Indiana Security Agreement is a legal document that outlines the terms and conditions regarding the pledging of member interests in Limited Liability Company (LLC) as collateral for a loan or other obligations. This contract provides protection for lenders by granting them rights to the pledged member interests in the event of default or non-compliance. The Indiana Security Agreement regarding Member Interests in LCS is governed by the Indiana Uniform Commercial Code (UCC), specifically Article 9 — Secured Transactions. This agreement serves as a crucial tool for lenders to secure their investment in the LLC and ensure repayment in case of default. There are several types of Indiana Security Agreements that can be established for Member Interests in LCS. These include: 1. Traditional Security Agreement: This is the most common form of security agreement, where the member pledges their interests in the LLC as collateral for a loan. The lender obtains a security interest in the member interests, gaining rights to foreclose or take possession of the interests if the debtor fails to meet the repayment obligations. 2. Floating Lien Security Agreement: This type of security agreement allows the lender to take a security interest not only in the existing member interests but also in any future-acquired interests of the debtor. It provides flexibility for the lender as it covers both the existing and future value of the LLC member interests. 3. Blanket Lien Security Agreement: Unlike a traditional security agreement that focuses solely on the member interests of the LLC, a blanket lien security agreement allows the lender to secure not only the member interests but also other assets of the debtor. This broader scope provides additional security for the lender. 4. Subordination Agreement: In certain cases, there may be multiple security interests on the same member interests of the LLC. A subordination agreement determines the priority of these security interests, establishing which lender has a superior claim in case of default. This agreement is crucial when dealing with multiple lenders or subsequent loans. The primary purpose of an Indiana Security Agreement regarding Member Interests in LCS is to protect the lender's rights and interests by securing repayment through the borrower's member interests in the company. It outlines the specifics of the pledge, including the description of the member interests, granting the lender necessary rights to enforce their security interest. Understanding the different types of Indiana Security Agreements helps both lenders and borrowers navigate the process efficiently, ensuring clear expectations regarding the pledge of member interests in LCS. Consulting an attorney familiar with Indiana LLC laws is advisable to draft and execute a legally enforceable and comprehensive security agreement.

Indiana Security Agreement regarding Member Interests in Limited Liability Company

