demands, use the Lookup field at the top of the display screen to get the one who does.

- In case you are happy with the shape, confirm your selection by visiting the Purchase now key. Then, select the rates program you favor and supply your references to sign up on an bank account.

- Process the deal. Make use of charge card or PayPal bank account to accomplish the deal.

- Select the format and download the shape on your device.

- Make alterations. Complete, change and print and signal the saved Indiana Beneficiary Deed.

Each design you added to your money does not have an expiration time which is your own property forever. So, if you want to download or print an additional backup, just proceed to the My Forms section and then click in the kind you want.

Gain access to the Indiana Beneficiary Deed with US Legal Forms, by far the most comprehensive catalogue of legal papers themes. Use a large number of specialist and status-specific themes that satisfy your small business or individual demands and demands.