Indiana Release of Claims for Personal Injuries by Employee

Description

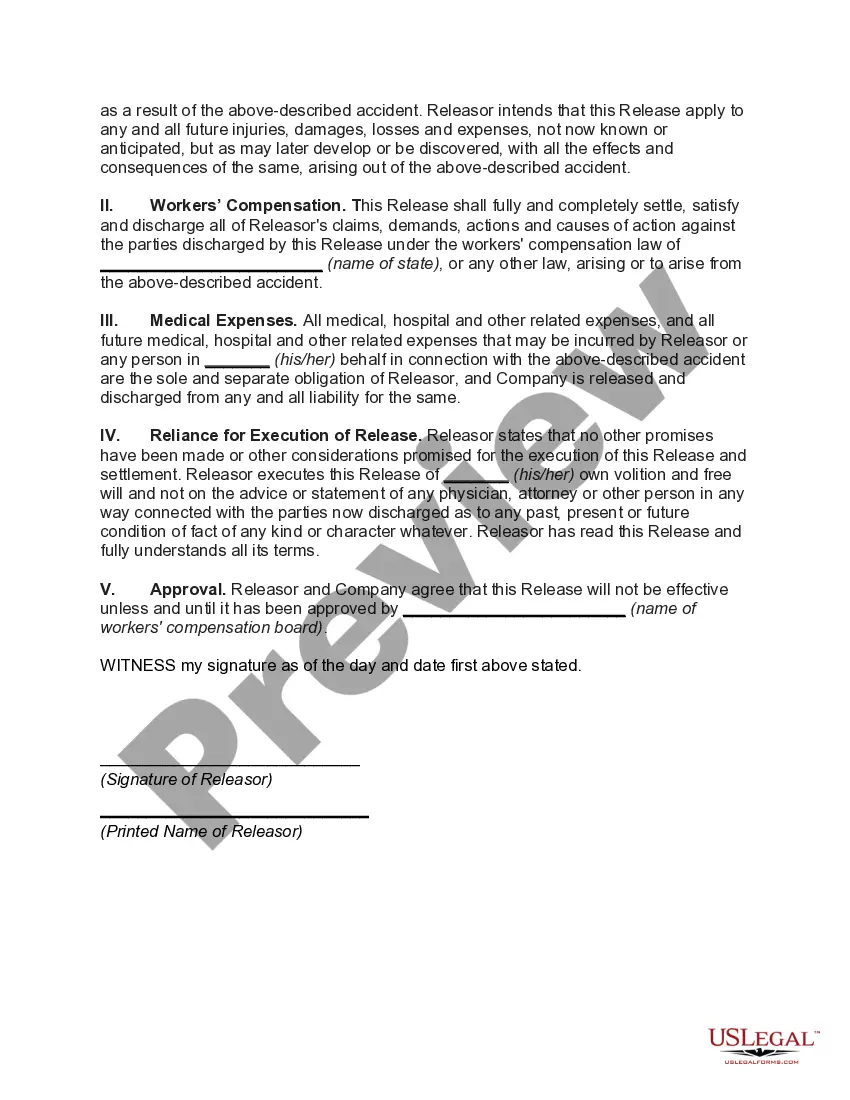

How to fill out Release Of Claims For Personal Injuries By Employee?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal templates that you can obtain or create.

By using the website, you can access thousands of forms for commercial and personal purposes, organized by categories, states, or keywords. You will find the latest versions of documents such as the Indiana Release of Claims for Personal Injuries by Employee in just minutes.

If you already have a monthly subscription, Log In and retrieve Indiana Release of Claims for Personal Injuries by Employee from the US Legal Forms collection. The Download button will appear on every document you view. You can access all previously saved documents under the My documents tab of your account.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the document to your device. Edit. Complete, modify, print, and sign the saved Indiana Release of Claims for Personal Injuries by Employee. Every template you add to your account has no expiration date and is yours indefinitely. So, if you wish to obtain or create another copy, simply go to the My documents section and click on the form you need. Gain access to the Indiana Release of Claims for Personal Injuries by Employee with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast range of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for your specific locality.

- Click the Review button to examine the content of the form.

- Check the form description to verify that you have chosen the right document.

- If the form does not meet your needs, utilize the Search field at the top of the page to find a suitable one.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the pricing plan you wish and provide your details to create an account.

Form popularity

FAQ

In Indiana, a 10% impairment rating payout is calculated based on your average weekly wage and the total number of weeks allowed for your injury. Typically, this means you could receive compensation for a specific number of weeks multiplied by your weekly income. This payout reflects your reduced earning capacity due to your work-related injury. Understanding the Indiana Release of Claims for Personal Injuries by Employee can help you navigate this process thoroughly.

If you are injured due to an accident at work, or suffer an illness because of your workplace, you may wonder whether you can be dismissed for bringing a personal injury claim for your injuries. However the simple answer to this question is no, you cannot get sacked for making a claim.

To claim against your employer, you need to be able to prove they acted negligently, causing your injury or illness....What Can Be Claimed For?Loss of earnings.The cost of home-care required by your injury, and damage to your property, such as your vehicle, if you were involved in a company car accident.More items...?

Founded in 1923, the mission of the National Council on Compensation Insurance (NCCI) is to foster a healthy workers compensation system. In support of this mission, NCCI gathers data, analyzes industry trends, and provides objective insurance rate and loss cost recommendations.

Indiana workers' compensation benefits can help cover an employee's medical treatment if they're sick or hurt from a work-related cause. It can also help replace some of an employee's lost wages if they can't work or work at full capacity due to their job-related injury or illness.

Filing a Workers' Comp Claim Isn't a Fireable Offense Furthermore, Indiana employers cannot fire an employee for filing a workers' compensation claim.

These benefits are available for a maximum of 500 weeks. If you're able to return to part-time or light-duty work while you're recovering, but earn less than your normal wages, you may eligible for temporary partial disability benefits.

A: The statute of limitations runs two years after the last date of compensation paid or in the alternative two years from the date of injury.

NCCI performs many important workers compensation functions for state governments and insurance companies....This is a list of the Non-NCCI States:California.Delaware.Indiana.Massachusetts.Michigan.Minnesota.New Jersey.New York.More items...

Many people in the insurance business believe that Indiana is an NCCI state. This is not true. Indiana maintains its own independent rating bureau, the Indiana Compensation Rating Bureau.