An Indiana Equipment Lease Agreement with an Independent Sales Organization (ISO) with Option to Purchase is a legally binding contract that outlines the terms and conditions under which equipment is leased by an ISO from a leasing company in the state of Indiana. This type of agreement allows the ISO to use the leased equipment for a defined period, with the option to buy it at the end of the lease term. The primary purpose of an Indiana Equipment Lease Agreement with an ISO is to provide businesses with access to essential equipment without the need for substantial upfront investments. This arrangement offers flexibility and cost-effectiveness by allowing companies to utilize the equipment they need to operate or expand their businesses without a significant financial burden. Under this agreement, the leasing company retains ownership of the equipment throughout the lease term, while the ISO is granted the right to use it. The lease term can vary depending on the specific needs of the ISO, typically ranging from a few months to several years. During this period, the ISO pays regular lease payments to the leasing company, which may include interest charges and other fees based on the agreed terms. The option to purchase is a key aspect of this agreement, providing the ISO with the opportunity to acquire the equipment at the end of the lease term. The purchase option is typically exercised by paying a predetermined price agreed upon in the lease agreement. This allows the ISO to have temporary access to the equipment and evaluate its suitability before committing to the long-term ownership. As for the different types of Indiana Equipment Lease Agreement with an Independent Sales Organization with Option to Purchase, they can vary based on the type of equipment being leased and the specific terms negotiated between the leasing company and the ISO. Some common types of equipment that are often leased include machinery, vehicles, technology equipment, medical devices, and office equipment. It is crucial for both the leasing company and the ISO to clearly define the terms, responsibilities, and obligations in the agreement. Key elements typically included are equipment specifications, lease duration, lease payment amounts and frequency, option price, maintenance and repair responsibilities, insurance requirements, and dispute resolution mechanisms. In conclusion, an Indiana Equipment Lease Agreement with an Independent Sales Organization with Option to Purchase is a valuable arrangement that allows businesses to access necessary equipment without substantial upfront costs. It provides flexibility, cost-effectiveness, and the opportunity to evaluate equipment before committing to ownership. Different types of equipment can be leased under this agreement, and it is essential for both parties to negotiate and define the terms carefully to ensure a mutually beneficial relationship.

Indiana Equipment Lease Agreement with an Independent Sales Organization with Option to Purchase

