Title: Indiana Sample Letter for Note and Deed of Trust — A Comprehensive Guide Introduction: An Indiana Sample Letter for Note and Deed of Trust serves as a crucial legal document and plays a significant role in various real estate transactions within the state. This detailed guide aims to provide essential information about this document, including its purpose, components, and different types. 1. Understanding the Indiana Sample Letter for Note and Deed of Trust: The Indiana Sample Letter for Note and Deed of Trust is a legally binding agreement created between a lender and a borrower during a real estate transaction. It outlines the terms and conditions of a loan, specifying the principal amount, interest rate, payment schedule, and any associated fees. Additionally, it establishes a trust, known as a deed of trust, which grants the lender a security interest in the property. 2. Key Components of the Indiana Sample Letter for Note and Deed of Trust: a. Borrower and Lender Information: The letter identifies the borrower (mortgagor) and the lender (mortgagee), providing their names, addresses, and contact details. b. Loan Terms: It specifies the loan amount, interest rate, and repayment schedule, including the number of installments and due dates. c. Property Description: This section describes the property being used as collateral for the loan, including its address, legal description, and any relevant details. d. Default and Remedies: It outlines the consequences in case of default, such as acceleration of the loan, foreclosure processes, and potential legal actions. 3. Different Types of Indiana Sample Letter for Note and Deed of Trust: a. Residential Real Estate Loan: This type of note and deed of trust is commonly used for residential properties, such as houses or condominiums. b. Commercial Real Estate Loan: This type pertains to loans associated with commercial properties, including office buildings, retail spaces, or industrial premises. c. Agricultural Real Estate Loan: Specifically designed for agricultural properties, this type of note and deed of trust caters to farm lands, ranches, or other agricultural sites. Conclusion: The Indiana Sample Letter for Note and Deed of Trust is a vital legal document that protects the interests of both lenders and borrowers during real estate transactions. It provides clear guidelines on loan terms, repayment obligations, and default consequences. Whether dealing with residential, commercial, or agricultural properties, using the appropriate sample letter for note and deed of trust ensures a secure and legally binding agreement.

