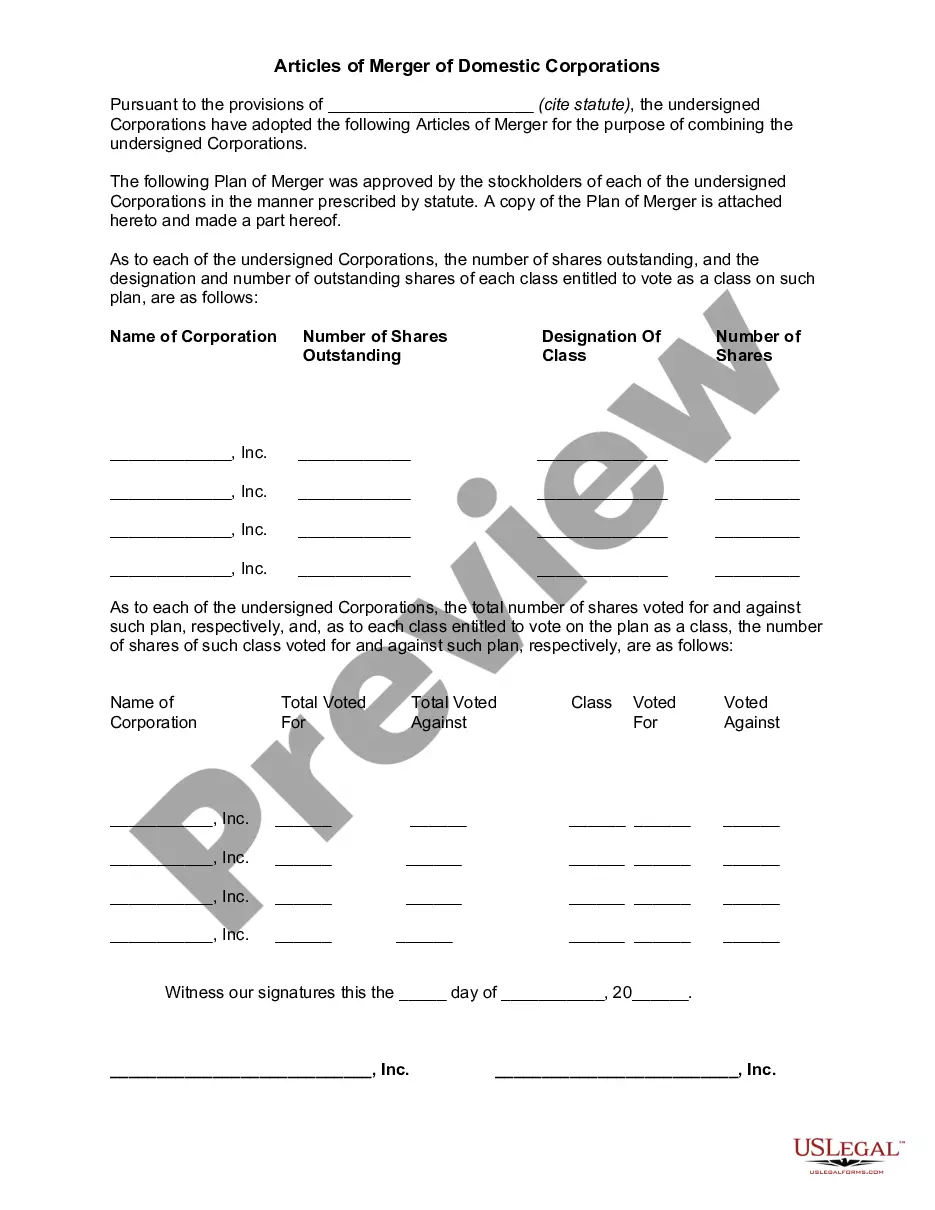

Statutes of the particular jurisdiction may require that merging corporations file copies of the proposed plan of combination with a state official or agency. Generally, information as to voting rights of classes of stock, number of shares outstanding, and results of any voting are required to be included, and there may be special requirements for the merger or consolidation of domestic and foreign corporations.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Indiana Articles of Merger of Domestic Corporations are important legal documents filed with the Indiana Secretary of State when two or more corporations decide to merge into a single entity. This process allows corporations to combine their assets, liabilities, and operations, ultimately streamlining their business activities under a unified structure. The Articles of Merger outline the specific terms and conditions related to the merger, providing a comprehensive understanding of the new entity's formation and governance. Keywords: Indiana, Articles of Merger, Domestic Corporations, merger, assets, liabilities, operations, business activities, unified structure, terms and conditions, formation, governance. There are different types of Indiana Articles of Merger of Domestic Corporations based on the specific nature of the merger: 1. Statutory Merger: This type of merger involves the consolidation of two or more corporations into a single entity, where one corporation continues its existence while the others cease to exist. The surviving corporation assumes all rights, privileges, and liabilities of the merged corporations. 2. Consolidation: Unlike a statutory merger, consolidation occurs when two or more corporations combine to create an entirely new entity. In this case, all merging corporations cease to exist, and a new corporation is formed to carry out the combined business activities. 3. Share Exchange: This type of merger involves the exchange of shares between the merging corporations, allowing one entity to acquire controlling interest or complete ownership of another. Shareholders of the acquired corporation receive shares in the acquiring corporation, typically resulting in a change in control of one or both entities. 4. Assets Acquisition: In some cases, corporations may choose to merge by transferring the assets of one entity to another. The acquiring corporation assumes the assets, liabilities, and contractual agreements of the merged entity, ensuring continuity in business operations while eliminating the non-surviving corporation. It is important to note that the specific requirements and procedures for filing Indiana Articles of Merger of Domestic Corporations may vary