Indiana Independent Contractor Agreement with Church

Description

How to fill out Independent Contractor Agreement With Church?

Selecting the appropriate legal document template can be quite a challenge.

Naturally, there are numerous templates accessible online, but how do you obtain the legal form you require.

Utilize the US Legal Forms website.

First, ensure you have selected the appropriate form for your area/county. You can browse the form using the Review button and read the form description to confirm it is the right one for you. If the form does not fulfill your needs, use the Search area to find the correct form. Once you are sure that the form is suitable, select the Get now button to obtain it. Choose the pricing plan you wish and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, and print and sign the acquired Indiana Independent Contractor Agreement with Church. US Legal Forms is the largest collection of legal forms where you can discover various document templates. Use the service to download professionally crafted documents that meet state requirements.

- The service offers thousands of templates, such as the Indiana Independent Contractor Agreement with Church, that can be utilized for business and personal purposes.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the Indiana Independent Contractor Agreement with Church.

- Use your account to view the legal forms you have previously obtained.

- Go to the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

Church ministers can be classified as employees or independent contractors, depending on their situation. If they receive a salary, benefits, and are under the authority of the church, they are likely to be employees. However, in many cases, church ministers operate as independent contractors under an Indiana Independent Contractor Agreement with Church, particularly if they have more autonomy in their work. This distinction is vital for churches to understand for compliance and tax purposes.

The classification of pastors as employees or independent contractors often depends on their specific relationship with the church. Many pastors serve as independent contractors under an Indiana Independent Contractor Agreement with Church, allowing flexibility in their roles. However, some may qualify as employees based on their level of control and commitment to the church. It is essential for churches to review this classification regularly.

A pastor generally falls under the category of religious leaders or clergy. This role can involve teaching, counseling, and leading worship services within a church or religious organization. Understanding this classification is vital when drafting an Indiana Independent Contractor Agreement with Church, as it affects tax obligations and employment status. Clear documentation can help clarify expectations.

In general, a pastor typically receives a 1099 form rather than a W-2. This can vary depending on whether the pastor is classified as an employee or an independent contractor under the Indiana Independent Contractor Agreement with Church. Independent contractors usually get a 1099 because they are not on the church's payroll. Always consult a tax professional to ensure proper classification.

Whether an independent contractor should form an LLC or S Corp depends on their individual circumstances and business goals. Forming an LLC provides personal liability protection and simplifies tax reporting. On the other hand, an S Corp may offer additional tax benefits, depending on income levels. Consulting with a tax professional can provide tailored advice that aligns with the Indiana Independent Contractor Agreement with Church.

Independent contractors need to fill out a W-9 form to provide their taxpayer information to the church. The church will then use this W-9 form to issue a 1099-NEC at the end of the tax year. Properly using the Indiana Independent Contractor Agreement with Church alongside these forms facilitates a smooth and compliant working relationship.

Besides the W-9 form, an independent contractor engaging with a church should also review the Indiana Independent Contractor Agreement with Church. This agreement details the nature of work and payment terms, making sure both parties are on the same page. Having these forms in place helps protect the interests of both the contractor and the church.

Independent contractors receive a 1099-NEC form, which reports nonemployee compensation. This form replaces the 1099-MISC for payments made to contractors in recent tax years. For churches and other organizations, using the Indiana Independent Contractor Agreement with Church and issuing a 1099-NEC helps ensure accurate reporting of payments and maintains transparency.

When engaging an independent contractor, you often need them to fill out a W-9 form. This form collects essential information, such as their tax identification number, which is crucial for tax reporting purposes. Using the Indiana Independent Contractor Agreement with Church alongside the W-9 helps solidify your working relationship and maintain compliance with IRS regulations.

