Title: Indiana Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code Keywords: Indiana Minutes, Special Meeting, Board of Directors, Adopt, Stock Ownership Plan, Section 1244, Internal Revenue Code 1. Introduction to Stock Ownership Plans in Indiana: Stock Ownership Plans (SOPs) offer corporations in Indiana an opportunity to incentivize employees and provide them with a stake in the company's success. This article focuses on the detailed description of Indiana Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt a Stock Ownership Plan under Section 1244 of the Internal Revenue Code. 2. Understanding the Importance of Indiana Minutes: Indiana Minutes serve as a vital record of corporate decisions made during special board meetings. These minutes provide legal documentation of the proceedings detailing the rationale behind adopting a Stock Ownership Plan and complying with the relevant laws, specifically Section 1244 of the Internal Revenue Code. 3. Overview of a Special Meeting of the Board of Directors: A Special Meeting of the Board of Directors is called when specific matters require immediate attention. In this case, the meeting is intended for adopting the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. The minutes will reflect the discussions, resolutions, and decisions made during this meeting. 4. Purpose and Benefits of Stock Ownership Plans in Indiana: Stock Ownership Plans encourage employee engagement, promote loyalty, and align employees' interests more closely with the corporation's long-term success. Adopting a SOP under Section 1244 of the Internal Revenue Code entitles qualified small business corporations to potential tax advantages. 5. Key Agenda Points Covered in the Indiana Minutes: a) Call to Order: Recording the time, date, and location of the special board meeting. b) Roll Call: Documenting the attendance of directors present and any necessary proxies. c) Approval of Agenda: Validating the items for discussion during the special meeting. d) Discussion of the Stock Ownership Plan: Detailed review of Section 1244, its implications, and its alignment with the corporation's goals. e) Resolutions and Voting: Recording the results of voting on all motions related to the adoption of the Stock Ownership Plan. f) Next Steps and Implementation: Outlining the necessary steps and assigning responsibilities for implementing the adopted SOP. g) Adjournment: Documenting the official close of the special meeting. 6. Legal Compliance: Indiana Minutes should explicitly state the corporation's compliance with all relevant legal requirements, including Section 1244 of the Internal Revenue Code and any other state-specific regulations influencing the Stock Ownership Plan adoption process. 7. Different Types of Indiana Minutes of Special Meeting: While the primary focus of this article remains on the adoption of a Stock Ownership Plan under Section 1244 of the Internal Revenue Code, it is important to note that Indiana Minutes can cover a wide range of topics and decisions undertaken by the board. Some other examples of Indiana Minutes might include minutes related to mergers and acquisitions, strategic planning discussions, or resolutions on significant operational changes. Conclusion: The Indiana Minutes of a Special Meeting of the Board of Directors to Adopt a Stock Ownership Plan under Section 1244 of the Internal Revenue Code provide a comprehensive record of the decision-making process, ensuring legal compliance, and capturing the essence of the meeting's discussions. These minutes serve as valuable documentation for the corporation's shareholders, employees, and stakeholders, ensuring transparency and accountability.

Indiana Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Indiana Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

