Title: Indiana Sample Letter for Reinstatement of Loan — Compromise of Matter: A Comprehensive Guide Introduction: In Indiana, individuals facing financial constraints due to a defaulted loan have the option to seek reinstatement through the Compromise of Matter process. The following article provides a detailed description of what the Indiana Sample Letter for Reinstatement of Loan — Compromise of Matter entails and highlights various types of situations where this letter could be used. 1. Understanding the Reinstatement of Loan — Compromise of Matter— - The Reinstatement of Loan — Compromise of Matter process allows individuals in Indiana to negotiate with lenders for a possible restructuring of loan terms and a potential reduction of loan amounts owed. — By presenting a compelling case, debtors can request a reconsideration of their loan terms, aiming for a more affordable repayment plan. — The Indiana Sample Letter captures the necessary details and justifications for reinstatement while ensuring professionalism and clarity. 2. Situations where Indiana Sample Letter for Reinstatement of Loan — Compromise of Matter can be utilized: a) Unanticipated Financial Hardships: — Circumstances such as job loss, decreased income, sudden medical expenses, or unexpected events can lead to the inability to repay loans as agreed upon. — In such cases, individuals can utilize the Indiana Sample Letter to present their financial situation and request for a modified repayment plan based on their current financial abilities. b) Divorce or Separation: — Divorce or separation can significantly alter the financial situation of individuals, making it challenging to fulfill loan obligations. — The Indiana Sample Letter can be employed to outline the impact of these life events, providing an opportunity to renegotiate loan terms and restore financial stability. c) Business or Economic Crisis: — Individuals facing business downturns or significant economic crises, resulting in cash flow issues, may find it challenging to meet loan payments. — By utilizing the Indiana Sample Letter, entrepreneurs can describe their financial challenges and seek potential assistance from the lender to revive the business and reinstate the loan. d) Medical Emergencies: — Sudden medical emergencies often bring unforeseen expenses, adding financial burdens that affect loan repayment capabilities. — This letter allows individuals to explain how medical debt has impacted their finances and request assistance from the lender through revised loan terms. Conclusion: The Indiana Sample Letter for Reinstatement of Loan — Compromise of Matter provides a valuable tool for individuals seeking to address their financial difficulties and negotiate with lenders for loan reinstatement. Whether facing unexpected financial hardships, divorces, economic crises, or medical emergencies, this letter serves as a guide to state the case professionally and potentially achieve more manageable loan terms.

Indiana Sample Letter for Reinstatement of Loan - Compromise of Matter

Description

How to fill out Indiana Sample Letter For Reinstatement Of Loan - Compromise Of Matter?

Are you presently in a placement the place you need to have files for possibly enterprise or person reasons nearly every day time? There are tons of authorized file web templates available online, but locating ones you can rely is not simple. US Legal Forms provides thousands of develop web templates, much like the Indiana Sample Letter for Reinstatement of Loan - Compromise of Matter, which can be created to meet federal and state requirements.

In case you are presently familiar with US Legal Forms web site and get a merchant account, just log in. Following that, you are able to acquire the Indiana Sample Letter for Reinstatement of Loan - Compromise of Matter design.

Unless you provide an bank account and want to begin using US Legal Forms, adopt these measures:

- Obtain the develop you want and make sure it is for the appropriate area/area.

