Title: Indiana Consulting Agreement with Independent Contractor: A Comprehensive Overview Introduction: An Indiana Consulting Agreement with an Independent Contractor is a legally binding document that outlines the terms and conditions between a consultant and a hiring entity. This agreement establishes a professional relationship and specifies the obligations, compensation, and rights of both parties. In Indiana, there are several types of Consulting Agreements with Independent Contractors, each serving different purposes based on the engagement. Key Elements of an Indiana Consulting Agreement: 1. Parties Involved: Identify the hiring entity (referred to as the "Company" or "Client") and the independent contractor (referred to as the "Consultant" or "Independent Contractor"). Include their legal names, addresses, and contact information. 2. Scope of Services: Describe in detail the specific services the Consultant will provide to the Client. This section should clearly outline the project's objectives, deliverables, and any specific timelines or milestones to be achieved. 3. Compensation: Specify the payment terms and how the Consultant will be remunerated for their services. Include the agreed-upon rates, hourly fees, or any other payment arrangements, as well as the frequency and method of invoicing and payment. 4. Independent Contractor Relationship: Emphasize that the Consultant is an independent contractor, not an employee of the Client. Explain that the Consultant is responsible for paying their own taxes, withholding any necessary amounts, and complying with all applicable laws and regulations. 5. Confidentiality and Non-Disclosure: Include clauses that protect the confidentiality of any proprietary or sensitive information shared between the parties during the engagement. Outline the obligations of both parties in handling confidential information and the timeline for which these obligations extend beyond the termination of the agreement. 6. Intellectual Property Rights: Specify who retains ownership of any intellectual property created by the Consultant during their engagement. Determine whether the Client will have exclusive rights to the deliverables or if the Consultant will retain certain rights, such as using the work as part of their portfolio. 7. Termination Clause: Outline the conditions under which either party can terminate the agreement. Consider including provisions related to breach of contract, non-compliance, or any other unforeseen circumstances that may warrant termination. Define the notice period required for termination and the consequences of early termination. Types of Indiana Consulting Agreements with Independent Contractors: 1. General Consulting Agreement: This is a standard agreement applicable to various consulting services across different industries. 2. Technology Consulting Agreement: This agreement specifically caters to technology-related consulting services, such as software development, IT consulting, or cybersecurity audits. 3. Management Consulting Agreement: Targeting consultants providing expertise in business strategy, operations management, or organizational development, this agreement focuses on management consulting services. 4. Marketing Consulting Agreement: Specifically designed for consultants providing marketing services, such as market research, digital marketing strategies, or campaign management. Conclusion: An Indiana Consulting Agreement with an Independent Contractor is a crucial document that protects the rights and defines the obligations of both parties engaged in a consulting relationship. By carefully crafting an agreement that encompasses the aforementioned key elements, businesses and independent consultants can establish a solid foundation for a successful professional collaboration while ensuring compliance with Indiana laws and regulations.

