Title: Indiana Sample Letter for Requesting Extension to File Business Tax Forms Introduction: Filing business tax forms by the set due date can be challenging for many businesses. In Indiana, businesses can request an extension to file their tax forms to ensure they have adequate time to organize their financial records and accurately report their income and deductions. This article provides a detailed description of what an Indiana Sample Letter for Requesting Extension to File Business Tax Forms contains, including relevant keywords to guide businesses in drafting their own request letters. Keywords: Indiana, sample letter, requesting extension, file business tax forms 1. Purpose of the Letter: The Indiana Sample Letter for Requesting Extension to File Business Tax Forms serves as a formal request to the Indiana Department of Revenue for an extension of time to file business tax forms. Keywords: purpose, Indiana Department of Revenue, extension of time, business tax forms 2. Contact Information: The letter must include the business's contact information, including the legal business name, mailing address, email address, and phone number. Keywords: contact information, legal business name, mailing address, email address, phone number 3. Explanation for Request: The letter should clearly articulate the reason for requesting the extension. Reasons may include delays in obtaining necessary financial statements or documentation, sudden illness, or unexpected circumstances affecting the business's ability to file on time. Keywords: explanation, requesting extension, delays, necessary financial statements, documentation, sudden illness, unexpected circumstances 4. Requested Extension Period: Specify the desired length of the extension period, typically up to six months from the original due date. This period allows businesses ample time to gather required information and prepare accurate tax forms. Keywords: requested extension period, up to six months, due date, gather required information, accurate tax forms 5. Acknowledgment of Late Payment: If the business anticipates owing taxes, mention that the payment will be made by the original due date to avoid any penalties or interest charges. Assure the department that the delay is solely for the filing of tax forms. Keywords: late payment acknowledgment, taxes owed, penalties, interest charges, tax form filing 6. Attach Relevant Documentation: If applicable, attach supporting documents that justify the need for an extension. These could include medical certificates, financial statements, or any other appropriate paperwork. Keywords: attach documentation, supporting documents, medical certificates, financial statements 7. Business Appreciation: Convey appreciation for the department's consideration of the request and assure them of fulfilling all necessary obligations promptly once the extension is granted. Keywords: business appreciation, consideration, obligations, prompt fulfillment Different Types of Indiana Sample Letters for Requesting Extension: 1. Indiana Sample Letter for Requesting Extension to File Sales Tax Forms 2. Indiana Sample Letter for Requesting Extension to File Property Tax Forms 3. Indiana Sample Letter for Requesting Extension to File Payroll Tax Forms Keywords: Indiana, sample letter, requesting extension, file sales tax forms, property tax forms, payroll tax forms Conclusion: Drafting a well-written Indiana Sample Letter for Requesting Extension to File Business Tax Forms is crucial to ensure businesses have sufficient time to meet their tax obligations accurately. By understanding the purpose and including the relevant keywords mentioned above, businesses can compose effective letters to request extensions for filing various types of tax forms in Indiana.

