The Indiana Agreement for Sale of Assets of Corporation is a legally binding document that outlines the terms and conditions governing the sale of assets of a corporation in the state of Indiana. This agreement allows corporations to transfer their assets to another party in exchange for monetary compensation or other forms of consideration. The agreement typically begins with the identification of the selling corporation and the purchasing party, along with their respective addresses and contact information. It may also include a preamble that provides an overview of the transaction and the parties' intentions. Key provisions of the Indiana Agreement for Sale of Assets of Corporation include the description of the assets being sold, the purchase price or consideration to be paid, and any specific terms and conditions of the sale. The agreement may cover various types of assets, such as tangible assets (e.g., real estate, equipment, inventory) and intangible assets (e.g., intellectual property, contracts, goodwill). Additionally, the agreement may address several aspects of the sale, such as representations and warranties made by both parties, any necessary consents or approvals from third parties, and the allocation of risk between the parties. This can include provisions related to indemnification, liability limitations, and dispute resolution mechanisms. In Indiana, there are different types of Agreement for Sale of Assets of Corporation that can be used based on specific circumstances. These may include: 1. Stock Purchase Agreement: This type of agreement focuses on the purchase and sale of the corporation's stock rather than its assets. It involves the transfer of ownership and control of the corporation. 2. Asset Purchase Agreement: This agreement concentrates on the transfer of specific assets from the selling corporation to the buyer. Unlike a stock purchase agreement, this type of agreement allows the buyer to select the specific assets they wish to acquire. 3. Merger Agreement: In cases where two corporations combine to form a single entity, a merger agreement is used. It outlines the terms and conditions of the merger, including the treatment of the assets of both parties involved. Regardless of the type of agreement used, it is crucial to consult with legal professionals familiar with Indiana state laws to ensure compliance with all relevant regulations and to tailor the agreement to meet the specific needs of the parties involved. This can help protect the parties' respective interests and facilitate a smooth and fair transaction.

Indiana Agreement for Sale of Assets of Corporation

Description

How to fill out Indiana Agreement For Sale Of Assets Of Corporation?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

On the website, you will obtain thousands of forms for business and personal purposes, categorized by categories, states, or keywords. You can find the latest versions of forms like the Indiana Agreement for Sale of Assets of Corporation within moments.

If you already have an account, Log In and download the Indiana Agreement for Sale of Assets of Corporation from the US Legal Forms collection. The Download button will appear on each form you view. You have access to all previously downloaded forms in the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, and print/sign the downloaded Indiana Agreement for Sale of Assets of Corporation.

- If you are new to US Legal Forms, here are straightforward instructions to get started:

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

- Read the form description to verify you have chosen the correct form.

- If the form doesn't meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you want and enter your details to register for an account.

Form popularity

FAQ

Doing business in Indiana can include having a physical presence, employing staff, or generating revenue from sources within the state. Even if your main operations are elsewhere, any significant activities in Indiana can trigger state taxation and compliance requirements. Understanding these parameters is essential, especially when entering into agreements like the Indiana Agreement for Sale of Assets of Corporation.

Starting a corporation in Indiana involves choosing a unique name, filing Articles of Incorporation with the Secretary of State, and creating corporate bylaws. After this, you will need to apply for an Employer Identification Number (EIN) from the IRS. Leveraging the Indiana Agreement for Sale of Assets of Corporation can help streamline transactions once your corporation is established.

Yes, Indiana has a bulk sales law that requires a seller to notify creditors when selling a substantial portion of their assets. This law is designed to protect creditors from potential losses. Understanding this law is crucial if you plan to use an Indiana Agreement for Sale of Assets of Corporation, as it can affect the transaction's validity.

Writing a simple business contract involves clearly stating the purpose of the agreement, the parties' names, and the terms of the transaction. Use straightforward language to describe the obligations, payment terms, and any timelines, bearing in mind the stipulations of an Indiana Agreement for Sale of Assets of Corporation. Efficient communication is key, so ensure each point is easily understood. Regularly review and revise your contract to keep it relevant and enforceable.

To write a contract for selling your business, begin by detailing the assets included in the sale, like equipment, inventory, and intellectual property. Incorporate the terms of the sale, including payment structure and timelines, using an Indiana Agreement for Sale of Assets of Corporation as a model. Ensure all parties involved understand their obligations to create a solid agreement. Consider seeking assistance from professionals to ensure your contract complies with legal standards.

An asset sale differs from an assignment. In an asset sale, the ownership of specific assets is transferred from one party to another, while an assignment typically refers to the transfer of rights under a contract. If you are considering an Indiana Agreement for Sale of Assets of Corporation, it's essential to clearly outline which assets are included in the sale. This clarity helps avoid misunderstandings and legal issues, ensuring a smooth transaction.

