Indiana Assignment of Principal Obligation and Guaranty

Description

How to fill out Assignment Of Principal Obligation And Guaranty?

Finding the right legitimate record web template can be quite a have a problem. Needless to say, there are plenty of web templates available on the net, but how can you get the legitimate develop you want? Make use of the US Legal Forms web site. The support gives a huge number of web templates, including the Indiana Assignment of Principal Obligation and Guaranty, that can be used for organization and private demands. All the kinds are checked by pros and meet federal and state specifications.

Should you be currently authorized, log in in your bank account and click on the Download key to get the Indiana Assignment of Principal Obligation and Guaranty. Use your bank account to check with the legitimate kinds you have ordered earlier. Visit the My Forms tab of your respective bank account and have another backup in the record you want.

Should you be a brand new end user of US Legal Forms, listed below are simple recommendations that you should stick to:

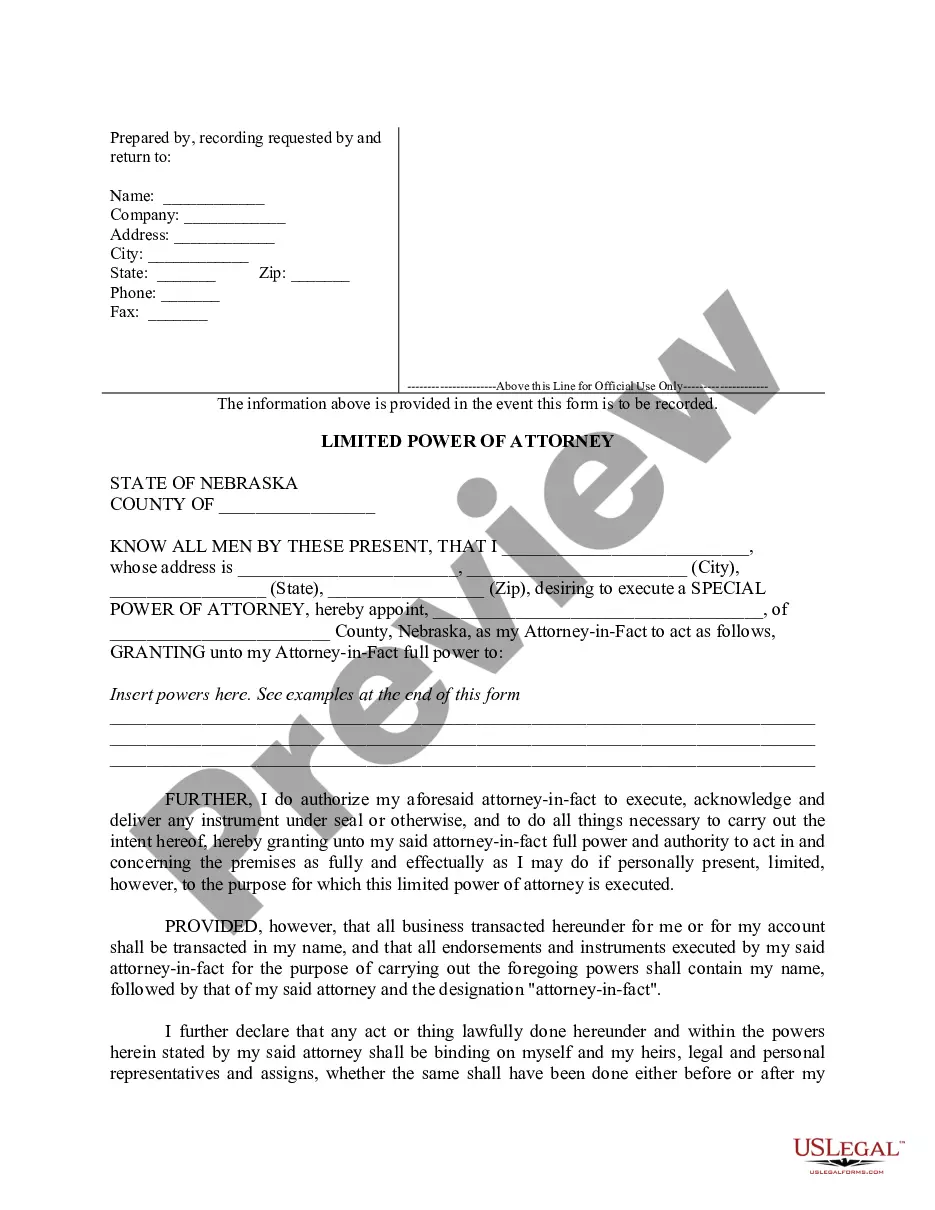

- Initially, make certain you have selected the proper develop for your area/state. You can check out the shape using the Review key and browse the shape explanation to make certain it will be the right one for you.

- In case the develop will not meet your expectations, use the Seach field to obtain the right develop.

- Once you are sure that the shape would work, click on the Buy now key to get the develop.

- Select the rates program you need and enter in the needed info. Create your bank account and buy the order making use of your PayPal bank account or credit card.

- Pick the document formatting and acquire the legitimate record web template in your product.

- Complete, change and printing and indication the obtained Indiana Assignment of Principal Obligation and Guaranty.

US Legal Forms is definitely the most significant local library of legitimate kinds that you can discover different record web templates. Make use of the company to acquire appropriately-made documents that stick to condition specifications.

Form popularity

FAQ

The usual way that a guaranty is enforced is through a written demand (although this is not usually required in most forms) followed by the filing of a law suit.

This means, among other things: (1) Lender may collect from Guarantor without first foreclosing on any real or personal property collateral pledged by Borrower; and (2) if Lender forecloses on any real property collateral pledged by Borrower, then (i) the amount of the debt may be reduced only by the price for which ...

In a finance or lending context, a guarantor would be forced to answer for the debt or default of the debtor to the creditor, if a debtor does not fulfill an obligation on their part to repay their debt.

The Guarantor may not assign, transfer or part with any of its rights or obligations under this Guarantee and Indemnity or any of the Relevant Lease Documents without the prior written consent of the Lessor. Assignment by Guarantor.

A guarantor is a person who makes a promise to pay a debt if the original debtor on the loan cannot pay.

The benefit of guarantees can be assigned to a third party.

The lender may assign all or part of the guaranteed portion of the loan to one or more holders by using an Assignment Guarantee Agreement.

An agreement by which a party (the guarantor) assumes the responsibility for the payment or performance of an obligation or action of another person (the primary obligor) if that other person defaults. A guarantee creates a secondary obligation to support the primary obligor's primary obligation to a third party.