Indiana Health Insurance for Summer Interns is a specialized health insurance plan designed specifically for interns who are spending their summers working in Indiana. This type of health insurance coverage assists interns in securing affordable and comprehensive healthcare services during their temporary stay in the state. This Indiana health insurance for summer interns offers a range of benefits tailored to meet the specific needs of interns. These benefits typically encompass access to a wide network of healthcare providers, coverage for medical consultations, hospital stays, prescription medications, and emergency care. The coverage may also include preventive services such as vaccinations, wellness check-ups, and access to mental health services. There are different types of Indiana Health Insurance for Summer Interns available, offering varying levels of coverage and cost. Some common types include: 1. Basic Coverage: This type of health insurance provides interns with essential health benefits, ensuring coverage for hospital visits, outpatient care, emergency services, and prescription drugs. It typically offers lower monthly premiums but may require higher deductibles and co-payments. 2. Comprehensive Coverage: Comprehensive plans offer interns a broader scope of coverage, including additional benefits like preventive care, mental health services, maternity care, and vision and dental care. These plans usually have higher premiums but lower out-of-pocket costs. 3. High-Deductible Health Plans (DHP): HDPS are designed to reduce monthly premiums by having a higher deductible, which is the amount interns must pay before the insurance coverage begins. Interns can pair HDPS with a Health Savings Account (HSA) to save money tax-free for medical expenses. 4. Managed Care Plans: These plans involve networks of healthcare providers that interns must use to receive maximum coverage. They often have lower out-of-pocket costs but may require referrals to see specialists and prior authorization for certain medical services. When considering Indiana Health Insurance for Summer Interns, it is essential for prospective interns to assess their individual needs, budget, and duration of stay in Indiana. Comparing different plans, evaluating costs, deductibles, co-payments, and checking if any preferred healthcare providers or services are covered can help interns make an informed decision. Overall, Indiana Health Insurance for Summer Interns offers peace of mind, ensuring interns can access the necessary healthcare services and treatments without financial strain during their temporary stay in Indiana.

Indiana Health Insurance for Summer Interns

Description

How to fill out Health Insurance For Summer Interns?

