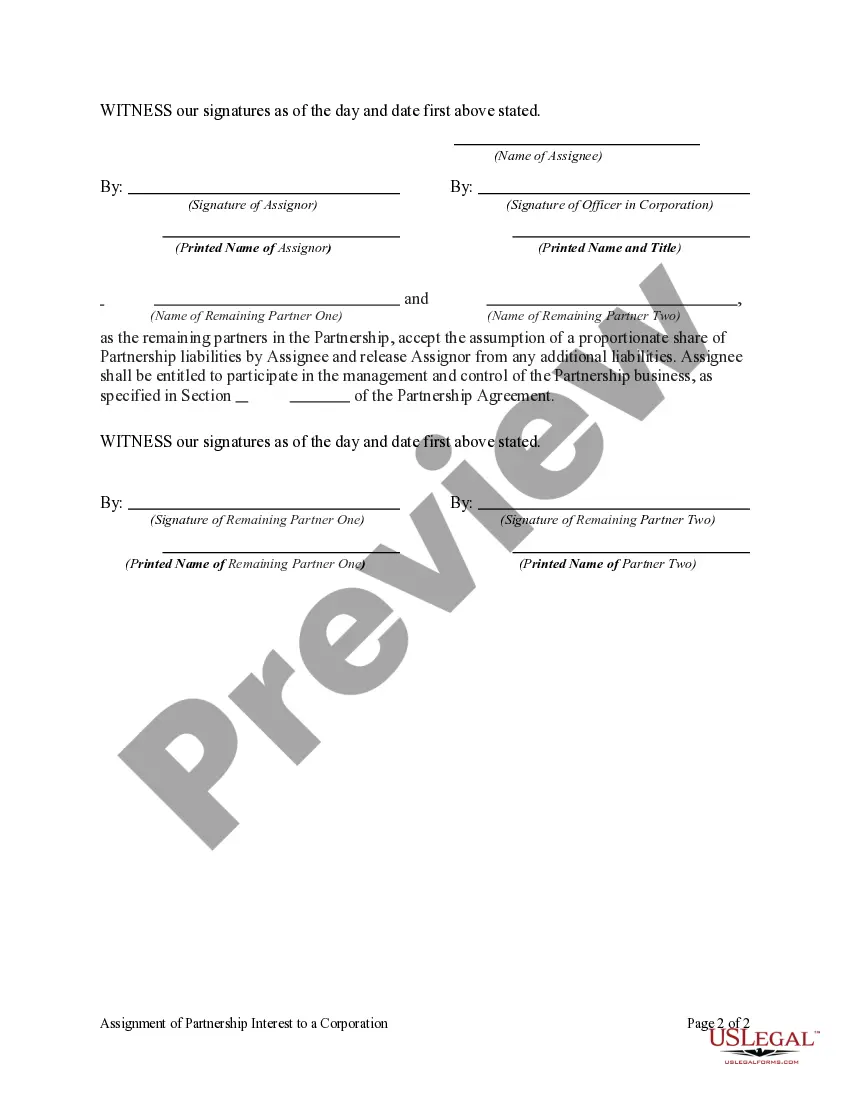

Indiana Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners

Description

How to fill out Assignment Of Partnership Interest To A Corporation With Consent Of Remaining Partners?

US Legal Forms - one of several largest libraries of legitimate types in the States - gives a variety of legitimate record web templates it is possible to obtain or print. Making use of the web site, you may get 1000s of types for company and personal purposes, categorized by classes, suggests, or search phrases.You will find the newest types of types such as the Indiana Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners within minutes.

If you already have a membership, log in and obtain Indiana Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners from the US Legal Forms library. The Acquire button will show up on every single form you look at. You get access to all formerly saved types in the My Forms tab of your accounts.

If you want to use US Legal Forms initially, listed here are basic directions to obtain began:

- Make sure you have selected the right form for the town/county. Click the Review button to check the form`s articles. See the form explanation to ensure that you have chosen the right form.

- If the form doesn`t suit your needs, utilize the Research discipline near the top of the display screen to get the one which does.

- In case you are satisfied with the shape, verify your selection by simply clicking the Buy now button. Then, choose the costs strategy you favor and offer your credentials to sign up for the accounts.

- Method the purchase. Use your credit card or PayPal accounts to complete the purchase.

- Find the formatting and obtain the shape on the system.

- Make changes. Load, edit and print and indication the saved Indiana Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners.

Each and every design you included in your money lacks an expiration particular date and is also the one you have for a long time. So, in order to obtain or print one more backup, just proceed to the My Forms portion and click on about the form you want.

Obtain access to the Indiana Assignment of Partnership Interest to a Corporation with Consent of Remaining Partners with US Legal Forms, by far the most considerable library of legitimate record web templates. Use 1000s of specialist and express-certain web templates that satisfy your organization or personal demands and needs.