Indiana Sample Letter for Letter Requesting Extension to File Business Tax Forms

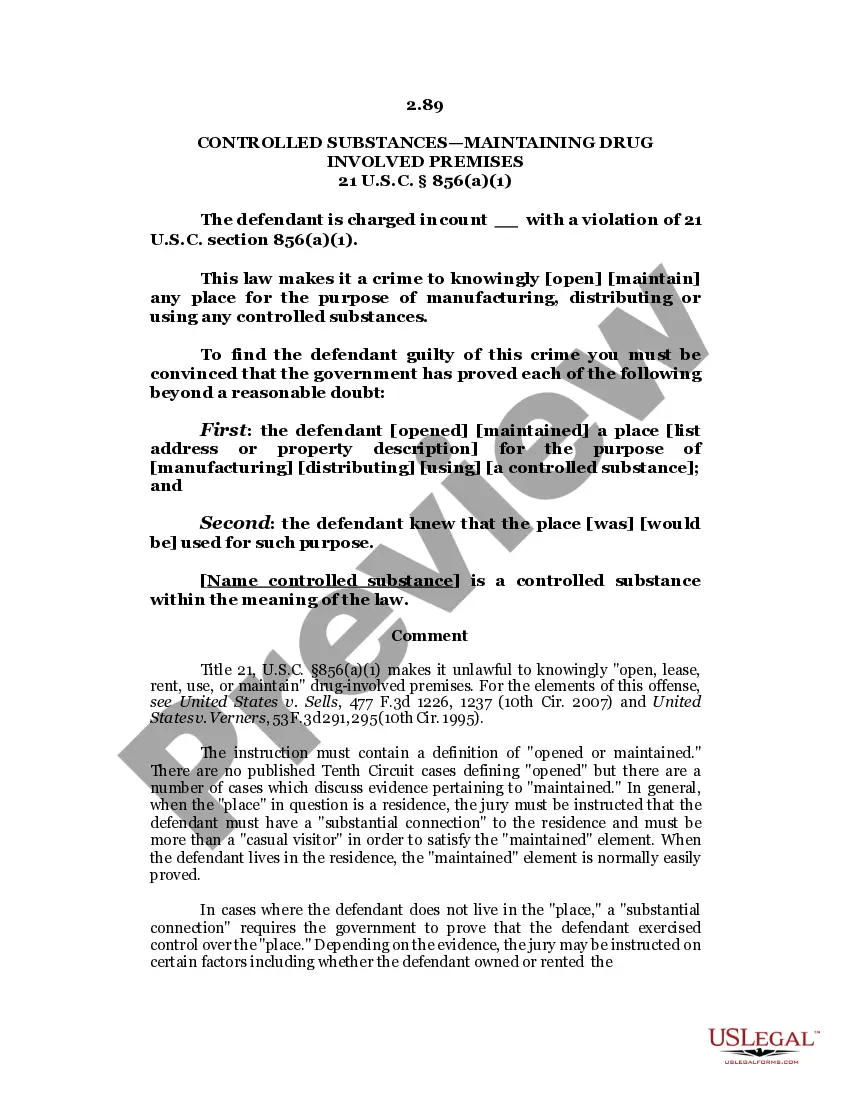

Description

How to fill out Indiana Sample Letter For Letter Requesting Extension To File Business Tax Forms?

You may spend several hours online searching for the legal papers design which fits the state and federal needs you require. US Legal Forms provides thousands of legal varieties which can be reviewed by pros. It is possible to obtain or produce the Indiana Sample Letter for Letter Requesting Extension to File Business Tax Forms from the service.

If you already possess a US Legal Forms accounts, you can log in and click on the Download key. Afterward, you can full, modify, produce, or sign the Indiana Sample Letter for Letter Requesting Extension to File Business Tax Forms. Every legal papers design you acquire is your own eternally. To obtain an additional backup associated with a acquired type, proceed to the My Forms tab and click on the corresponding key.

If you use the US Legal Forms internet site the very first time, adhere to the straightforward directions listed below:

- Initially, make certain you have chosen the best papers design to the county/metropolis of your choosing. Look at the type description to make sure you have picked out the proper type. If accessible, take advantage of the Review key to check through the papers design at the same time.

- In order to discover an additional edition of your type, take advantage of the Search field to get the design that suits you and needs.

- When you have found the design you need, simply click Purchase now to continue.

- Select the costs prepare you need, type in your accreditations, and register for your account on US Legal Forms.

- Total the deal. You may use your bank card or PayPal accounts to fund the legal type.

- Select the formatting of your papers and obtain it to your system.

- Make modifications to your papers if needed. You may full, modify and sign and produce Indiana Sample Letter for Letter Requesting Extension to File Business Tax Forms.

Download and produce thousands of papers themes while using US Legal Forms web site, which offers the largest assortment of legal varieties. Use specialist and express-particular themes to tackle your business or specific needs.