Title: Understanding the Indiana Irrevocable Funded Life Insurance Trust with Beneficiaries Having Crummy Right of Withdrawal and First to Die Policy with Survivorship Rider Intro: In this article, we dive into the Indiana Irrevocable Funded Life Insurance Trust (IIT) structure, focusing on the unique aspect of beneficiaries having a Crummy Right of Withdrawal along with a First to Die Policy with a Survivorship Rider. We will explore the benefits, features, and potential variations of this trust type. Keywords: Indiana Irrevocable Funded Life Insurance Trust, Beneficiaries, Crummy Right of Withdrawal, First to Die Policy, Survivorship Rider, trust structure, insurance planning. 1. Understanding the Indiana Irrevocable Funded Life Insurance Trust (IIT) The Indiana Irrevocable Funded Life Insurance Trust is a legal entity that allows individuals to protect their life insurance policy proceeds from being included in their taxable estate. This trust provides multiple benefits for policyholders and their beneficiaries while offering flexibility in terms of ownership and control. 2. Beneficiaries with Crummy Right of Withdrawal One notable feature of the Indiana IIT is that beneficiaries have the Crummy Right of Withdrawal. This legal provision allows beneficiaries to withdraw a limited amount of money from the trust within a specified time frame. This specific right not only offers flexibility but may also help establish the trust as a present interest rather than a future interest, maintaining its potential tax benefits. 3. First to Die Policy with Survivorship Rider The Indiana IIT operates using a First to Die Policy with a Survivorship Rider. This insurance structure combines two lives under a single policy, ensuring that the death benefit is paid out upon the first insured person's passing. The survivorship rider then continues coverage on the remaining insured life, enabling a seamless transfer of assets to the beneficiaries. 4. Benefits of the Indiana IIT — Estate Tax Reduction: By funding the trust with life insurance policies, policyholders can effectively reduce the size of their taxable estate and minimize estate taxes upon their passing. — Asset Protection: SincthirtyIT owns the life insurance policy, the policy proceeds are protected from potential creditors and lawsuits. — Control and Flexibility: The trust creator maintains control over the insurance policy's beneficiaries, enabling specific instructions on how the proceeds should be distributed. — Efficient Asset Transfer: The First to Die Policy with Survivorship Rider allows for an efficient transfer of assets to the beneficiaries, providing financial stability even after the first insured person's death. 5. Variations of Indiana IIT with Crummy Right of Withdrawal and First to Die Policy with Survivorship Rider While the Indiana IIT in this context focuses on the Crummy Right of Withdrawal and the First to Die Policy with a Survivorship Rider, it's important to note that individuals can customize their trust structure and terms based on their unique financial goals and circumstances. Different variations of this trust may include additional provisions or features tailored to the specific needs of the trust creator and their intended beneficiaries. Conclusion: The Indiana Irrevocable Funded Life Insurance Trust with Beneficiaries Having Crummy Right of Withdrawal and First to Die Policy with Survivorship Rider provides individuals and families with an opportunity to protect their estate, minimize taxes, and efficiently transfer assets to future generations. By understanding the various aspects and potential variations of this trust, individuals can make informed decisions regarding their estate planning and insurance needs.