depending on the type of merger and the unique circumstances of the process. Corporations should consult legal professionals or reference the Indiana Secretary of State's guidelines to ensure accurate completion and submission of the Articles of Merger.Indiana Articles of Merger of Domestic Corporations are important legal documents filed with the Indiana Secretary of State when two or more corporations decide to merge into a single entity. This process allows corporations to combine their assets, liabilities, and operations, ultimately streamlining their business activities under a unified structure. The Articles of Merger outline the specific terms and conditions related to the merger, providing a comprehensive understanding of the new entity's formation and governance. Keywords: Indiana, Articles of Merger, Domestic Corporations, merger, assets, liabilities, operations, business activities, unified structure, terms and conditions, formation, governance. There are different types of Indiana Articles of Merger of Domestic Corporations based on the specific nature of the merger: 1. Statutory Merger: This type of merger involves the consolidation of two or more corporations into a single entity, where one corporation continues its existence while the others cease to exist. The surviving corporation assumes all rights, privileges, and liabilities of the merged corporations. 2. Consolidation: Unlike a statutory merger, consolidation occurs when two or more corporations combine to create an entirely new entity. In this case, all merging corporations cease to exist, and a new corporation is formed to carry out the combined business activities. 3. Share Exchange: This type of merger involves the exchange of shares between the merging corporations, allowing one entity to acquire controlling interest or complete ownership of another. Shareholders of the acquired corporation receive shares in the acquiring corporation, typically resulting in a change in control of one or both entities. 4. Assets Acquisition: In some cases, corporations may choose to merge by transferring the assets of one entity to another. The acquiring corporation assumes the assets, liabilities, and contractual agreements of the merged entity, ensuring continuity in business operations while eliminating the non-surviving corporation. It is important to note that the specific requirements and procedures for filing Indiana Articles of Merger of Domestic Corporations may vary depending on the type of merger and the unique circumstances of the process. Corporations should consult legal professionals or reference the Indiana Secretary of State's guidelines to ensure accurate completion and submission of the Articles of Merger.