Indiana Guaranty with Pledged Collateral is a legal agreement that ensures repayment of a loan or debt by providing a guarantee backed by collateral. This arrangement is commonly used in various financial transactions where an individual or business entity seeks additional security for a loan. The main purpose of the Indiana Guaranty with Pledged Collateral is to protect the lender in case the borrower defaults on the loan. By requiring collateral to be pledged, lenders ensure that they have a tangible asset that can be sold or liquidated to recover their losses. In Indiana, there are several types of Guaranty with Pledged Collateral that vary depending on the nature of the loan and the type of collateral used. Here are some common types: 1. Real Estate Guaranty: This type of guaranty involves pledging real property, such as land or buildings, as collateral. The value of the real estate is assessed, and the lender may place a lien on the property to secure the loan. 2. Equipment Guaranty: In this type of guaranty, specific equipment or machinery is pledged as collateral. The lender evaluates the value and condition of the equipment and may take possession or place a lien on it to protect their interests. 3. Inventory Guaranty: Borrowers may pledge their inventory, including finished products or raw materials, as collateral. The lender assesses the value of the inventory and may require periodic audits to ensure its continued existence and worth. 4. Accounts Receivable Guaranty: This type of guaranty involves using accounts receivable, which are outstanding customer invoices, as collateral. Lenders may evaluate the creditworthiness of the debtor and discount the value of the receivables when determining the loan amount. It's important to note that the terms and conditions of Indiana Guaranty with Pledged Collateral can vary based on the agreement between the lender and the borrower. Additionally, the lender may require additional guarantees or stipulations to further secure the loan. In conclusion, Indiana Guaranty with Pledged Collateral is a legal arrangement that provides lenders with additional security by requiring borrowers to pledge collateral. Through this arrangement, various types of assets, such as real estate, equipment, inventory, or accounts receivable, are used as collateral to protect the lender's interests.

Indiana Guaranty with Pledged Collateral

Description

How to fill out Indiana Guaranty With Pledged Collateral?