Indiana Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider

Description

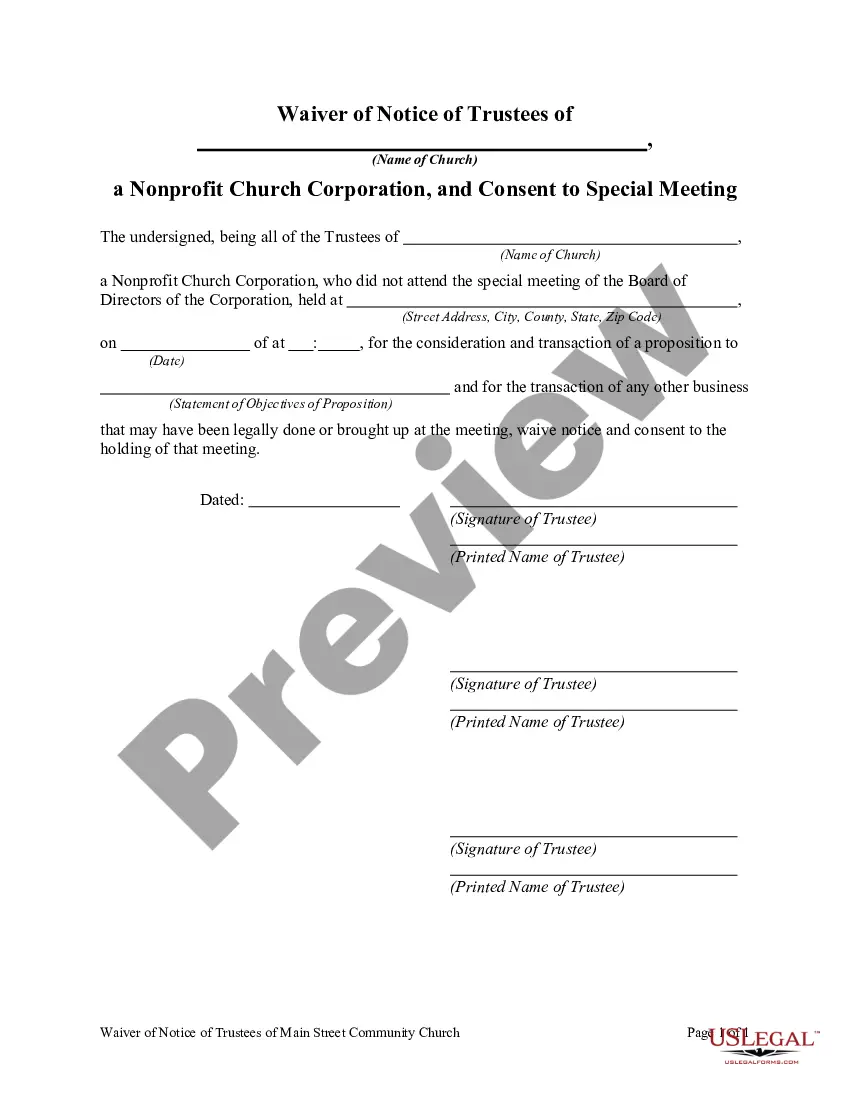

How to fill out Indiana Irrevocable Funded Life Insurance Trust Where Beneficiaries Have Crummey Right Of Withdrawal With First To Die Policy With Survivorship Rider?

You are able to spend time on-line searching for the legal papers web template that meets the federal and state demands you want. US Legal Forms offers a huge number of legal kinds that happen to be examined by pros. It is possible to acquire or print out the Indiana Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider from the assistance.

If you already have a US Legal Forms accounts, you may log in and then click the Download switch. Next, you may total, change, print out, or sign the Indiana Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider. Every legal papers web template you buy is the one you have for a long time. To acquire an additional backup associated with a acquired develop, visit the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms website the very first time, adhere to the straightforward recommendations under:

- Initial, make certain you have chosen the right papers web template for that region/city of your choosing. Look at the develop description to ensure you have chosen the right develop. If readily available, take advantage of the Preview switch to search through the papers web template too.

- If you want to discover an additional edition of your develop, take advantage of the Search discipline to get the web template that suits you and demands.

- When you have found the web template you desire, click on Purchase now to proceed.

- Pick the prices strategy you desire, enter your qualifications, and register for your account on US Legal Forms.

- Comprehensive the deal. You can use your charge card or PayPal accounts to fund the legal develop.

- Pick the formatting of your papers and acquire it to your device.

- Make modifications to your papers if required. You are able to total, change and sign and print out Indiana Irrevocable Funded Life Insurance Trust where Beneficiaries Have Crummey Right of Withdrawal with First to Die Policy with Survivorship Rider.

Download and print out a huge number of papers templates utilizing the US Legal Forms site, that offers the greatest collection of legal kinds. Use specialist and status-particular templates to handle your business or personal demands.