A Detailed Description of Indiana Deed Conveying Property to Charity with Reservation of Life Estate When considering charitable giving, individuals in Indiana may opt for a unique type of donation known as a Deed Conveying Property to Charity with Reservation of Life Estate. This legal document enables property owners to transfer ownership of their real estate to a charitable organization while retaining their right to live on and use the property for the remainder of their lives. This arrangement offers certain advantages, such as potential tax benefits, philanthropic fulfillment, and the comfort of remaining in one's home. The Indiana Deed Conveying Property to Charity with Reservation of Life Estate is a legally binding instrument that outlines the terms and conditions of the property transfer. It must adhere to specific state laws and requirements to ensure its validity and enforceability. It is essential to consult an attorney proficient in Indiana estate planning and charitable giving to properly establish and execute this type of deed. Key elements included in an Indiana Deed Conveying Property to Charity with Reservation of Life Estate are as follows: 1. Parties Involved: The deed should clearly identify the individual or individuals transferring ownership (the granter(s)), the charitable organization accepting the property (the grantee), and any trustees or representatives involved in the process. 2. Property Description: A detailed description of the property being conveyed must be provided, including its legal address, boundaries, and any other relevant identifying information. The document should also specify any attached conditions or additional assets included in the transfer, such as furnishings or equipment. 3. Life Estate Clause: This crucial provision reserves the right for the granter(s) to occupy and utilize the property for their lifetimes. It should define the scope of their rights, responsibilities, and limitations within the coexistence agreement with the charitable organization. For instance, it may address maintenance responsibilities or alterations the granter(s) may undertake. 4. Charitable Intent: Clearly expressing the granter's intention to donate the property as a charitable gift is crucial. The deed should substantiate the granter's desire to support the specified charitable organization and outline any specific conditions or restrictions related to the property's use or future sale by the charity. 5. Tax Considerations: Consultation with a tax professional is highly recommended as the donation may have significant implications for the granter's estate and income tax filings. Indiana's laws and regulations regarding tax deductions for charitable contributions should be thoroughly understood and adhered to when completing the deed. It is worth noting that within the category of Indiana Deed Conveying Property to Charity with Reservation of Life Estate, different variations may exist to meet unique circumstances and goals. These could include but are not limited to: 1. Charitable Remainder Unit rust (CUT): This variation allows granters to transfer property into a trust, receive income from the trust for a specified period or lifetime, and subsequently donate the remaining assets to a charitable organization. 2. Charitable Remainder Annuity Trust (CAT): Similar to a CUT, a CAT enables granters to receive a fixed annuity payment from the trust for a specified period or lifetime. Upon termination, the remaining assets pass to the charitable organization. 3. Charitable Lead Trust (CLT): In this arrangement, the granter(s) transfers ownership of the property to a trust, and income generated from the trust is distributed to a charitable organization for a designated period. After this period, the property ownership reverts to the granter(s) or their designated beneficiaries. Regardless of the specific type or variation, an Indiana Deed Conveying Property to Charity with Reservation of Life Estate enables altruistic individuals to support the causes they care about while enjoying the benefits of their property during their lifetime. Professional legal and financial advice is crucial to navigate the complexities of this arrangement to ensure compliance with Indiana laws and maximize the intended benefits of the donation.