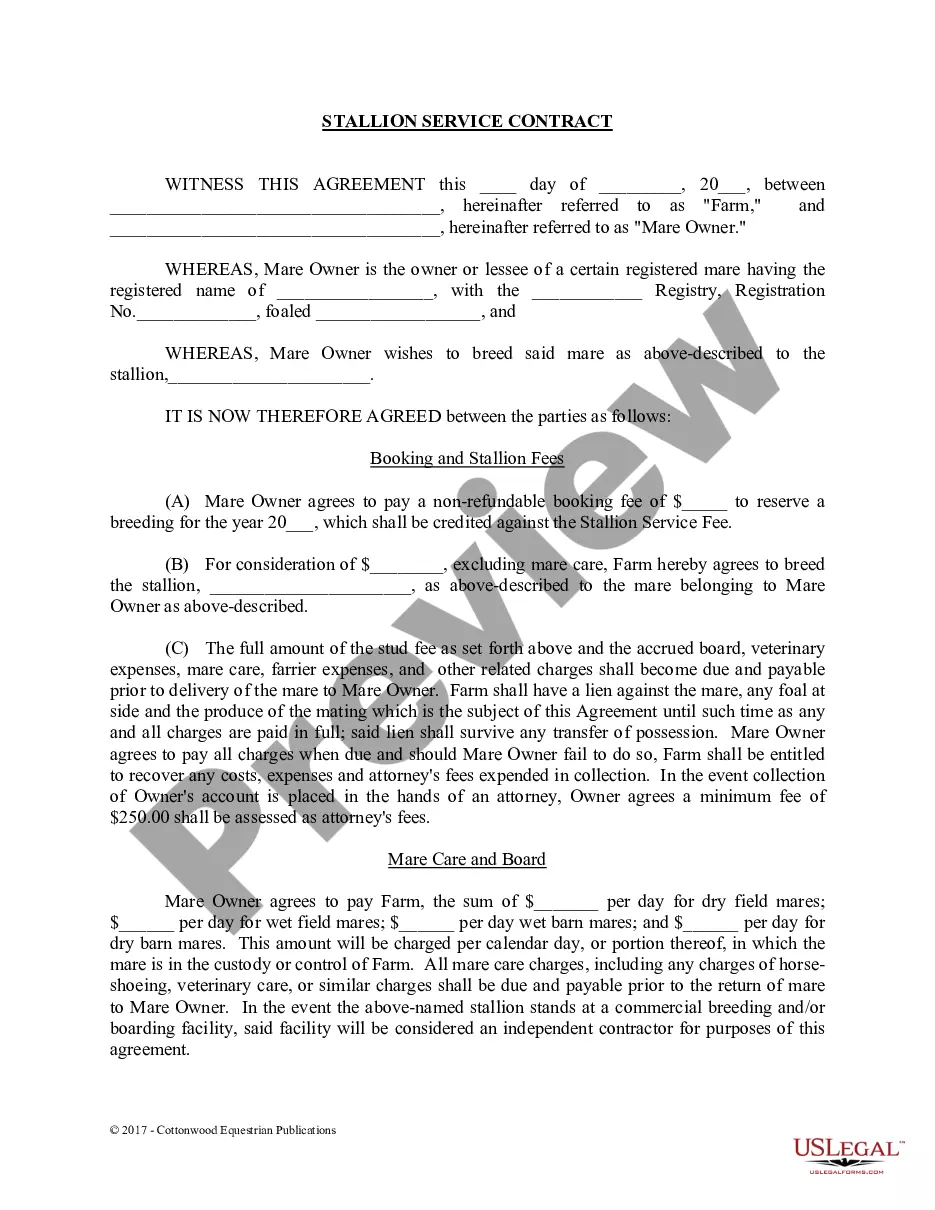

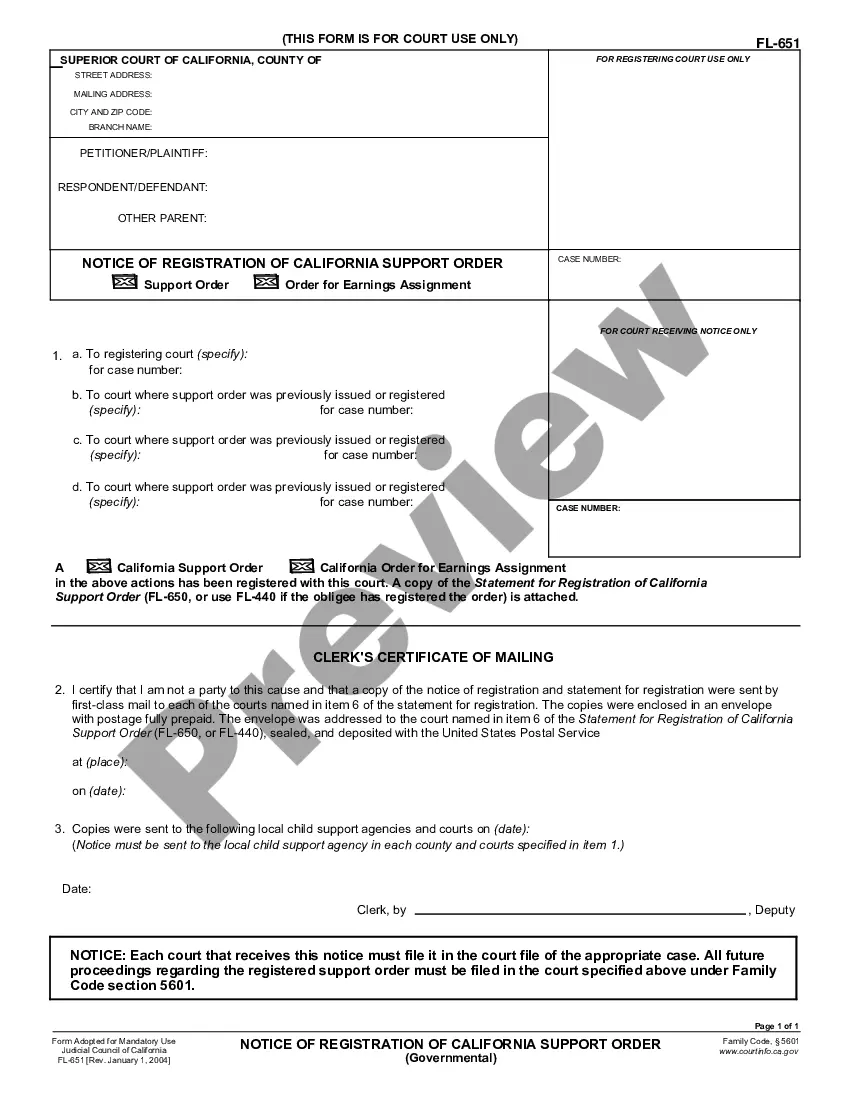

Have you been inside a placement the place you need to have files for sometimes company or personal reasons nearly every day? There are a variety of authorized record themes available on the Internet, but getting versions you can rely on isn`t straightforward. US Legal Forms offers a huge number of type themes, just like the Indiana Health Insurance for Summer Interns, which can be published to meet federal and state specifications.

If you are presently acquainted with US Legal Forms internet site and have a merchant account, basically log in. Following that, it is possible to download the Indiana Health Insurance for Summer Interns format.

If you do not offer an accounts and would like to start using US Legal Forms, follow these steps:

- Find the type you need and ensure it is to the correct metropolis/county.

- Use the Review option to examine the form.

- Browse the outline to actually have chosen the right type.

- In case the type isn`t what you are seeking, use the Lookup field to get the type that fits your needs and specifications.

- When you get the correct type, click Acquire now.

- Pick the rates plan you need, fill out the specified information to generate your bank account, and buy your order using your PayPal or bank card.

- Pick a handy file formatting and download your duplicate.

Locate all of the record themes you may have bought in the My Forms food list. You can aquire a additional duplicate of Indiana Health Insurance for Summer Interns whenever, if necessary. Just click the essential type to download or printing the record format.

Use US Legal Forms, one of the most substantial variety of authorized varieties, in order to save time as well as prevent blunders. The support offers professionally made authorized record themes that can be used for a variety of reasons. Create a merchant account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

Before the internship begins, there are a few things that you can work on to have an edge during the internship.Product. Get a basic idea of the company's product.Tech stack.Git.Responsibility.Attentiveness.Clean and well-designed code.Doubts.Use a good note-taking app.More items...

8 Ways to Turn an Internship into a Job OfferResearch the Company. Find out everything you can about the company before you start.Ask Questions. Employers like to see interns who are engaged and eager to learn.Set Goals.Work Hard.Be Professional.Get to Know Everyone.Be Positive.Learn From Others.

