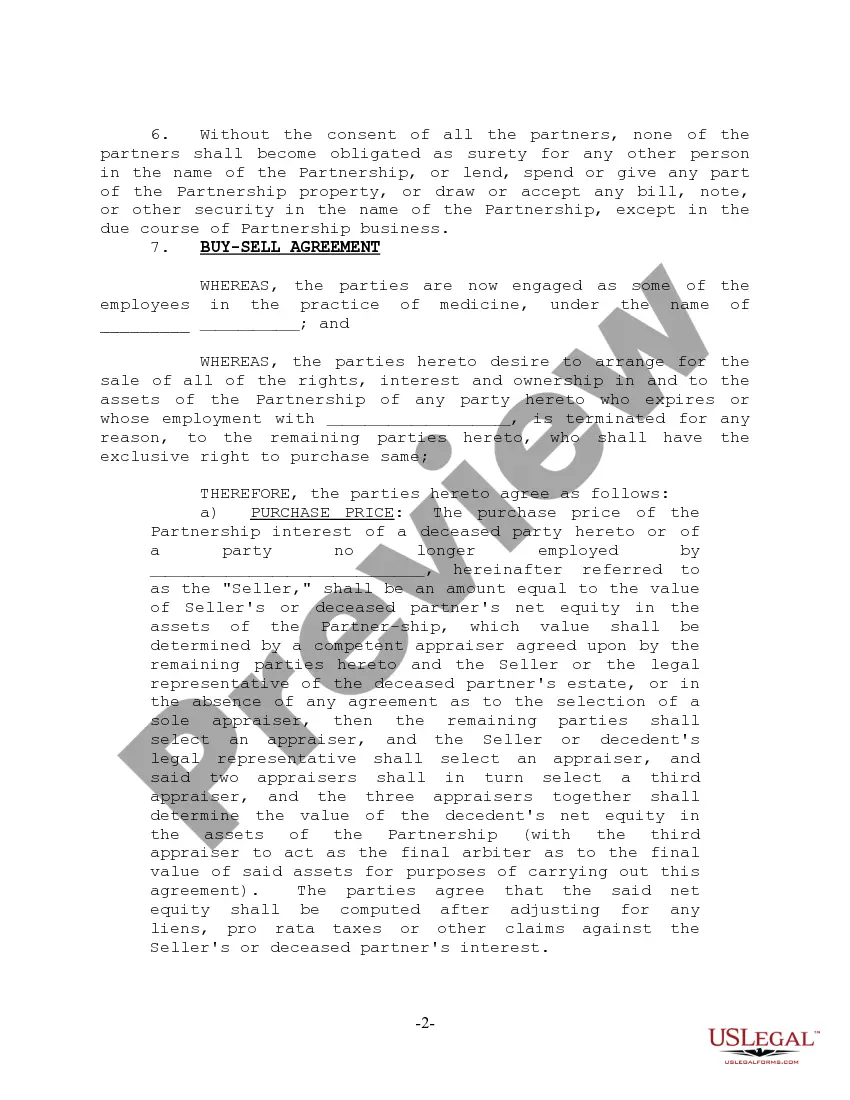

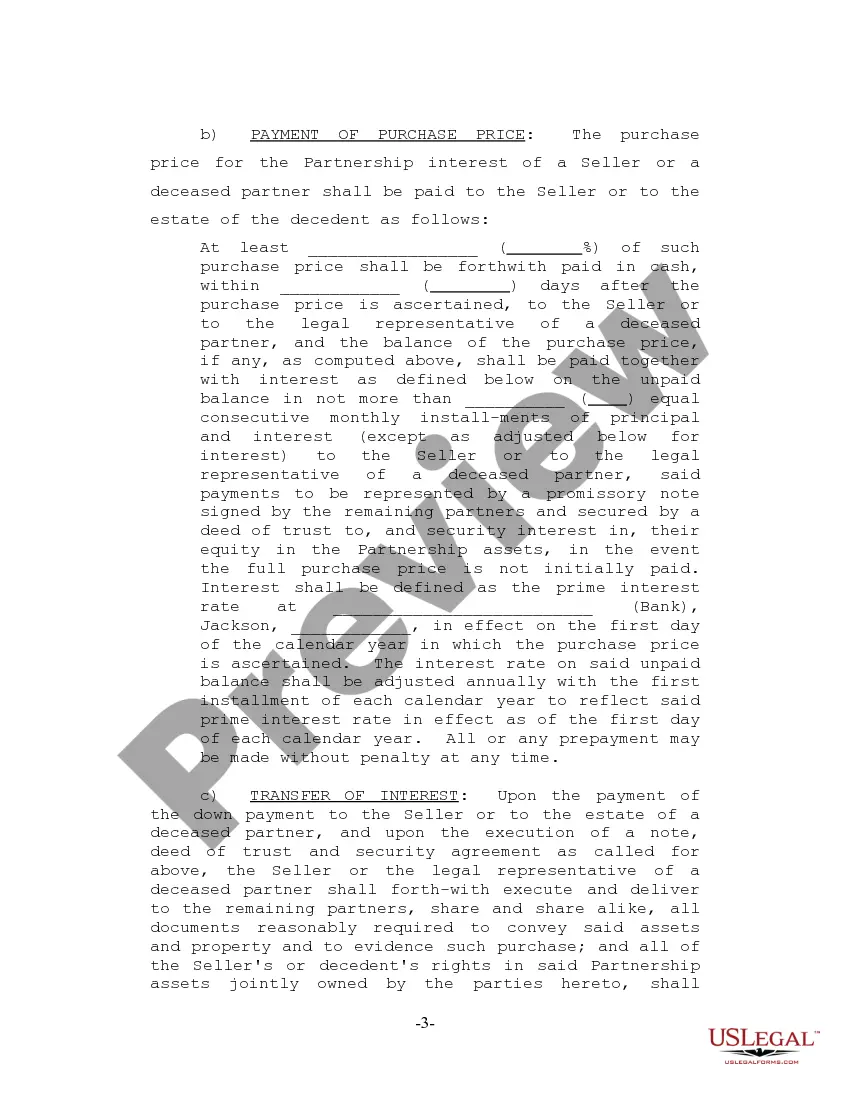

Indiana Partnership Agreement for Law Firm is a legally binding document that outlines the specific terms and conditions for the formation and operation of a partnership in the state of Indiana within the legal industry. This agreement serves as a blueprint for how partners within a law firm will conduct business, allocate profits and losses, make decisions, and manage the overall firm. There are typically two main types of Indiana Partnership Agreements for Law Firms: 1. General Partnership Agreement: This type of agreement establishes a partnership in which all partners have unlimited liability for the firm's debts and obligations. Each partner is equally responsible for the firm's operations, decision-making, and financial obligations. 2. Limited Liability Partnership (LLP) Agreement: An LLP agreement offers partners limited liability protection, meaning their personal assets are safeguarded against the firm's debts and liabilities. In an LLP, partners can have varying levels of involvement and limited liability based on their individual contributions and roles within the firm. The Indiana Partnership Agreement for Law Firm typically includes the following key components: 1. Partnership Name and Purpose: Clearly specifies the name under which the partnership will operate and outlines the primary objectives and goals of the firm. 2. Duration of Partnership: Defines the duration of the partnership, whether it is for a fixed term or an indefinite period. 3. Capital Contributions: Details the monetary and non-monetary contributions that each partner will make to the firm. This section also outlines the process for additional capital contributions required in the future. 4. Profit and Loss Sharing: Specifies how profits and losses will be distributed amongst the partners, outlining the percentage or proportion each partner will receive. 5. Management and Decision-Making: Clarifies the decision-making structure within the firm, including the role of managing partners or committees responsible for major business decisions. 6. Partner Withdrawals and Transfers: Outlines the procedures and requirements for partners seeking to withdraw from the firm or transfer their ownership interests. 7. Dissolution and Liquidation: Describes the process for dissolving the partnership, including the distribution of assets and liabilities amongst partners. 8. Dispute Resolution: Specifies methods and procedures for resolving disputes and conflicts that may arise amongst the partners. It is important for law firms in Indiana to have a comprehensive and well-drafted Partnership Agreement to protect the interests and ensure smooth operations of the firm. Seeking legal counsel from professionals experienced in partnership law is highly recommended ensuring compliance with Indiana laws and regulations.

Indiana Partnership Agreement for Law Firm

Description

How to fill out Indiana Partnership Agreement For Law Firm?

Discovering the right lawful record design can be quite a struggle. Naturally, there are a variety of themes accessible on the Internet, but how would you find the lawful develop you will need? Use the US Legal Forms website. The service gives a huge number of themes, including the Indiana Partnership Agreement for Law Firm, which you can use for enterprise and private requires. All of the types are examined by experts and meet federal and state needs.