Indiana Sample Letter for Note and Deed of Trust

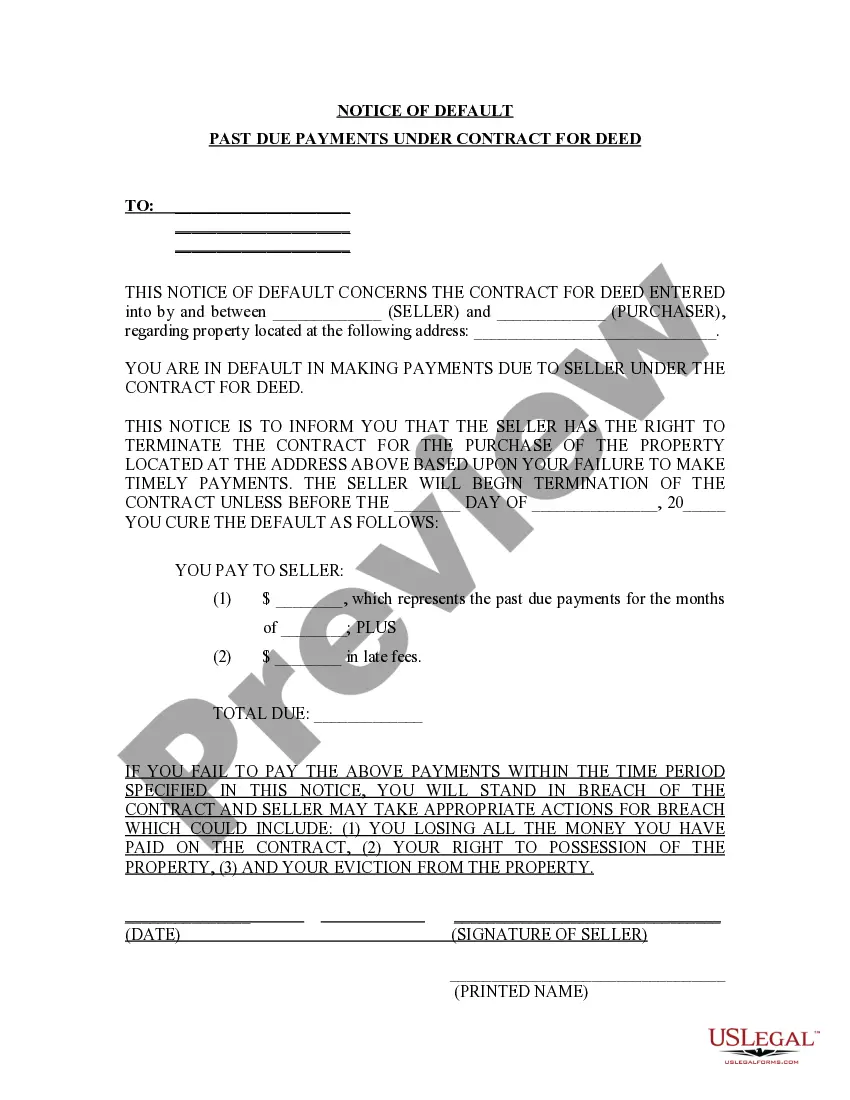

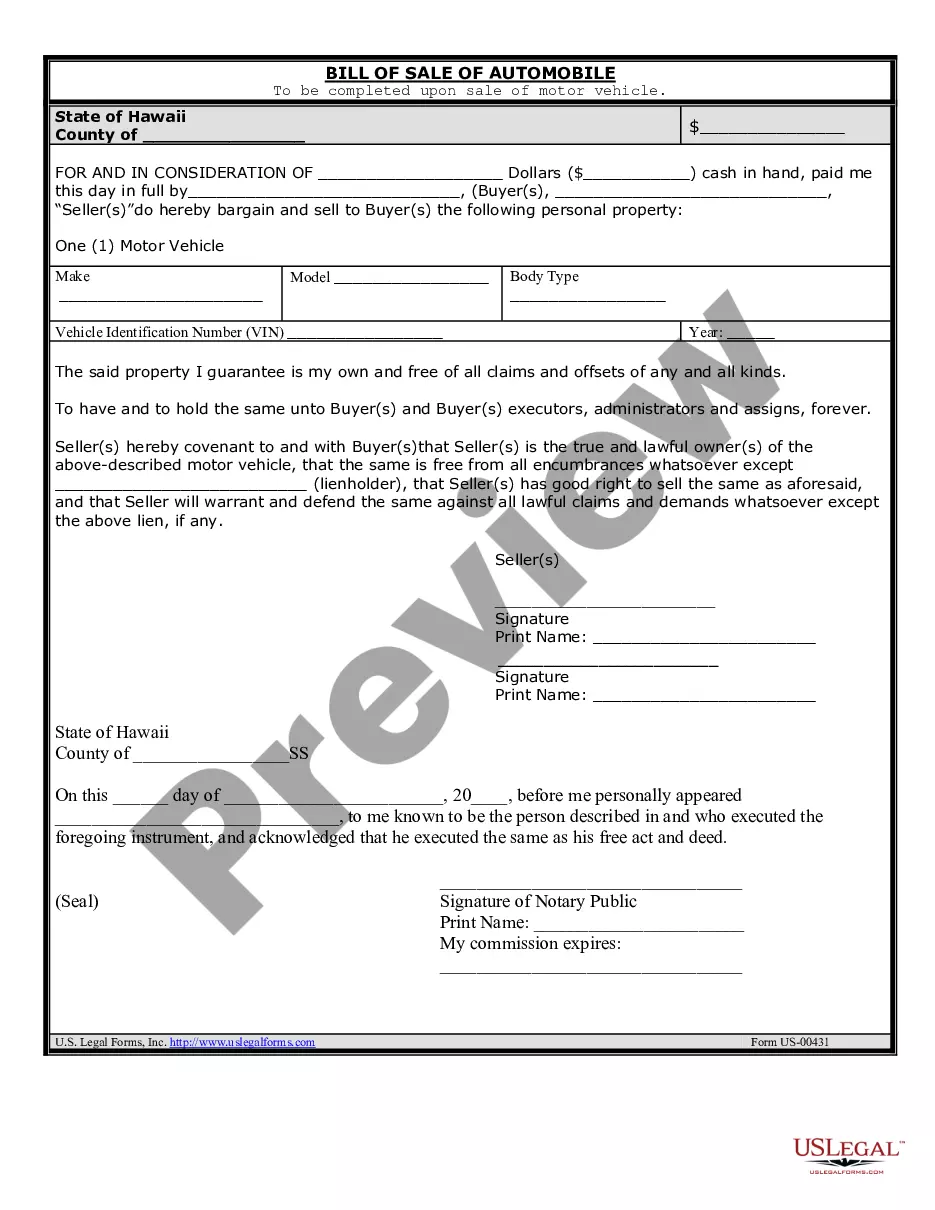

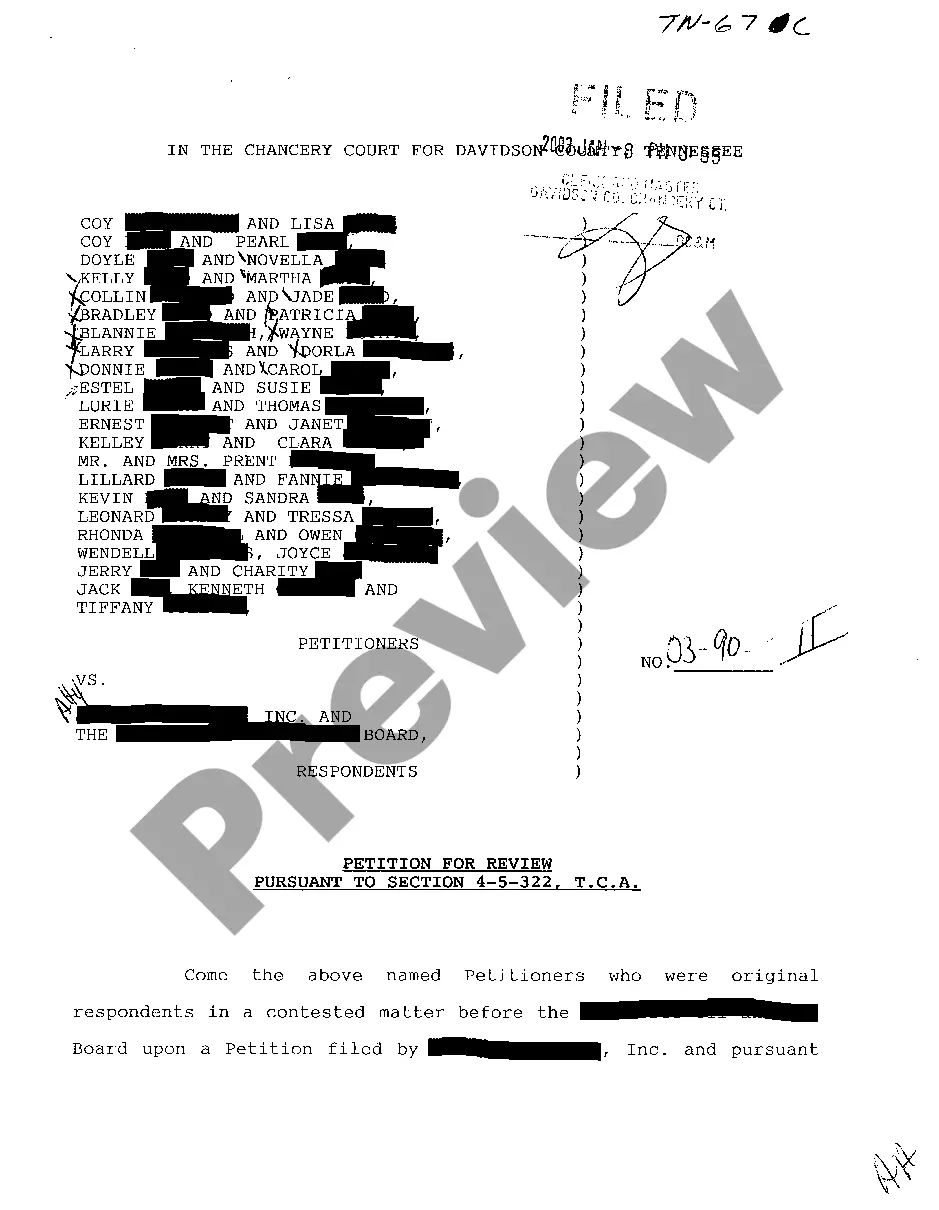

Description

How to fill out Indiana Sample Letter For Note And Deed Of Trust?

Have you been in the placement in which you require papers for possibly enterprise or individual functions nearly every time? There are a lot of legitimate file web templates available online, but discovering versions you can rely isn`t effortless. US Legal Forms offers thousands of type web templates, such as the Indiana Sample Letter for Note and Deed of Trust, that are published to fulfill federal and state specifications.

Should you be previously informed about US Legal Forms web site and possess a merchant account, just log in. Next, you are able to down load the Indiana Sample Letter for Note and Deed of Trust format.

Should you not have an profile and would like to start using US Legal Forms, abide by these steps:

- Obtain the type you will need and ensure it is for the proper metropolis/county.

- Utilize the Review option to analyze the shape.

- Browse the outline to ensure that you have selected the correct type.

- In case the type isn`t what you`re looking for, make use of the Lookup industry to get the type that meets your requirements and specifications.

- Whenever you obtain the proper type, just click Buy now.

- Opt for the costs strategy you desire, complete the desired details to generate your money, and pay for the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a convenient paper file format and down load your version.

