The Uniform Commercial Code (UCC) has been adopted in whole or in part by the legislatures of all 50 states.

Section 2-107 classifies items to be severed from realty and growing crops, or timber to be cut, in terms of whether the items constitute goods that may be made the subject of a sale and whether a transaction concerning them is a sale before severance. The section provides that certain attached and embedded things are "goods" when they are to be severed by the seller. This category consists of minerals in the ground, including oil and gas, and structures on land. Also treated as goods are: (1) standing timber; (2) growing crops; and (3) any other thing attached to land, provided it can be removed without causing material harm to the land.

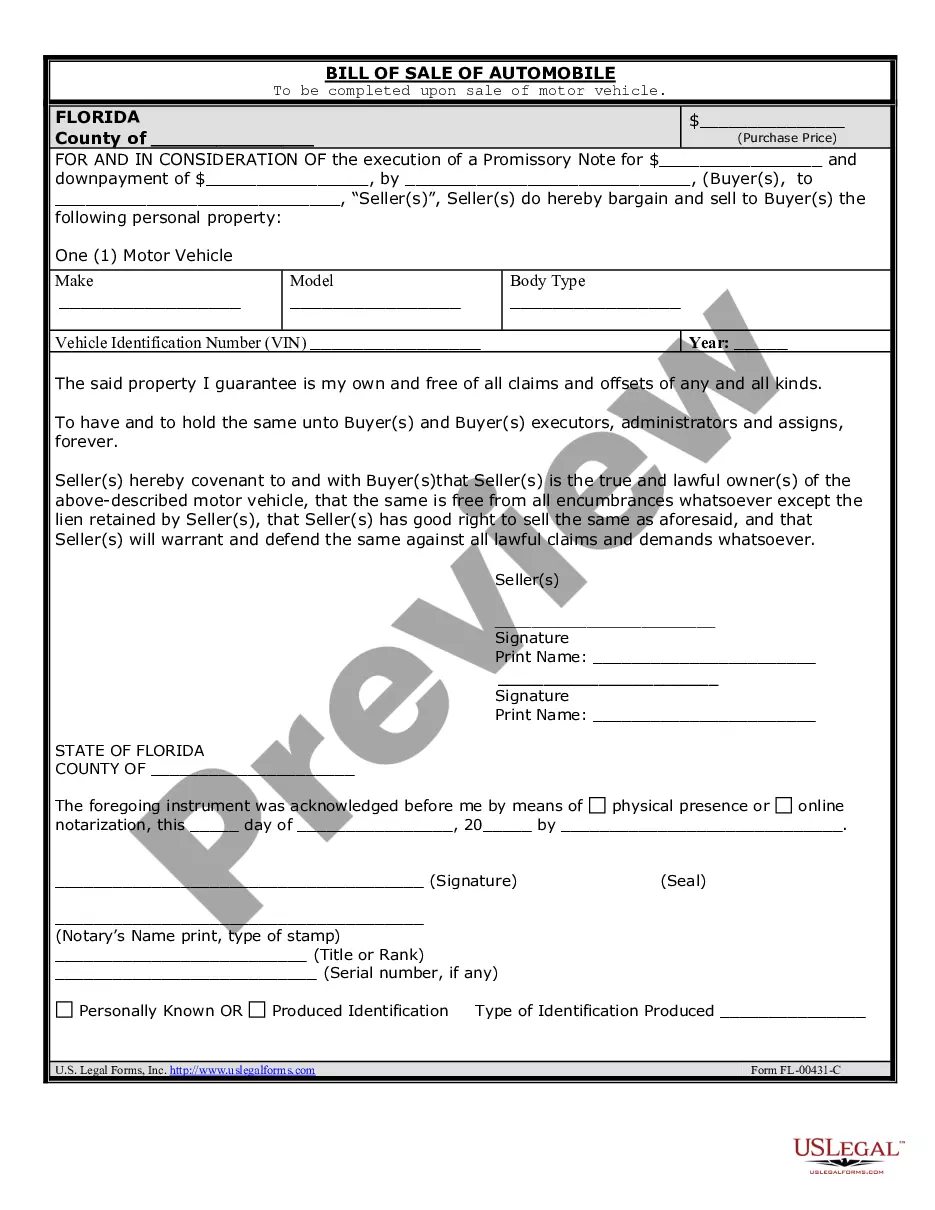

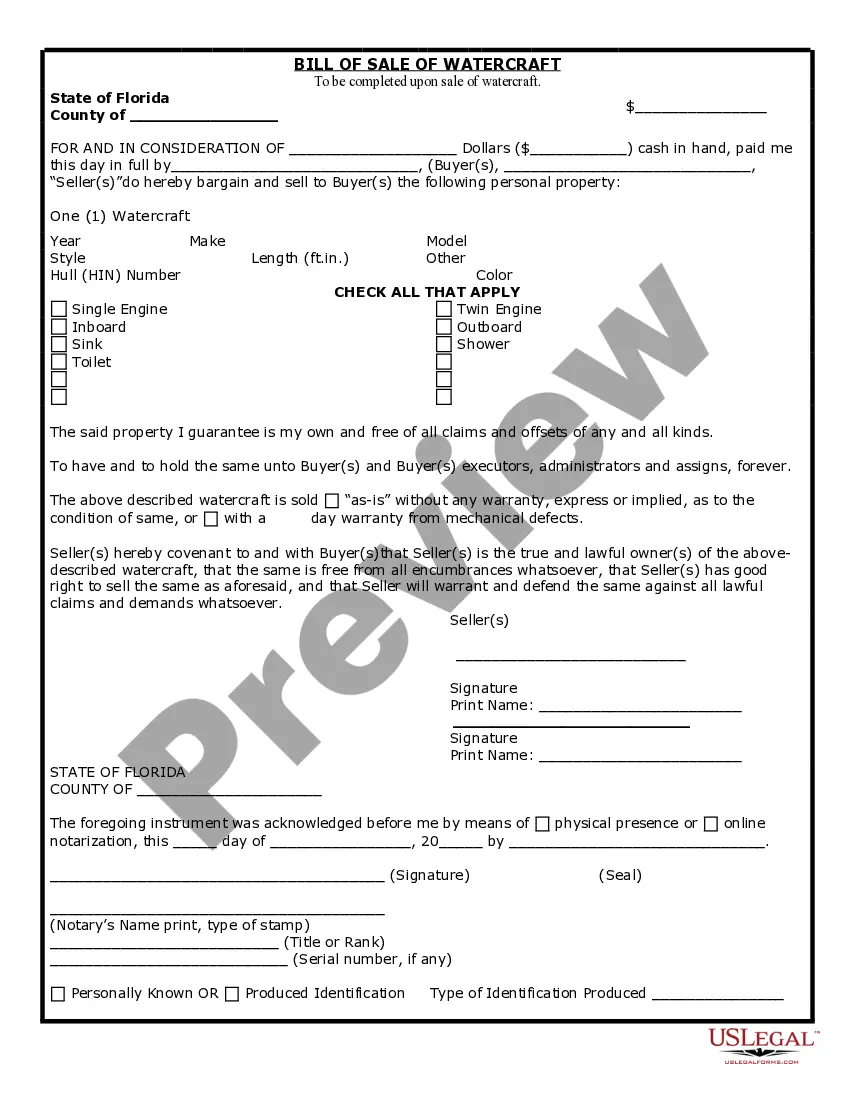

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Indiana Agreement for Sale of Growing Crops After Severed from Realty is a legal document that outlines the terms and conditions surrounding the sale of crops that have been severed from the real estate property. This agreement is specifically meant for the state of Indiana and ensures that both the seller and the buyer are protected throughout the transaction process. In this agreement, various key aspects are covered, including the identification of the seller and buyer, details about the crops being sold, purchase price, payment terms, and any additional conditions or contingencies. It serves as a legally binding contract that creates a clear understanding between both parties involved. One of the types of Indiana Agreement for Sale of Growing Crops After Severed from Realty is the "Cash Sale Agreement." This type of agreement involves the immediate payment of the purchase price in full upon the delivery of the growing crops. It is the most straightforward and common type of agreement where payment is made in cash or through other forms of immediate payment such as check or bank transfer. Another type is the "Installment Sale Agreement," wherein the purchase price is divided into multiple payments over a specified period. This type of agreement allows the buyer to pay for the growing crops in installments, usually with an agreed-upon interest rate. This type of arrangement can be beneficial for buyers who may not have the immediate funds to make a cash payment but still want to acquire the crops. Additionally, the "Crop Share Agreement" is another type of Indiana Agreement for Sale of Growing Crops After Severed from Realty. This agreement involves the seller receiving a percentage of the crops' total yield as payment instead of a traditional monetary exchange. The agreed percentage is usually based on the anticipated yield and can vary depending on the type of crop and prevailing market conditions. It is important to note that these are just a few types of Indiana Agreement for Sale of Growing Crops After Severed from Realty, and there may be other variations or customized agreements based on specific circumstances. Legal professionals should be consulted to ensure that the agreement meets all state and federal regulations and adequately protects the interests of both parties involved in the sale of growing crops severed from realty in Indiana.