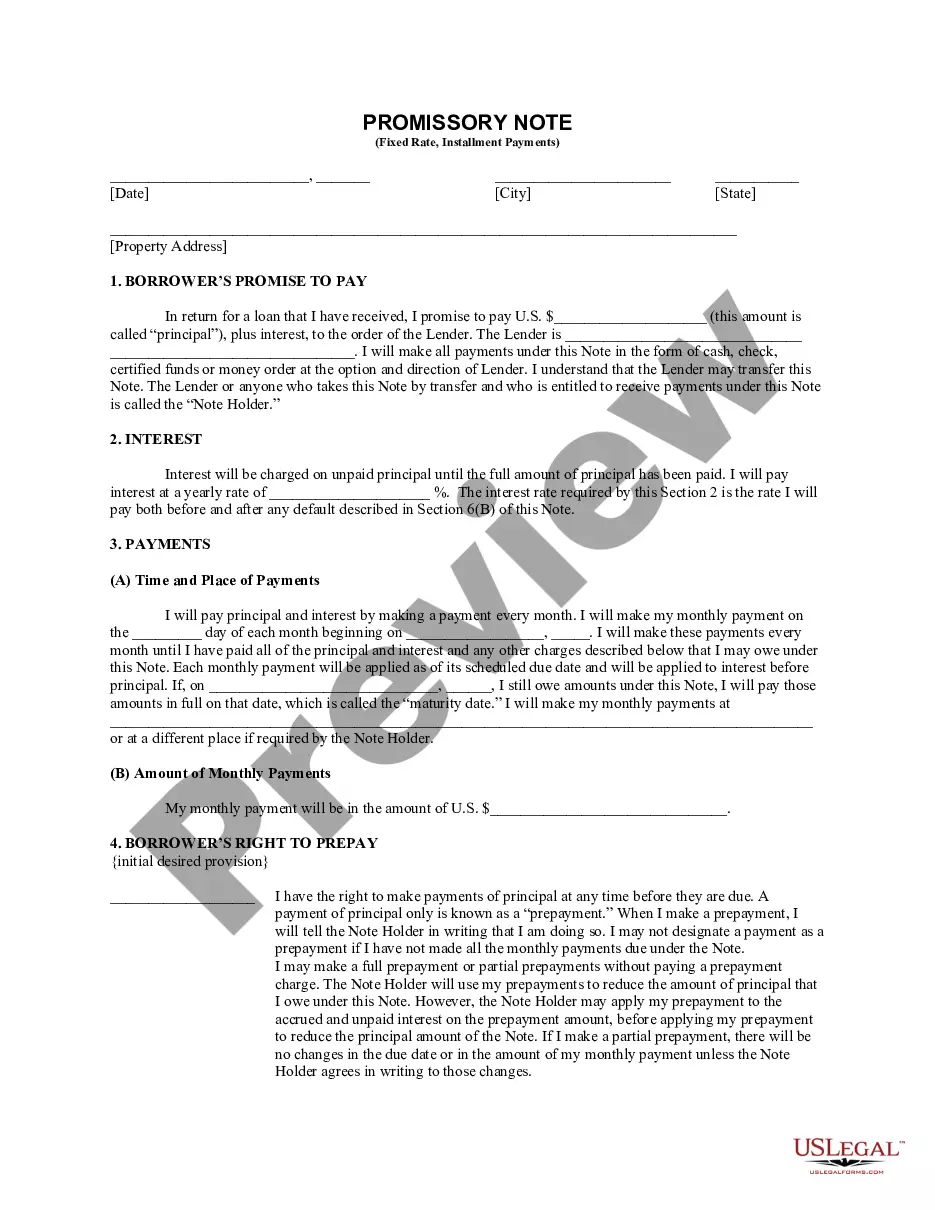

The Indiana Employee Lending Agreement refers to a legally binding contract between an employer and an employee within the state of Indiana. This agreement outlines the terms and conditions under which an employer may provide financial assistance or lend money to an employee, typically for personal or emergency purposes. The purpose of such an agreement is to establish clear guidelines and protect the interests of both parties involved. Keywords: Indiana, employee lending agreement, financial assistance, money lending, employer, employee, contract, terms and conditions, personal purposes, emergency purposes, guidelines, interests. In Indiana, there may be different types of employee lending agreements based on various factors, such as the specific terms and purpose of the loan. Some common types could include: 1. Emergency Loan Agreement: This type of agreement is used when an employee urgently requires financial assistance, such as in the event of an unexpected medical expense or a sudden financial crisis. The agreement would outline the loan amount, repayment terms, and any applicable interest rates or fees. 2. Education Loan Agreement: In some cases, employers may offer educational support to their employees by providing loans to fund their further education or professional development. This type of agreement would specify the loan amount, repayment terms, and any conditions related to the employee's continued employment with the company. 3. Relocation Loan Agreement: When an employee is required to relocate for work purposes, employers may offer a relocation loan to assist with the expenses associated with moving. The agreement would detail the loan amount, repayment terms, and any conditions related to the employee's tenure at the new location. 4. Employee Assistance Loan Agreement: This type of agreement could encompass various financial assistance provided by the employer for personal reasons, such as home repairs, debt consolidation, or unexpected expenses. The terms and conditions of the agreement would be specific to the nature of the loan. 5. Employee Purchase Loan Agreement: In some cases, employers may provide loans to employees to facilitate the purchase of specific items or services, such as a vehicle or significant household appliances. This type of agreement would outline the loan amount, repayment terms, interest rates, and any conditions related to the use of funds. It is essential for both employers and employees to carefully review and understand the terms laid out in the Indiana Employee Lending Agreement before entering into such a financial arrangement. Consulting legal professionals or seeking guidance from human resources departments can ensure compliance with local laws and regulations, protecting the rights and interests of both parties involved in the agreement.

Indiana Employee Lending Agreement

Description

How to fill out Indiana Employee Lending Agreement?

You may commit time online searching for the authorized document design that suits the federal and state demands you require. US Legal Forms gives thousands of authorized forms which are evaluated by pros. It is possible to obtain or printing the Indiana Employee Lending Agreement from the assistance.

If you already possess a US Legal Forms accounts, you may log in and then click the Down load button. Following that, you may total, change, printing, or indicator the Indiana Employee Lending Agreement. Each and every authorized document design you purchase is yours forever. To have yet another version for any bought kind, proceed to the My Forms tab and then click the related button.