If you have interns, make sure they covered for workplace injuries. Call your insurance agent and ask them about coverage for your new intern. They can help you make sure that they are covered in the event of a workplace accident. Workers compensation is important to have for interns and employees alike.

Internships do not displace regular employees. Instead, interns work in partnership with and under the supervision of regular employees. Employers receive no immediate benefit from interns' activities. In a true internship, program training will occasionally impede business operations.

How do you get a PPO after an internship?The candidates who perform above a threshold criteria are offered a PPO directly by the management and hiring team.Many firms mention PPO from the starting itself, that is, if you complete the internship successfully, you will definitely be given the PPO.More items...?

Here are some advantages of internships for students:Job experience.Research experience.Access to a variety of tasks and departments.Mentorship.Help guide career goals.Create a professional network.Build a strong resume.Secure good references and recommendations.More items...?

The benefits of hiring an intern or graduateEstablish a relationship with the college and university.Increase productivity.Bring in fresh perspectives.Enhance supervisory skills of your staff.Create company visibility.Develop student/graduate skill sets.Cut down on recruitment costs.More items...

When Is It Too Late to Apply for an Internship? It is never too late to apply for internships. Of course, it can be too late for a specific position because the due date has passed, or even for a particular season because most companies accept applications months prior.

Every intern is critically evaluated by a panel of leaders for pre-placement offers and in the last few years, over 50% of the summer interns were given PPOs. PPO's are like the proverbial last slice of Pizza everyone is eager to grab.

Before the internship begins, there are a few things that you can work on to have an edge during the internship.Product. Get a basic idea of the company's product.Tech stack.Git.Responsibility.Attentiveness.Clean and well-designed code.Doubts.Use a good note-taking app.More items...