Indiana Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

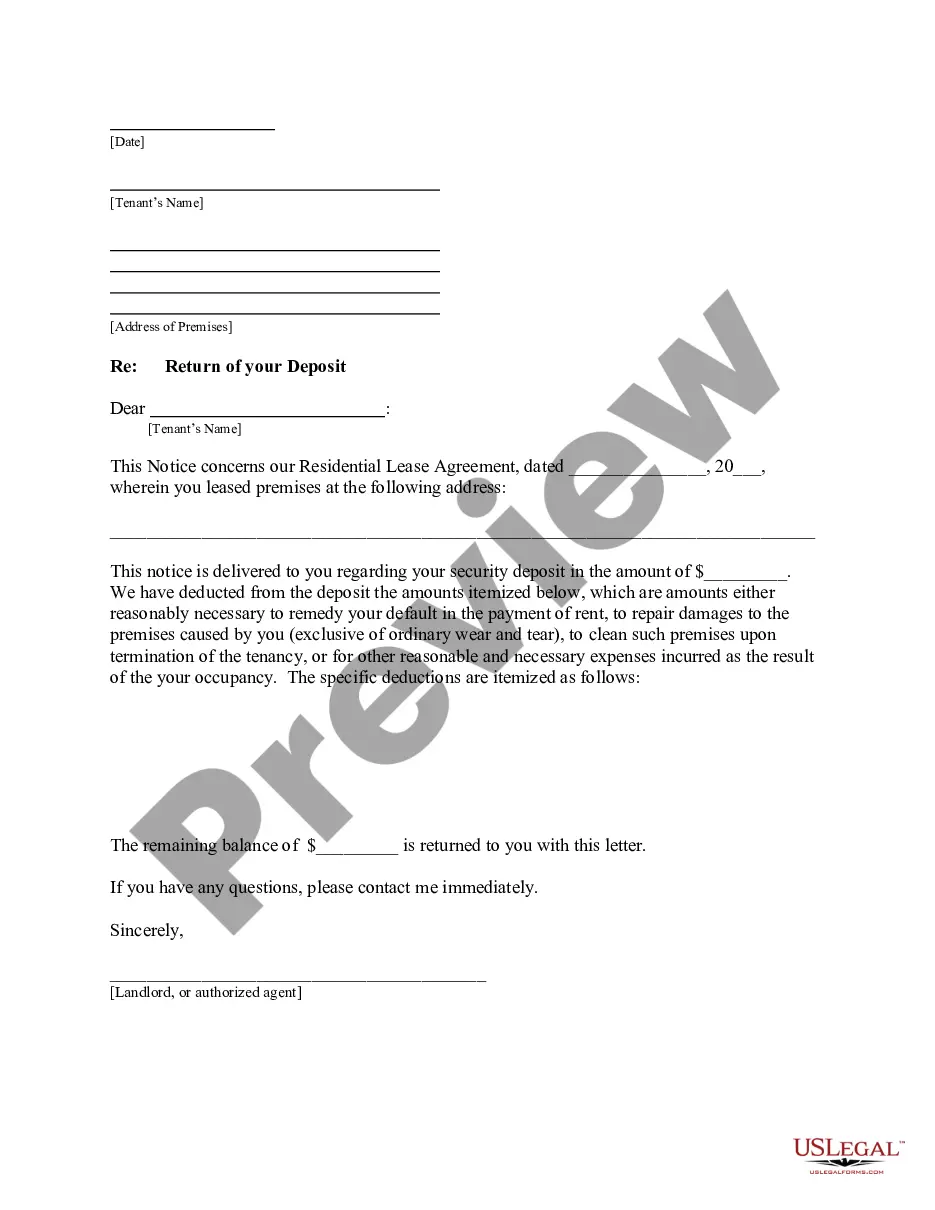

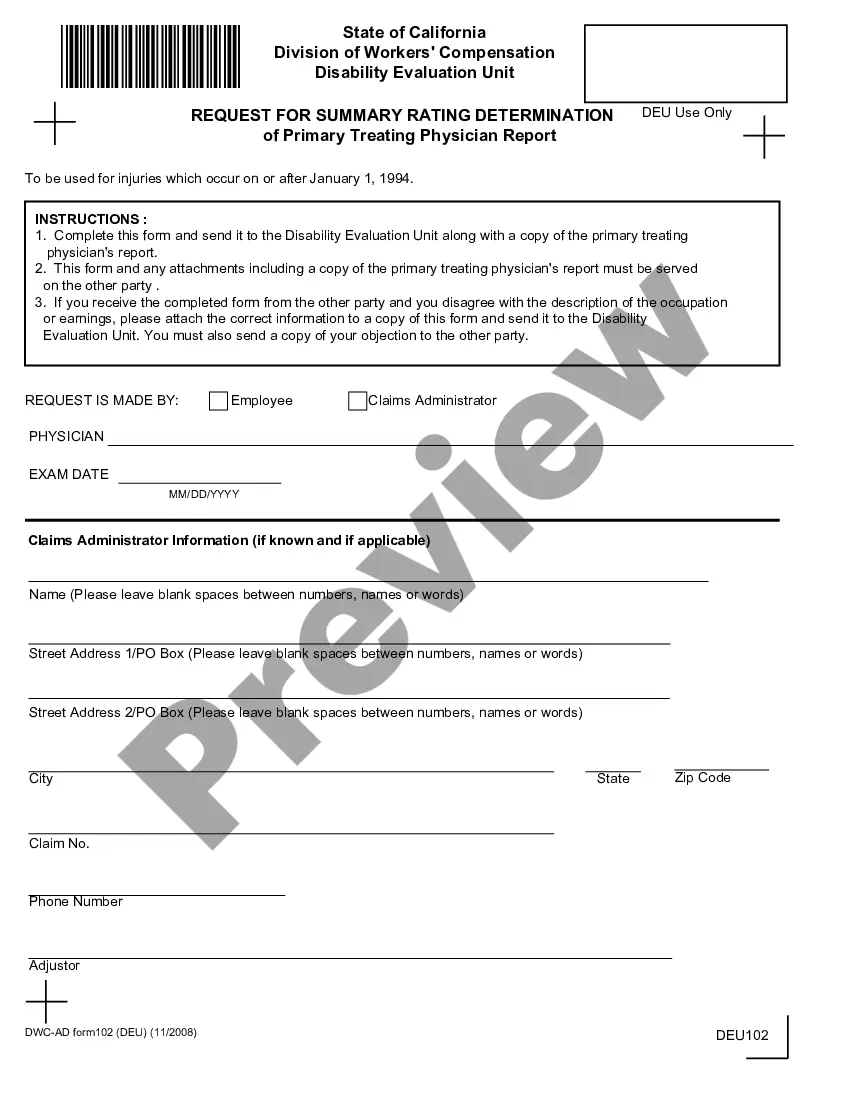

Finding the correct legal document template can be a challenge. Naturally, there are many templates available online, but how can you find the legal form you need? Use the US Legal Forms website. This service offers thousands of templates, including the Indiana Private Annuity Agreement, which can be utilized for both business and personal purposes. All forms are reviewed by experts and meet state and federal requirements.

If you are already registered, Log In to your account and click the Download button to access the Indiana Private Annuity Agreement. Use your account to look through the legal forms you may have acquired previously. Visit the My documents tab of your account to retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are some simple steps to follow: First, ensure you have selected the correct form for your state/city. You can browse the form using the Review button and check the form summary to confirm it suits your needs. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are confident that the form is accurate, click the Get now button to obtain the form.

- Select the pricing plan you prefer and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

- Select the document format and download the legal document template to your device.

- Complete, modify, print, and sign the obtained Indiana Private Annuity Agreement.

- US Legal Forms is indeed the largest collection of legal forms where you can find various document templates.

- Use the service to download properly designed documents that comply with state regulations.

Form popularity

FAQ

