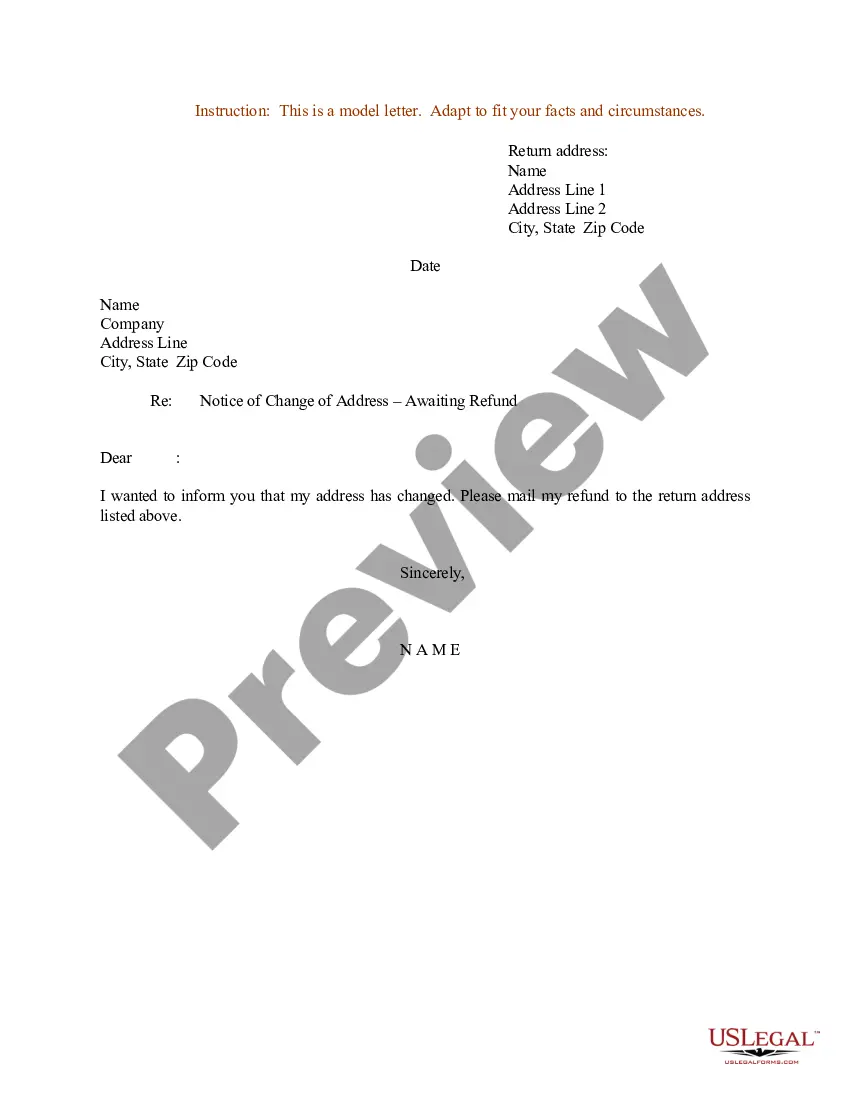

Indiana Sample Letter for Notice of Change of Address - Awaiting Refund

Description

How to fill out Sample Letter For Notice Of Change Of Address - Awaiting Refund?

Are you currently in a position that requires documentation for either business or personal matters on a daily basis.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

