Indiana Balance Sheet Notes Payable refers to a financial statement item that represents the amount of debt owed by a company in the state of Indiana. Notes payable are typically long-term debts that a company incurs to finance its operations, investments, or acquisitions. These obligations are documented through promissory notes or other written agreements, which outline the terms and conditions of the debt, including repayment terms, interest rates, and relevant collateral. In Indiana, businesses can utilize different types of notes payable to meet their financing needs. These may include: 1. Term Loans: Term loans are a common type of notes payable where a company borrows a fixed amount of money from a lender and agrees to repay it over a predetermined period. These loans can be used for various purposes such as purchasing equipment, expanding facilities, or funding long-term projects. 2. Bonds Payable: Bonds payable are a form of long-term debt issued by companies to raise capital from investors. Companies in Indiana might issue corporate bonds to finance large-scale projects, acquisitions, or other business activities. These bonds have a specified interest rate and maturity date, with interest payments typically made semi-annually or annually. 3. Mortgage Notes Payable: Mortgage notes payable are used when a company borrows money to purchase real estate or other property in Indiana. A mortgage note outlines the terms of the loan, including the principal amount, interest rate, and repayment schedule. The property itself often serves as collateral for the loan. 4. Convertible Notes Payable: Convertible notes payable are a unique type of debt that can be converted into equity (common stock) at a later date. This form of financing is commonly used by startups and early-stage businesses seeking initial funding. If certain conditions are met, the notes can be converted into shares of the company's stock at a predetermined conversion price. 5. Installment Notes Payable: Installment notes payable involve repaying the borrowed amount in multiple installments over a specified period. Each installment includes a portion of the principal and interest. This type of notes payable is commonly used for smaller loans or when the repayment capacity of the borrower is limited. Having accurate information about the amount and types of notes payable on an Indiana balance sheet is crucial for various stakeholders, including potential investors, lenders, and company management. Analyzing this information helps assess the financial health of a company, its ability to manage its debts, and the potential risks associated with the notes payable. It allows investors and creditors to make informed decisions regarding whether to provide additional funding, extend credit, or invest in the company's securities.

