Title: Understanding Indiana Partnership Agreement for Investment Club: Types and Key Considerations Introduction: In Indiana, a Partnership Agreement for an Investment Club serves as a legally binding document that outlines the terms, rights, and responsibilities of the members participating in an investment club. This detailed description aims to provide an overview of Indiana Partnership Agreement for Investment Clubs, including various types and essential aspects to consider. Types of Indiana Partnership Agreements for Investment Clubs: 1. General Partnership Agreement: A general partnership agreement is the most common type of investment club partnership in Indiana. Under this structure, all members share equal responsibility, liabilities, and profits. 2. Limited Partnership Agreement: In Indiana, an investment club may also choose to establish a limited partnership agreement. This arrangement typically involves two types of partners: general partners, who actively manage the club's operations and bear unlimited liability, and limited partners, who contribute capital but have limited liability. 3. Limited Liability Partnership Agreement: For investment clubs primarily concerned with limiting personal liability, a limited liability partnership (LLP) agreement may be appropriate. This type allows all partners to participate in management while shielding them from personal liability for the actions of other partners. Key Considerations: 1. Ownership Structure: The Partnership Agreement should outline the ownership structure, including the percentage of ownership held by each member or partner. It clarifies profit/loss distribution and voting rights in investment decisions. 2. Contributions: The agreement should detail the initial capital contributions made by each partner, along with provisions for additional contributions or loans in the future. It allows members to understand their financial obligations and promotes transparency. 3. Roles and Responsibilities: Clearly defining the roles and responsibilities of each partner within the investment club is essential. This includes identifying who will actively manage the club's investments, handle administrative tasks, or represent the club in legal matters. 4. Decision-Making Process: A robust Partnership Agreement should address the decision-making process within the investment club. This can include voting mechanisms, required quorums for decision-making, and guidelines for resolving conflicts or disputes. 5. Profit Sharing: The agreement should specify how profits and losses will be allocated among the partners. Options can include equal sharing or proportionate distribution based on individual capital contributions or active involvement. 6. Dissolution and Exit Strategy: It is crucial to outline provisions for dissolving the investment club or handling the departure of a partner. This includes processes for asset liquidation, profit distribution, and buyout calculations, ensuring a smooth transition in case of changes in membership or dissolution. Conclusion: Understanding the different types and key considerations outlined in an Indiana Partnership Agreement for Investment Clubs is vital for establishing a legally sound and harmonious investment club. By incorporating these elements, investment club members can navigate their operations confidently and ensure mutual success while mitigating risks and clarifying legal obligations.

Indiana Partnership Agreement for Investment Club

Description

How to fill out Indiana Partnership Agreement For Investment Club?

Have you been in the place in which you require paperwork for either company or personal uses almost every time? There are a variety of legitimate file themes available on the net, but locating types you can depend on is not straightforward. US Legal Forms provides a large number of form themes, just like the Indiana Partnership Agreement for Investment Club, that are published in order to meet state and federal needs.

If you are currently familiar with US Legal Forms web site and also have an account, just log in. Following that, you may down load the Indiana Partnership Agreement for Investment Club format.

If you do not come with an bank account and need to begin using US Legal Forms, adopt these measures:

- Find the form you will need and ensure it is for the right town/county.