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

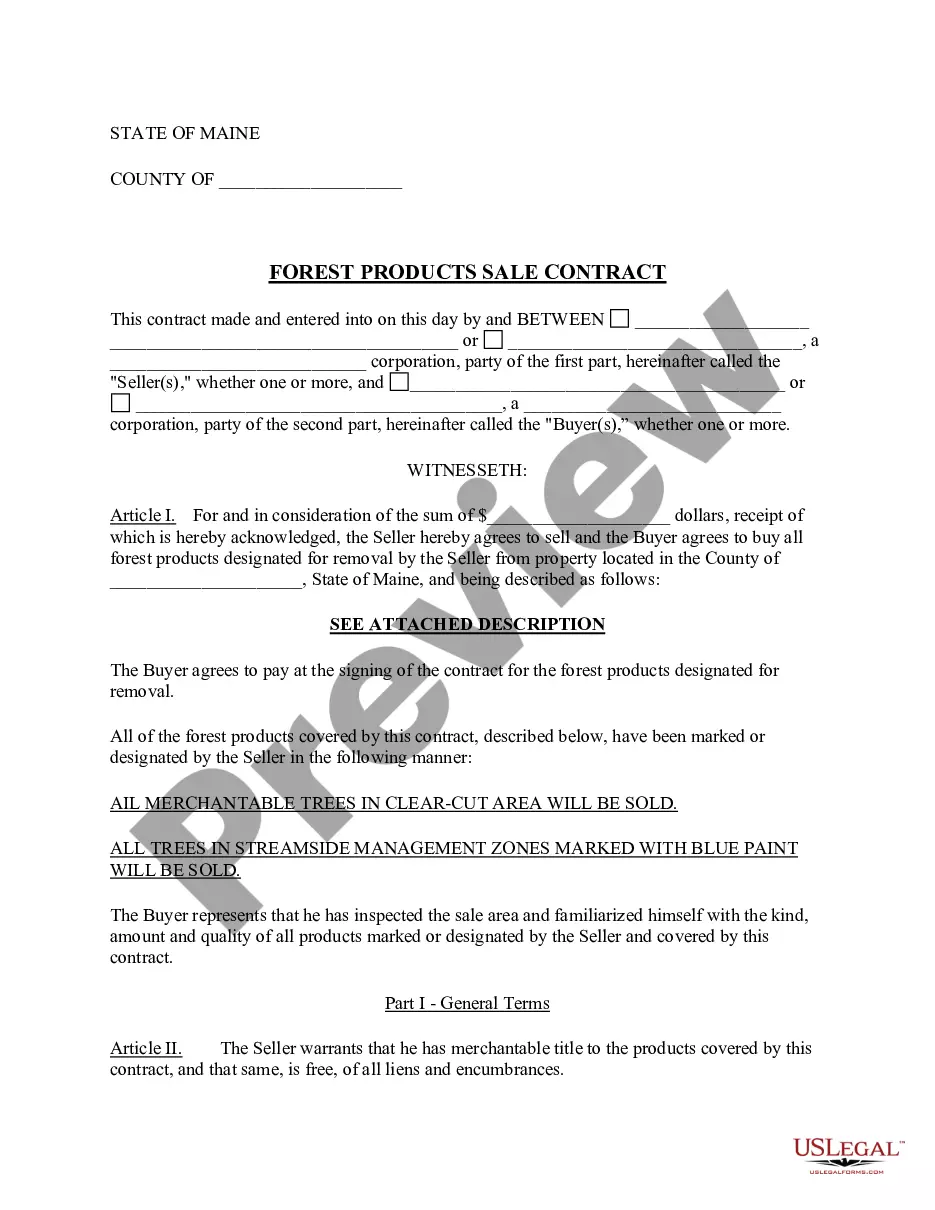

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

The parties shall keep this Agreement and its terms confidential, but any party may make such disclosures as it reasonably considers are required by law or necessary to obtain financing.

Interesting Questions

More info

Re PROXY MED Florida Corporation, Purchase and Sale of Computer Equipment dated June 14, 2012, PURCHASE AND SALE OF COMPUTER EQUIPMENT BY PROXY MED Florida Corporation, Purchase and Sale of Computer Components dated June 14, 2012, PURCHASE AND SALE OF COMPUTER EQUIPMENT BY PROXY MED Florida Corporation, Purchase and Sale of Computer Software dated June 14, 2012, PURCHASE AND SALE OF COMPUTER COMPONENTS AND SOFTWARE BY PROXY MED Florida Corporation, Purchase and Sale of Computer Software and Computer Components and Computer Software for a Business Operating a Solar Wind Power Plant dated June 14, 2012, PURCHASE AND SALE OF COMPONENTS AND SOFTWARE BY PROXY MED Florida Corporation, Purchase and Sale of Computer Software for an Environmental Control Company dated June 14, 2012, PURCHASE AND SALE OF COMPONENTS AND SOFTWARE BY PROXY MED Florida Corporation, Purchase and Sale of Computer Software for a Business Operating a Solar Wind Power Plant dated June 14, 2012, PURCHASE AND SALE OF