Description

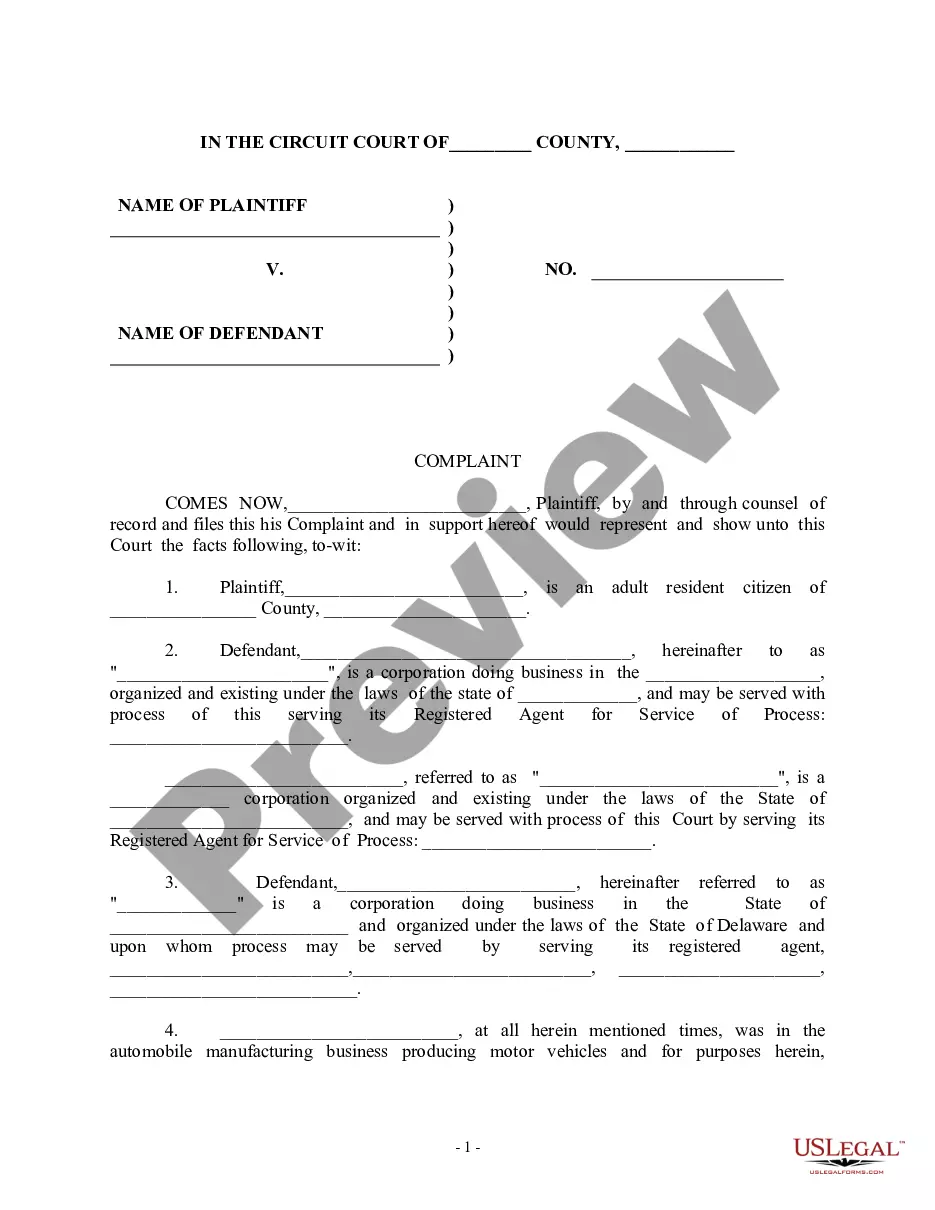

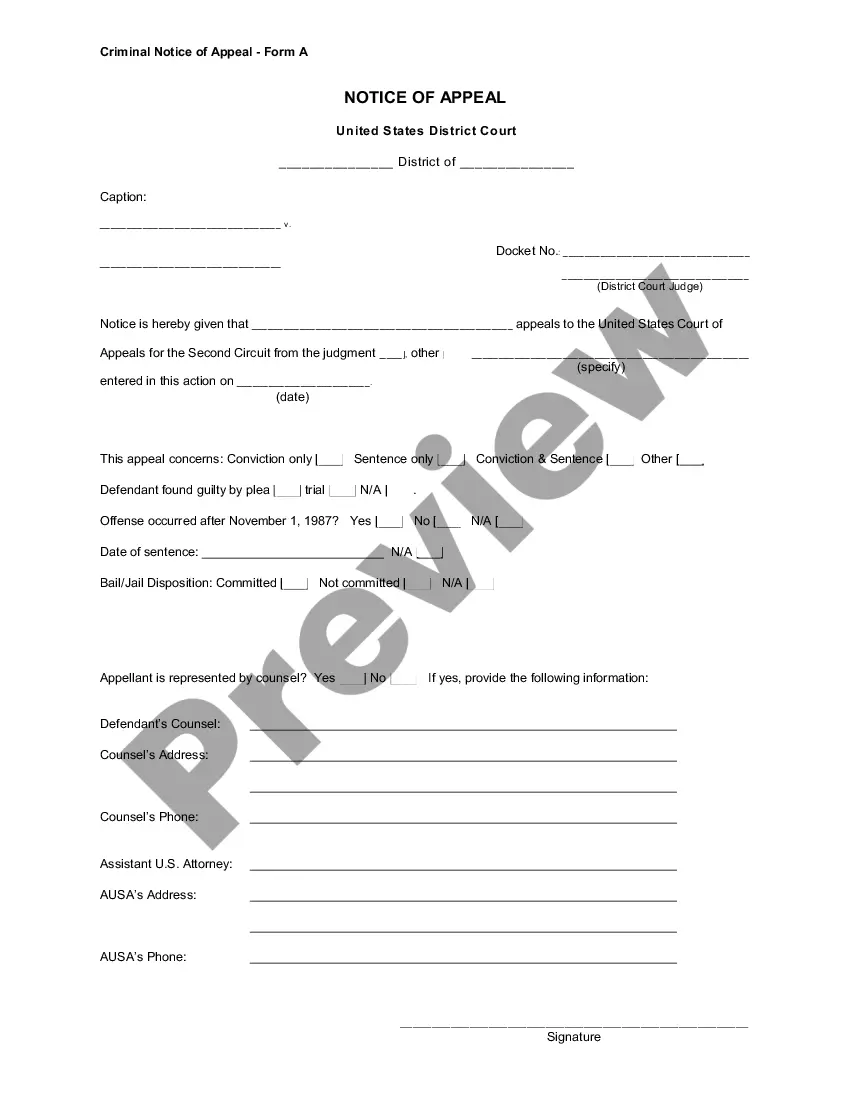