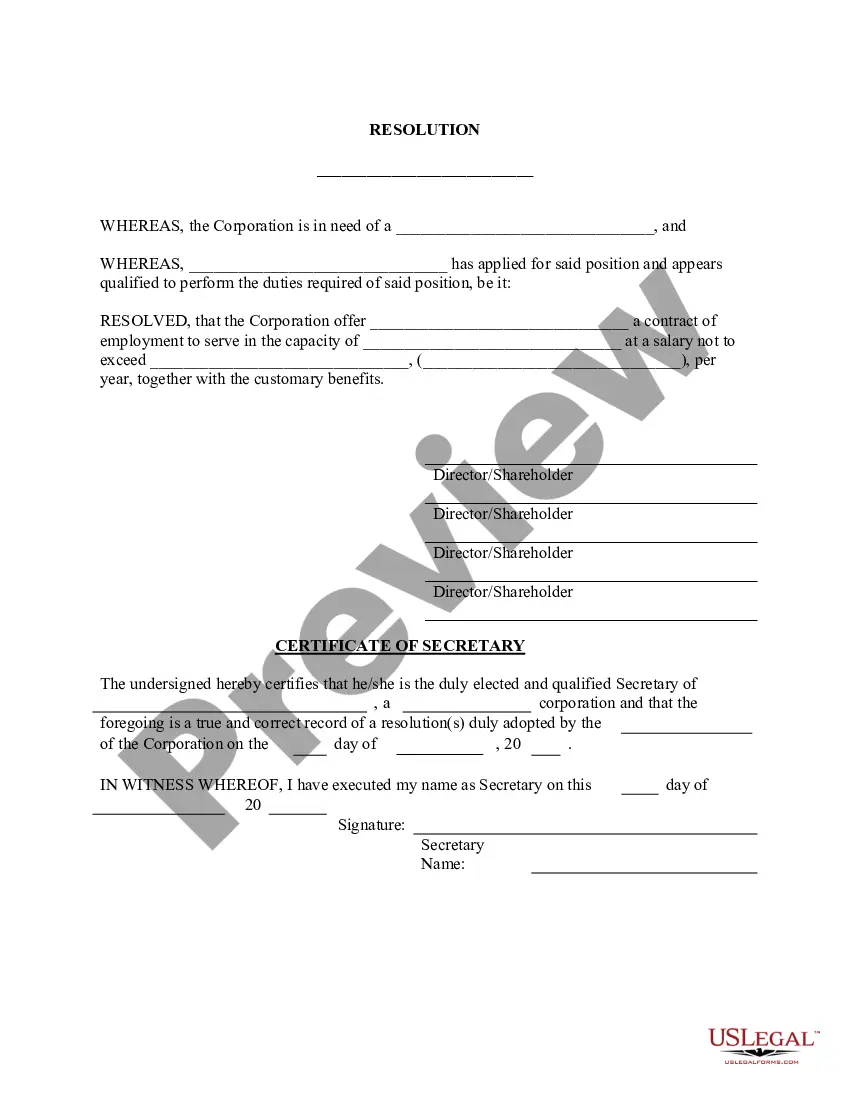

- Take advantage of the Preview key to analyze the form.

- Read the explanation to actually have selected the appropriate form.

- In case the form is not what you`re looking for, take advantage of the Research industry to obtain the form that meets your requirements and needs.

- Once you discover the right form, simply click Acquire now.

- Opt for the rates strategy you would like, submit the required info to generate your bank account, and pay money for the transaction with your PayPal or Visa or Mastercard.

- Select a practical data file format and down load your version.

Discover all of the file themes you have bought in the My Forms food selection. You can aquire a further version of Indiana Partnership Agreement for Investment Club whenever, if required. Just click the essential form to down load or print the file format.

Use US Legal Forms, the most considerable assortment of legitimate varieties, to conserve time and avoid errors. The assistance provides expertly made legitimate file themes which can be used for an array of uses. Make an account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

What to Include in Your Partnership AgreementName of the partnership. One of the first things you must do is agree on a name for your partnership.Contributions to the partnership.Allocation of profits, losses, and draws.Partners' authority.Partnership decision making.

If you are a business owner, looking to draft your own partnership agreement, you can do so using free templates available online. It is advisable to contact a business lawyer or a partnership agreement lawyer to ensure that the agreement follows the federal, state and local laws.

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

Simply put, a general partnership does not need to file annual accounts. On the other hand, LLPs must file certain information with Companies House. Indeed, an LLP is subject to a similar filing regime to companies in relation to trading disclosures and filing obligations.

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

The state of Indiana does not have a general business license that all general partnerships are required to obtain. However, depending on what industry you operate in, your business may need licenses or permits to enable you to run your company in a compliant fashion.

A general partnership has no separate legal existence distinct from the partners. Unlike a private limited company or limited liability partnership, it does not need to be registered at or make regular filings to Companies House, which can help keep things simple.

It is not mandatory to register a partnership firm as per the provisions of the Partnership Act, 1932. However, it is better to register a partnership firm. If the firm is not registered it cannot avail any legal benefits provided to the firm under the Partnership Act, 1932.

A limited partnership is required to have both general partners and limited partners. General partners have unlimited liability and have full management control of the business. Limited partners have little to no involvement in management, but also have liability that's limited to their investment amount in the LP.

What Constitutes a Legally Binding Business Partnership?All partners must hold up their side of the business responsibilities, financial payments, and guidelines set when the partnership was created.Both partners are responsible for their share fair of the investment.More items...