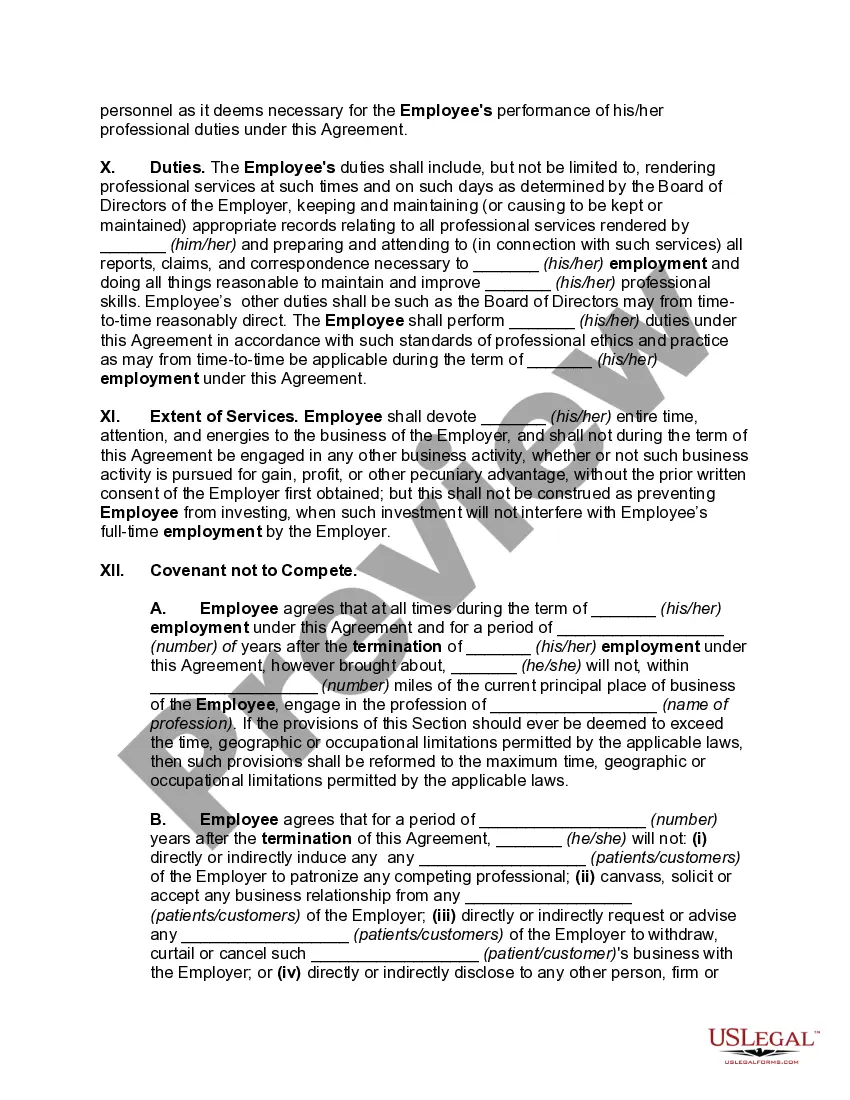

The Indiana General Form of Employment Agreement for Professional Corporation is a legal document that outlines the terms and conditions of employment between a professional corporation and its employee in the state of Indiana. This agreement is specifically designed for professional corporations, which are formed by licensed professionals such as doctors, lawyers, accountants, architects, or engineers, to provide their specialized services. The primary purpose of the Indiana General Form of Employment Agreement for Professional Corporation is to define the rights and responsibilities of both the professional employee and the professional corporation. It covers various crucial aspects, such as job duties, compensation, working hours, benefits, and termination procedures. By having a well-drafted employment agreement, both the employee and the corporation can explicitly understand their obligations, protecting their rights and mitigating potential disputes. Certain keywords are relevant when discussing the Indiana General Form of Employment Agreement for Professional Corporation. These keywords include: 1. Professional Corporation: A business entity formed by licensed professionals to provide their services while benefiting from certain legal advantages. 2. Employee: The individual who enters into an agreement with the professional corporation to provide specialized services. 3. Employer: The professional corporation that hires the employee and provides an agreed-upon salary or compensation. 4. Job Duties: A detailed description of the tasks and responsibilities the employee is expected to perform within the professional corporation. 5. Compensation: The agreed-upon salary or payment system the professional corporation provides to the employee for their services. 6. Working Hours: The specified hours or schedule the employee is expected to work within the professional corporation. 7. Benefits: The additional perks or benefits, such as health insurance, vacation days, or retirement plans, provided by the professional corporation to the employee. 8. Termination: The procedures and conditions that dictate the end of the employment relationship, whether initiated by the employee or the professional corporation. It's important to note that while the Indiana General Form of Employment Agreement for Professional Corporation serves as a general template, different types of professional corporations may require specific modifications or additional provisions based on the nature of their services, statutory requirements, or unique circumstances. Examples may include agreements tailored for medical professional corporations, legal professional corporations, or accounting professional corporations. In conclusion, the Indiana General Form of Employment Agreement for Professional Corporation is a comprehensive legal document that outlines the rights and responsibilities of employees and professional corporations in the state of Indiana. It covers various essential aspects of employment, ensuring clarity and protection for both parties involved in the professional relationship.

Indiana General Form of Employment Agreement for Professional Corporation

Description

How to fill out Indiana General Form Of Employment Agreement For Professional Corporation?

If you need to full, obtain, or print out authorized file layouts, use US Legal Forms, the biggest variety of authorized kinds, which can be found on the Internet. Utilize the site`s basic and practical look for to obtain the papers you will need. A variety of layouts for business and individual purposes are sorted by types and claims, or keywords and phrases. Use US Legal Forms to obtain the Indiana General Form of Employment Agreement for Professional Corporation in just a couple of click throughs.

Should you be already a US Legal Forms customer, log in to your account and click on the Obtain option to obtain the Indiana General Form of Employment Agreement for Professional Corporation. You can also gain access to kinds you previously downloaded within the My Forms tab of your respective account.

If you are using US Legal Forms for the first time, refer to the instructions under:

- Step 1. Make sure you have chosen the shape for your correct area/land.

- Step 2. Make use of the Preview choice to look through the form`s articles. Do not forget about to read the description.

- Step 3. Should you be not happy with all the develop, use the Lookup industry towards the top of the monitor to find other models of the authorized develop design.

- Step 4. Upon having found the shape you will need, click on the Purchase now option. Choose the costs strategy you favor and add your references to sign up for an account.

- Step 5. Method the financial transaction. You should use your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Find the file format of the authorized develop and obtain it on your product.

- Step 7. Total, revise and print out or signal the Indiana General Form of Employment Agreement for Professional Corporation.

Each and every authorized file design you buy is your own property eternally. You may have acces to every single develop you downloaded inside your acccount. Click the My Forms portion and decide on a develop to print out or obtain once again.

Be competitive and obtain, and print out the Indiana General Form of Employment Agreement for Professional Corporation with US Legal Forms. There are thousands of skilled and state-certain kinds you can utilize for your business or individual demands.