Indiana Irrevocable Trust which is a Qualifying Subchapter-S Trust

Description

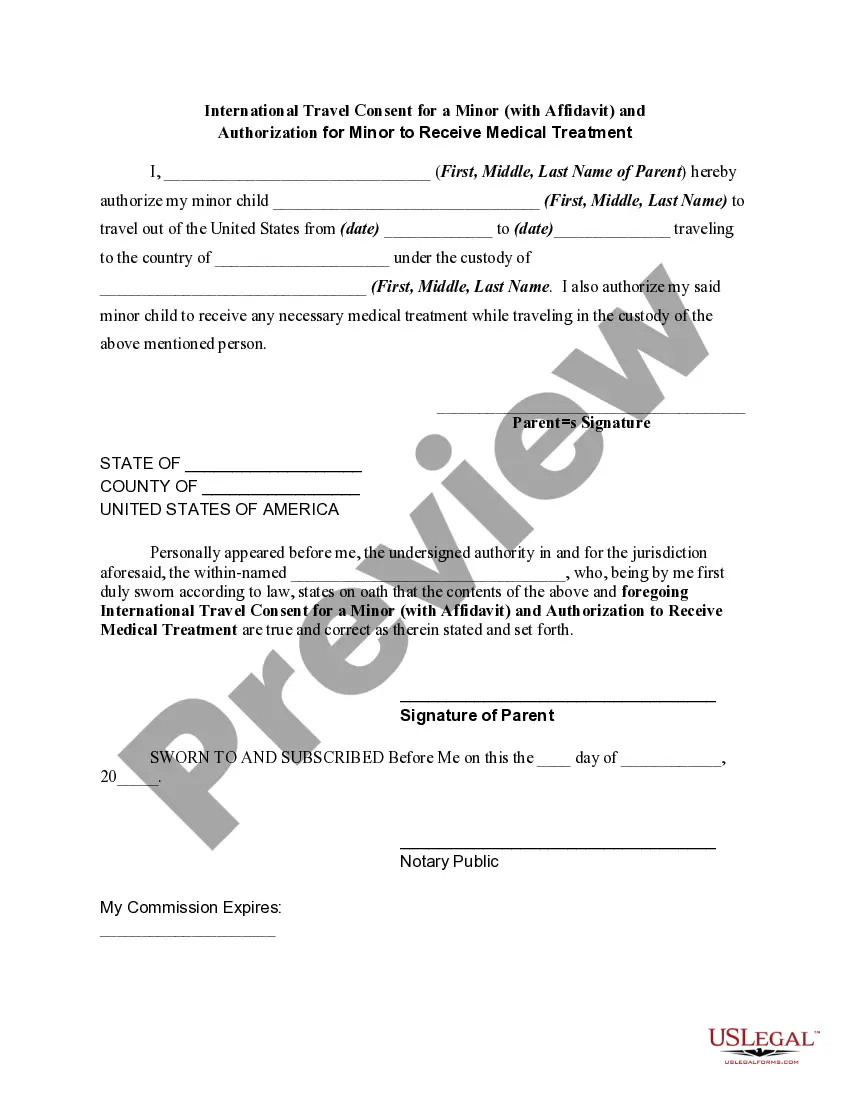

How to fill out Irrevocable Trust Which Is A Qualifying Subchapter-S Trust?

Selecting the optimal legal document template can be a challenge.

Clearly, there are numerous designs accessible online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. The platform offers a plethora of templates, such as the Indiana Irrevocable Trust that qualifies as a Subchapter-S Trust, suitable for both business and personal purposes.

You can view the form using the Review option and read the form description to confirm it is suitable for you.

- All templates are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and hit the Download button to access the Indiana Irrevocable Trust that is a Qualifying Subchapter-S Trust.

- Use your account to browse the legal documents you have previously ordered.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new customer of US Legal Forms, here are simple steps you should follow.

- First, ensure you have chosen the correct form for your city/county.

Form popularity

FAQ

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

Irrevocable trusts are an important tool in many people's estate plan. They can be used to lock-in your estate tax exemption before it drops, keep appreciation on assets from inflating your taxable estate, protect assets from creditors, and even make you eligible for benefit programs like Medicaid.

Under this scenario, the subtrust would elect QSST status, while the original trust could continue to be a complex trust. If the original trust has multiple beneficiaries, then a separate S corporation subtrust would need to be created for each beneficiary.

The downside to irrevocable trusts is that you can't change them. And you can't act as your own trustee either. Once the trust is set up and the assets are transferred, you no longer have control over them.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

Under an irrevocable marital trust, assets are transferred from one spouse to another upon the first spouse's death. An approved trustee manages the assets, essentially keeping the assets outside the estate. The grantor decides what the surviving spouse can receive in income from the trust and the withdrawal limits.

Irrevocable trusts are generally set up to minimize estate taxes, access government benefits, and protect assets. This is in contrast to a revocable trust, which allows the grantor to modify the trust, but loses certain benefits such as creditor protection.

Separate Trust Under this scenario, the subtrust would elect QSST status, while the original trust could continue to be a complex trust. If the original trust has multiple beneficiaries, then a separate S corporation subtrust would need to be created for each beneficiary.

IRREVOCABLE TRUSTS These trusts are used by people who are exposed to estate taxes. When you convey assets into an irrevocable wealth preservation trust, you are removing the assets from your own name for estate tax purposes. Irrevocable trusts can also be used to protect assets from litigants seeking redress.

A simple trust must distribute all its income currently. Generally, it cannot accumulate income, distribute out of corpus, or pay money for charitable purposes. If a trust distributes corpus during a year, as in the year it terminates, the trust becomes a complex trust for that year.