Indiana LLC Operating Agreement for Two Partners

Description

How to fill out LLC Operating Agreement For Two Partners?

Are you currently in a situation where you require documents for either commercial or personal purposes almost every day.

There is a plethora of legal document templates available online, but finding reliable forms can be challenging.

US Legal Forms provides thousands of document templates, such as the Indiana LLC Operating Agreement for Two Partners, designed to fulfill federal and state requirements.

Choose the pricing plan you prefer, provide the necessary information to create your account, and pay for your order using PayPal or a credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- After that, you can download the Indiana LLC Operating Agreement for Two Partners template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

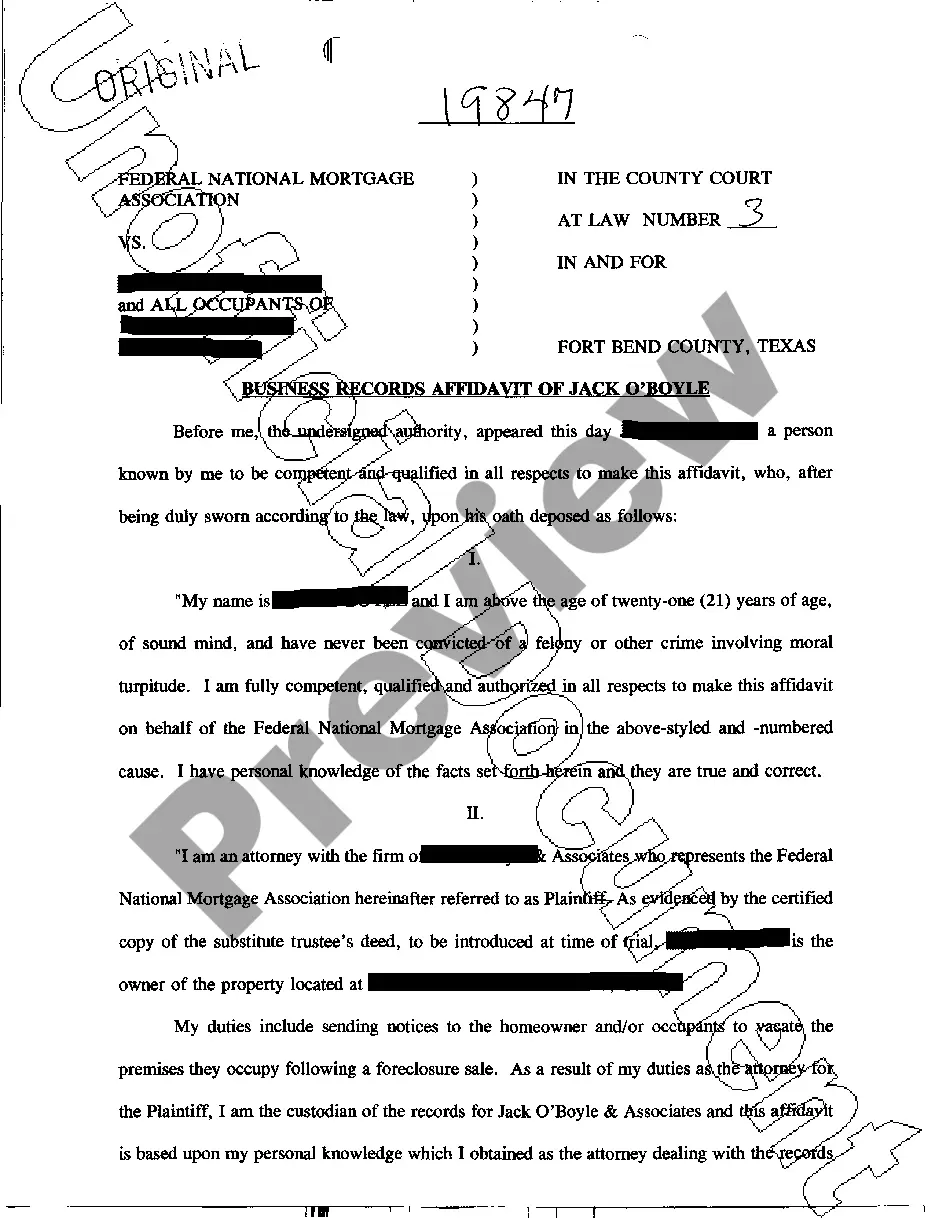

- Use the Preview button to review the form.

- Check the details to confirm that you have selected the appropriate document.

- If the document is not what you are looking for, utilize the Search field to find the form that matches your needs.

- Once you find the right document, simply click Get now.

Form popularity

FAQ

An operating agreement governs the internal operations of an LLC, while a Standard Operating Procedure (SOP) details specific tasks and processes. Essentially, the operating agreement provides a broader overview of how the business functions as a whole. With an Indiana LLC Operating Agreement for Two Partners, you focus on the partnership's dynamic, leaving SOPs for the day-to-day tasks.

While Indiana does not legally require a two-member LLC to have an operating agreement, it is highly recommended to have one in place. An Indiana LLC operating agreement for two partners provides clarity on management and finances, reducing misunderstandings. This document establishes rules about the operation of the business and protects your interests. By having an operating agreement, you create a strong foundation for your partnership.

Yes, you can start an LLC with two partners in Indiana. An Indiana LLC operating agreement for two partners outlines the roles, responsibilities, and profit-sharing arrangements between each partner. This agreement serves as a crucial document to ensure both parties understand their commitments and helps prevent future disputes. Starting with a clear framework sets the right tone for a successful partnership.

Can an LLC have two managing members? Yes. A multi-member LLC can have as many managing members as desired.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Basic Steps to Form a Multi-Member LLCChoose a business name.Apply for an EIN (Employer Identification Number).File your LLC's articles of organization.Create an operating agreement.Apply for the necessary business licenses and permits.Open a separate bank account for your business.

Is an LLC Operating Agreement required in Indiana? No, Indiana does not require LLCs to create an Operating Agreement as a legal document to operate. However, the state does recommend having an Operating Agreement on file in case of disputes or issues.

An Indiana LLC operating agreement is a legal document that will provide assistance to the member(s) of businesses, in any size, to provide an outline of the company's organization of members, operational procedures, and many various aspects of the business that will be agreed upon by all members prior to

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Indiana LLC net income must be paid just as you would with any self-employment business.

Member LLC Operating Agreement is a document that establishes how an entity with two (2) or more members will be run. Without putting the contract into place, the entity is governed in accordance with the rules and standards established by the state, which may or may not align with the company's goals.