Revenue sharing is a funding arrangement in which one government unit grants a portion of its tax income to another government unit. For example, provinces or states may share revenue with local governments, or national governments may share revenue with provinces or states. Laws determine the formulas by which revenue is shared, limiting the controls that the unit supplying the money can exercise over the receiver and specifying whether matching funds must be supplied by the receiver.

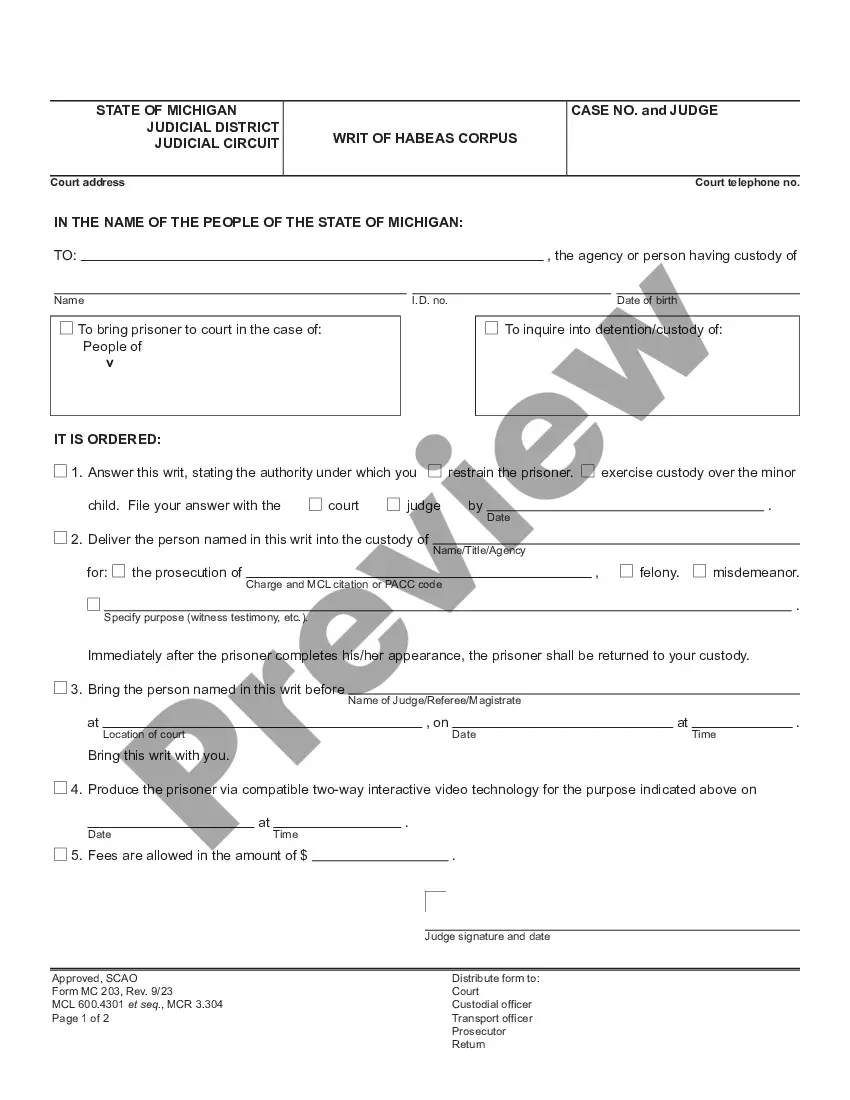

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana Revenue Sharing Agreement is a legal and financial contract between the state government of Indiana and its local government entities, aimed at distributing tax revenues equitably and promoting economic growth and development statewide. This agreement outlines the specific terms and conditions under which revenue generated from various sources will be shared amongst different governing bodies in Indiana. The primary objective of the Indiana Revenue Sharing Agreement is to ensure a fair and balanced allocation of tax revenues to support essential services, infrastructure, and public projects at the local level. By sharing a portion of the state's tax revenues, this agreement helps foster collaboration between the state government and local governments, enabling them to better meet the needs of their communities. The Indiana Revenue Sharing Agreement encompasses various types of revenue sources, including income tax, sales tax, property tax, and other revenues generated within the state. The exact allocation of these funds depends on several factors, such as population size, assessed property values, economic indicators, and other relevant criteria. Local government entities that can enter into the revenue sharing agreement include counties, cities, towns, and special districts. Types of Indiana Revenue Sharing Agreement: 1. County Revenue Sharing Agreement: This type of agreement focuses on revenue sharing between the state government and individual counties within Indiana. It ensures that counties receive a fair share of tax revenues collected within their jurisdictions, allowing them to fund local services, infrastructure projects, and public welfare programs. 2. City/Town Revenue Sharing Agreement: This agreement pertains to revenue sharing between the state government and cities or towns in Indiana. It establishes a mechanism for sharing tax revenues generated within city/town limits, enabling urban areas to meet their unique needs and invest in urban development projects, public safety initiatives, and community improvement plans. 3. Special District Revenue Sharing Agreement: Special districts, such as school districts, water districts, or transportation districts, often have specific revenue and funding requirements. The state government may enter into separate revenue sharing agreements with these districts to ensure equitable distribution of tax revenues and support their specific operations and development goals. Overall, the Indiana Revenue Sharing Agreement plays a critical role in fostering intergovernmental cooperation, reducing disparities between regions, and promoting a balanced economic growth across the state. It provides a framework for revenue allocation that aligns with the overall objectives of enhancing public services, improving infrastructure, and supporting local governments in meeting the evolving needs of their communities.Indiana Revenue Sharing Agreement is a legal and financial contract between the state government of Indiana and its local government entities, aimed at distributing tax revenues equitably and promoting economic growth and development statewide. This agreement outlines the specific terms and conditions under which revenue generated from various sources will be shared amongst different governing bodies in Indiana. The primary objective of the Indiana Revenue Sharing Agreement is to ensure a fair and balanced allocation of tax revenues to support essential services, infrastructure, and public projects at the local level. By sharing a portion of the state's tax revenues, this agreement helps foster collaboration between the state government and local governments, enabling them to better meet the needs of their communities. The Indiana Revenue Sharing Agreement encompasses various types of revenue sources, including income tax, sales tax, property tax, and other revenues generated within the state. The exact allocation of these funds depends on several factors, such as population size, assessed property values, economic indicators, and other relevant criteria. Local government entities that can enter into the revenue sharing agreement include counties, cities, towns, and special districts. Types of Indiana Revenue Sharing Agreement: 1. County Revenue Sharing Agreement: This type of agreement focuses on revenue sharing between the state government and individual counties within Indiana. It ensures that counties receive a fair share of tax revenues collected within their jurisdictions, allowing them to fund local services, infrastructure projects, and public welfare programs. 2. City/Town Revenue Sharing Agreement: This agreement pertains to revenue sharing between the state government and cities or towns in Indiana. It establishes a mechanism for sharing tax revenues generated within city/town limits, enabling urban areas to meet their unique needs and invest in urban development projects, public safety initiatives, and community improvement plans. 3. Special District Revenue Sharing Agreement: Special districts, such as school districts, water districts, or transportation districts, often have specific revenue and funding requirements. The state government may enter into separate revenue sharing agreements with these districts to ensure equitable distribution of tax revenues and support their specific operations and development goals. Overall, the Indiana Revenue Sharing Agreement plays a critical role in fostering intergovernmental cooperation, reducing disparities between regions, and promoting a balanced economic growth across the state. It provides a framework for revenue allocation that aligns with the overall objectives of enhancing public services, improving infrastructure, and supporting local governments in meeting the evolving needs of their communities.