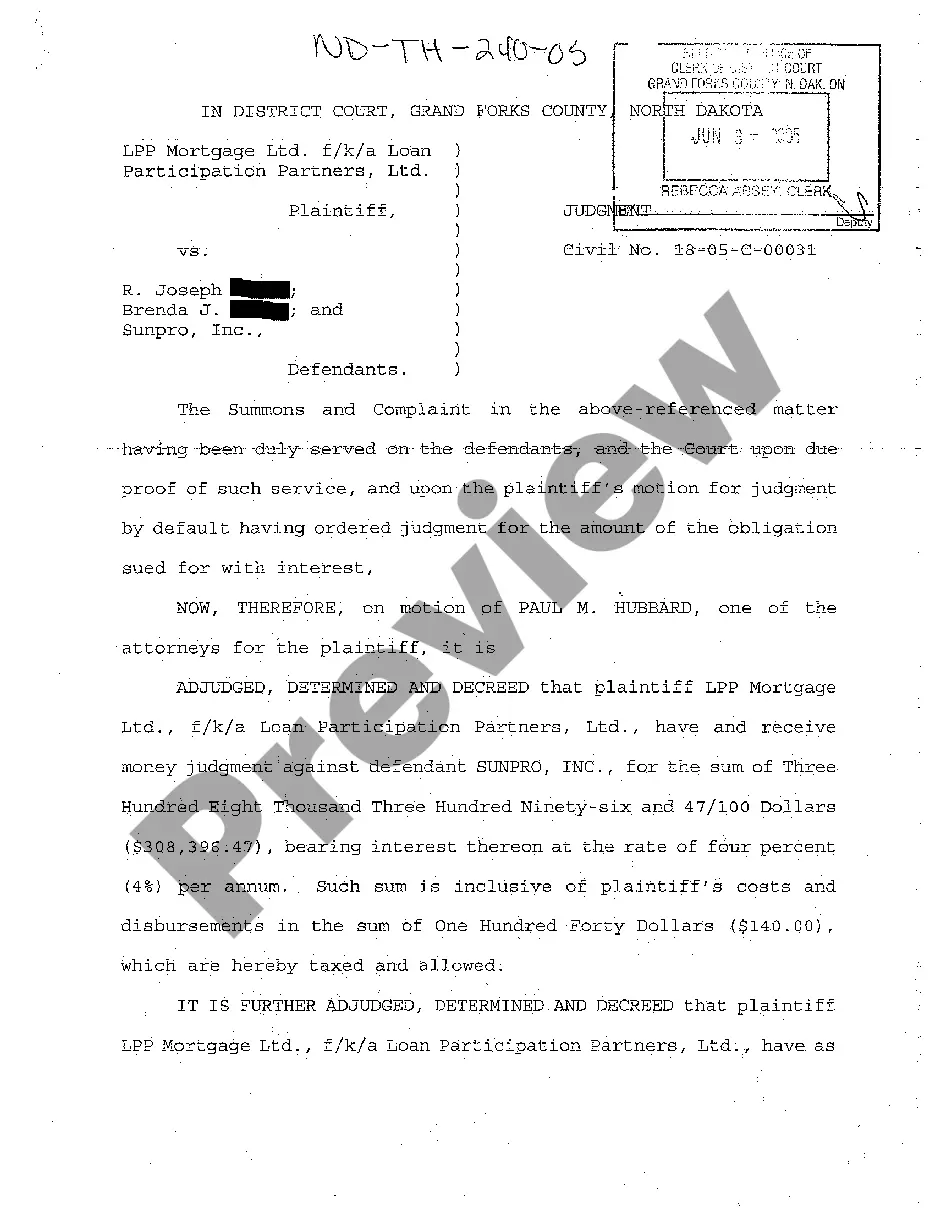

The Indiana Software License Agreement Involving Third-Party is a legal document that outlines the terms and conditions between a software provider and a user or licensee in the state of Indiana. This agreement is specifically designed to address the involvement of a third party in the software usage or licensing process. One important type of Indiana Software License Agreement Involving Third-Party is the End-User License Agreement (EULA). This agreement is typically presented to the end-users of the software and outlines the rights and restrictions related to the software usage. It also covers the involvement of any third-party software or components embedded within the licensed software. Another type of Indiana Software License Agreement Involving Third-Party is the Reseller Agreement. This agreement is often used when a software provider sells their software through a third-party reseller. It sets out the terms for the reseller to distribute, market, and sell the software, and also addresses any obligations or responsibilities related to the third party's involvement. The Indiana Software License Agreement Involving Third-Party usually includes various key elements. Firstly, it defines the software being licensed and identifies the parties involved. It also outlines the scope of the license, specifying the permitted uses, any restrictions, and the duration of the license. Furthermore, the agreement discusses the involvement of third-party software or components. It clarifies the ownership and intellectual property rights associated with these third-party elements and any limitations on their use. This section may also address the support and maintenance responsibilities for the third-party software. Additionally, the agreement covers considerations such as payment terms, warranties, and liability limitations. It may include provisions regarding confidentiality, prohibiting the disclosure of proprietary information to third parties. Indemnification clauses may be present to allocate responsibility in the event of legal claims arising from software usage. The Indiana Software License Agreement Involving Third-Party is crucial for protecting the rights and interests of both the software provider and the licensee. It ensures that all parties understand their respective obligations, restrictions, and liabilities, and promotes a transparent and mutually beneficial software licensing relationship.

Indiana Software License Agreement Involving Third-Party

Description

How to fill out Indiana Software License Agreement Involving Third-Party?

Have you been within a situation in which you need papers for either enterprise or personal purposes nearly every day? There are plenty of authorized document layouts available on the net, but finding ones you can trust isn`t effortless. US Legal Forms delivers thousands of type layouts, such as the Indiana Software License Agreement Involving Third-Party, that are composed to fulfill state and federal demands.

If you are currently knowledgeable about US Legal Forms internet site and also have a free account, just log in. After that, you are able to download the Indiana Software License Agreement Involving Third-Party format.