To achieve a monthly income of $1,000 from an annuity, you might need to invest somewhere between $200,000 and $300,000, depending on factors like interest rates and payout duration. It’s crucial to evaluate these components carefully to ensure your financial goals align. An Indiana Private Annuity Agreement can guide you through this planning process efficiently.

The monthly payment on a $100,000 annuity often depends on a few factors, including the interest rate and the duration of the payout. Generally, an annuity might provide payments ranging from $400 to $600 a month based on these variables. To get precise figures, consider using an Indiana Private Annuity Agreement to explore personalized scenarios and outcomes.

A portion of pension and annuity income is taxable in Indiana but payments from life insurance policies are not considered taxable income. Income from rental properties, dividends, interest, and royalties is taxable in Indiana.

Insuring the life of the transferee is an available option; however, any connection of the life insurance policy to the private annuity will be deemed as a secured transaction.

Each annuity payment is treated as part tax-free return of basis, part capital gain, and part ordinary income until your entire basis is recovered. Once your basis is recovered, the entire annuity is treated as part capital gain and part ordinary income until you have surpassed your life expectancy.

After an annuitant dies, insurance companies distribute any remaining payments to beneficiaries in a lump sum or stream of payments. It's important to include a beneficiary in the annuity contract terms so that the accumulated assets are not surrendered to a financial institution if the owner dies.

A private annuity is a special agreement in which an individual (annuitant) transfers property to an obligor. The obligor agrees to make payments to the annuitant according to an agreed-upon schedule in exchange for the property transfer.