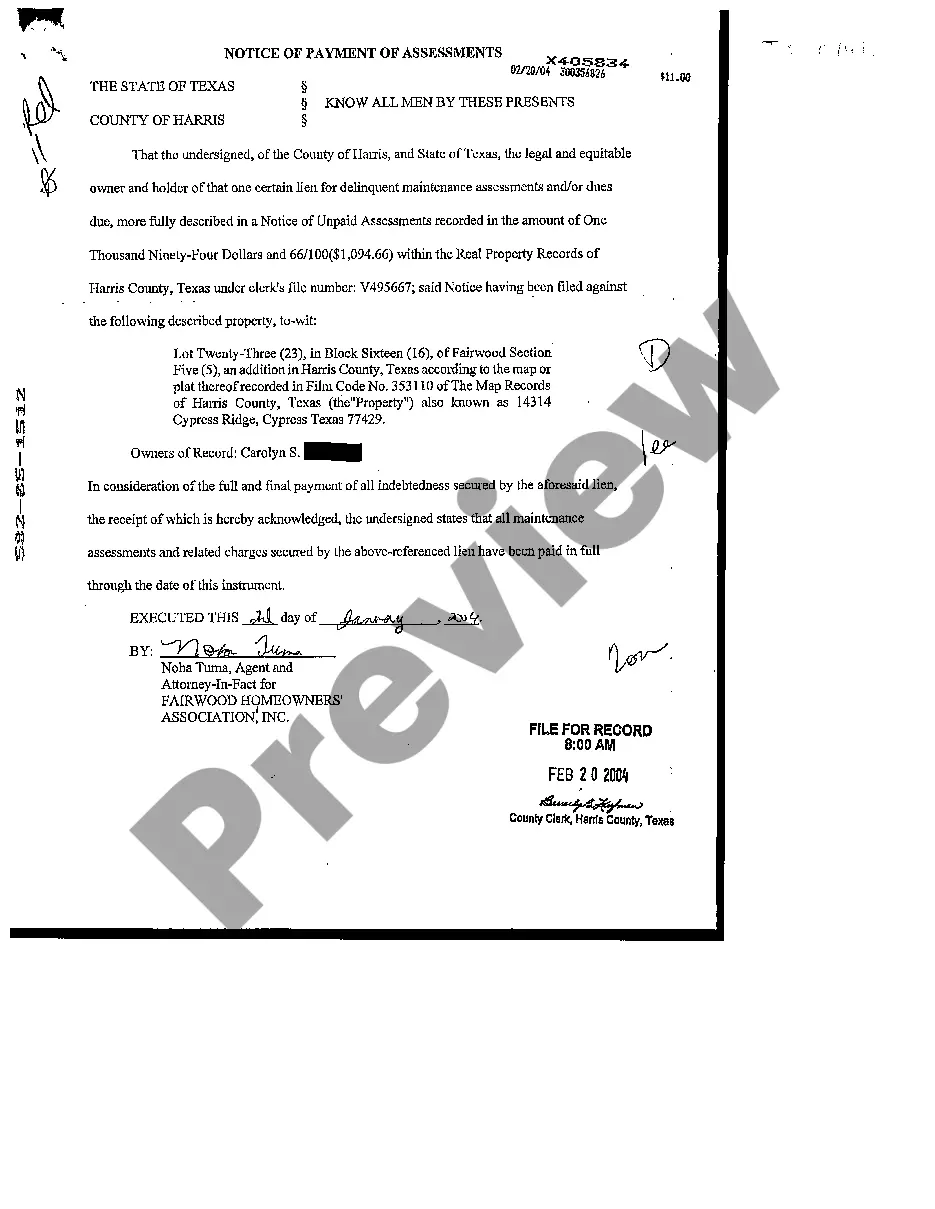

- Make use of the Review option to review the shape.

- See the information to ensure that you have selected the correct develop.

- In case the develop is not what you are trying to find, utilize the Lookup industry to get the develop that meets your needs and requirements.

- When you obtain the appropriate develop, just click Get now.

- Opt for the rates program you would like, fill in the required details to make your bank account, and purchase an order utilizing your PayPal or bank card.

- Decide on a hassle-free document file format and acquire your duplicate.

Find all of the file web templates you possess bought in the My Forms menus. You can get a more duplicate of Indiana Sample Letter for Reinstatement of Loan - Compromise of Matter whenever, if necessary. Just click the essential develop to acquire or produce the file design.

Use US Legal Forms, the most considerable variety of authorized forms, to conserve efforts and avoid blunders. The services provides skillfully manufactured authorized file web templates which you can use for a range of reasons. Create a merchant account on US Legal Forms and start producing your way of life easier.

Form popularity

FAQ

Negotiating a ReinstatementDefaulting property owners can also negotiate reinstatement of their mortgage loans with their lenders. Negotiating a reinstatement of a defaulted mortgage with that loan's lender is a bit more involved than simply paying all missed payments and late fees though.

How to write a reinstatement letterKnow who you're writing to.Look at the current job openings.Start with a friendly introduction.State the reason for writing.Explain why they should hire you.Conclude with a call to action.Include your contact information.

Write your own explanation letter. For example: Date: To Whom it may concern, I am applying for reinstatement because I (state your violation) during the semester. This happened because (provide the reason especially emphasizing any circumstances beyond your control).

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

Reinstating a loan stops a foreclosure because the borrower catches up on the defaulted payments. The borrower also has to pay any overdue fees and expenses incurred because of the default. Once the loan is reinstated, the borrower resumes making regular payments on the debt.

Verify Previous Employment. Call the human resources department for the name of the senior recruiter, HR manager or the hiring manager for the job for which you're applying.Contact Former Supervisor.Write Introduction.Describe Skills and Company Knowledge.Ask for an Interview.

Reinstate the loan If your car has just been repossessed, you may be able to pay back any payments you missed and reinstate your auto loan, which means you'd get your vehicle back and begin making payments again.

A reinstatement clause is an insurance policy clause that states when coverage terms are reset after the insured individual or business files a claim due to previous loss or damage. Reinstatement clauses don't usually reset a policy's terms, but they do allow the policy to restart coverage for future claims.

Example: "Hello, I'm a former employer of ABC and I'm very interested in the job of production manager that you have advertised. I'd like to verify the dates I worked at the company for my application."

Mortgage reinstatement, sometimes called loan reinstatement, is the process of restoring your mortgage after a mortgage default by paying the total amount past due. You will arrive at the point of a mortgage default after missing payments for several months.