Indiana Cash Disbursements and Receipts refer to the monetary transactions involving the state of Indiana's government agencies, organizations, and departments. These transactions involve the disbursement of funds from authorized sources and the receipt of funds through various channels. The Indiana Cash Disbursements and Receipts system aim to ensure transparent and efficient financial management within the state. In Indiana, there are various types of cash disbursements and receipts carried out by the government entities. These include: 1. Vendor Payments: Indiana Cash Disbursements involve the payment made to vendors/suppliers who provide goods and services to the state. This includes payments for contracts, services, utilities, supplies, and other necessary payments. 2. Payroll Disbursements: Cash disbursements also encompass salary and wage payments to government employees working in different departments and agencies. The payroll disbursements ensure that employees receive their compensation accurately and timely. 3. Benefits and Grant Payments: Indiana Cash Disbursements include disbursing benefits and grants to eligible recipients, such as social welfare payments, healthcare benefits, educational scholarships, and research grants. These aim to support the citizens and advance various sectors of the state. 4. Tax Refunds: The state of Indiana refunds excess taxes collected from individuals and businesses. The disbursement of tax refunds is an important aspect of the Cash Disbursements system, ensuring taxpayers receive appropriate refunds promptly. 5. Real Estate and Property Disbursements: Cash disbursements are also made for purchasing or selling properties, maintaining and repairing state-owned real estate, and other property-related expenditures. These disbursements require careful financial management and accountability. On the other hand, Indiana Cash Receipts involve the inflow of funds into the state's coffers. This includes: 1. Tax Revenue: Indiana Cash Receipts majorly come from various forms of taxes, including income tax, sales tax, property tax, and corporate tax. These revenues contribute to the functioning and development of the state. 2. Federal Funds: Indiana receives funds from the federal government for specific programs, initiatives, grants, and projects. Cash receipts from federal funds support various sectors such as education, healthcare, infrastructure, and social welfare. 3. License and Permit Fees: Indiana Cash Receipts also include fees collected for licenses, permits, registrations, and certifications. These fees are imposed for activities like operating a business, professional licensing, and permitting for specific events or activities. 4. Fines and Penalties: The state collects fines and penalties from individuals or businesses for violations of laws, regulations, and traffic offenses. Cash receipts from fines and penalties contribute to law enforcement and statutory enforcement programs. 5. Lottery and Gaming Revenue: Indiana generates revenue from state-operated lotteries and regulated gaming activities such as casinos and racetracks. These funds contribute to education, public safety, and other designated purposes. Overall, the Indiana Cash Disbursements and Receipts system ensures transparency, accountability, and effective financial management. By accurately tracking and managing the flow of funds, the state can provide necessary services, support economic growth, and fulfill its obligations to its residents and taxpayers.