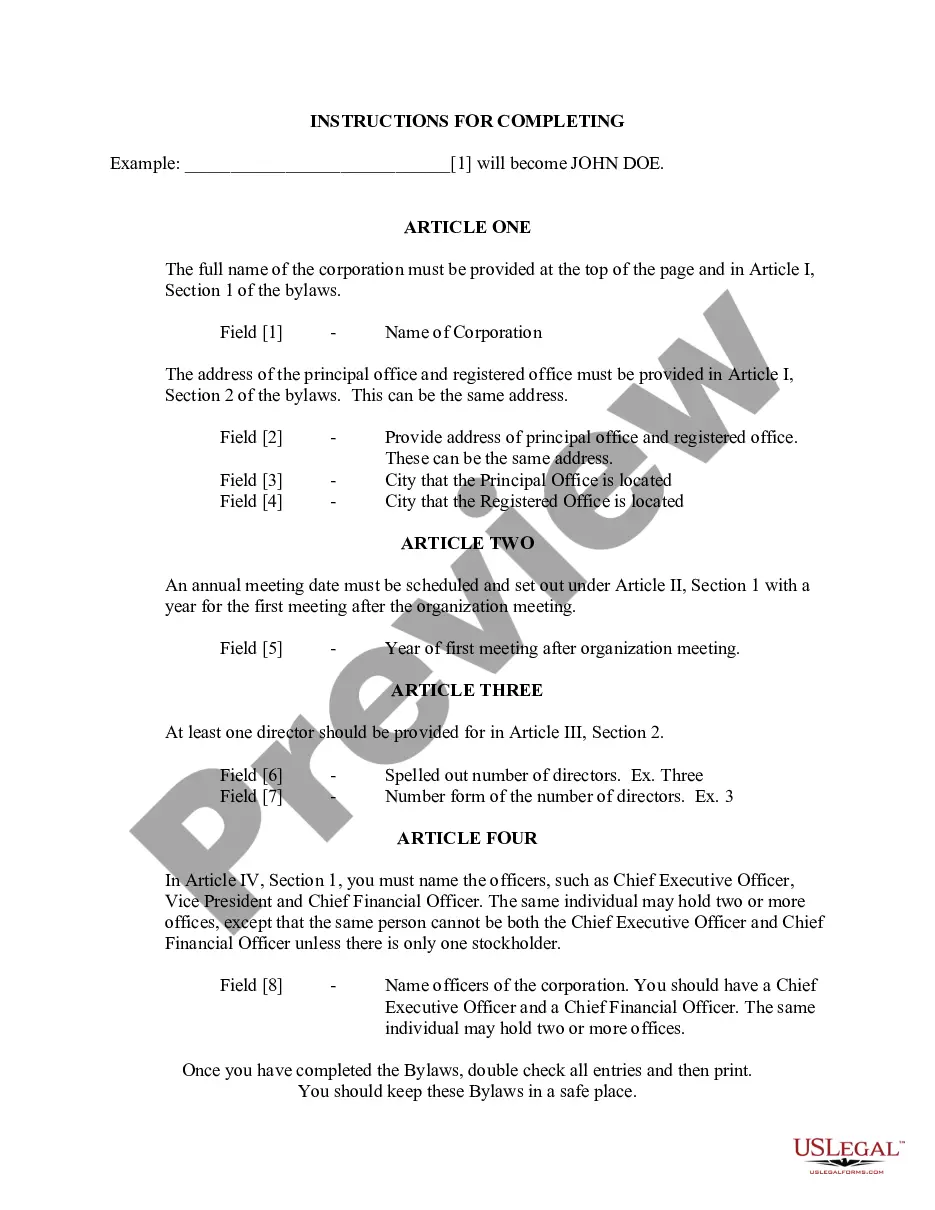

To fill out an Indiana Independent Contractor Agreement with Church, start by providing the names and addresses of both the contractor and the church. Next, outline the scope of work clearly, detailing what the contractor will do. Additionally, specify payment terms, including rates and deadlines. Finally, ensure both parties sign and date the agreement after reviewing it to confirm mutual understanding.