A receiver is a person authorized to take custody of another's property in a receivership and to apply and use it for certain purposes. Receivers are either court receivers or non-court receivers.

Appointment of a receiver may be by agreement of the debtor and his or her creditors. The receiver takes custody of the property, business, rents and profits of an insolvent person or entity, or a party whose property is in dispute.

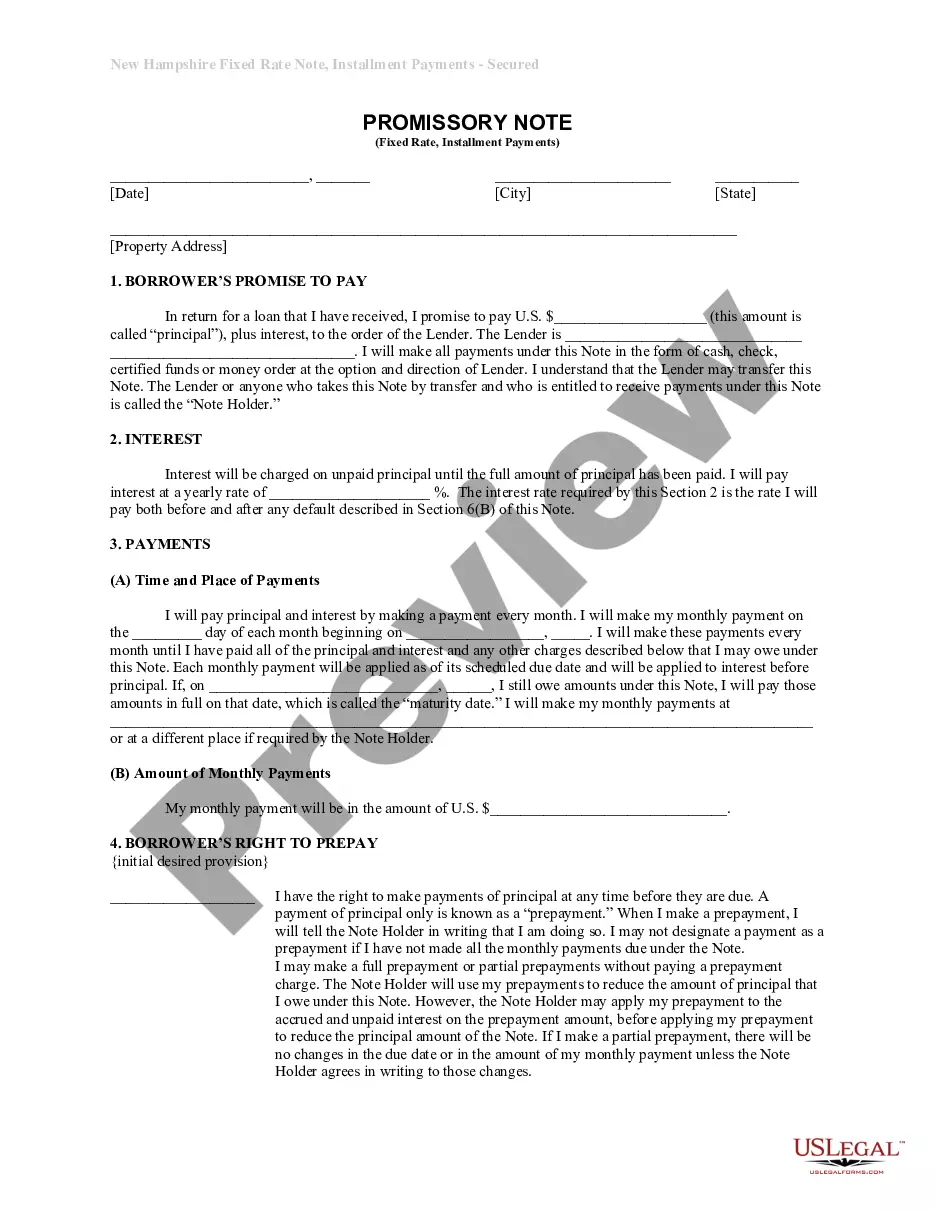

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Indiana Agreement between Creditors and Debtor for Appointment of Receiver: Explained Introduction: In the state of Indiana, an Agreement between Creditors and Debtor for Appointment of Receiver provides a mechanism for addressing financial distress situations. This legal agreement enables creditors to appoint a receiver to manage and liquidate a debtor's assets in order to repay outstanding debts and ensure fair treatment for all parties involved. This article aims to provide a detailed description of the Indiana Agreement between Creditors and Debtor for Appointment of Receiver, highlighting its significance, types, and key components. Key Components of the Agreement: 1. Intent and Purpose: The agreement outlines the primary purpose of appointing a receiver, which is usually to maximize the value of the debtor's assets and distribute the proceeds equitably among creditors. 2. Parties Involved: The agreement clearly identifies the parties involved, including the creditors and the debtor. Each creditor is listed by name, address, and the amount of their outstanding debt. The debtor's information is also provided to establish their consent to the appointment of a receiver. 3. Appointment of Receiver: The agreement specifies the process for appointing a receiver, including identifying the individual or entity responsible for this role. This can be the creditors collectively, a specific creditor, or an independent receiver appointed by the court. 4. Receiver's Powers and Duties: The agreement outlines the specific powers and duties assigned to the receiver. These may include managing, preserving, and liquidating the debtor's assets in an efficient and transparent manner. The receiver also takes responsibility for distributing proceeds among creditors as directed by the agreement or court order. 5. Establishment of a Receivership Estate: The agreement defines a framework for the creation of a receivership estate, which comprises all assets, claims, and other rights held by the debtor. This estate is managed by the receiver until the debts are settled. Different Types of Indiana Agreement between Creditors and Debtor for Appointment of Receiver: 1. Voluntary Agreement: This type of agreement occurs when a debtor voluntarily offers to appoint a receiver to handle their financial affairs and repay outstanding debts. It reflects the debtor's willingness to cooperate and resolve their financial obligations. 2. Involuntary Agreement: An involuntary agreement stems from the creditors' demand to appoint a receiver due to the debtor's failure to fulfill their financial obligations. In such cases, multiple creditors may join forces to protect their interests and recover the outstanding debts. Conclusion: The Indiana Agreement between Creditors and Debtor for Appointment of Receiver serves as a crucial legal tool for navigating financially troubled situations. By appointing a receiver, creditors can ensure the orderly and equitable collection of debts, while debtors gain the opportunity to address their financial burdens. Understanding the various types and key components of this agreement is essential for all parties involved in resolving financial distress effectively.