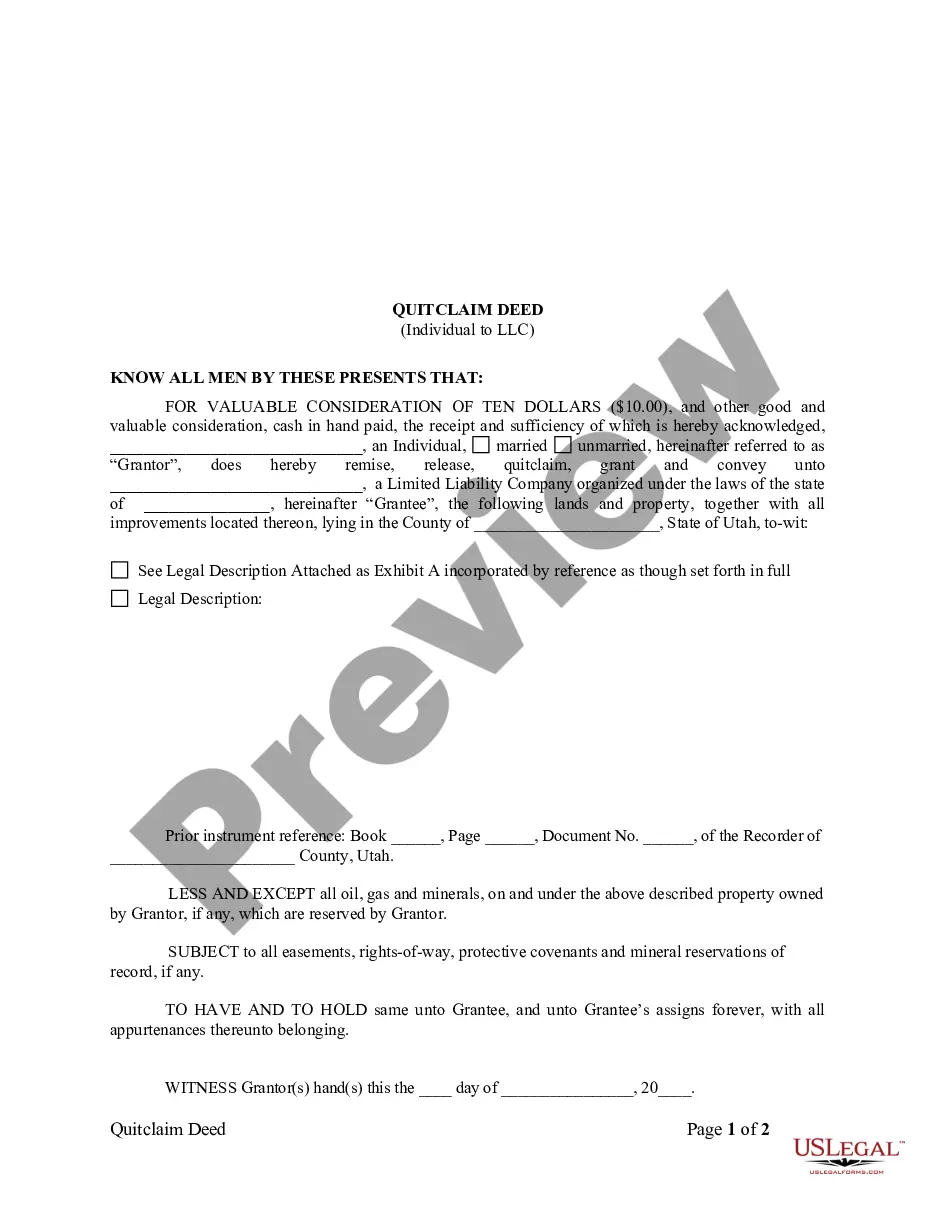

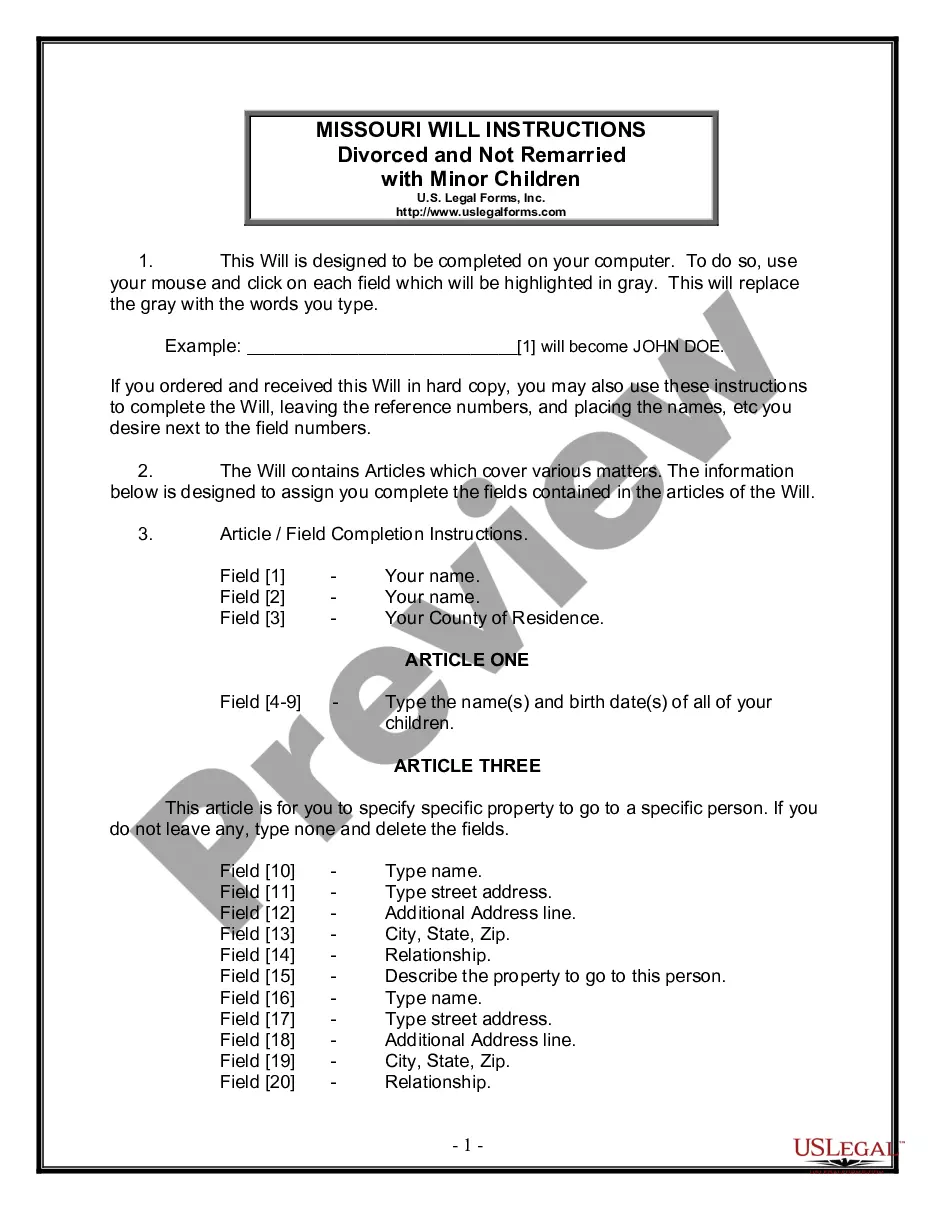

How to fill out Indiana Security Agreement Regarding Member Interests In Limited Liability Company?

