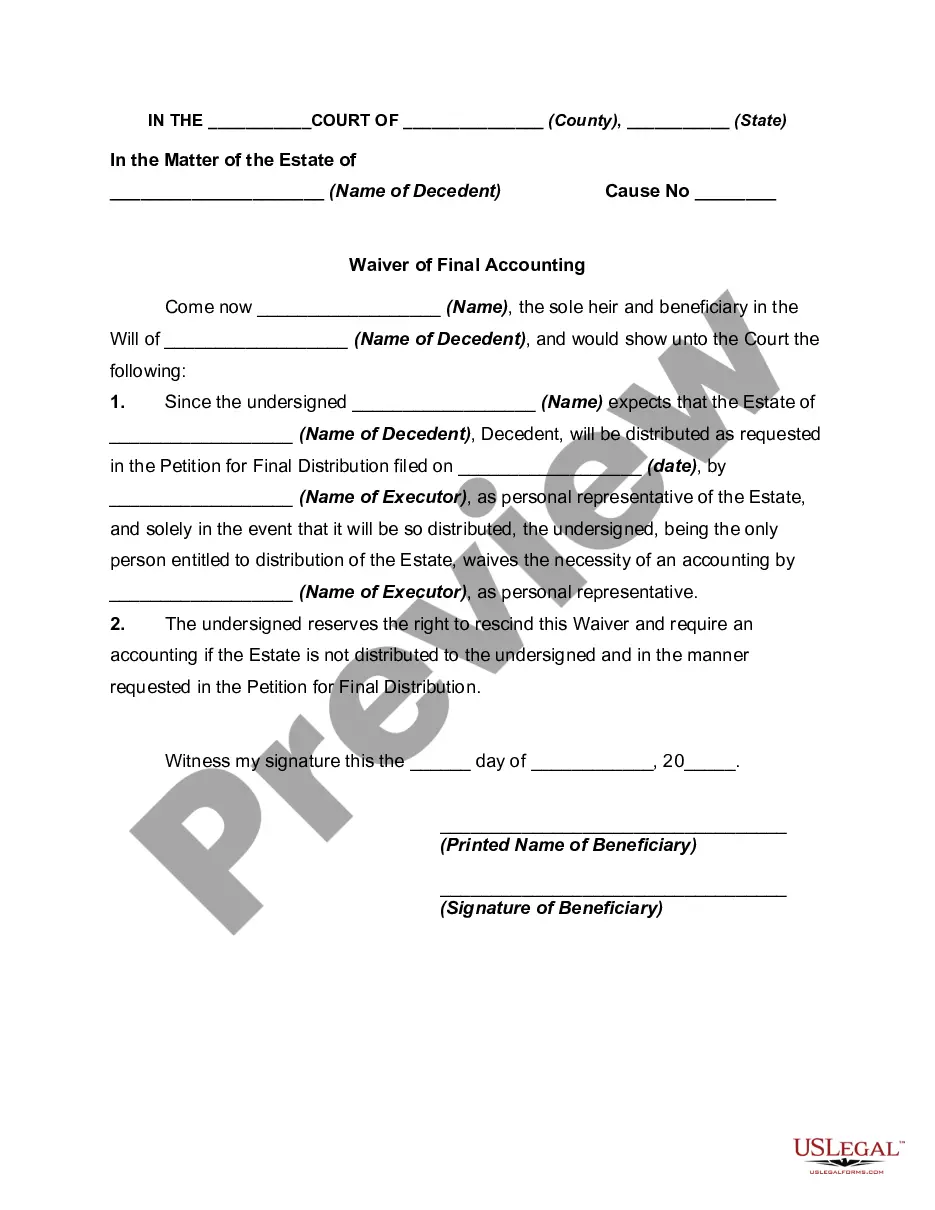

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

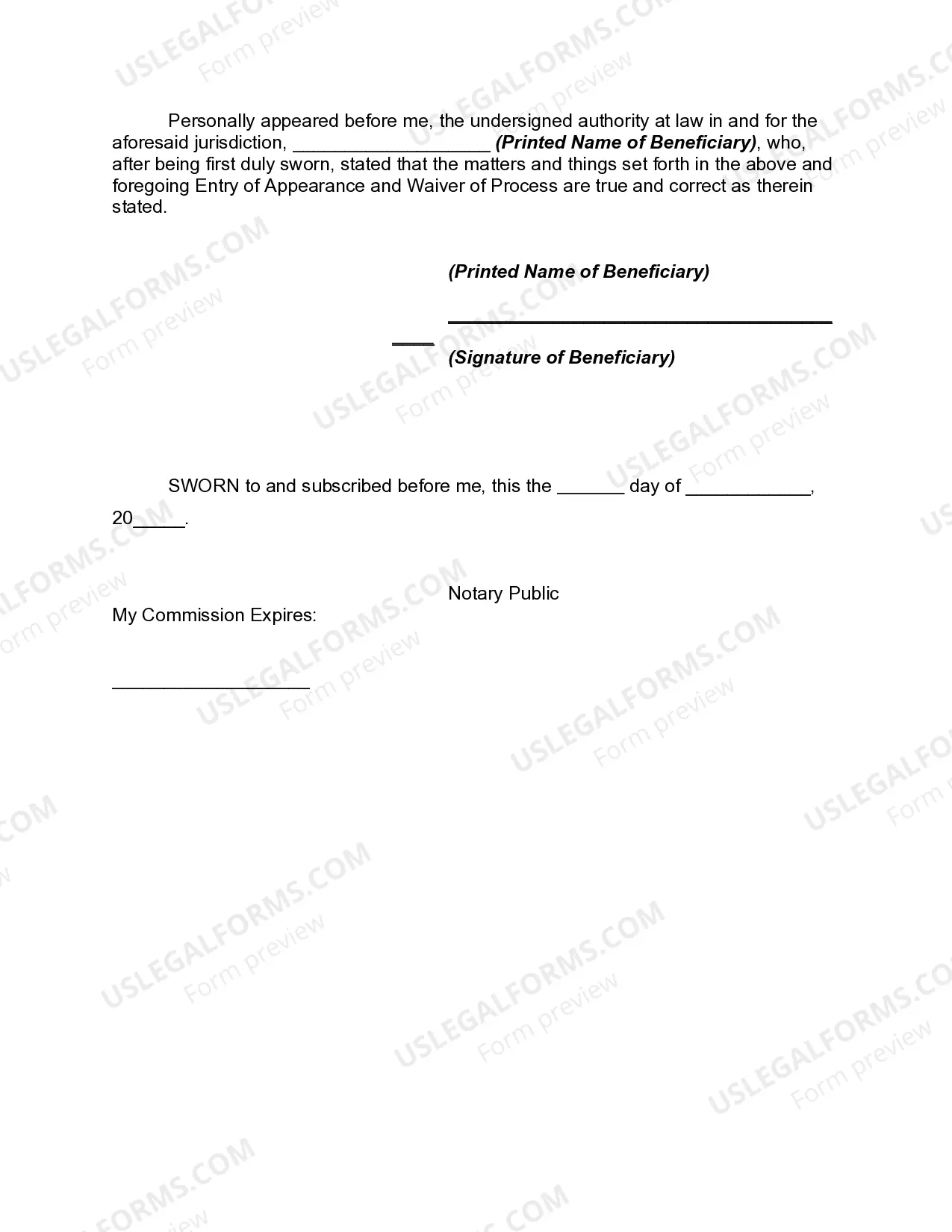

Title: Indiana Waiver of Final Accounting by Sole Beneficiary: Detailed Description and Types Introduction: In Indiana, the Waiver of Final Accounting by Sole Beneficiary is a legal document that allows a sole beneficiary of an estate to waive the requirement for a final accounting. By signing this waiver, the beneficiary acknowledges that they have received their share of the estate and relinquishes their right to a detailed account of the estate's finances. Detailed Description: 1. Purpose of the Waiver of Final Accounting: The primary purpose of the Waiver of Final Accounting by Sole Beneficiary is to simplify and expedite the probate process. It eliminates the need for the personal representative or executor to prepare and file a detailed final accounting, which can be time-consuming and costly. This waiver provides the sole beneficiary with the freedom to proceed with the distribution of assets without the need for an extensive review of financial records. 2. Key Elements of the Waiver: a. Identification of Beneficiary: The waiver should clearly identify the sole beneficiary who is waiving the final accounting. b. Confirmation of Receipt of Inheritance: The beneficiary must acknowledge that they have received their share of the estate. c. No Objection to Final Accounting Waiver: The beneficiary must declare their agreement in waiving the final accounting and accept the risks associated with doing so. d. Signature and Notarization: The waiver requires the beneficiary's signature in the presence of a notary public to validate its authenticity. 