Indiana Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor

Description

How to fill out Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor?

If you have to complete, download, or print lawful file themes, use US Legal Forms, the most important variety of lawful types, which can be found on the Internet. Use the site`s simple and easy convenient search to obtain the documents you want. Different themes for business and personal functions are sorted by classes and claims, or search phrases. Use US Legal Forms to obtain the Indiana Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor within a couple of mouse clicks.

If you are already a US Legal Forms consumer, log in for your bank account and click the Down load switch to get the Indiana Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor. Also you can access types you earlier saved from the My Forms tab of your bank account.

If you work with US Legal Forms the very first time, refer to the instructions under:

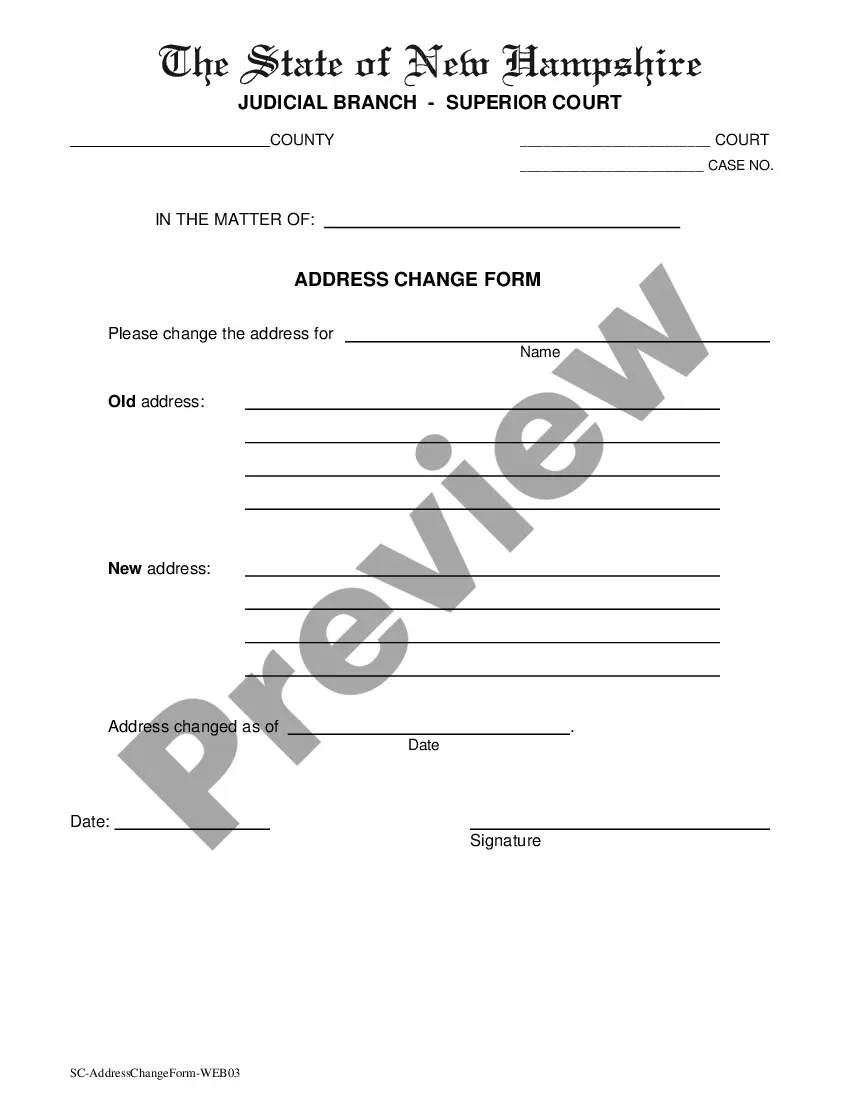

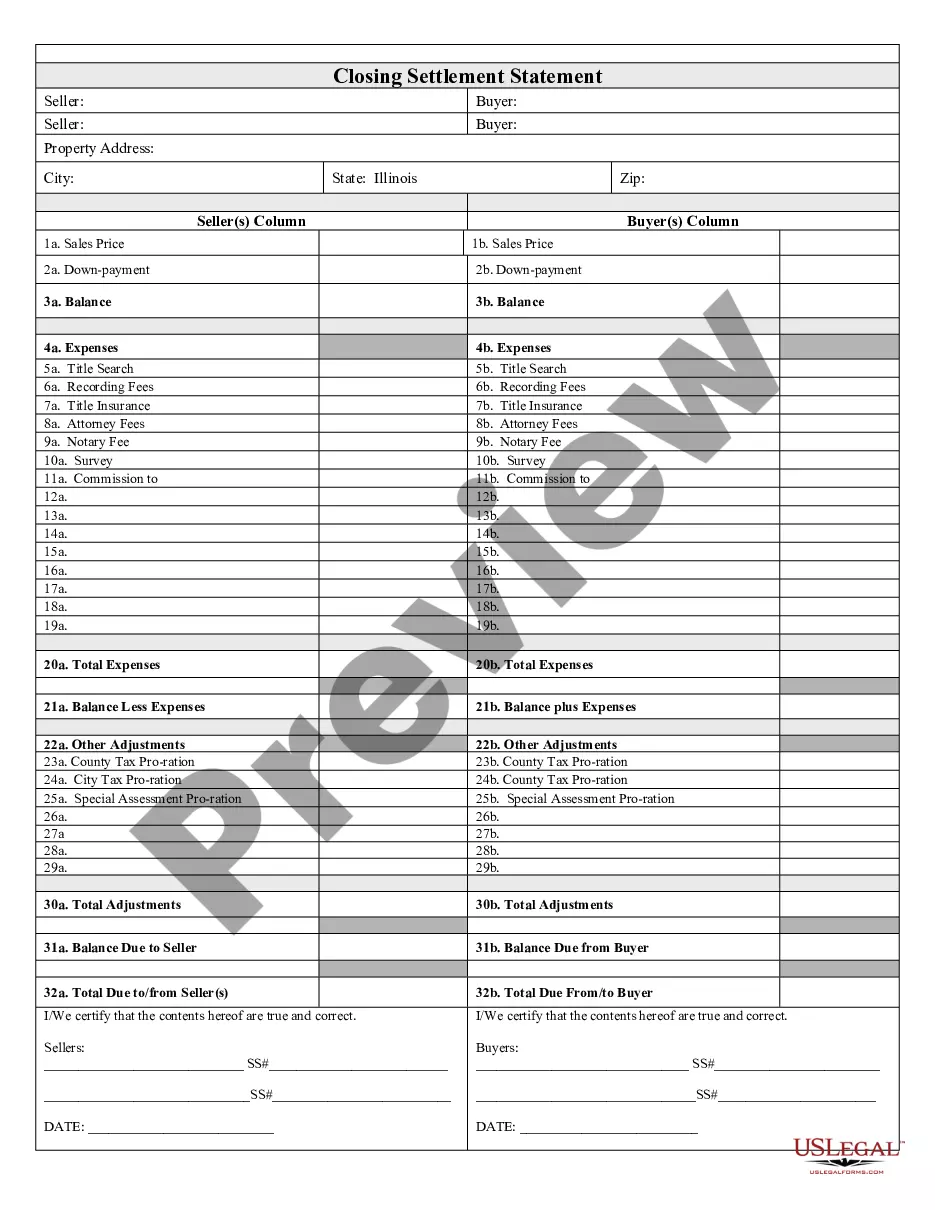

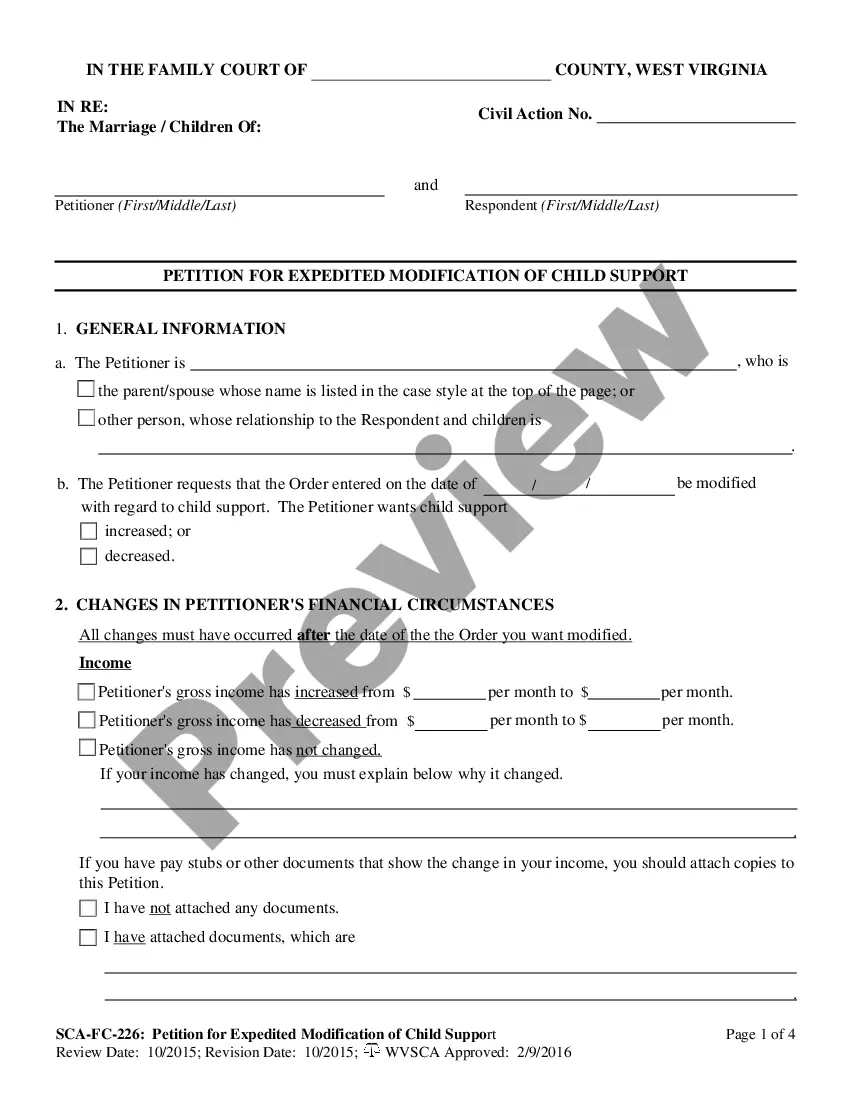

- Step 1. Ensure you have chosen the shape for your proper town/nation.

- Step 2. Take advantage of the Review option to check out the form`s information. Never forget about to read through the outline.

- Step 3. If you are unhappy with all the type, utilize the Look for discipline at the top of the screen to discover other models of the lawful type web template.

- Step 4. After you have identified the shape you want, click the Get now switch. Select the pricing program you favor and include your qualifications to register for an bank account.

- Step 5. Method the deal. You can use your credit card or PayPal bank account to finish the deal.

- Step 6. Pick the formatting of the lawful type and download it on the system.

- Step 7. Comprehensive, edit and print or sign the Indiana Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor.

Every single lawful file web template you purchase is your own forever. You may have acces to every single type you saved with your acccount. Click on the My Forms portion and select a type to print or download once more.

Remain competitive and download, and print the Indiana Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor with US Legal Forms. There are many skilled and state-distinct types you can utilize for your personal business or personal requires.