Indiana Receipt and Withdrawal from Partnership

Description

How to fill out Receipt And Withdrawal From Partnership?

Are you situated in a location where you frequently require documents for possibly business or specific intentions? There are numerous authorized document templates accessible online, but obtaining ones you can rely on isn't simple.

US Legal Forms provides thousands of template options, including the Indiana Receipt and Withdrawal from Partnership, which can be printed to meet federal and state requirements.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. Then, you can download the Indiana Receipt and Withdrawal from Partnership template.

Select a convenient document format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can acquire an additional copy of the Indiana Receipt and Withdrawal from Partnership at any time, if necessary. Just access the required form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be used for a variety of objectives. Create an account on US Legal Forms and start making your life a bit easier.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is for the correct city/county.

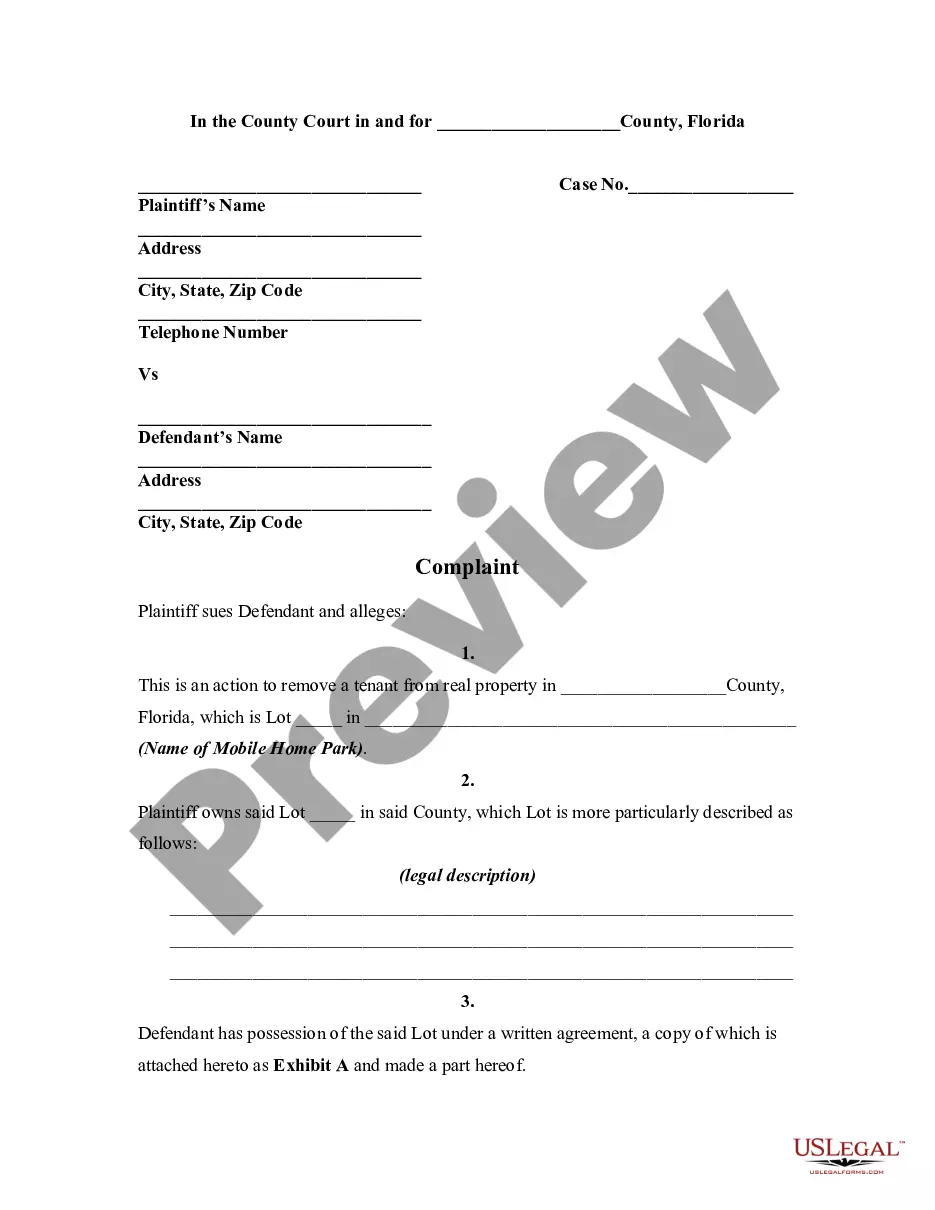

- Use the Preview button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn't what you were looking for, use the Search area to find the form that matches your needs and requirements.

- Once you find the appropriate form, click on Get now.

- Choose the pricing plan you desire, complete the necessary information to create your account, and finalize the transaction using your PayPal, Visa, or Mastercard.

Form popularity

FAQ

The tax consequences of a partner leaving a partnership can be significant, particularly if the withdrawal involves the transfer of assets or profits. The Indiana Receipt and Withdrawal from Partnership can help clarify the financial terms during the exit process. Consulting a tax professional after a partner's withdrawal is critical, as they can provide guidance specific to your situation and help mitigate any tax liabilities.

When A Partner Withdraws From The Partnership The Partnership Dissolves? When one of the partners leaves a partnership, the operation is dissolved, unless the remaining partner decides to form a sole proprietorship instead.

Limited partners may withdraw from a partnership in the manner allowed by the partnership agreement, or state law if there is no agreement. In states that follow the Revised Uniform Limited Partnership Act (RULPA), a limited partner has the right to withdraw after six months' notice to all the general partners.

Withdrawal from a partnership is achieved by serving a written notice ending the involvement of a particular partner in the partnership for one reason or another. There are two kinds of withdrawals: Voluntary withdrawal is when a partner chooses to leave the partnership and is serving notice on the other partner(s).

Accordingly, if a partner resigns or if a partnership expels a partner, the partnership is considered legally dissolved. Other causes of dissolution are the BANKRUPTCY or death of a partner, an agreement of all partners to dissolve, or an event that makes the partnership business illegal.

In a normal partnership, when one partner withdraws, or leaves the company, the partnership dissolves.

To determine whether a partnership exists courts look at: (1) intention of the parties, (2) sharing of profits and losses (3) joint administration and control of business operation, (4) capital investment by each partner, and (5) common ownership of property.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

Under the UPA, the withdrawal of a partner from the partnership automatically causes a dissolution (a break-up) of the partnership. One of the major r introduced with RUPA was to allow a partner to withdraw from the partnership without automatically causing a dissolution of the partnership.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.