3. Types of Indiana Waiver of Final Accounting by Sole Beneficiary: a. Waiver of Final Accounting for Defined Small Estates: Indiana law provides a specific waiver procedure for small estates valued under a certain threshold (varying from county to county). This waiver expedites the estate settlement by exempting small estates from the formal accounting requirement. b. Standard Waiver of Final Accounting for All Estates: This waiver applies to estates of any size and grants the sole beneficiary the option to forego the final accounting process. Conclusion: The Indiana Waiver of Final Accounting by Sole Beneficiary is an essential legal document that makes the probate process more efficient for sole beneficiaries and can simplify estate distribution. By understanding its purpose and the different types available, beneficiaries can make informed decisions regarding the waiver, taking into account the size of the estate and any specific county requirements. It is advisable to consult an attorney specializing in estate planning to ensure compliance with Indiana state laws and regulations.Title: Indiana Waiver of Final Accounting by Sole Beneficiary: Detailed Description and Types Introduction: In Indiana, the Waiver of Final Accounting by Sole Beneficiary is a legal document that allows a sole beneficiary of an estate to waive the requirement for a final accounting. By signing this waiver, the beneficiary acknowledges that they have received their share of the estate and relinquishes their right to a detailed account of the estate's finances. Detailed Description: 1. Purpose of the Waiver of Final Accounting: The primary purpose of the Waiver of Final Accounting by Sole Beneficiary is to simplify and expedite the probate process. It eliminates the need for the personal representative or executor to prepare and file a detailed final accounting, which can be time-consuming and costly. This waiver provides the sole beneficiary with the freedom to proceed with the distribution of assets without the need for an extensive review of financial records. 