Form popularity

FAQ

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).

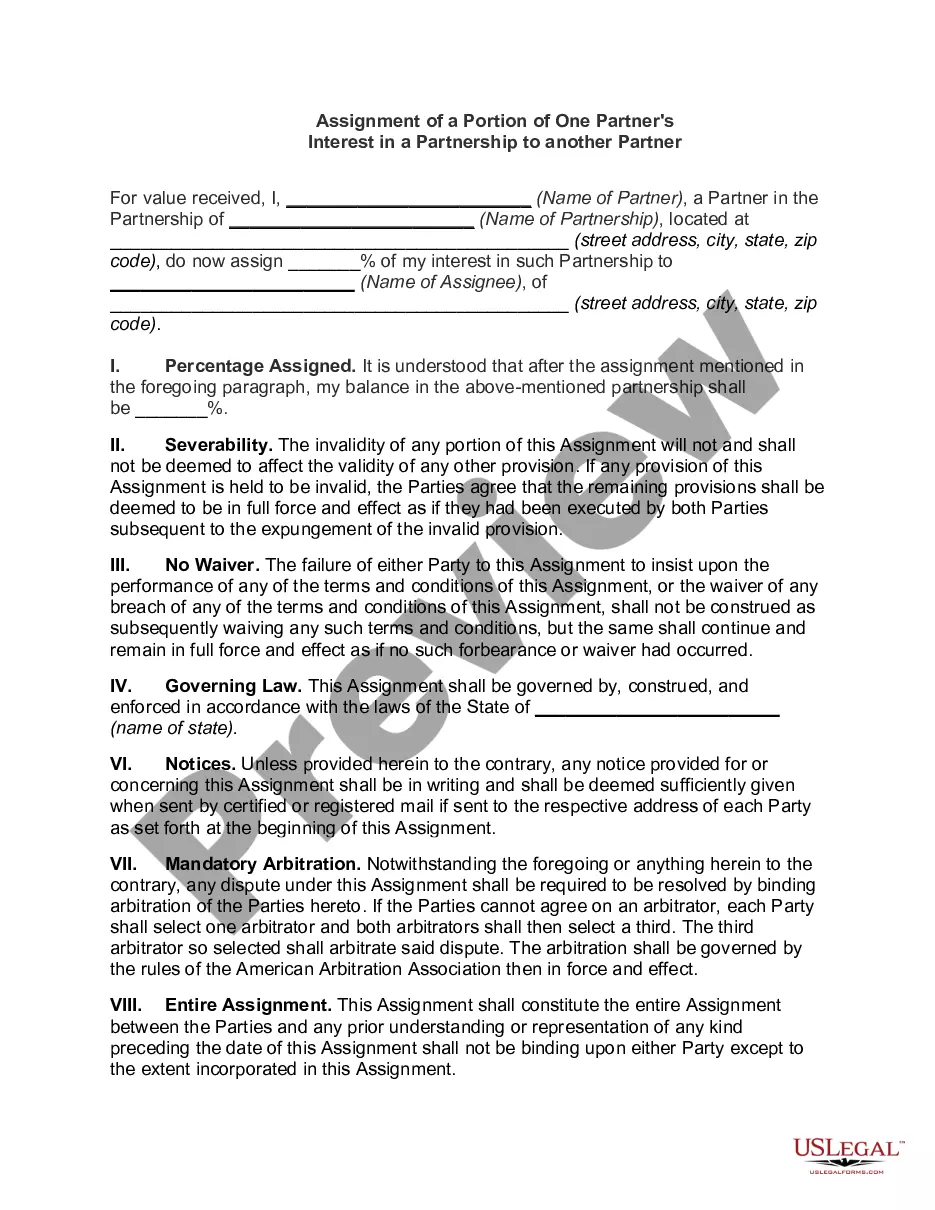

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.

An Assignment of Partnership Interest occurs when a partner sells their stake in a partnership to a third party. The assignment document records the details of the transfer to the new partner.

Transferring Interest ing to state laws, partnership interests are free to transfer, so the only way a partner might run into difficulties is if there are restrictions in the partnership agreement.

The partnership's operating agreement and overall operations also affect the gift of partnership interests and more importantly, the availability of the annual gift tax exclusions. In order to qualify for the annual gift tax exclusion, the gift must be of a present interest in property.

Transfer of limited partnership interest is allowed as long as the general partner consents to the arrangement and it is done in concert with the established partnership agreement. A common example of a limited partnership is the family limited partnership, which is often created to administer a family business.

If the partner dies, the partner's estate will typically succeed to that decedent's interest in the partnership.