The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. Depending on the nature of the business sold, statutes and regulations concerning the issuance and transfer of permits, licenses, and/or franchises should be consulted. If a license or franchise is important to the business, the buyer generally would want to make the sales agreement contingent on such approval. Sometimes, the buyer will assume certain debts, liabilities, or obligations of the seller. In such a sale, it is vital that the buyer know exactly what debts he/she is assuming.

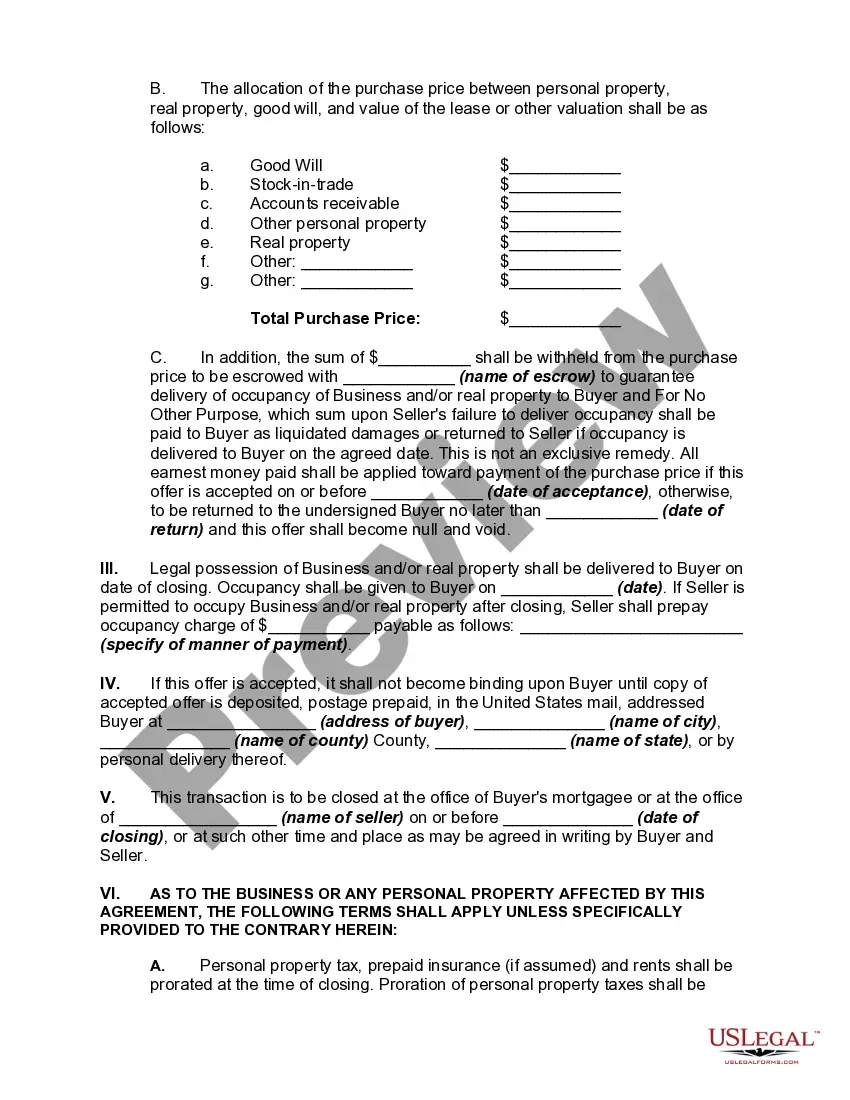

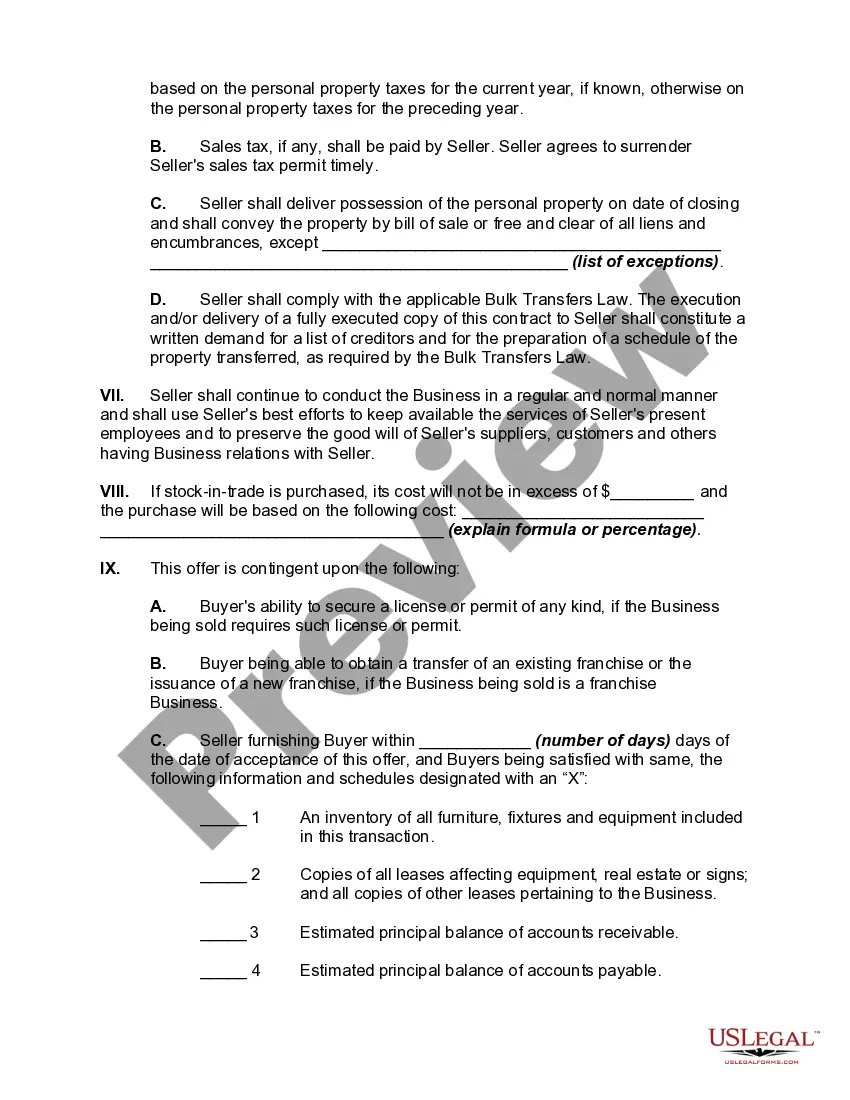

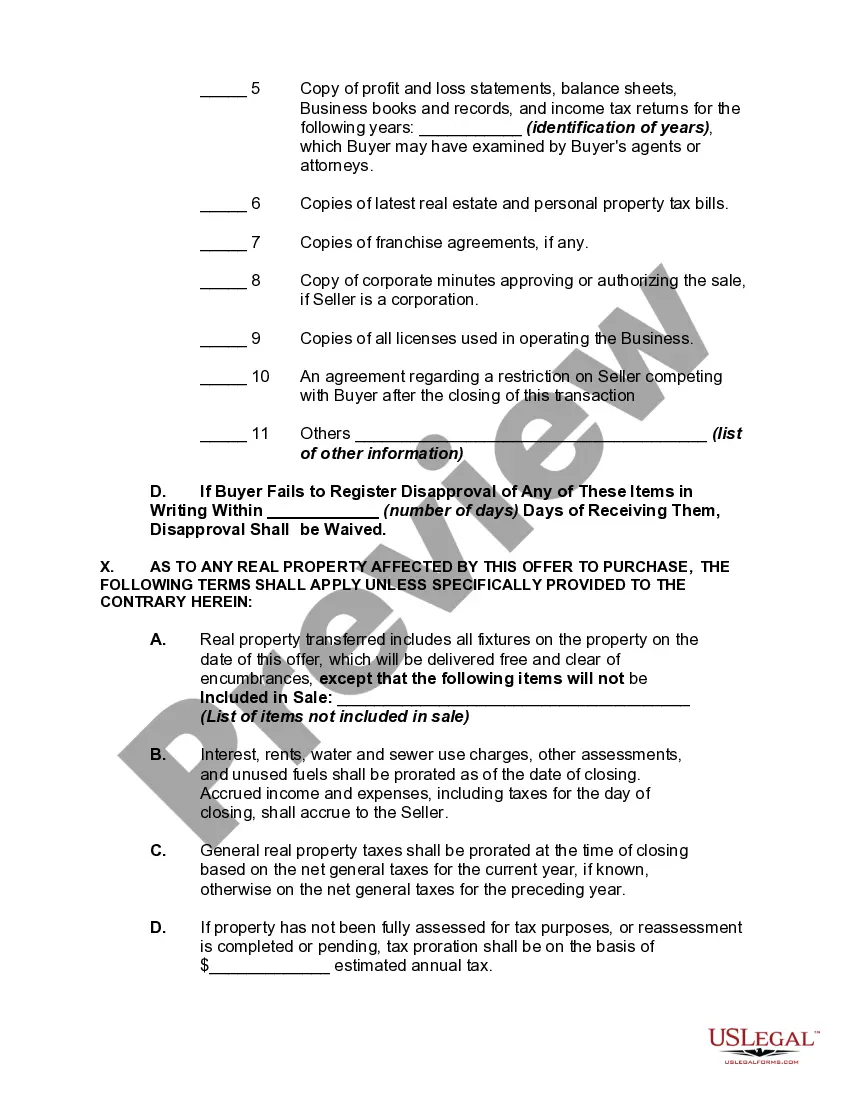

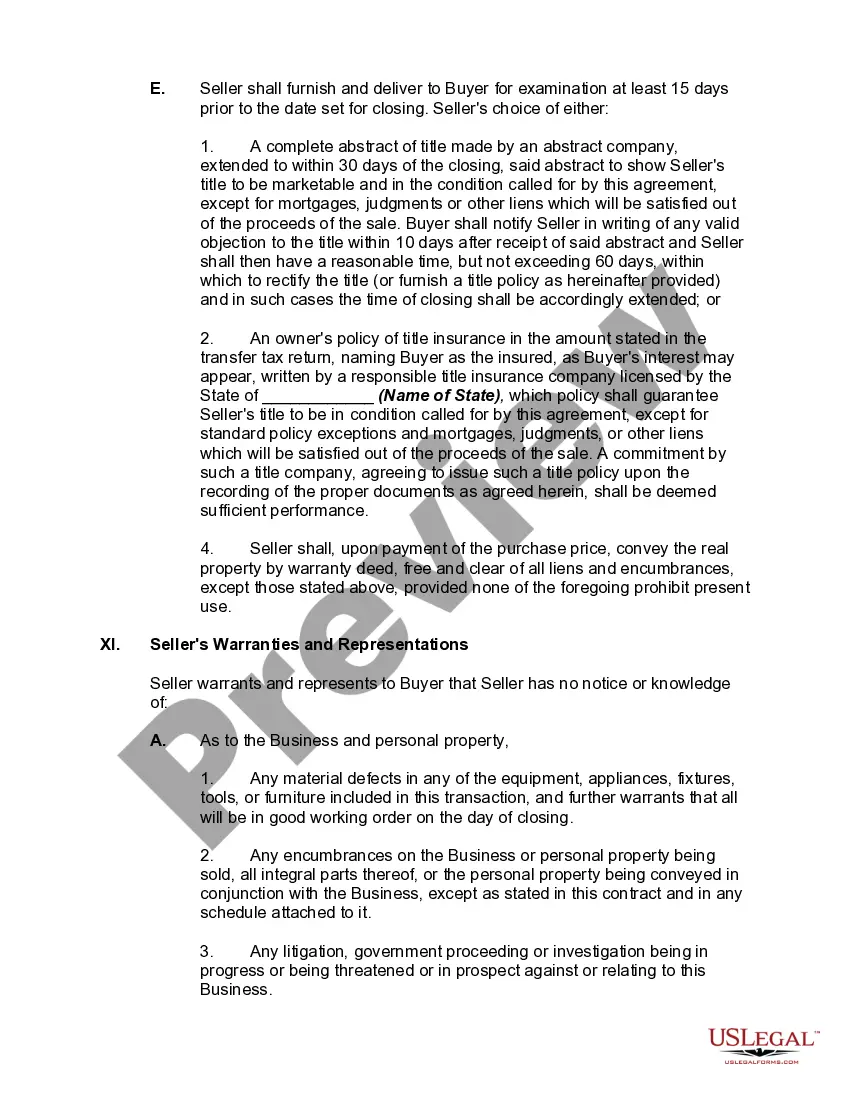

A sale of a business is considered for tax purposes to be a sale of the various assets involved. Therefore it is important that the contract allocate parts of the total payment among the items being sold. For example, the sale may require the transfer of the place of business, including the real property on which the building(s) of the business are located. The sale might involve the assignment of a lease, the transfer of good will, equipment, furniture, fixtures, merchandise, and inventory. The sale may also include the transfer of the business name, patents, trademarks, copyrights, licenses, permits, insurance policies, notes, accounts receivables, contracts, cash on hand and on deposit, and other tangible or intangible properties. It is best to include a broad transfer provision to insure that the entire business is being transferred to the buyer, with an itemization of at least the more important assets to be transferred.

