Indiana Filing System for a Business

Description

How to fill out Filing System For A Business?

Have you ever been in a situation where you require documents for both business or particular needs almost daily.

There are numerous legal document templates accessible online, but finding versions you can trust is challenging.

US Legal Forms offers a vast array of document templates, such as the Indiana Filing System for a Business, designed to meet state and federal standards.

Choose a suitable file format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the Indiana Filing System for a Business at any time, if needed. Just navigate to the required document to download or print the template.

Utilize US Legal Forms, the largest collection of legal documents, to save time and avoid errors. The service offers professionally crafted legal document templates that you can employ for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Indiana Filing System for a Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the document you need and confirm it is for the correct area/region.

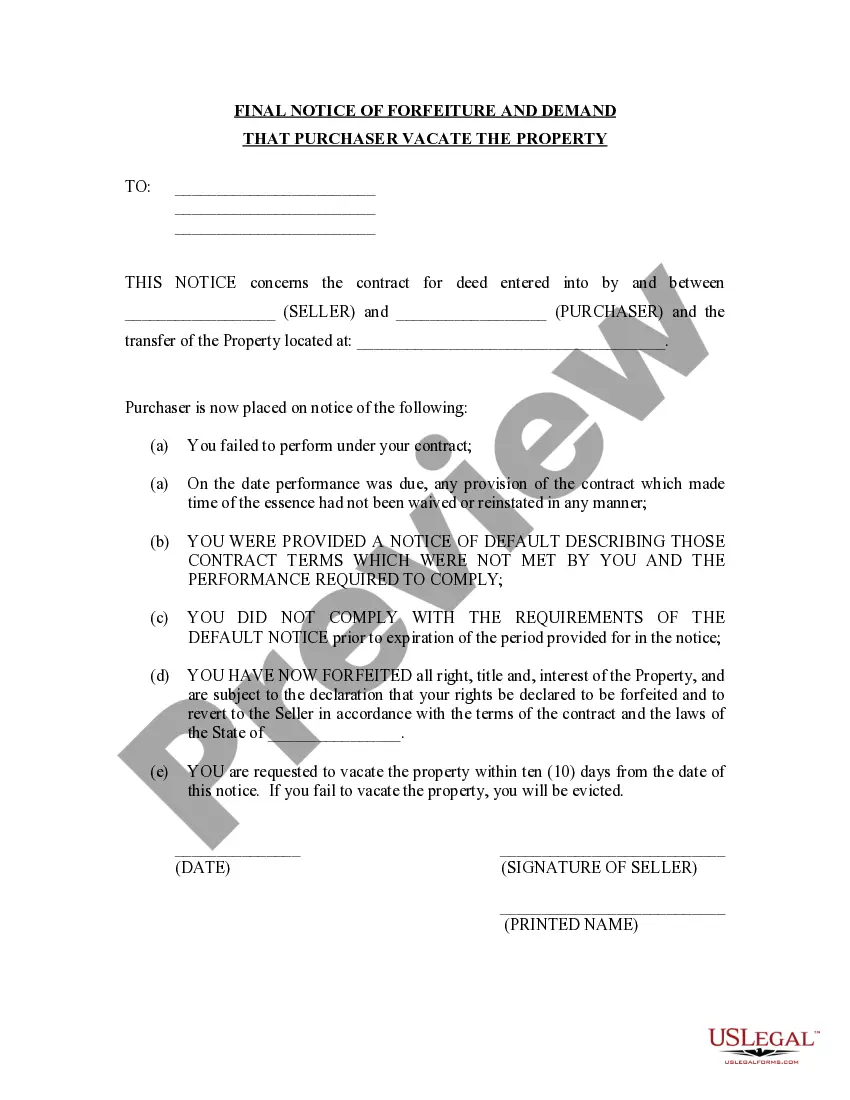

- Utilize the Preview button to review the document.

- Examine the details to ensure you have selected the appropriate document.

- If the document is not what you are looking for, use the Lookup field to find the document that meets your needs.

- Once you identify the correct document, click Buy now.

- Select the payment plan you want, complete the necessary information to create your account, and process the payment using your PayPal or credit card.

Form popularity

FAQ

Yes, Indiana requires most businesses to obtain a business license, which ensures they comply with state regulations. Depending on your business type and location, you may need to apply for specific local licenses as well. Utilizing the Indiana Filing System for a Business can simplify this process and help you understand all necessary licenses for your venture.

If you fail to file a business entity report in Indiana, your business may face significant consequences. The Indiana Filing System for a Business requires periodic reporting to maintain good standing. Not filing can result in penalties, late fees, and even administrative dissolution of your business entity. To avoid these issues, it’s essential to adhere to filing deadlines to maintain your business's compliance and eligibility.

Indiana New Employer RegistrationRegister online with INBiz. Click Register Now at the bottom of the page and follow the instructions.You'll receive your Tax Identification Number within 2-3 hours after completing the registration online. For more information, please contact the agency at (317) 233-4016.

To register your Indiana LLC, you'll need to file the Articles of Organization with the Indiana Secretary of State Business Services Division. You can apply online or by mail. Read our Form an LLC in Indiana guide for details. Or use a professional service like ZenBusiness or to form your LLC for you.

How much does it cost to start a business in Indiana? To form an LLC in Indiana, file your Articles of Organization with the Indiana Secretary of State along with the $100 filing fee. Forming a corporation in the State of Indiana also costs $100.

Most states require you to register with the Secretary of State's office, a Business Bureau, or a Business Agency.

If you are starting a new business in Indiana, you may need to register with the Indiana Department of Revenue.

How to Form a Corporation in IndianaChoose a Corporate Name.File Articles of Incorporation.Appoint a Registered Agent.Prepare Corporate Bylaws.Appoint Initial Directors and Hold First Board Meeting.File Biennial Report.Obtain an EIN.

Cost to Form an LLC in Indiana. The cost to start an Indiana limited liability company (LLC) is $95. This fee is paid to the Indiana Secretary of State when filing the LLC's Articles of Organization. Use our free Form an LLC in Indiana guide to do it yourself.

The State of Indiana requires you to file a biennial report for your LLC. You can file the report online at the SOS website or file a form (State Form 48725) by mail. The report is due every other year in the anniversary month of your LLC's formation.