Indiana Consulting Agreement with Independent Contractor

Description

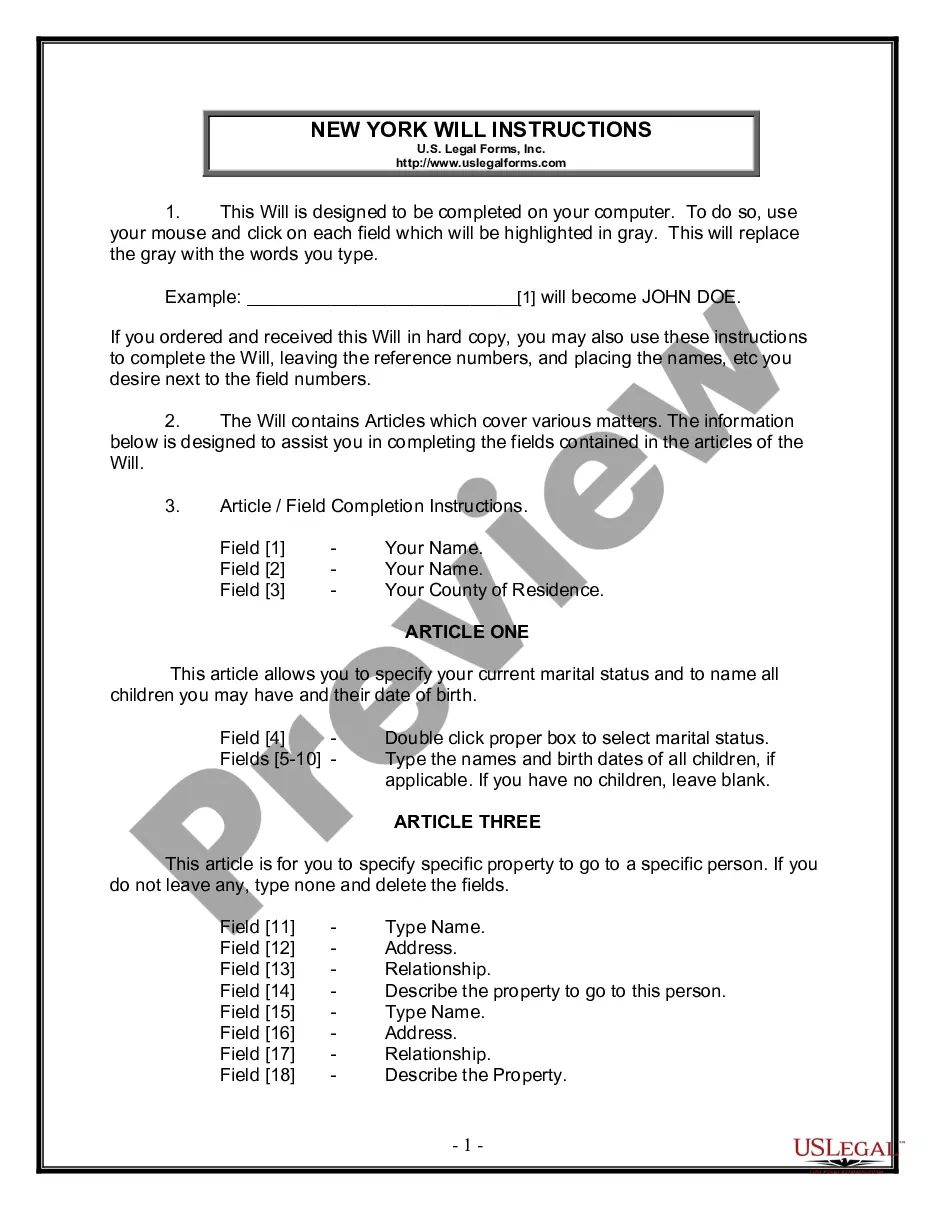

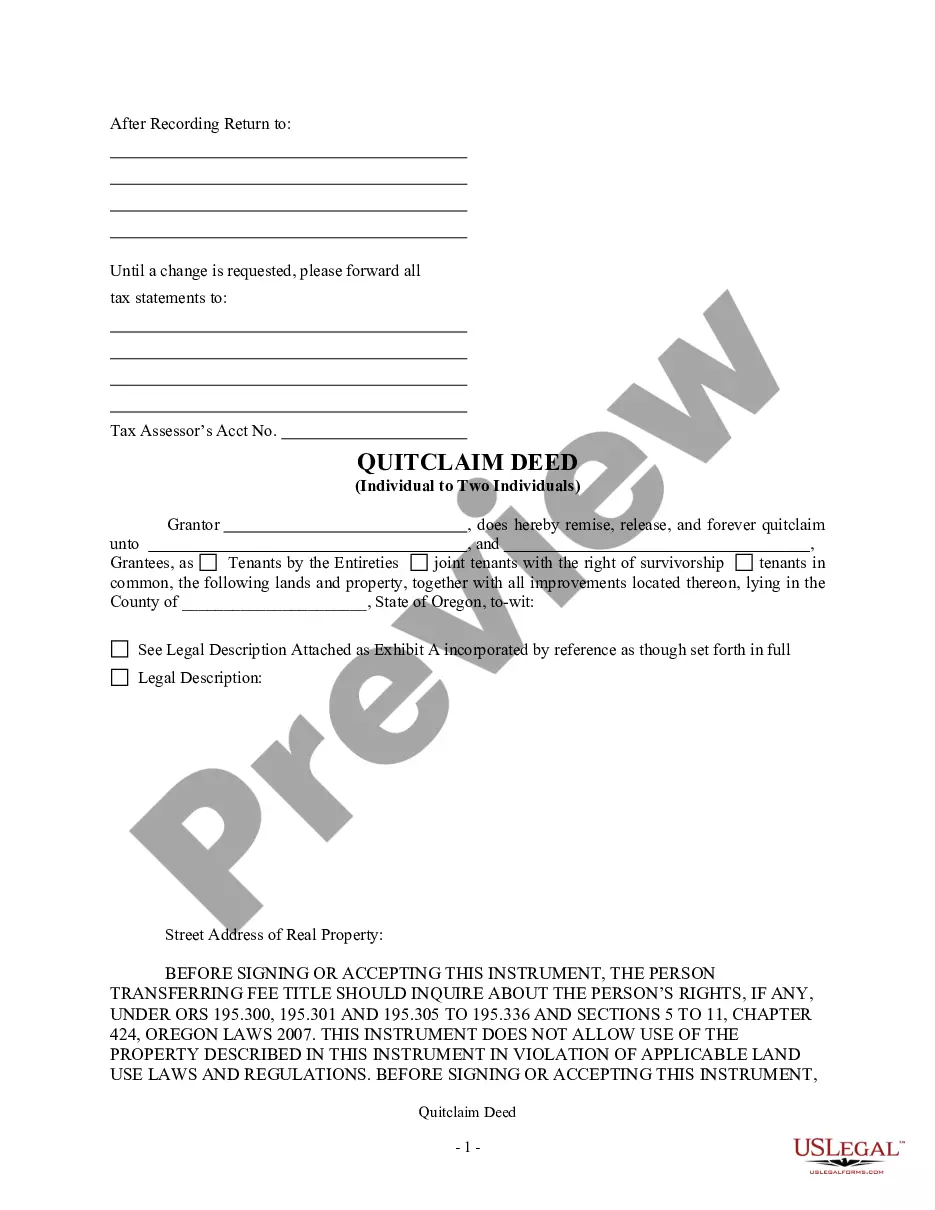

How to fill out Consulting Agreement With Independent Contractor?

Discovering the right legitimate file web template can be a have difficulties. Needless to say, there are tons of layouts available on the Internet, but how can you discover the legitimate develop you need? Utilize the US Legal Forms internet site. The services provides a huge number of layouts, for example the Indiana Consulting Agreement with Independent Contractor, that can be used for business and private demands. Each of the kinds are examined by professionals and meet up with state and federal needs.

Should you be already authorized, log in to the bank account and then click the Acquire key to find the Indiana Consulting Agreement with Independent Contractor. Make use of bank account to search through the legitimate kinds you have acquired previously. Visit the My Forms tab of your respective bank account and have yet another backup in the file you need.

Should you be a new customer of US Legal Forms, listed below are basic recommendations that you should stick to:

- First, ensure you have selected the correct develop to your city/region. It is possible to look through the shape utilizing the Review key and study the shape outline to make certain this is the best for you.

- If the develop will not meet up with your expectations, utilize the Seach industry to get the proper develop.

- When you are certain that the shape would work, go through the Get now key to find the develop.

- Select the prices plan you would like and enter the needed information. Build your bank account and buy the transaction making use of your PayPal bank account or credit card.

- Select the data file file format and acquire the legitimate file web template to the gadget.

- Comprehensive, change and print and indication the obtained Indiana Consulting Agreement with Independent Contractor.

US Legal Forms is definitely the greatest catalogue of legitimate kinds for which you will find numerous file layouts. Utilize the company to acquire appropriately-created files that stick to status needs.

Form popularity

FAQ

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

The contractor isn't an employee of the company but works independently. The contractor provides services to the client under an Independent Contractor Agreement.

Pay self-employment taxAs an independent consultant you are considered self-employed, so if you earn more than $400 for the year, the IRS expects you to pay your own tax. The self-employment tax rate is 15.3% of your net earnings.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.