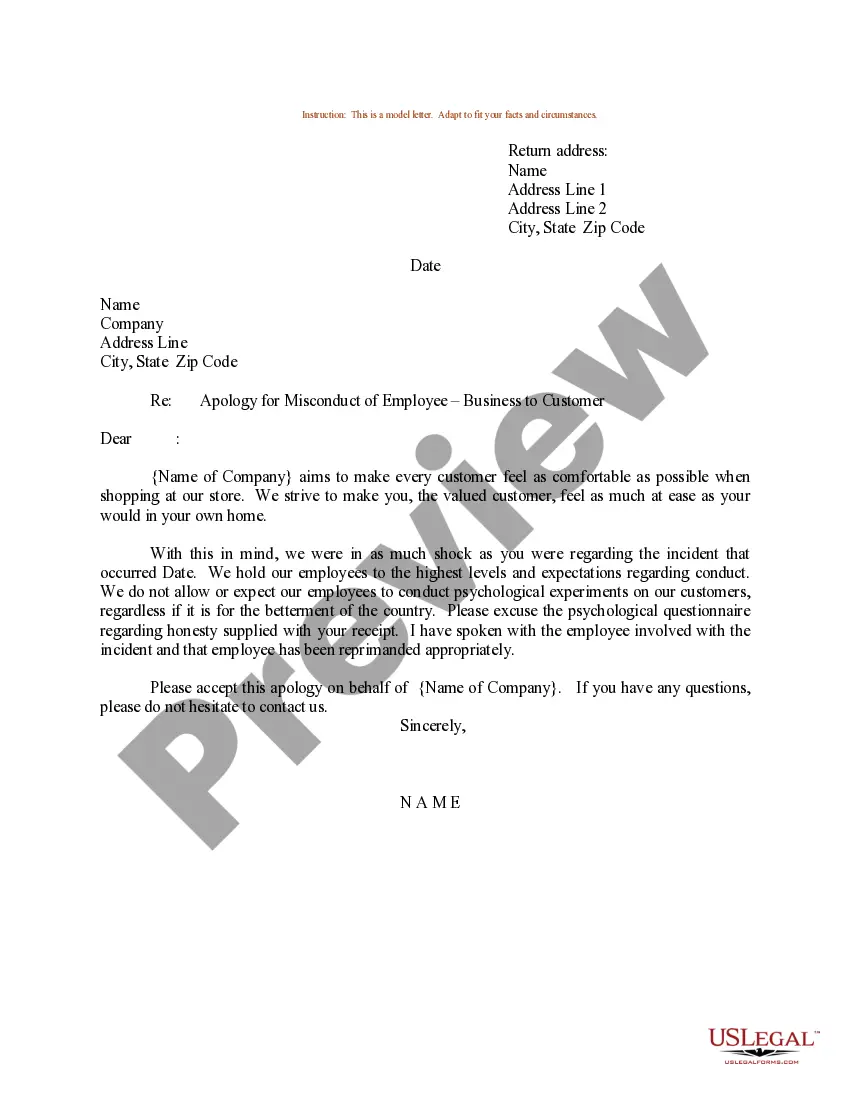

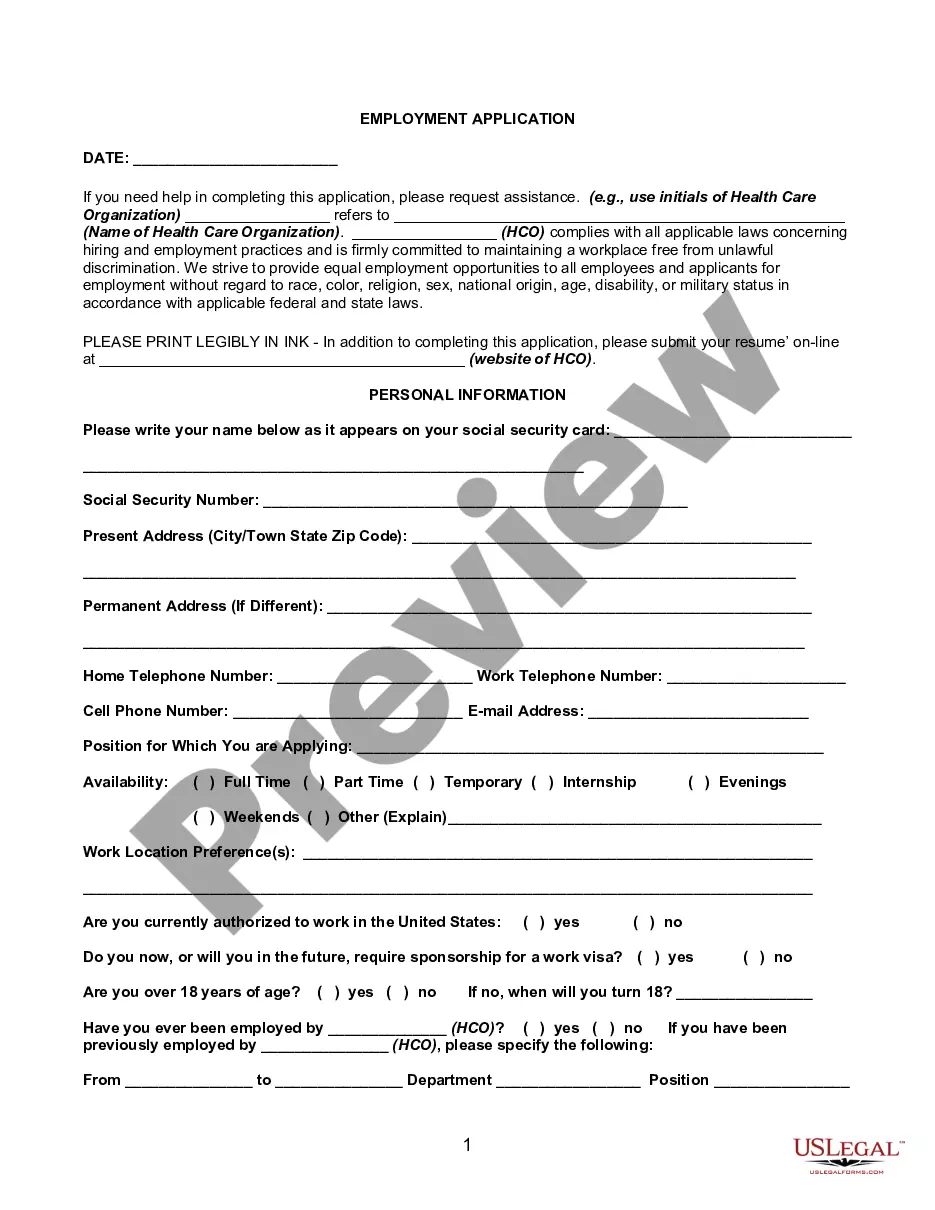

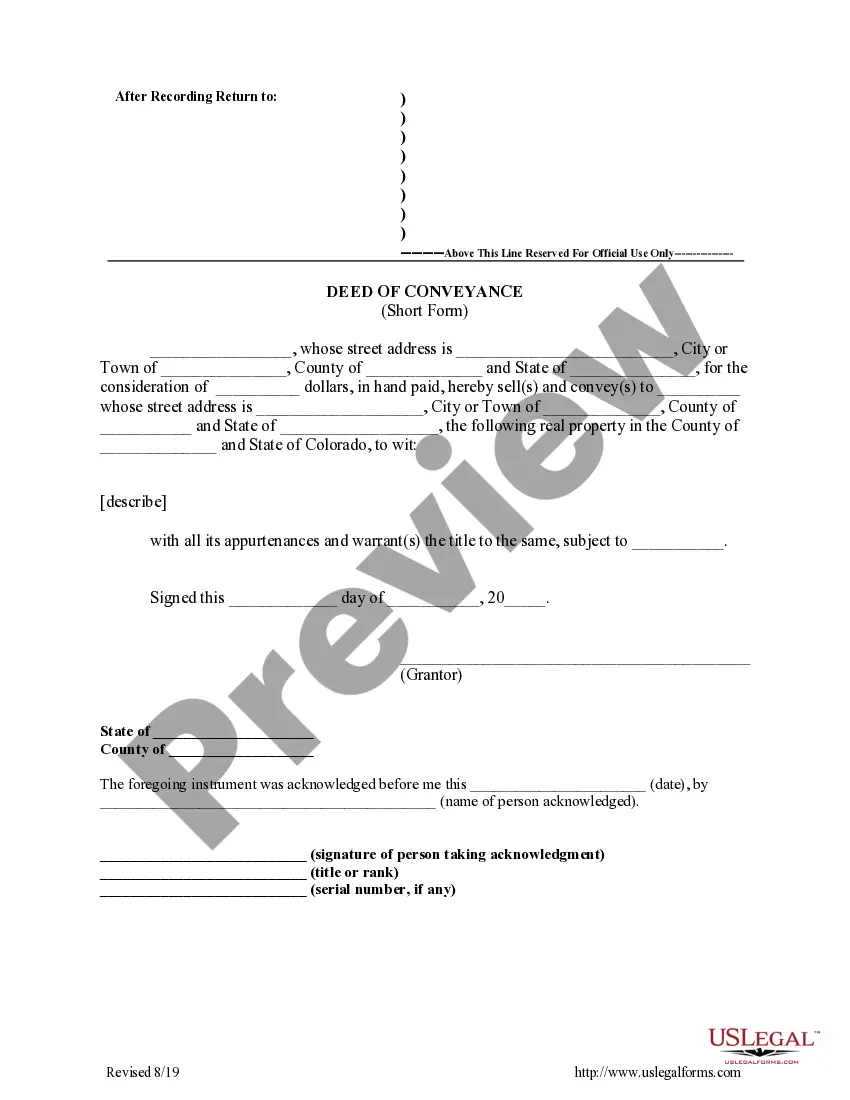

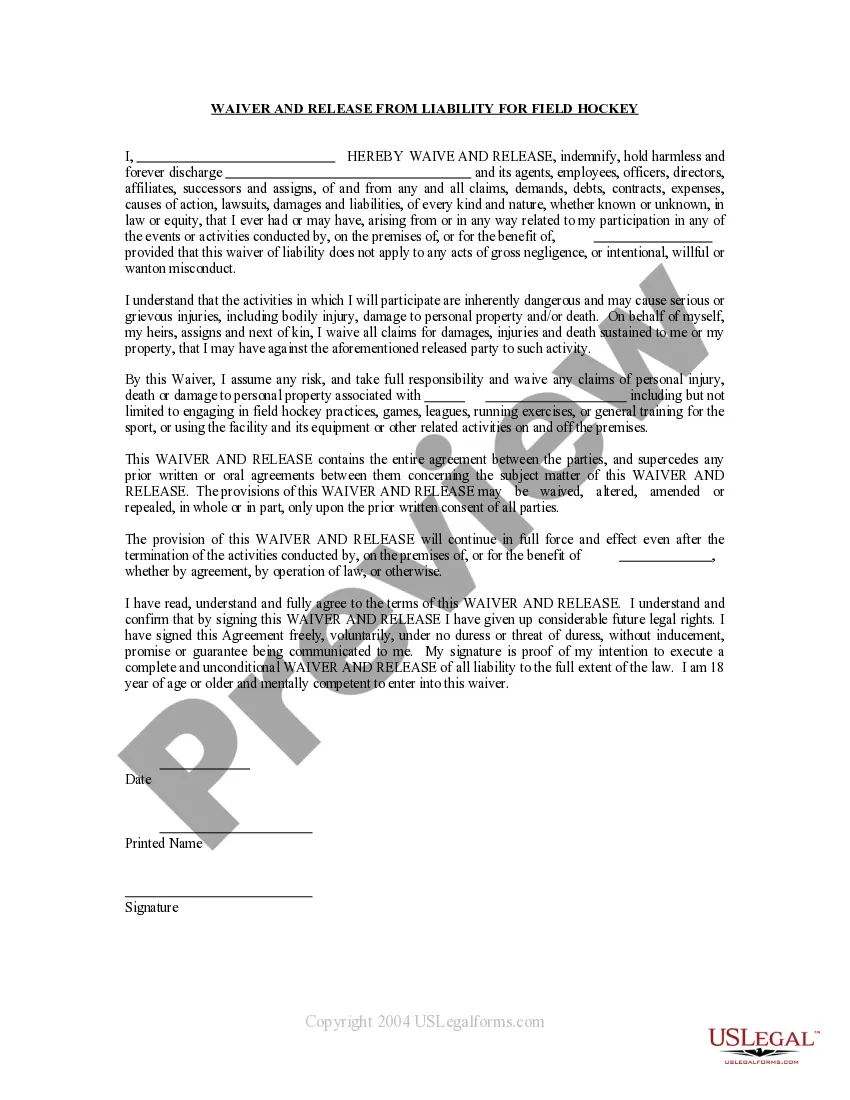

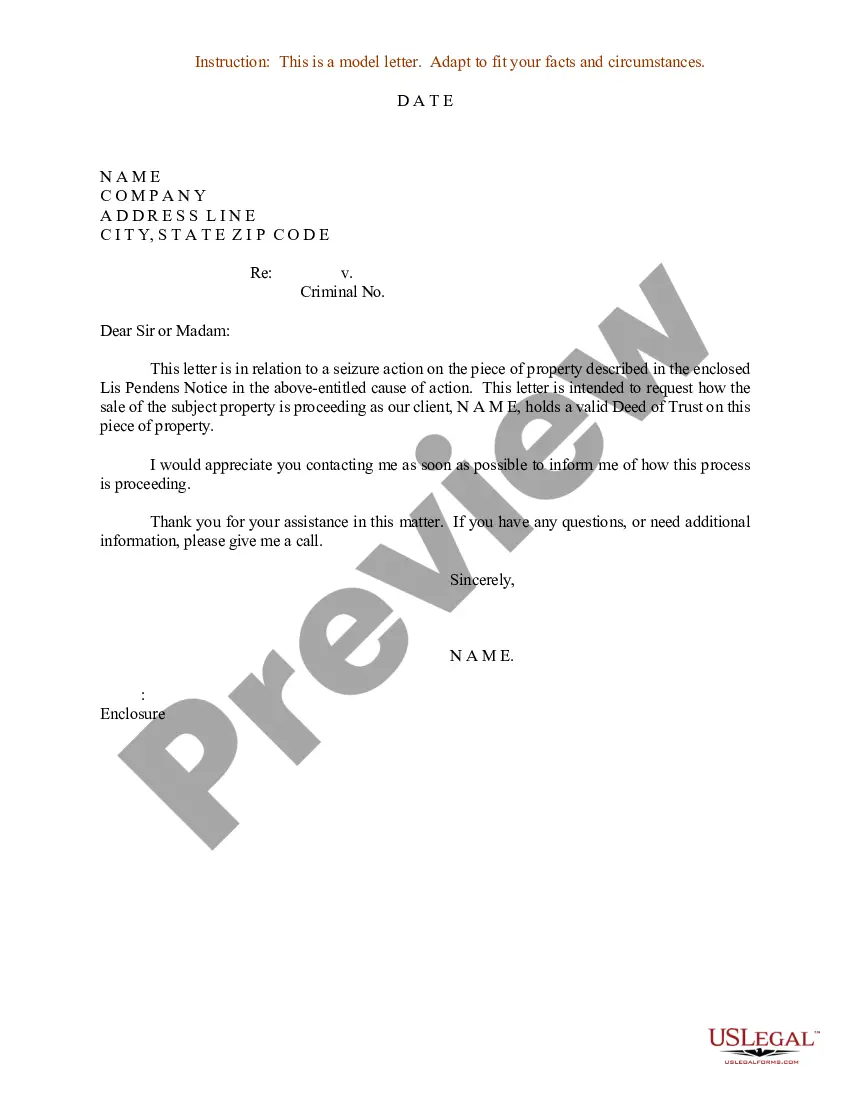

Are you currently in the placement where you need to have papers for either company or individual purposes nearly every working day? There are plenty of lawful papers web templates accessible on the Internet, but getting kinds you can depend on is not easy. US Legal Forms delivers thousands of type web templates, just like the Indiana Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, that are created to satisfy federal and state needs.

If you are presently knowledgeable about US Legal Forms site and get a free account, basically log in. Next, you are able to down load the Indiana Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code template.

