Indiana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance The Indiana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is a legally binding contract between an employer and an employee in the state of Indiana. This agreement outlines the terms and conditions of the employee's nonqualified retirement plan, which is funded through life insurance. This type of retirement plan is designed to provide financial security to employees during their retirement years, offering them additional benefits beyond traditional qualified retirement plans like a 401(k) or pension. By funding the plan with life insurance, the employer ensures that the employee's beneficiaries receive a death benefit in case of the employee's untimely demise. Keywords: Indiana, employment agreement, nonqualified retirement plan, life insurance, financial security, retirement years, qualified retirement plans, 401(k), pension, death benefit, beneficiaries. There are different types of Indiana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance. Some of them include: 1. Defined Contribution Plan: In this type of agreement, the employer agrees to contribute a specific amount or percentage of the employee's salary towards the nonqualified retirement plan. The ultimate retirement benefit is determined by the contributions made and the investment performance of the plan. 2. Supplemental Executive Retirement Plan (SERP): This type of agreement is specifically designed for highly compensated employees or executives. It provides an additional retirement benefit beyond what is offered in regular retirement plans. The funding is typically done through life insurance policies. 3. Deferred Compensation Plan: This agreement allows employees to defer a portion of their salary or bonuses to be paid out at a later date, usually during retirement. The deferred amount is invested and grows tax-deferred until it is distributed. Life insurance is used to fund the plan, providing a death benefit to the employee's beneficiaries. 4. Split Dollar Insurance Plan: This type of agreement combines elements of life insurance and a nonqualified retirement plan. The employer and employee share the premium payments and death benefit of a life insurance policy, while the cash value of the policy is used to fund the retirement plan. This arrangement allows the employee to build cash value and secure a retirement benefit while providing life insurance protection. Keywords: Defined contribution plan, supplemental executive retirement plan, SERP, deferred compensation plan, split dollar insurance plan, retirement benefit, highly compensated employees, deferred salary, tax-deferred, cash value, premium payments. In conclusion, the Indiana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is a comprehensive contract that outlines the terms and conditions of an employee's retirement plan. It offers additional financial security during retirement years and utilizes life insurance policy as a funding mechanism.

Indiana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

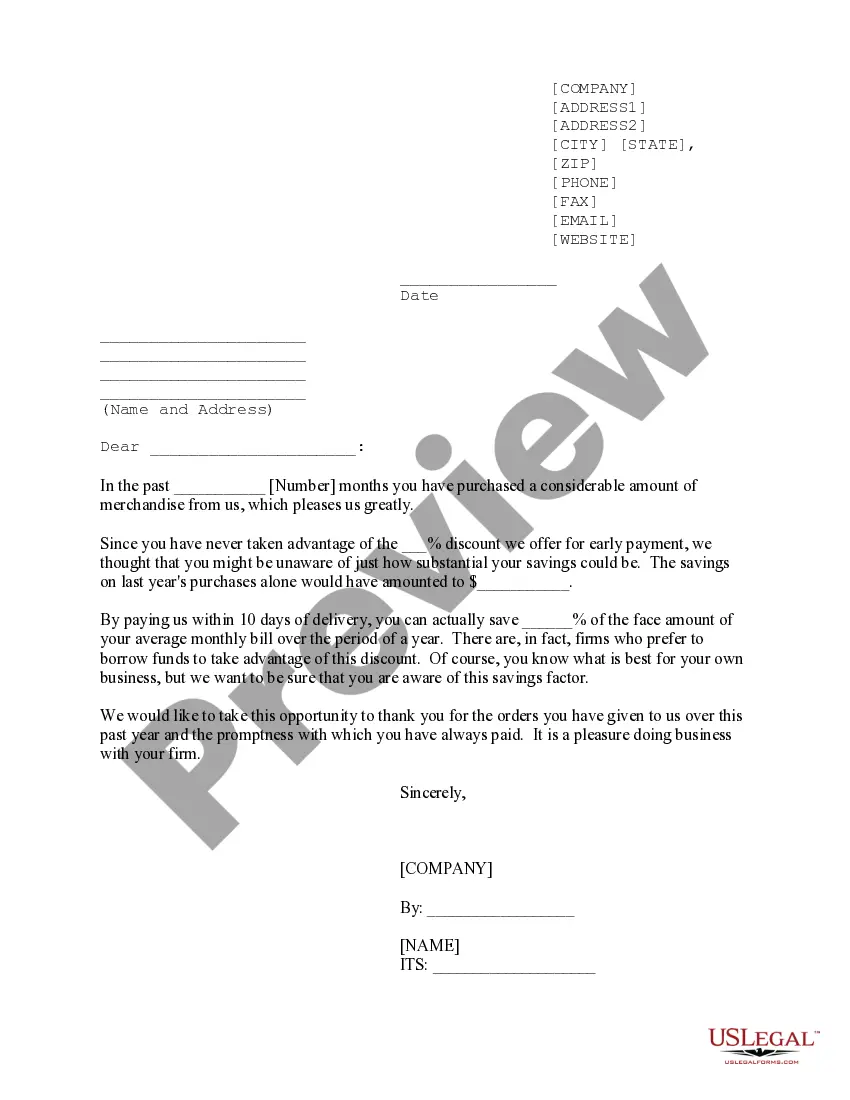

How to fill out Indiana Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

US Legal Forms - one of many most significant libraries of legal types in the States - offers an array of legal file themes it is possible to acquire or produce. Utilizing the web site, you can find thousands of types for company and specific purposes, sorted by groups, states, or search phrases.You will discover the newest models of types much like the Indiana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance within minutes.

If you currently have a subscription, log in and acquire Indiana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance from your US Legal Forms catalogue. The Download switch will appear on each and every form you look at. You have accessibility to all formerly acquired types from the My Forms tab of your respective profile.

If you want to use US Legal Forms initially, listed below are easy directions to obtain began:

- Ensure you have selected the best form for your personal town/county. Go through the Preview switch to examine the form`s content. Browse the form outline to ensure that you have chosen the right form.

- When the form doesn`t match your specifications, take advantage of the Look for discipline towards the top of the display screen to find the the one that does.

- In case you are satisfied with the shape, confirm your option by clicking on the Purchase now switch. Then, select the rates strategy you favor and give your qualifications to register for an profile.

- Approach the deal. Make use of your bank card or PayPal profile to finish the deal.

- Select the formatting and acquire the shape in your device.

- Make adjustments. Complete, edit and produce and sign the acquired Indiana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance.

Each and every web template you added to your account does not have an expiration particular date and is also your own forever. So, if you want to acquire or produce one more duplicate, just go to the My Forms segment and then click around the form you want.

Get access to the Indiana Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance with US Legal Forms, the most extensive catalogue of legal file themes. Use thousands of skilled and express-particular themes that satisfy your organization or specific requires and specifications.