If you wish to comprehensive, acquire, or print out lawful papers layouts, use US Legal Forms, the largest selection of lawful types, that can be found on the Internet. Utilize the site`s simple and easy handy search to obtain the documents you need. A variety of layouts for company and person uses are sorted by types and states, or keywords. Use US Legal Forms to obtain the Indiana Security Agreement regarding Member Interests in Limited Liability Company in just a number of click throughs.

Should you be previously a US Legal Forms customer, log in in your account and click on the Download option to find the Indiana Security Agreement regarding Member Interests in Limited Liability Company. You may also gain access to types you in the past saved within the My Forms tab of your account.

If you work with US Legal Forms the first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form for your correct city/country.

- Step 2. Utilize the Review method to examine the form`s articles. Do not overlook to learn the explanation.

- Step 3. Should you be unsatisfied with all the kind, utilize the Research area at the top of the display to get other models of the lawful kind format.

- Step 4. After you have found the form you need, go through the Acquire now option. Select the pricing strategy you favor and put your references to sign up to have an account.

- Step 5. Procedure the purchase. You should use your charge card or PayPal account to complete the purchase.

- Step 6. Choose the format of the lawful kind and acquire it on your own system.

- Step 7. Complete, revise and print out or indicator the Indiana Security Agreement regarding Member Interests in Limited Liability Company.

Every lawful papers format you purchase is yours for a long time. You might have acces to each kind you saved within your acccount. Click on the My Forms segment and select a kind to print out or acquire again.

Be competitive and acquire, and print out the Indiana Security Agreement regarding Member Interests in Limited Liability Company with US Legal Forms. There are many specialist and express-certain types you can utilize to your company or person requirements.

Form popularity

FAQ

Limited liability partnership interests are typically securities, since, like in limited partnerships, LLP limited interests lack managerial powers and have limited liability.

Limited liability companies (LLCs) do not have stock, nor can they issue it. Despite this fact, LLCs may have advantages over corporations, depending on your particular business needs and goals.

As a result, lenders desiring to secure their loans with an equity pledge (typically either in the borrower itself or its subsidiaries) are increasingly taking pledges of LLC membership interests as part of their collateral.

Under LLP structure, liability of the partner is limited to his agreed contribution. Further, no partner is liable on account of the independent or un-authorized acts of other partners, thus allowing individual partners to be shielded from joint liability created by another partner's wrongful acts or misconduct.

Because the Agreement of Limited Partnership is considered an investment contract, the SEC classifies LP units as securities. If the partnership is sold to the public, then they must be registered under the Securities Act of 1933.

In California, shares of an LLC in which any member is not continuously actively involved in the management of the LLC would qualify as securities.

Under most circumstances, an LLC interest is a general intangible, and the lender will perfect its security interest by filing an initial UCC financing statement in the state where the pledgor is located, which for an individual pledgor is the state of his/her principal residence and for a registered organization

Hence, a general partnership interest is not necessarily or even typically securities unless the Animal Farm1 rule applies, i.e., some general partners have much greater power and/or control of the information so that the other general partners are seen more like relatively passive investors.

Under this definition, a membership interest in an LLC is a security for California law purposes unless all of the members are actively engaged in management. Thus, interests in a manager-managed LLC where not all members are managers are securities under California law.

Like a company, an LLP is a body corporate and therefore a separate legal entity and an LLP member's liability is limited. However, like a partnership the relationship between the LLP members is governed by private agreement. An LLP does not have shareholders or directors and is taxed like a partnership.