Indiana Offer to Purchase Business, Including Good Will, is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a business, including its assets, liabilities, and the intangible asset known as "goodwill." It is essential for both parties involved in the transaction, the buyer, and the seller, as it formalizes the agreement and protects everyone's interests. This legal instrument includes various components, starting with the identification of the buyer and seller, both of whom must provide their legal names, addresses, and contact information. The document outlines the date of the agreement and includes a comprehensive description of the business being purchased, including its trade name, address, permits, licenses, and any intellectual property rights associated with the business. The Indiana Offer to Purchase Business, Including Good Will, specifies the purchase price agreed upon by both parties and outlines the terms of payment. It may include details about the payment method, such as a lump-sum payment, installment payments, or financial arrangements, including the assumption of existing debts or a loan provided by the seller. Furthermore, the document may address the inventory or stock included in the agreement, detailing how it will be valued and transferred. A provision for the sale and assignment of business contracts, including leases, vendor agreements, and customer contracts, may also be included. The key aspect of an Indiana Offer to Purchase Business is the inclusion of "goodwill." Goodwill refers to the intangible value associated with the reputation, customer base, and other advantages a business has gained over time. The agreement must expressly state that the buyer acknowledges and understands the value of goodwill and agrees to purchase it as part of the transaction. In Indiana, there may be various types of Offer to Purchase Business, Including Good Will, depending on the nature of the business and specific circumstances. Some common variations include: 1. Simple Asset Purchase: This type of agreement focuses primarily on the purchase of tangible assets, such as fixtures, equipment, inventory, and leasehold improvements, with minimal emphasis on goodwill. 2. Stock Purchase: In this case, the agreement revolves around the purchase of the company's stock, which includes both tangible and intangible assets, including goodwill. The buyer assumes the role of majority shareholder, gaining control of the entire company. 3. Merger or Acquisition: This type entails the integration or union of two businesses, often resulting in a new legal entity. The agreement becomes more complex as it involves the transfer of assets, liabilities, and goodwill from both parties, alongside the negotiation of ownership stakes. It is vital for both buyers and sellers to seek legal counsel and ensure that all relevant details are accurately described in the Offer to Purchase Business, Including Good Will document. By doing so, they can mitigate risks and establish a secure foundation for the business transaction, promoting a fair and transparent exchange for all parties involved.Indiana Offer to Purchase Business, Including Good Will, is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a business, including its assets, liabilities, and the intangible asset known as "goodwill." It is essential for both parties involved in the transaction, the buyer, and the seller, as it formalizes the agreement and protects everyone's interests. This legal instrument includes various components, starting with the identification of the buyer and seller, both of whom must provide their legal names, addresses, and contact information. The document outlines the date of the agreement and includes a comprehensive description of the business being purchased, including its trade name, address, permits, licenses, and any intellectual property rights associated with the business. The Indiana Offer to Purchase Business, Including Good Will, specifies the purchase price agreed upon by both parties and outlines the terms of payment. It may include details about the payment method, such as a lump-sum payment, installment payments, or financial arrangements, including the assumption of existing debts or a loan provided by the seller. Furthermore, the document may address the inventory or stock included in the agreement, detailing how it will be valued and transferred. A provision for the sale and assignment of business contracts, including leases, vendor agreements, and customer contracts, may also be included. The key aspect of an Indiana Offer to Purchase Business is the inclusion of "goodwill." Goodwill refers to the intangible value associated with the reputation, customer base, and other advantages a business has gained over time. The agreement must expressly state that the buyer acknowledges and understands the value of goodwill and agrees to purchase it as part of the transaction. In Indiana, there may be various types of Offer to Purchase Business, Including Good Will, depending on the nature of the business and specific circumstances. Some common variations include: 1. Simple Asset Purchase: This type of agreement focuses primarily on the purchase of tangible assets, such as fixtures, equipment, inventory, and leasehold improvements, with minimal emphasis on goodwill. 2. Stock Purchase: In this case, the agreement revolves around the purchase of the company's stock, which includes both tangible and intangible assets, including goodwill. The buyer assumes the role of majority shareholder, gaining control of the entire company. 3. Merger or Acquisition: This type entails the integration or union of two businesses, often resulting in a new legal entity. The agreement becomes more complex as it involves the transfer of assets, liabilities, and goodwill from both parties, alongside the negotiation of ownership stakes. It is vital for both buyers and sellers to seek legal counsel and ensure that all relevant details are accurately described in the Offer to Purchase Business, Including Good Will document. By doing so, they can mitigate risks and establish a secure foundation for the business transaction, promoting a fair and transparent exchange for all parties involved.