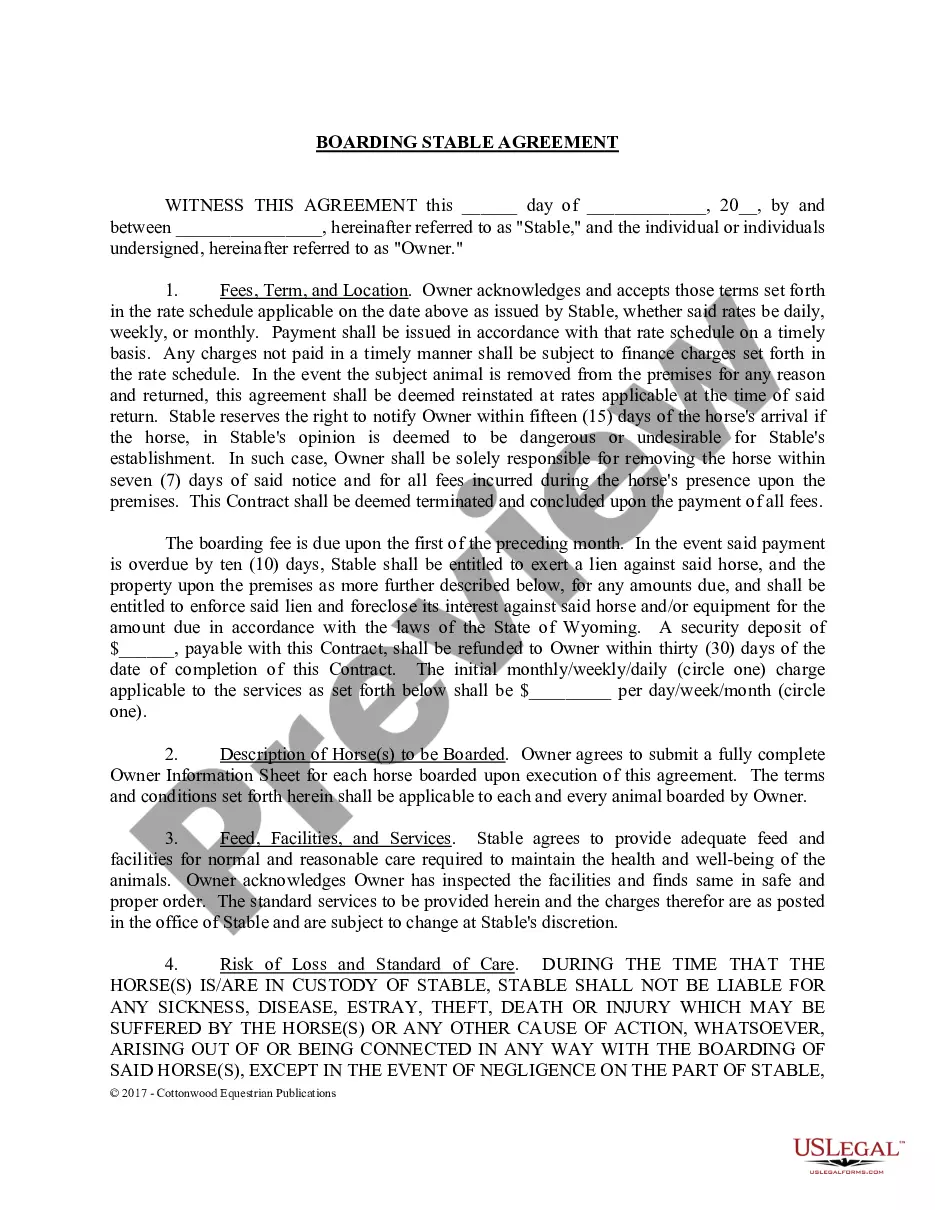

An Indiana Contract with Independent Contractor — Contractor has Employees is a legal agreement between a contractor and an independent contractor who operates a business with employees in the state of Indiana. This type of contract outlines the terms and conditions of the working relationship between the parties. In this arrangement, the independent contractor is a business entity that provides services to the contractor, and the contractor is a party who engages the independent contractor's services. The distinct factor in this contract is that the independent contractor has employees working under their supervision. Here are some relevant keywords and types of Indiana Contract with Independent Contractor — Contractor has Employees: 1. Scope of Work: The contract should clearly state the scope of work that the independent contractor's employees will perform for the contractor. This may include specific tasks, responsibilities, and deliverables. 2. Duration and Termination: The contract should specify the duration of the agreement and outline the provisions for termination by either party. It may include provisions for early termination, notice period, or reasons for termination. 3. Compensation: The contract should detail how the independent contractor's employees will be compensated. This may include hourly rates, flat fees, or any other agreed-upon payment method and schedule. 4. Employee Obligations: The contract should outline the obligations of the independent contractor's employees, such as work performance, working hours, and adherence to the contractor's policies and procedures. 5. Confidentiality and Non-Disclosure: The contract may include clauses related to confidentiality and non-disclosure of sensitive information that the independent contractor's employees may have access to during their engagement with the contractor. 6. Independent Contractor Status: The contract should clearly state that the independent contractor and their employees are not employees of the contractor but are independent businesses. This clarifies the non-employer relationship between the parties. 7. Indemnification and Liability: The contract may include provisions about the indemnification of the contractor by the independent contractor regarding any claims or liabilities arising from the actions of the independent contractor's employees. 8. Insurance Coverage: The contract may specify the required insurance coverage that the independent contractor must maintain to protect against any potential liabilities or claims. 9. Dispute Resolution: The contract may include clauses for resolving disputes that may arise between the parties, such as through arbitration or mediation. 10. Governing Law: The contract should specify that it will be governed by the laws of the state of Indiana, ensuring that any legal matters regarding the contract will be resolved according to Indiana state regulations. In conclusion, an Indiana Contract with Independent Contractor — Contractor has Employees defines the business relationship between a contractor and an independent contractor who operates a business with employees. This detailed agreement protects the interests of both parties and provides a framework for a successful working arrangement.

Indiana Contract with Independent Contractor - Contractor has Employees

Description

How to fill out Indiana Contract With Independent Contractor - Contractor Has Employees?

