An Indiana Assignment Creditor's Claim Against Estate refers to a legal process in which a creditor seeks to recover a debt owed to them by the deceased person's estate. When a person passes away, their estate is responsible for settling any outstanding debts, which may include loans, credit card bills, mortgages, or any other financial obligations. In Indiana, there are various types of creditor's claims that can be filed against an estate. These claims can fall under different categories, including: 1. Secured Creditor's Claim: This type of claim arises when a creditor holds a security interest or lien on a specific asset or property of the deceased individual. The creditor can pursue the sale of the secured asset to satisfy the debt if it cannot be repaid through other means. 2. Unsecured Creditor's Claim: These claims encompass debts that are not backed by any specific collateral or security, such as credit card debts, personal loans, medical bills, or utility bills. Unsecured creditors are typically entitled to a pro rata share of the assets available in the estate. 3. Tax Creditor's Claim: In cases where the deceased owed outstanding taxes, such as income taxes or property taxes, the tax authorities can file a claim against the estate to recover the unpaid amounts. To initiate an Indiana Assignment Creditor's Claim Against Estate, creditors must follow a specific process. They need to file a written claim with the estate representative or executor appointed by the court. The claim should include relevant supporting documentation, such as invoices, loan agreements, or credit statements, that demonstrate the validity and amount of the debt owed. Upon receiving the claim, the estate representative or executor will review its validity and determine whether it should be accepted or rejected. If accepted, the creditor's claim becomes part of the estate's liabilities, and the funds available will be distributed among the creditors based on priority and the estate's available assets. However, if the claim is rejected, the creditor may need to pursue other legal avenues to collect their debt. It is crucial for creditors to be aware of the applicable statutes of limitations for filing a claim against an estate, as there are time limits for initiating these proceedings in Indiana. Consulting with an attorney experienced in estate administration and creditor's claims can provide valuable guidance and help ensure the proper legal procedures are followed. Overall, an Indiana Assignment Creditor's Claim Against Estate allows creditors to seek payment for outstanding debts from the assets left behind by a deceased person. Understanding the different types of claims and the process for filing them is important for creditors seeking to collect on their debts while respecting the legal framework surrounding estate administration in Indiana.