If you do not have an bank account and wish to start using US Legal Forms, abide by these steps:

- Find the type you want and make sure it is for the right town/region.

- Use the Review switch to analyze the form.

- See the information to actually have selected the right type.

- In case the type is not what you`re looking for, take advantage of the Look for industry to obtain the type that fits your needs and needs.

- When you find the right type, simply click Purchase now.

- Choose the pricing prepare you would like, submit the required details to produce your money, and pay for the transaction with your PayPal or credit card.

- Decide on a handy file structure and down load your version.

Get each of the papers web templates you possess bought in the My Forms food selection. You can get a further version of Indiana Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code at any time, if necessary. Just click on the essential type to down load or print the papers template.

Use US Legal Forms, by far the most extensive assortment of lawful kinds, in order to save some time and steer clear of faults. The assistance delivers skillfully created lawful papers web templates that can be used for a range of purposes. Produce a free account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

: a meeting held for a special and limited purpose specifically : a corporate meeting held occasionally in addition to the annual meeting to conduct only business described in a notice to the shareholders.

Special stockholder meetings can be called by the board of directors or any person that is authorized in the certificate of incorporation or in the bylaws of the company.

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

Most special meetings involve director elections, which typically work pursuant to a less-restrictive plurality standard, rather than a majority standard.

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

Special meetings of the Board for any purpose or purposes may be called at any time by the chairman of the Board, the chief executive officer, the secretary or any two directors. The person(s) authorized to call special meetings of the Board may fix the place and time of the meeting.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

The corporation can allow others to call a special meeting, such as the BoD Chair, CEO, or yes, shareholders.