If you are using the US Legal Forms internet site the first time, adhere to the easy instructions beneath:

- Initial, be sure that you have selected the best document design for your state/town of your choice. Browse the kind description to make sure you have selected the correct kind. If accessible, use the Preview button to look from the document design too.

- If you want to locate yet another edition from the kind, use the Search field to get the design that meets your requirements and demands.

- When you have located the design you desire, just click Buy now to proceed.

- Choose the rates program you desire, type in your references, and sign up for your account on US Legal Forms.

- Complete the purchase. You can utilize your bank card or PayPal accounts to fund the authorized kind.

- Choose the format from the document and obtain it in your device.

- Make alterations in your document if required. You may total, change and indicator and printing Indiana Employee Lending Agreement.

Down load and printing thousands of document web templates using the US Legal Forms web site, that offers the biggest assortment of authorized forms. Use skilled and status-certain web templates to handle your small business or specific requirements.

Form popularity

FAQ

INDIANA NO LONGER HAS SEPARATE COUNTY TAX RATES FOR RESIDENTS AND NON-RESIDENTS.

As an employer, you must pay careful attention to the local taxes where your employees work. If the tax is a withholding tax, local tax laws require you to withhold the tax from employee wages and remit it. But if the tax is an employer tax, you must pay it.

Indiana Tax Identification NumberYou can find your Tax Identification Number on any mail you have received from the Department of Revenue.If you're unsure, contact the agency at (317) 233-4016.

Indiana employers are required to withhold both state and county taxes from employees' wages, generally. Employers have to register to withhold tax in Indiana and must have an Employer Identification Number issued by the federal government.

Purpose: Form BT-1 is an application used when registering with the Indiana Department of Revenue for Sales Tax, Withholding Tax, Out-of-State Use Tax, Food & Beverage Tax, County Innkeepers Tax, Motor Vehicle Rental Excise Tax, and Prepaid Sales Tax on Gasoline, or a combination of these taxes.

This is common for an employer to not withhold local tax, if the city you work in does not have a tax; even though the city you live in does have a tax.

COMPOSITE WITHHOLDING PAYMENTS (FORM IT-6WTH) Amounts withheld from nonresident owners included in the composite return should be remitted. with Form IT-6WTH. Payment is due the 15th day of the 4th month following the close of the pass. through entity's tax period.

To register for withholding for Indiana, the business must have an Employer Identification Number (EIN) from the federal government. In addition, the employer should look at Departmental Notice #1 that details the withholding rates for each of Indiana's 92 counties.

The WH-1 is the Indiana Withholding Tax Form and is required for any business that is withholding taxes from its employees. When completed correctly, this form ensures that a business's withholding taxes by county are reported accurately and timely.

The WH-3 (Annual Withholding Reconciliation Form) is a reconciliation form for the amount of state and county income taxes withheld throughout the year. All employers must file the WH-3 by January 31 each year.