When you are currently registered, log in to the bank account and then click the Down load switch to have the Indiana Partnership Agreement for Law Firm. Utilize your bank account to check through the lawful types you have acquired earlier. Proceed to the My Forms tab of the bank account and acquire yet another copy from the record you will need.

When you are a whole new user of US Legal Forms, listed below are basic directions that you can comply with:

- Initial, make certain you have chosen the proper develop for your area/area. You may look through the form using the Review switch and read the form outline to make sure this is basically the right one for you.

- If the develop is not going to meet your requirements, utilize the Seach industry to obtain the appropriate develop.

- Once you are certain the form is acceptable, select the Get now switch to have the develop.

- Pick the costs strategy you want and enter the necessary info. Design your bank account and buy the order making use of your PayPal bank account or credit card.

- Select the document format and down load the lawful record design to the gadget.

- Comprehensive, modify and printing and indicator the received Indiana Partnership Agreement for Law Firm.

US Legal Forms is the largest catalogue of lawful types in which you can discover various record themes. Use the company to down load appropriately-manufactured documents that comply with condition needs.

Form popularity

FAQ

Below, I outline seven key elements to include in formalized partnership agreements.Death. Providing support for the company in the event a partner passes is an absolute necessity.Disability.Transfer Of Partnership Interests.Right Of First Refusal.Keyman Insurance.Financing.Valuation Of Business Assets.

Partnership Agreements Are Essential Planning ahead avoids disputes and costly court battles later. No matter how much of a friend your potential partner is, you should never enter a business partnership with him or her without a formally drawn up partnership agreement.

The state of Indiana does not have a general business license that all general partnerships are required to obtain. However, depending on what industry you operate in, your business may need licenses or permits to enable you to run your company in a compliant fashion.

A partnership agreement is a voluntary agreement as it is not required by law. However, we recommend drawing up one because without a written agreement, your partnership will be controlled by the Partnership Act 1890.

If you are a business owner, looking to draft your own partnership agreement, you can do so using free templates available online. It is advisable to contact a business lawyer or a partnership agreement lawyer to ensure that the agreement follows the federal, state and local laws.

Although there's no requirement for a written partnership agreement, often it's a very good idea to have such a document to prevent internal squabbling (about profits, direction of the company, etc.) and give the partnership solid direction.

A business partnership agreement is a legally binding document that outlines details about business operations, ownership stake, financials and decision-making. Business partnership agreements, when coupled with other legal entity documents, could limit liability for each partner.

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

Solution. When there is no partnership agreement between partners, the division of Profits takes place in equal ratio.

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.