Find all of the file web templates you have bought in the My Forms menu. You can aquire a additional version of Indiana Sample Letter for Note and Deed of Trust any time, if possible. Just go through the needed type to down load or print out the file format.

Use US Legal Forms, probably the most substantial variety of legitimate kinds, to conserve time as well as prevent blunders. The assistance offers skillfully produced legitimate file web templates that can be used for a range of functions. Produce a merchant account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

Not all states recognize a Trust Deed. Use a Mortgage Deed if you live in: Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, or Wisconsin.

A deed of trust involves three parties: (1) the trustor, who is the person who received the loan, (2) the beneficiary, who is the person who loaned the money to the trustor, and (3) the trustee, who is the person that released the loan once it has been paid off.

A trust deed is always used together with a promissory note that sets out the amount and terms of the loan. The property owner signs the note, which is a written promise to repay the borrowed money.

Over to the Trustees mentioned hereunder, is hereby acknowledged by the Trustees, who hereby accept the appointment as such Trustees of the said Trust, under the terms and conditions, set out hereunder for the fulfillment of the objects of the Trust, more fully and particularly described and set out hereunder.

Ing to the term of a trust instrument, it can be defined into different types. For example: Inter Vivo trust is created when the settlor is alive. Testamentary trust is usually created through the terms of a settlor's will and goes into effect after the death of the settlor.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.