Indiana Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure

Description

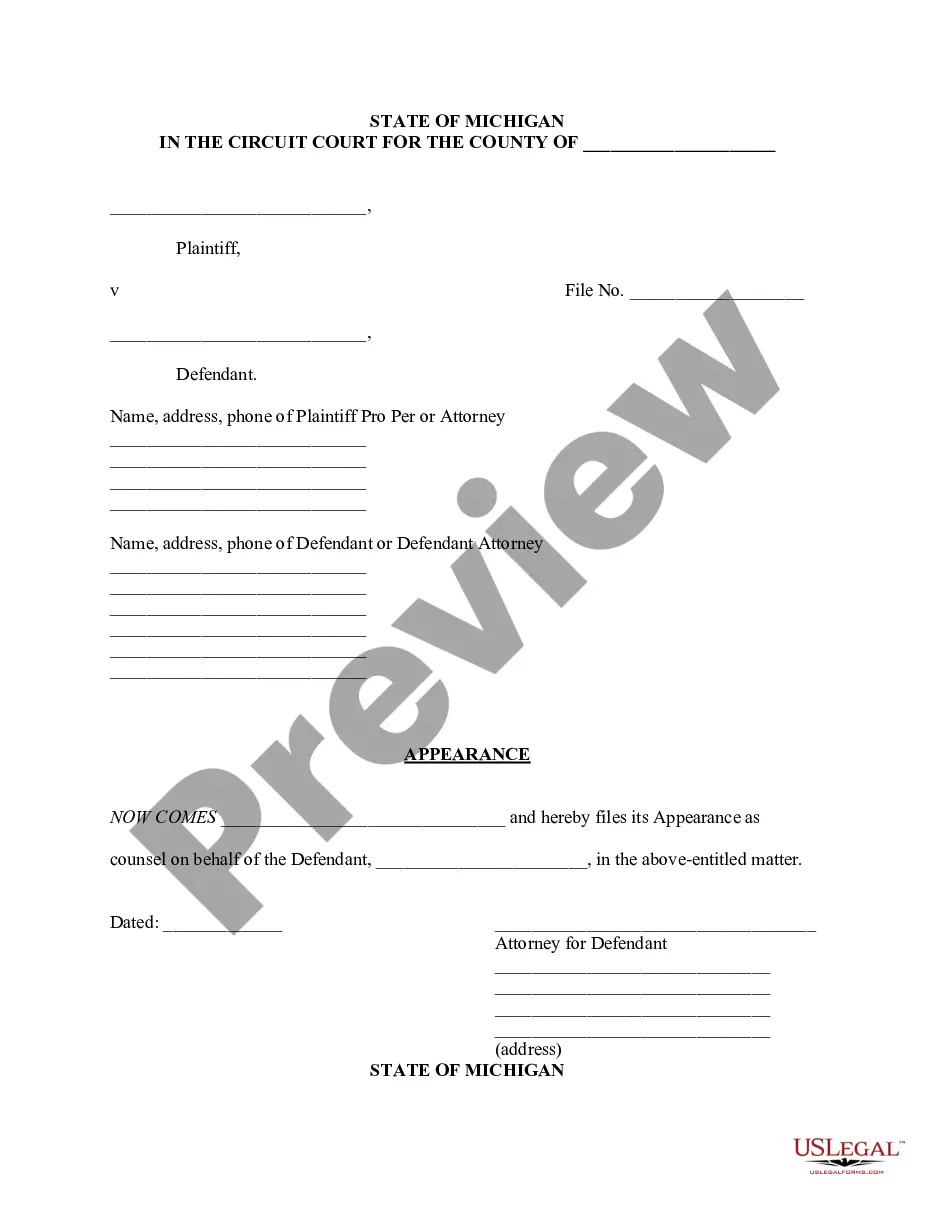

How to fill out Sample Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure?

US Legal Forms - among the largest libraries of lawful varieties in the USA - delivers an array of lawful file templates you are able to down load or print out. Utilizing the internet site, you may get 1000s of varieties for company and person reasons, categorized by classes, says, or keywords and phrases.You can get the latest models of varieties much like the Indiana Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure in seconds.

If you have a subscription, log in and down load Indiana Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure from the US Legal Forms catalogue. The Download button will show up on each develop you see. You have access to all earlier delivered electronically varieties within the My Forms tab of your profile.

If you would like use US Legal Forms for the first time, listed here are simple recommendations to get you started:

- Make sure you have selected the proper develop for your personal town/county. Select the Review button to review the form`s articles. See the develop description to actually have chosen the proper develop.

- In case the develop does not suit your specifications, utilize the Look for field towards the top of the display screen to find the the one that does.

- If you are content with the shape, affirm your option by visiting the Acquire now button. Then, opt for the rates program you like and offer your accreditations to register on an profile.

- Approach the deal. Make use of your Visa or Mastercard or PayPal profile to accomplish the deal.

- Pick the format and down load the shape on the gadget.

- Make alterations. Fill up, edit and print out and signal the delivered electronically Indiana Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure.

Every web template you put into your bank account lacks an expiry particular date and is your own property for a long time. So, if you want to down load or print out yet another backup, just proceed to the My Forms segment and click on in the develop you need.

Gain access to the Indiana Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure with US Legal Forms, by far the most considerable catalogue of lawful file templates. Use 1000s of skilled and status-specific templates that meet your organization or person requires and specifications.

Form popularity

FAQ

A debt collection letter, also called a demand letter, is a letter sent to clients who have failed to pay their legal bills on time. Ordinarily, firms send their clients a bill and provide reminders via phone or email as needed.

Although you can ask for many details, debt collectors are only required to provide information on the original creditor, the balance owed and the name of the person who owes the debt before resuming collection efforts.

Collect any documentation or evidence that supports your claim. This can include bank statements, payment records, contracts, or any other relevant documents that prove you are not responsible for the debt. Make sure to keep copies of all communication with the debt collector as well.

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

How to Request Debt Verification. To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

The promise to pay is set out in a written document called a promissory note. A promissory note represents an underlying debt owed by one person to another. The signed promissory note is not the debt itself, but evidence the debt exists.

In this article, ?debt validation letter? means the initial notice a debt collector must send you under federal law, and ?debt verification letter? means a letter you send to the debt collector to request more information and/or to dispute the debt.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.