US Legal Forms - one of several most significant libraries of authorized varieties in America - gives a variety of authorized document web templates you are able to obtain or produce. While using website, you can get 1000s of varieties for enterprise and specific reasons, sorted by types, says, or key phrases.You will find the most up-to-date models of varieties like the Indiana Contract with Independent Contractor - Contractor has Employees within minutes.

If you already possess a membership, log in and obtain Indiana Contract with Independent Contractor - Contractor has Employees from the US Legal Forms library. The Download switch will show up on every single develop you view. You have accessibility to all in the past acquired varieties inside the My Forms tab of the account.

If you wish to use US Legal Forms initially, allow me to share straightforward directions to obtain started out:

- Make sure you have picked the proper develop for your town/region. Click the Preview switch to review the form`s content. Look at the develop information to ensure that you have chosen the proper develop.

- If the develop does not match your specifications, utilize the Lookup discipline towards the top of the monitor to discover the the one that does.

- Should you be content with the form, confirm your decision by visiting the Buy now switch. Then, opt for the pricing prepare you favor and provide your credentials to register on an account.

- Process the purchase. Use your Visa or Mastercard or PayPal account to perform the purchase.

- Choose the file format and obtain the form on your own gadget.

- Make adjustments. Complete, change and produce and indicator the acquired Indiana Contract with Independent Contractor - Contractor has Employees.

Each and every web template you included in your bank account does not have an expiry particular date and is yours permanently. So, in order to obtain or produce yet another copy, just proceed to the My Forms portion and click on around the develop you need.

Gain access to the Indiana Contract with Independent Contractor - Contractor has Employees with US Legal Forms, probably the most considerable library of authorized document web templates. Use 1000s of expert and condition-particular web templates that meet your small business or specific demands and specifications.

Form popularity

FAQ

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Indiana Workers' Compensation Requirements In Indiana employers are required to purchase workers' compensation coverage if they employ one or more workers. Sole Proprietors, Partners and LLC Members are all excluded from coverage, but have the option to be included.

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

If you're an independent contractor in a construction trade, those who hire you are not required to provide you with workers' compensation insurance as long as you meet the IRS tests for independent contractor status.

Independent contractors are not eligible for workers' compensation coverage; employers are not required by state law to purchase coverage for independent contractors. However, some employers misclassify employees as independent contractors to avoid paying payroll taxes and workers' comp premiums for them.

Most employers are required to have workers' compensation in Indiana. Workers' compensation insurance provides benefits to workers that get sick or injured as a result of their job. Workers' compensation also helps protect business owners in the Hoosier State by limiting their liability for work-related accidents.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The law defines a worker as an independent contractor if he/she meets the guidelines of the IRS (See statute quote above in section 2). Senate Enrolled Act 576, (Public Law 168), provides that all independent contractors, not just those in the construction trades, may now obtain a clearance certificate.