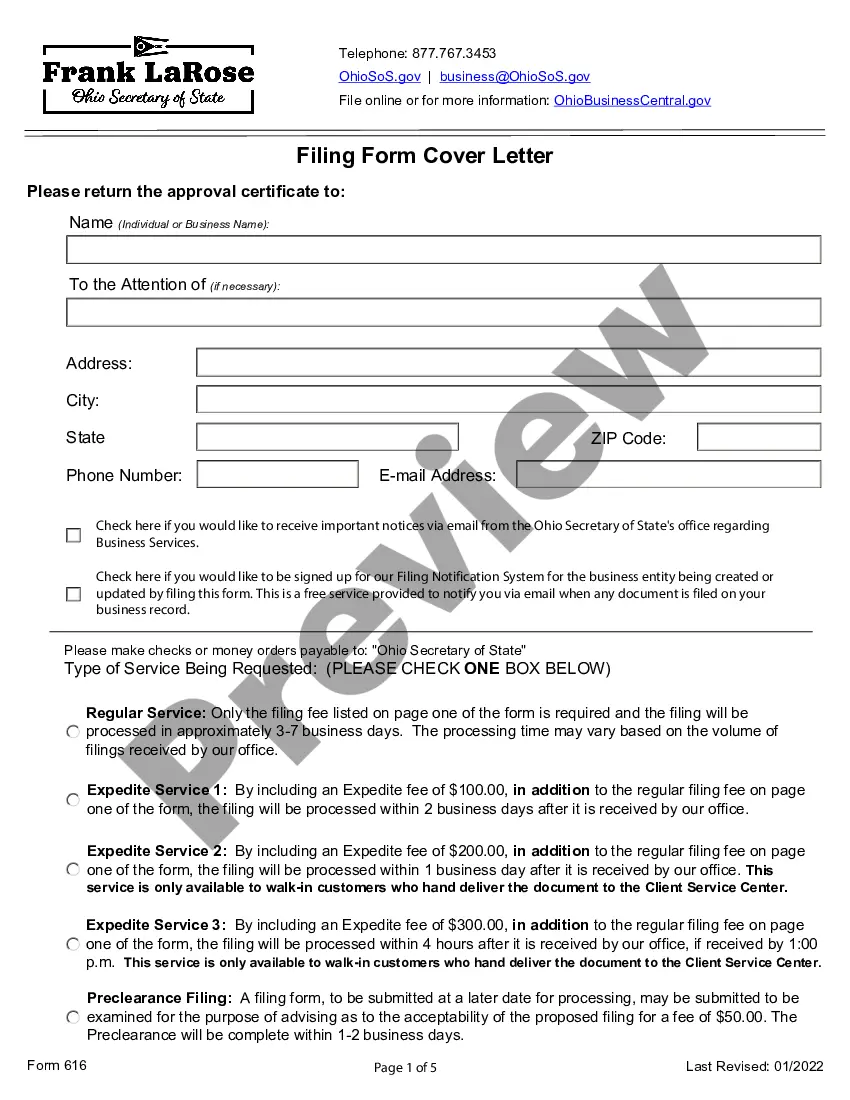

US Legal Forms offers thousands of form templates, including the Indiana Sample Letter for Notice of Change of Address - Awaiting Refund, which can be customized to comply with state and federal regulations.

Select a convenient document format and download your copy.

Retrieve all the document templates you have purchased from the My documents menu. You can obtain another copy of the Indiana Sample Letter for Notice of Change of Address - Awaiting Refund at any time, if necessary. Just click on the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and minimize errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Indiana Sample Letter for Notice of Change of Address - Awaiting Refund template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Utilize the Preview option to review the document.

- Check the description to ensure you have selected the correct form.

- If the form is not what you’re looking for, use the Search area to find the form that suits your needs and requirements.

- Once you find the appropriate form, click on Get now.

- Choose the pricing plan you want, fill in the required details to create your account, and pay for your order using PayPal or a credit/debit card.

Form popularity

FAQ

Through INTIME:In INTIME, log into your account, navigate to the All Actions tab, and click Manage Names and Addresses", then select the address you want to change and update it.

Does this affect it at all/should I just leave the mistake? If your address is wrong with the IRS, you need to fill out form 8822 and mail it to them. Since you are using direct deposit, your refund won't be affected, but you may not get important correspondence from the IRS if you don't update your address.

Some common reasons that a tax refund would take longer to process include incomplete or incorrect forms, calculation or clerical errors or filing duplicate returns. Be sure to sign your tax return electronically or on paper, and double-check account and routing numbers if receiving your refund via direct deposit.

How to Check the Status of Your RefundOnline via INTIME.By telephone at 317-232-2240 (Option 3) to access the automated refund line. Please allow 2-3 weeks of processing time before calling. Some tax returns may take longer to process due to factors like return errors or incomplete information.

How to change your addressThrough INTIME. Log in to your account in INTIME, navigate to the "All Actions" tab, and click "Manage Names & Addresses." Select the address you want to change, then update.By Mail. Indiana Department of Revenue.By Fax. 317-615-2608.In person.

Your return could have been flagged as fraudulent because of identity theft or fraud. Some returns are taking longer because of corrections needed that are related to the earned-income tax credit and the pandemic-related stimulus payments (officially termed a Recovery Rebate Credit).

FooterAbout State Information Center.Call: 800-457-8283.

If you're still waiting on your tax refund, it's possible that your tax return is taking longer for the IRS to process because it requires additional review. There are several reasons why your tax return may be delayed: Errors such as an incomplete filing status. Missing information.

To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party Business and send them to the address shown on the forms.

Refunds are received, on average, within seven to 14 days when filing electronically. Check the status of your refund.