Indiana Deed Conveying Property to Charity with Reservation of Life Estate

Description

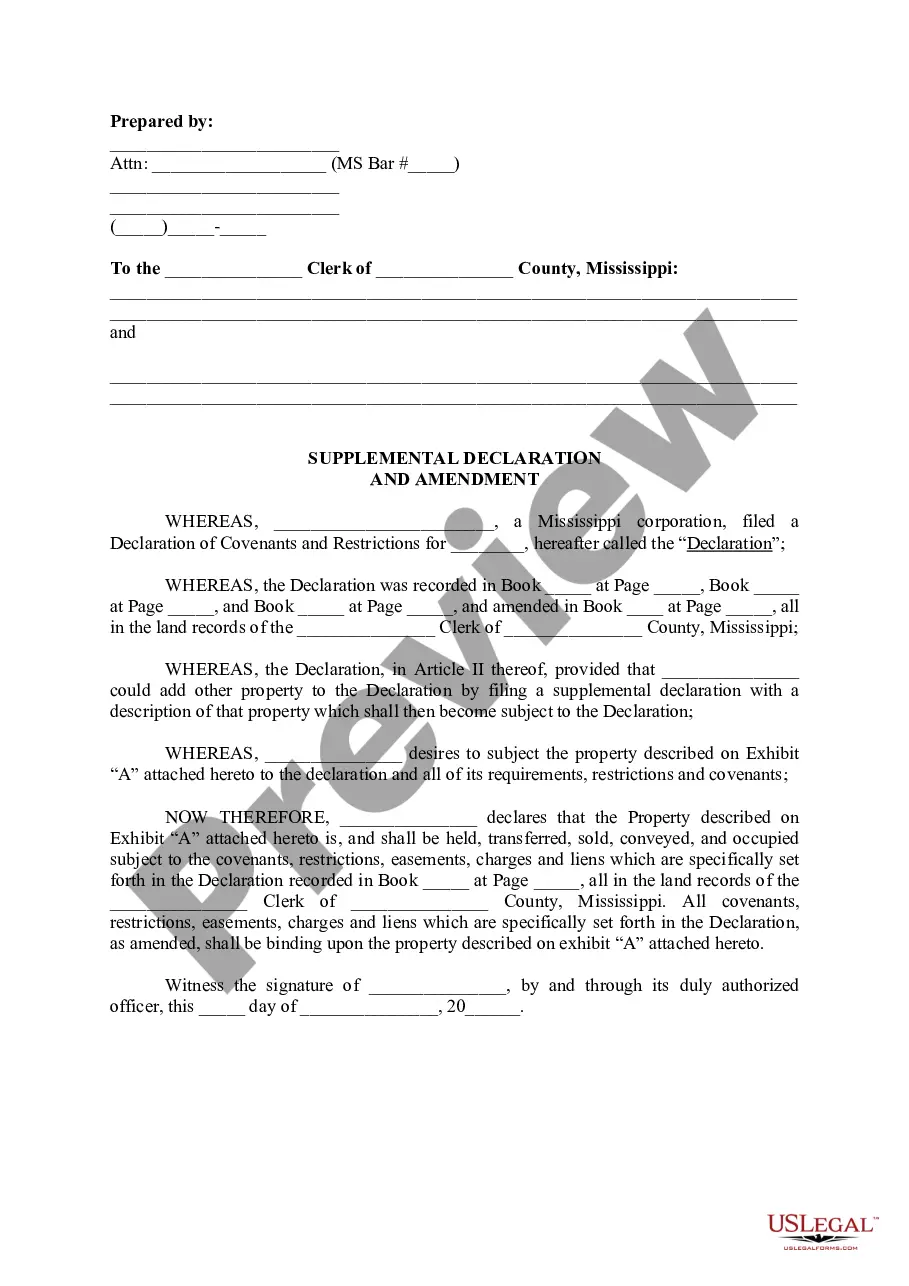

How to fill out Indiana Deed Conveying Property To Charity With Reservation Of Life Estate?

Discovering the right legal file format could be a have difficulties. Of course, there are tons of web templates available on the net, but how can you obtain the legal kind you will need? Take advantage of the US Legal Forms internet site. The services gives a huge number of web templates, including the Indiana Deed Conveying Property to Charity with Reservation of Life Estate, which you can use for business and private needs. All the types are inspected by pros and meet state and federal specifications.

In case you are previously registered, log in for your profile and click on the Down load button to obtain the Indiana Deed Conveying Property to Charity with Reservation of Life Estate. Utilize your profile to check through the legal types you have ordered previously. Check out the My Forms tab of the profile and have an additional backup from the file you will need.

In case you are a brand new user of US Legal Forms, listed below are simple guidelines that you can adhere to:

- First, make sure you have chosen the correct kind for the town/county. It is possible to look through the form while using Review button and study the form description to make certain it will be the right one for you.

- If the kind fails to meet your preferences, use the Seach discipline to discover the correct kind.

- When you are certain that the form would work, select the Acquire now button to obtain the kind.

- Pick the rates program you need and type in the necessary details. Make your profile and buy the transaction using your PayPal profile or charge card.

- Choose the data file format and down load the legal file format for your gadget.

- Complete, edit and print and signal the received Indiana Deed Conveying Property to Charity with Reservation of Life Estate.

US Legal Forms will be the greatest collection of legal types for which you can discover different file web templates. Take advantage of the service to down load appropriately-made documents that adhere to condition specifications.

Form popularity

FAQ

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

A life estate deed is a legal document that changes the ownership of a piece of real property. The person who owns the real property (in this example, Mom) signs a deed that will pass the ownership of the property automatically upon her death to someone else, known as the "remainderman" (in this example, Son).

A life tenant does not have complete control over the property because they do not own the whole bundle of rights. The life tenant cannot sell, mortgage or in any way transfer or encumber the property. If either party wants to sell the property, both the life tenant and remainderman must agree.

Within a life estate, the life estate deed is a document that grants the owner the ability to pass on ownership of a property without including it in a will as part of a person's assets.

If you own property jointly with someone else, and this ownership includes the "right of survivorship," then the surviving owner automatically owns the property when the other owner dies.

Executor's Deed: This may be used when a person dies testate (with a will). The estate's executor will dispose of the decedent's assets and an executor's deed may be used to convey the title or real property to the grantee.

In Indiana, real estate can be transferred via a TOD deed, which allows a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

The person who has the right to occupy and use the property is called the life tenant. The owner of the property subject to the life estate is called a remainderman. When the life estate terminates, title to the property automatically passes to the remainderman free and clear of the life estate.