Description

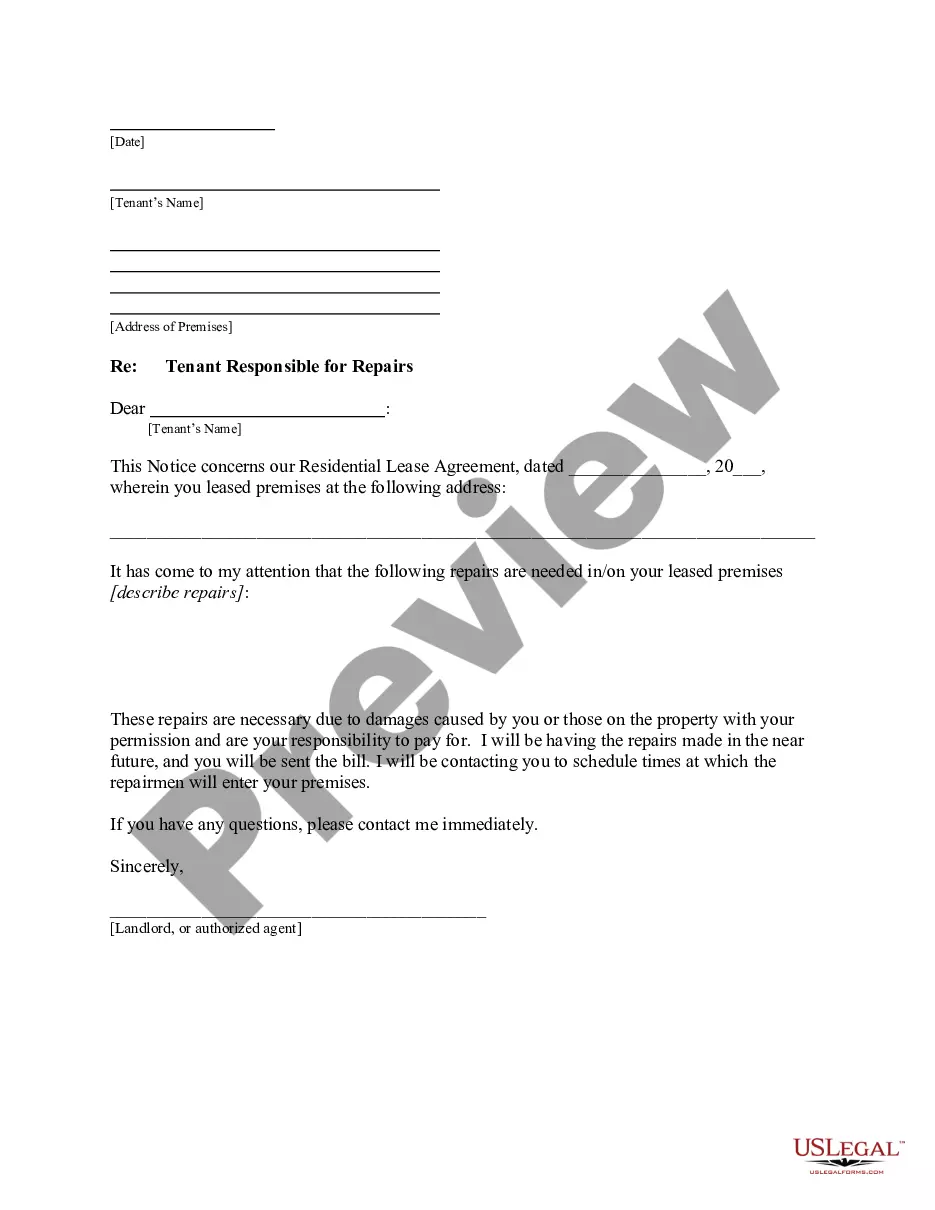

How to fill out Indiana Equipment Lease Agreement With An Independent Sales Organization With Option To Purchase?

Are you currently inside a position where you need files for sometimes enterprise or person purposes just about every day time? There are plenty of authorized papers web templates available online, but discovering ones you can rely on isn`t effortless. US Legal Forms offers thousands of form web templates, much like the Indiana Equipment Lease Agreement with an Independent Sales Organization with Option to Purchase, that are composed to satisfy federal and state requirements.

When you are already familiar with US Legal Forms web site and have a merchant account, just log in. Next, you are able to obtain the Indiana Equipment Lease Agreement with an Independent Sales Organization with Option to Purchase format.

Should you not provide an accounts and want to begin to use US Legal Forms, follow these steps:

- Find the form you want and make sure it is for that right town/region.

- Make use of the Review switch to analyze the shape.

- Browse the outline to ensure that you have selected the correct form.

- If the form isn`t what you`re looking for, make use of the Look for area to find the form that meets your requirements and requirements.

- When you get the right form, click Buy now.

- Pick the prices plan you want, complete the specified info to make your money, and pay money for an order utilizing your PayPal or charge card.

- Select a handy document formatting and obtain your version.

Find all of the papers web templates you possess bought in the My Forms food selection. You can get a more version of Indiana Equipment Lease Agreement with an Independent Sales Organization with Option to Purchase whenever, if necessary. Just click the needed form to obtain or produce the papers format.

Use US Legal Forms, one of the most substantial variety of authorized forms, to save lots of some time and stay away from errors. The services offers professionally manufactured authorized papers web templates that can be used for an array of purposes. Create a merchant account on US Legal Forms and start producing your life a little easier.

Form popularity

FAQ

Provides an income tax break, because you can deduct your leasing costs as a business expense. Offers an easier way to get the equipment you need if your company's credit is iffy. Eliminates the hassle and cost of trashing outdated and sometimes environmentally harmful equipment.

Provides an income tax break, because you can deduct your leasing costs as a business expense. Offers an easier way to get the equipment you need if your company's credit is iffy. Eliminates the hassle and cost of trashing outdated and sometimes environmentally harmful equipment.

Leases require little or no down payment, and there are no upfront sales tax charges. Additionally, monthly payments are usually lower, and you get the pleasure of owning a new car every few years.

How to Record "Lease to Own" Computer assetCreate Other Current Liability account for the loan/lease payable.Create Fixed Asset account for Computer Equipment.You must use a General Journal Entry, as taxes cannot be entered from the register.

Lease liability recording it Once we have gathered our information, i.e., we know the lease term, the lease payment and the discount rate, we simply discount the liability over the lease term, using the discount rate. We then record the lease liability, or the resulting amount, on the balance sheet.

Equipment LeaseGo to the Lists menu, then choose Chart of Accounts.From the Account 25bcdropdown, click New.Select an account type, then select Continue.Complete the account details.Once done, click Save & Close.

Accounting: Lease is considered an asset (leased asset) and liability (lease payments). Payments are shown on the balance sheet. Tax: As the owner, the lessee claims depreciation expense and interest expense.

Key takeaway: With an operating lease, you have access to the equipment for a time but don't own it. The lease period tends to be shorter than the life of the equipment. With a finance lease, you own the equipment at the end of the term. Big companies typically use this type of lease.

A $1 Buyout Lease, also called a capital lease, is similar to purchasing equipment with a loan. With this type of lease, there is a higher monthly payment compared with an FMV lease, but at the end of the lease term, the lessee purchases the equipment for $1.

Typically, these leases were recorded on the asset side of the balance sheet under Property, Plant and Equipment (PP&E) while the lease liabilities were recorded in Debt or Other Liabilities.