If you do not have an bank account and would like to start using US Legal Forms, follow these steps:

- Find the type you will need and make sure it is to the correct city/area.

- Take advantage of the Preview switch to analyze the form.

- Browse the information to actually have chosen the correct type.

- In the event the type isn`t what you`re seeking, utilize the Search field to find the type that suits you and demands.

- Once you find the correct type, click Get now.

- Select the pricing prepare you want, complete the desired information and facts to create your account, and pay for an order using your PayPal or bank card.

- Pick a hassle-free file formatting and download your copy.

Discover each of the document layouts you have purchased in the My Forms food selection. You can obtain a extra copy of Indiana Software License Agreement Involving Third-Party at any time, if needed. Just select the required type to download or print out the document format.

Use US Legal Forms, the most substantial selection of authorized varieties, to conserve time as well as stay away from mistakes. The services delivers professionally produced authorized document layouts which you can use for a selection of purposes. Produce a free account on US Legal Forms and initiate producing your lifestyle a little easier.

Form popularity

FAQ

Making good on his State of the State promise to provide clarity on the previously murky topic of software-as-a-service (SaaS) and its sales tax status, today Governor Holcomb signed Senate Bill 257 into law.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

Goods that are subject to sales tax in Indiana include physical property, like furniture, home appliances, and motor vehicles. The purchase of groceries and prescription medicine are tax-exempt.

Sales of custom software - delivered on tangible media are exempt from the sales tax in Indiana. Sales of custom software - downloaded are exempt from the sales tax in Indiana.

In general, the storage, use, or consumption of tangible personal property in Indiana is subject to use tax if the property was acquired in a retail transaction, regardless of where the transaction took Page 6 Sales Tax Information Bulletin #60 Page 6 place, and where Indiana sales tax had not been paid on that

What goods are exempt from sales and use tax?equipment directly used or consumed in the direct production of tangible personal property, as well as for property incorporated into goods for sale;property predominantly used in providing public transportation;certain medical equipment, drugs and devices;groceries;More items...?

Tax Exempt ItemsFood for human consumption.Manufacturing machinery.Raw materials for manufacturing.Utilities and fuel used in manufacturing.Medical devices and services.

In most states, where services aren't taxable, SaaS also isn't taxable. Other states, like Washington, consider SaaS to be an example of tangible software and thus taxable. Just like with anything tax related, each state has made their own rules and laws.

Purchases of tangible personal property, accommodations, or utilities made directly by the United States government, its agencies, and instrumentalities are exempt from Indiana sales tax. Sales by these same entities are also exempt from sales tax.