2. Key Elements of the Waiver: a. Identification of Beneficiary: The waiver should clearly identify the sole beneficiary who is waiving the final accounting. b. Confirmation of Receipt of Inheritance: The beneficiary must acknowledge that they have received their share of the estate. c. No Objection to Final Accounting Waiver: The beneficiary must declare their agreement in waiving the final accounting and accept the risks associated with doing so. d. Signature and Notarization: The waiver requires the beneficiary's signature in the presence of a notary public to validate its authenticity. 3. Types of Indiana Waiver of Final Accounting by Sole Beneficiary: a. Waiver of Final Accounting for Defined Small Estates: Indiana law provides a specific waiver procedure for small estates valued under a certain threshold (varying from county to county). This waiver expedites the estate settlement by exempting small estates from the formal accounting requirement. b. Standard Waiver of Final Accounting for All Estates: This waiver applies to estates of any size and grants the sole beneficiary the option to forego the final accounting process. Conclusion: The Indiana Waiver of Final Accounting by Sole Beneficiary is an essential legal document that makes the probate process more efficient for sole beneficiaries and can simplify estate distribution. By understanding its purpose and the different types available, beneficiaries can make informed decisions regarding the waiver, taking into account the size of the estate and any specific county requirements. It is advisable to consult an attorney specializing in estate planning to ensure compliance with Indiana state laws and regulations.