Indiana Cash Disbursements and Receipts

Description

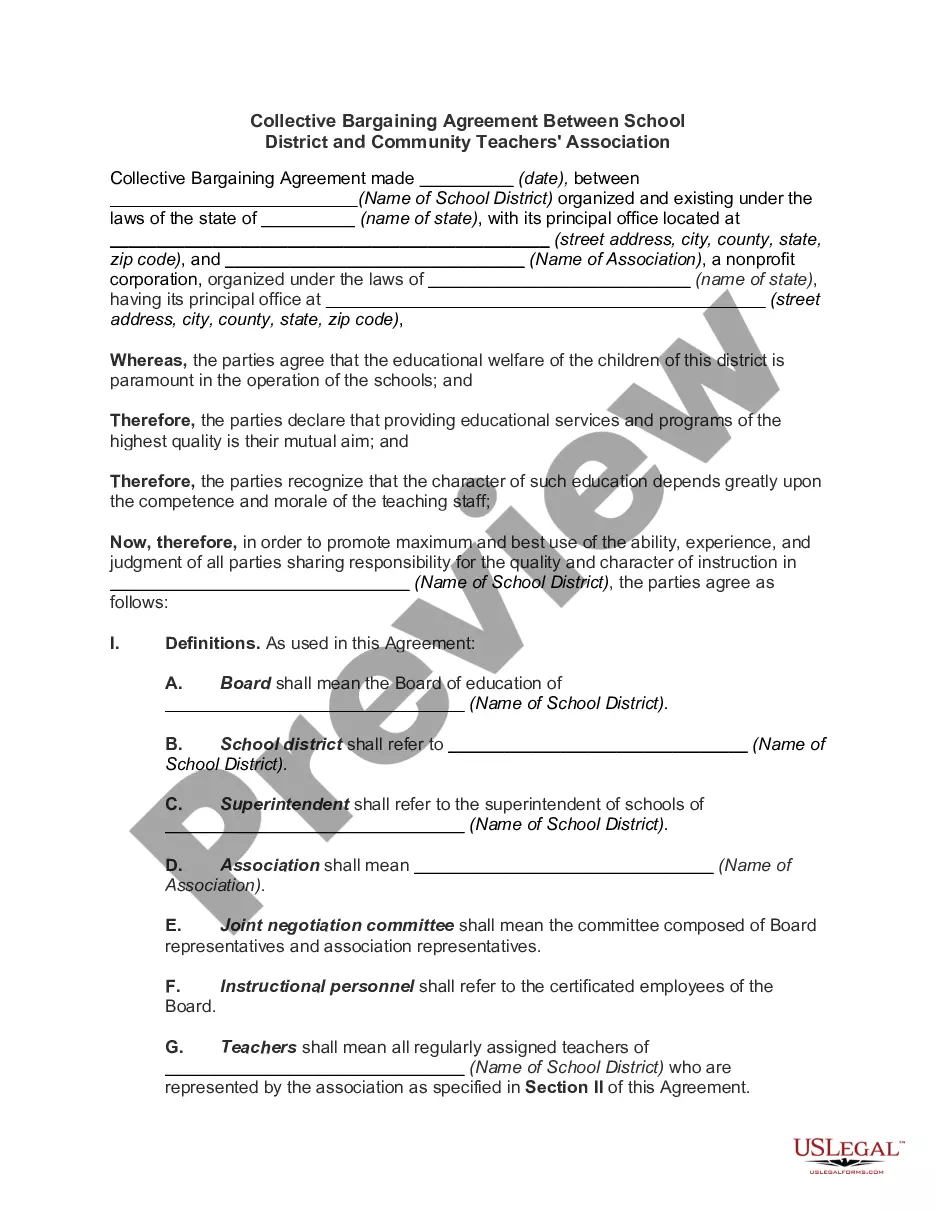

How to fill out Indiana Cash Disbursements And Receipts?

You may commit hrs on-line searching for the lawful record web template that suits the state and federal specifications you require. US Legal Forms supplies a huge number of lawful kinds that are analyzed by professionals. It is simple to acquire or produce the Indiana Cash Disbursements and Receipts from your support.

If you have a US Legal Forms accounts, it is possible to log in and then click the Download key. After that, it is possible to complete, edit, produce, or indication the Indiana Cash Disbursements and Receipts. Every lawful record web template you purchase is your own for a long time. To obtain yet another copy of the acquired develop, visit the My Forms tab and then click the related key.

If you use the US Legal Forms site the first time, stick to the straightforward instructions under:

- Initially, be sure that you have selected the proper record web template for that state/metropolis of your choice. See the develop outline to ensure you have picked the appropriate develop. If available, utilize the Review key to look with the record web template at the same time.

- If you want to get yet another variation in the develop, utilize the Look for industry to get the web template that fits your needs and specifications.

- Upon having identified the web template you desire, click Purchase now to proceed.

- Find the rates program you desire, key in your qualifications, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You can use your bank card or PayPal accounts to pay for the lawful develop.

- Find the formatting in the record and acquire it to your system.

- Make alterations to your record if possible. You may complete, edit and indication and produce Indiana Cash Disbursements and Receipts.

Download and produce a huge number of record web templates utilizing the US Legal Forms web site, that provides the biggest variety of lawful kinds. Use skilled and status-certain web templates to deal with your business or specific demands.