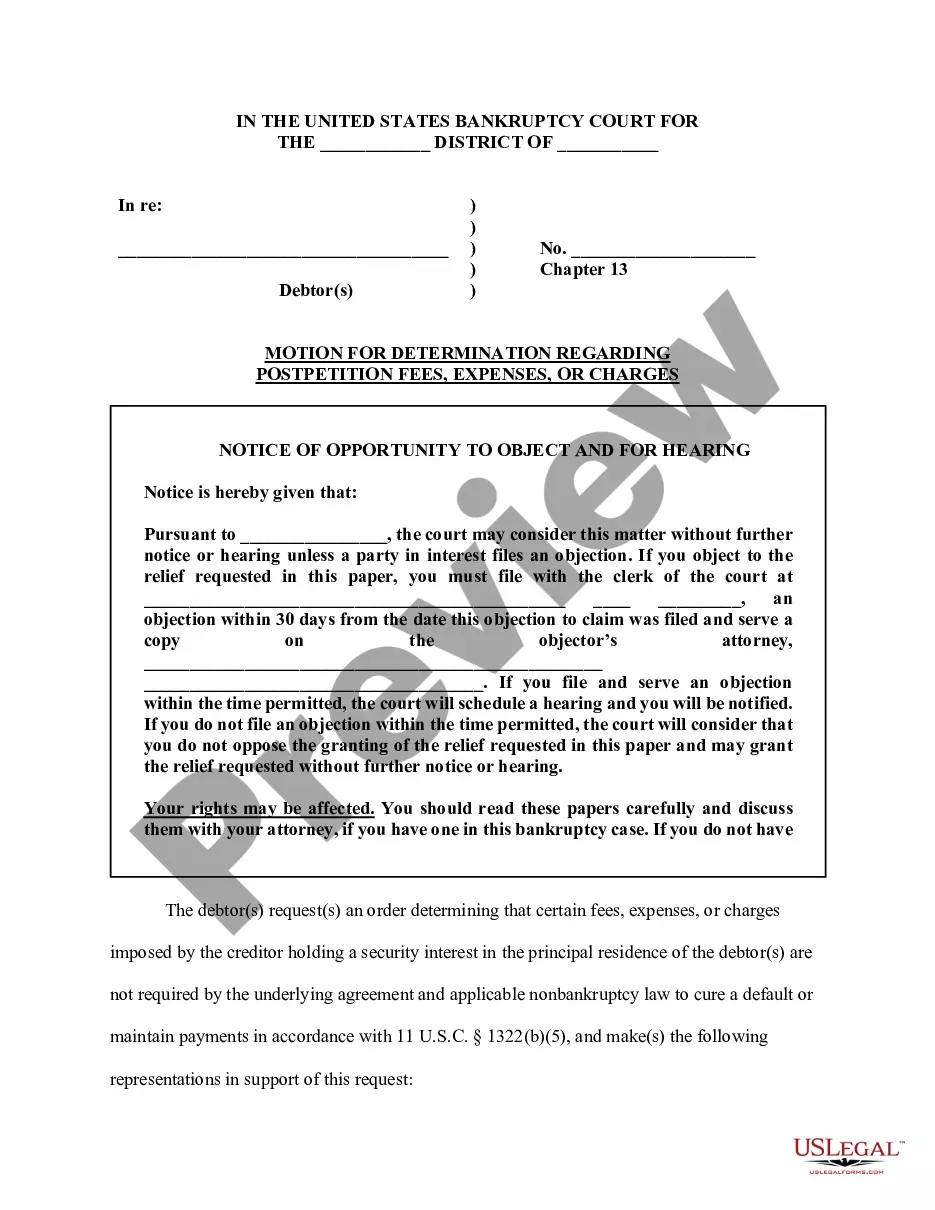

Indiana Assignment Creditor's Claim Against Estate

Description

How to fill out Indiana Assignment Creditor's Claim Against Estate?

US Legal Forms - one of several most significant libraries of authorized varieties in America - provides a wide range of authorized document layouts you are able to acquire or produce. Utilizing the website, you can find 1000s of varieties for company and personal functions, categorized by categories, claims, or keywords and phrases.You will find the most recent types of varieties just like the Indiana Assignment Creditor's Claim Against Estate in seconds.

If you already possess a monthly subscription, log in and acquire Indiana Assignment Creditor's Claim Against Estate in the US Legal Forms catalogue. The Download switch can look on each kind you see. You get access to all in the past downloaded varieties inside the My Forms tab of your own bank account.

If you wish to use US Legal Forms the very first time, listed here are basic directions to help you started:

- Be sure you have selected the proper kind for your personal area/county. Click the Review switch to check the form`s content. Look at the kind explanation to ensure that you have chosen the correct kind.

- When the kind doesn`t satisfy your requirements, take advantage of the Look for discipline on top of the screen to discover the one that does.

- Should you be satisfied with the shape, validate your decision by simply clicking the Buy now switch. Then, select the costs plan you like and give your references to sign up on an bank account.

- Process the deal. Use your Visa or Mastercard or PayPal bank account to accomplish the deal.

- Pick the formatting and acquire the shape on your own system.

- Make modifications. Fill out, edit and produce and signal the downloaded Indiana Assignment Creditor's Claim Against Estate.

Each and every design you added to your account does not have an expiration particular date and it is the one you have eternally. So, if you wish to acquire or produce one more copy, just go to the My Forms section and click about the kind you will need.

Gain access to the Indiana Assignment Creditor's Claim Against Estate with US Legal Forms, one of the most extensive catalogue of authorized document layouts. Use 1000s of expert and state-particular layouts that satisfy your small business or personal requirements and requirements.