Indiana Letter of Intent to Form a Limited Partnership

Description

How to fill out Letter Of Intent To Form A Limited Partnership?

Selecting the appropriate legal document format can be quite challenging. Of course, there are numerous templates available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Indiana Letter of Intent to Form a Limited Partnership, which you can use for business and personal purposes. All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already a member, Log In to your account and click on the Download button to obtain the Indiana Letter of Intent to Form a Limited Partnership. Use your account to search for the legal forms you have previously acquired. Go to the My documents tab in your account and download another copy of the document you need.

Complete, modify, print, and sign the received Indiana Letter of Intent to Form a Limited Partnership. US Legal Forms is the largest repository of legal documents where you can find various file templates. Use the service to obtain well-crafted documents that adhere to state requirements.

- First, ensure you have selected the correct form for your city or county.

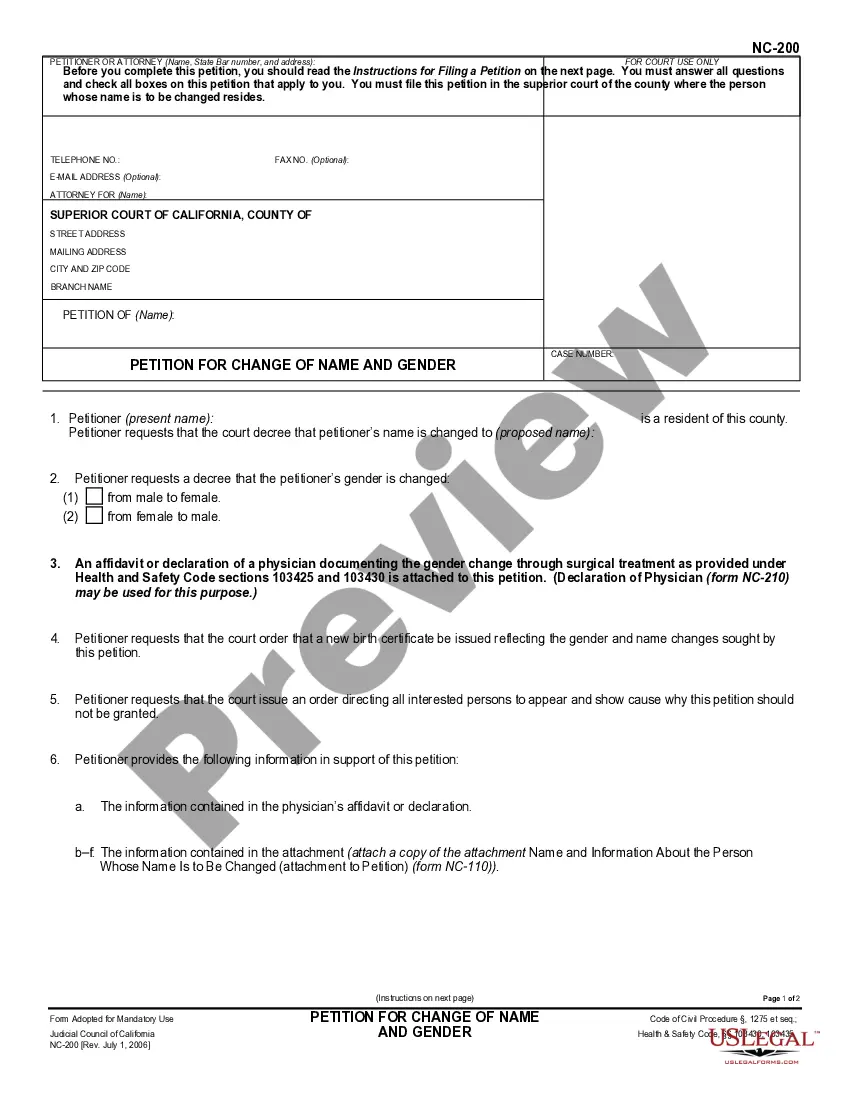

- You can review the form using the Preview button and read the form description to confirm it is suitable for your needs.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident the form is suitable, click the Get now button to procure the form.

- Select the pricing plan you want and enter the necessary details. Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document to your device.

Form popularity

FAQ

A limited partnership is similar to a general partnership, but offers limited liability protection to some partners. At least one partner must be a general partner with unlimited liability, and at least one partner must be a limited partner whose liability is typically limited to the amount of his or her investment.

You can set up ('incorporate') a limited liability partnership ( LLP ) to run a business with 2 or more members. A member can be a person or a company, known as a 'corporate member'.

No. The complete form of LLP is Limited Liability Partnership.

Key Takeaways A limited partnership (LP) exists when two or more partners go into business together, but the limited partners are only liable up to the amount of their investment. An LP is defined as having limited partners and a general partner, which has unlimited liability.

The state of Indiana does not have a general business license that all general partnerships are required to obtain. However, depending on what industry you operate in, your business may need licenses or permits to enable you to run your company in a compliant fashion.

Advantages of an LLP are: Two or more partners who can run the business as a partnership. Partners who are usually of the same profession, such as doctors or attorneys. Protection for partners from the negligence of other partners.

DPIN can be obtained for any person when registering an LLP, or a person can later apply for a DPIN to become a designated partner of an existing LLP.

Steps to Create an Indiana General PartnershipDetermine if you should start a general partnership.Choose a business name.File a DBA name (if needed)Draft and sign partnership agreement.Obtain licenses, permits, and clearances.Get an Employer Identification Number (EIN)Get Indiana state tax identification numbers.

Each state has its own rules, but in general you must pay a fee and file papers with the state, usually a "certificate of limited partnership" or "certificate of limited liability partnership." This document is similar to the articles (or certificate) filed by a corporation or an LLC and includes information about the

The necessary paper work for an LLP can be filed either online or by mail. LLPs that begin in Indiana, known as domestic LLPs, have to file an Articles of Registration for a Limited Liability Partnership.