Indiana Balance Sheet Notes Payable

Description

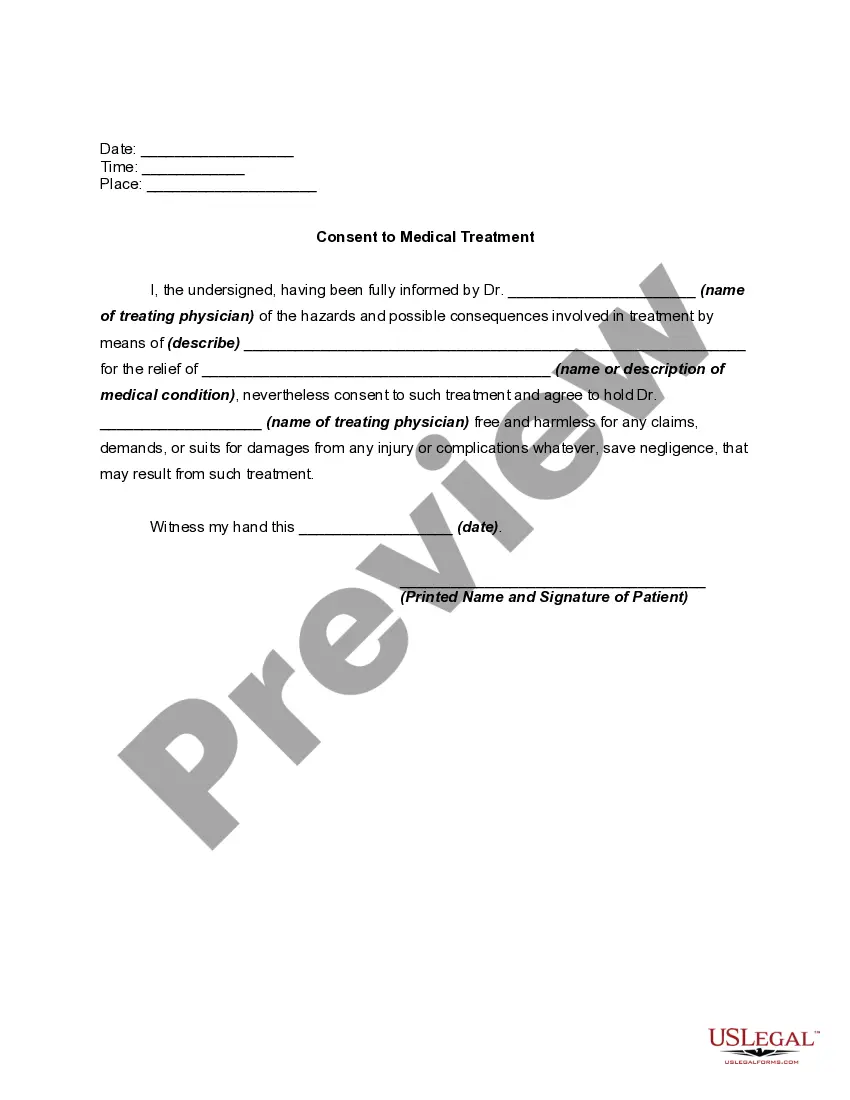

How to fill out Indiana Balance Sheet Notes Payable?

You can devote hours on-line looking for the legal papers format that meets the state and federal requirements you require. US Legal Forms offers a large number of legal varieties which can be examined by pros. You can easily acquire or print out the Indiana Balance Sheet Notes Payable from your services.

If you currently have a US Legal Forms bank account, you may log in and click the Down load option. Following that, you may full, edit, print out, or indicator the Indiana Balance Sheet Notes Payable. Every single legal papers format you purchase is your own forever. To have an additional copy of the obtained kind, check out the My Forms tab and click the related option.

If you use the US Legal Forms site initially, follow the straightforward directions listed below:

- Initially, make sure that you have selected the right papers format for your state/metropolis of your liking. Look at the kind explanation to make sure you have picked the proper kind. If offered, make use of the Preview option to check with the papers format at the same time.

- In order to discover an additional model of your kind, make use of the Lookup area to get the format that meets your requirements and requirements.

- When you have discovered the format you need, just click Get now to move forward.

- Find the pricing prepare you need, enter your accreditations, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your credit card or PayPal bank account to cover the legal kind.

- Find the file format of your papers and acquire it for your system.

- Make modifications for your papers if necessary. You can full, edit and indicator and print out Indiana Balance Sheet Notes Payable.

Down load and print out a large number of papers layouts utilizing the US Legal Forms site, which offers the greatest variety of legal varieties. Use professional and condition-particular layouts to deal with your company or specific requires.

Form popularity

FAQ

A company's balance sheet provides a tremendous amount of insight into its solvency and business dealings. 1 A balance sheet consists of three primary sections: assets, liabilities, and equity.

Contents of the balance sheetfixed assets - long-term possessions.current assets - short-term possessions.current liabilities - what the business owes and must repay in the short term.long-term liabilities - including owner's or shareholders' capital.

Notes to the financial statements disclose the detailed assumptions made by accountants when preparing a company's: income statement, balance sheet, statement of changes of financial position or statement of retained earnings. The notes are essential to fully understanding these documents.

A note payable is classified in the balance sheet as a short-term liability if it is due within the next 12 months, or as a long-term liability if it is due at a later date. When a long-term note payable has a short-term component, the amount due within the next 12 months is separately stated as a short-term liability.

How to make a balance sheetStep 1: Pick the balance sheet date.Step 2: List all of your assets.Step 3: Add up all of your assets.Step 4: Determine current liabilities.Step 5: Calculate long-term liabilities.Step 6: Add up liabilities.Step 7: Calculate owner's equity.Step 8: Add up liabilities and owners' equity.10-Dec-2020

Notes to the accounts detail and comment on the information presented in the Balance sheet, Income statement, and Cash flow statement. Notes to the accounts reflect the accounting principles and the facts that can have a significant impact on the judgment of the reader of accounting information.

Notes payable are classified as current liabilities when the amounts are due within one year of the balance sheet date.

Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as income taxes owed.

Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a company. Examples of current liabilities include accounts payables, short-term debt, accrued expenses, and dividends payable.

The following are the common items that appear in the notes to the financial statements:Basis of presentation.Accounting policies.Depreciation of assets.Valuation of inventory.Subsequent events.Intangible assets.Consolidation of financial statements.Employee benefits.More items...