Title: Indiana Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse Keywords: Indiana, deed, condominium unit, charity, reservation, life tenancy, donor, spouse Introduction: An Indiana Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse is a legal document that transfers ownership of a condominium unit to a charitable organization while reserving the right for the donor and the donor's spouse to live in the property for the duration of their lives. This unique arrangement allows individuals to make a charitable contribution while retaining their right to occupy and utilize their property throughout their lifetimes. Different Types of Indiana Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse: 1. General Indiana Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy: This type of deed outlines the transfer of ownership of a condominium unit to a charitable organization, while providing the donor and the donor's spouse with a life tenancy. The terms and conditions are typically agreed upon between the donor, the charitable organization, and any relevant legal advisors. 2. Indiana Deed Conveying Condominium Unit with Charitable Remainder Trust: In this case, the donor transfers the condominium unit to a charitable organization while retaining the right to receive income from the property during their lifetime. After the donor's passing, the remaining property interest is then conveyed to a charitable remainder trust, which benefits the chosen charitable cause. 3. Indiana Deed Conveying Condominium Unit with Charitable Lead Trust: Here, the donor transfers the condominium unit to a charitable organization, but the use and enjoyment of the property are initially granted to a lead trust for a specific period. Once the predetermined period ends, the property ownership may either revert to the donor or directly pass to the chosen charitable organization. Importance and Benefits: — Charitable Contribution: This type of deed enables individuals to make a significant charitable contribution by donating their property while still being able to occupy it during their lifetime. — Tax Advantages: The donation of a condominium unit to a charitable organization may offer tax benefits to the donor, such as reduced capital gains tax or a charitable tax deduction. — Estate Planning: By making a charitable gift with a reservation of life tenancy, donors can incorporate their philanthropic goals into their estate plans, ensuring a lasting impact beyond their lifetime. — Continued Use and Enjoyment: The donor and their spouse have the right to reside in and utilize the property for the remainder of their lives, providing them with security and comfort. Conclusion: An Indiana Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse offers a unique opportunity for individuals to contribute to charitable causes while maintaining the right to occupy and utilize their property during their lifetime. With various types of agreements available, donors can tailor the arrangement to their specific goals and circumstances. It is essential to consult with legal professionals experienced in estate planning and property transactions to ensure a smooth and legally compliant transfer process.

Indiana Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

How to fill out Indiana Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

Finding the right lawful record template can be a struggle. Naturally, there are tons of web templates available online, but how will you discover the lawful kind you need? Utilize the US Legal Forms internet site. The support offers a large number of web templates, like the Indiana Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse, which you can use for organization and personal demands. Each of the forms are inspected by pros and meet state and federal demands.

When you are presently registered, log in to the account and click on the Acquire key to have the Indiana Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse. Make use of your account to appear through the lawful forms you might have ordered previously. Proceed to the My Forms tab of your account and have one more copy of your record you need.

When you are a whole new consumer of US Legal Forms, allow me to share basic instructions for you to stick to:

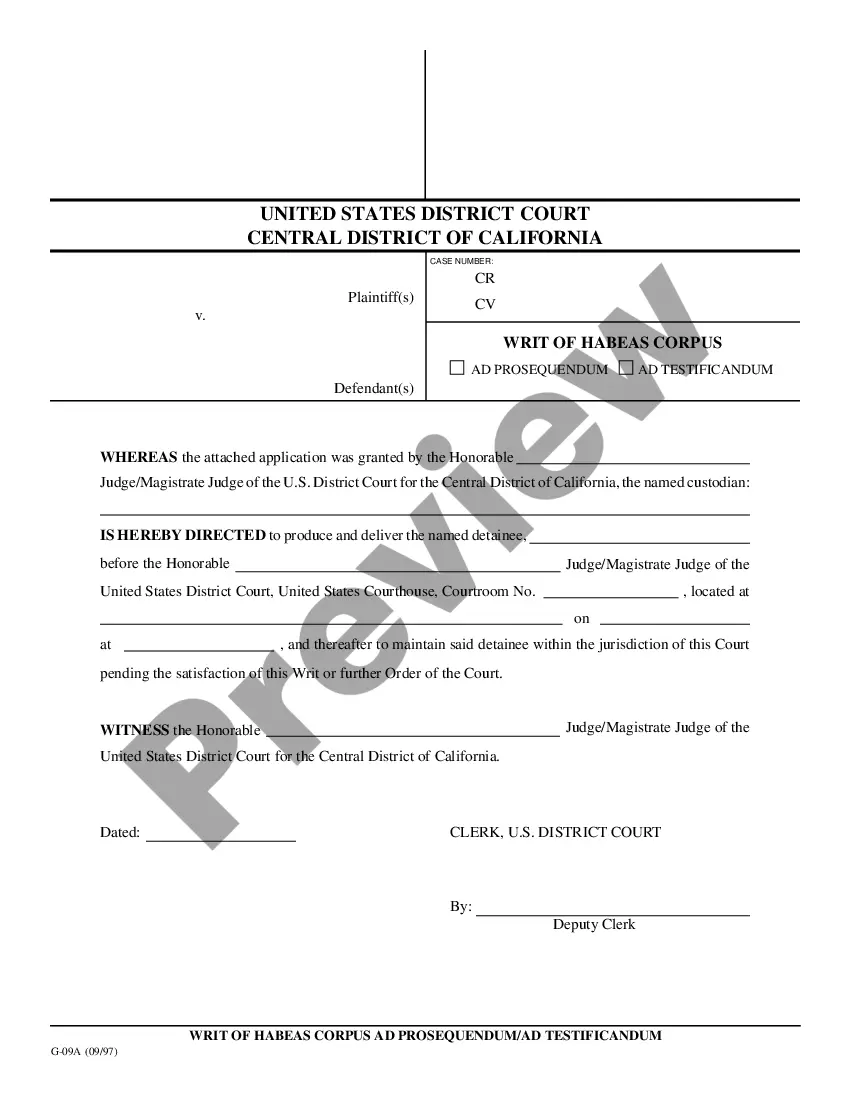

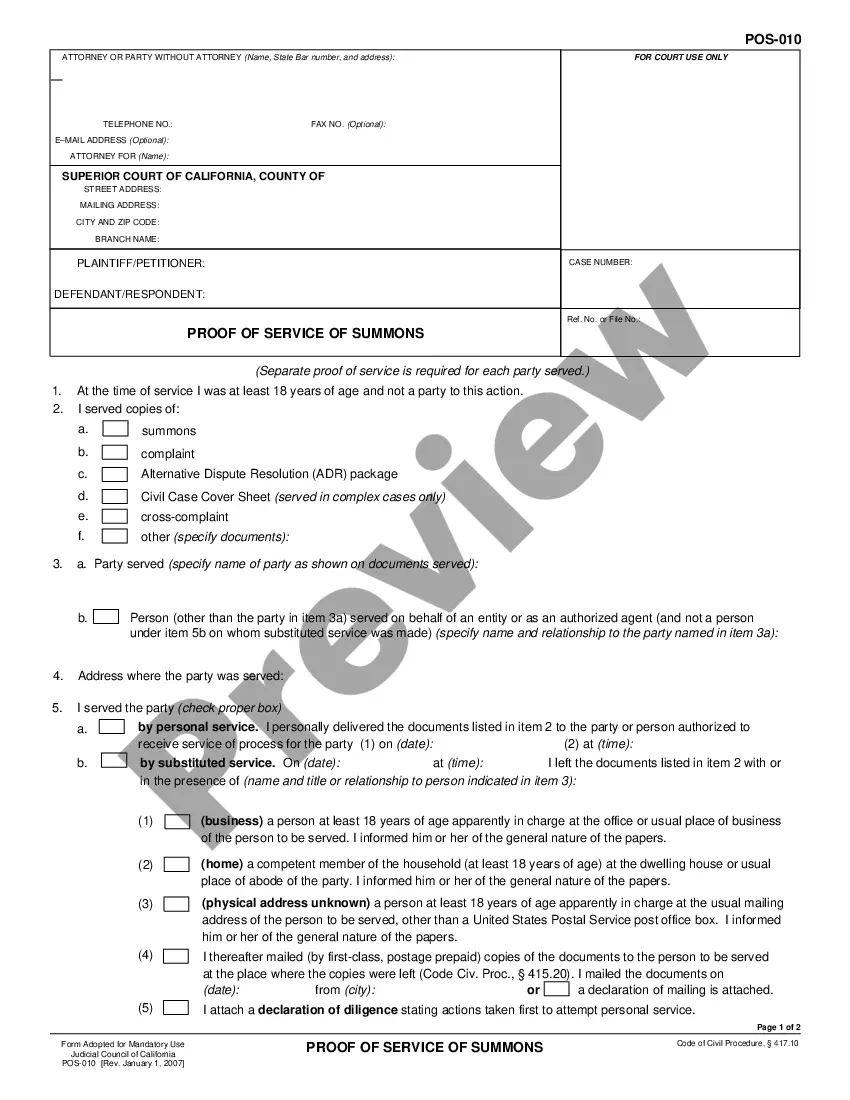

- Initial, be sure you have chosen the right kind for your personal city/state. You are able to look over the form while using Review key and look at the form explanation to guarantee this is basically the right one for you.

- When the kind is not going to meet your expectations, make use of the Seach field to get the appropriate kind.

- When you are sure that the form would work, go through the Purchase now key to have the kind.

- Opt for the costs plan you would like and enter in the necessary details. Design your account and pay for the transaction making use of your PayPal account or credit card.

- Opt for the document structure and obtain the lawful record template to the system.

- Complete, revise and print and indication the obtained Indiana Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse.

US Legal Forms is the greatest local library of lawful forms that you can find different record web templates. Utilize the company to obtain skillfully-made documents that stick to status demands.

Form popularity

FAQ

Life Estates establish two different categories of property owners: the Life Tenant Owner and the Remainder Owner. The Life Tenant Owner maintains the absolute and exclusive right to use the property during his or her lifetime. This can be a sole owner or joint Life Tenants.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

If you co-own real estate in joint tenancy (also called "joint tenancy with right of survivorship"), when one co-owner dies, that co-owner's share of the property will automatically go to the surviving co-owner(s).

The owner of a life estate cannot leave the property to anyone in their will as their interest in the property will terminate at their death. The holder has full rights to possess and use the property, and may also transfer their interest during their lifetime.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

Defining a California Life Estate A life estate is a form of ownership that allows one person to live in or on a piece of real property until they pass away. At their death, the real property passes to the intended beneficiary of the original owner.

A life tenant does not have complete control over the property because they do not own the whole bundle of rights. The life tenant cannot sell, mortgage or in any way transfer or encumber the property. If either party wants to sell the property, both the life tenant and remainderman must agree.

Dower & Curtesy Defined At common law, the estate of dower is held by a widow upon her husband's death and consists of a life estate of one-third to one-half of the land owned by her husband if he held a freehold interest in the land (e.g., a fee simple) and the land is inheritable by the issue of the marriage.