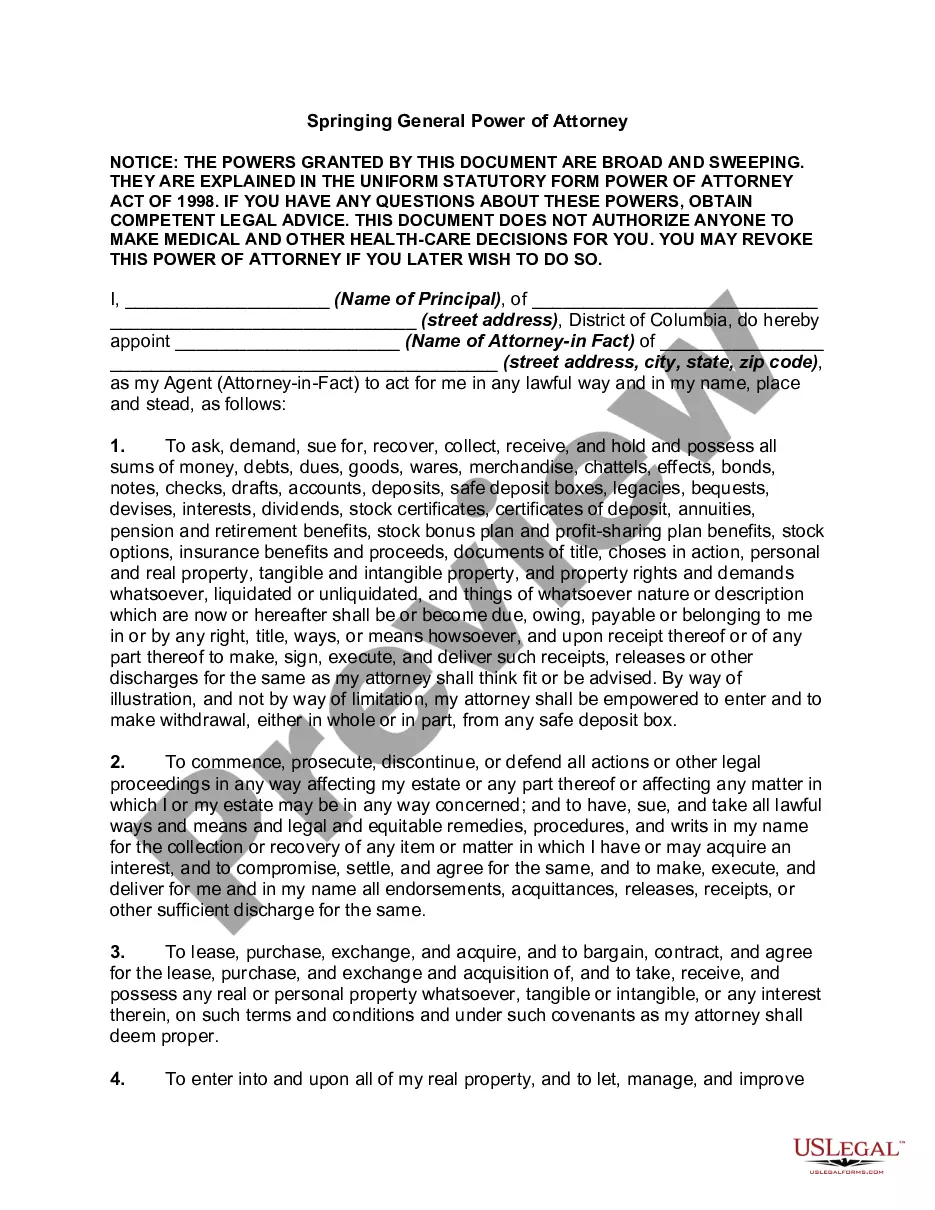

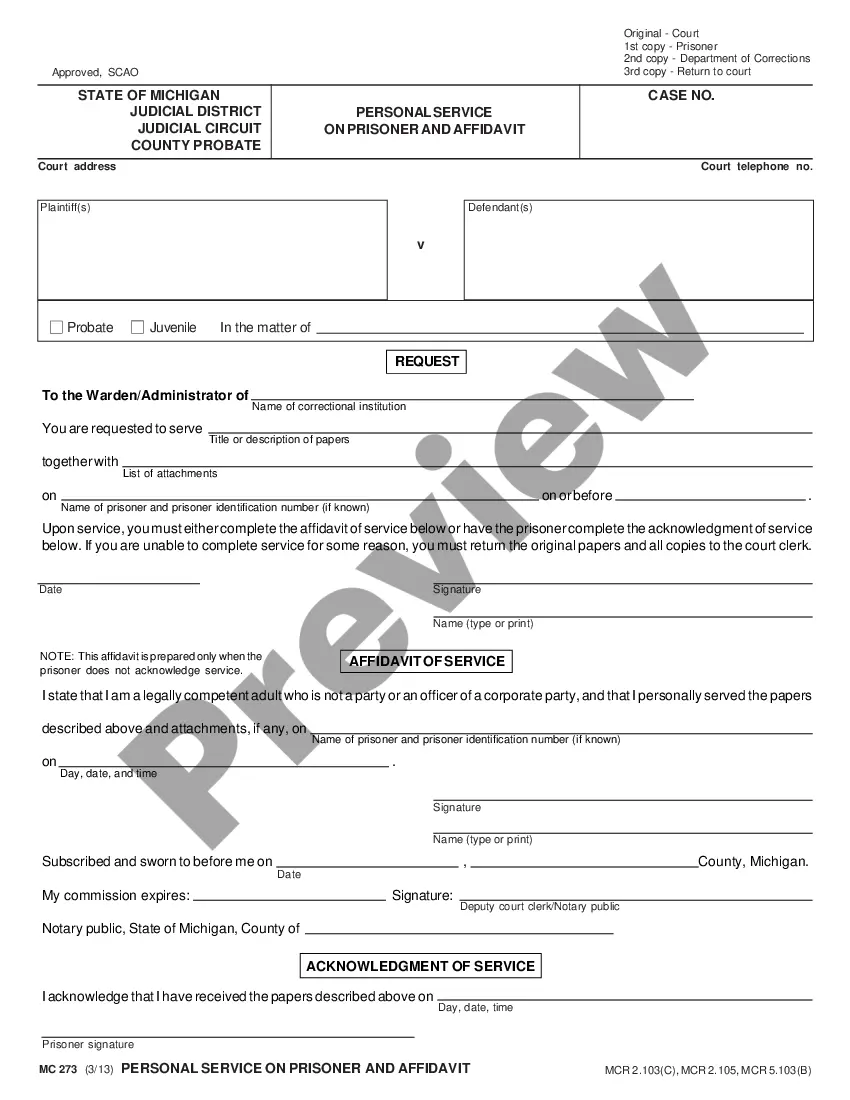

Have you been in a place in which you will need papers for either organization or personal functions nearly every day time? There are plenty of authorized record web templates accessible on the Internet, but locating types you can depend on isn`t simple. US Legal Forms gives a huge number of type web templates, such as the Indiana Guaranty with Pledged Collateral, which are published to fulfill state and federal demands.

In case you are currently knowledgeable about US Legal Forms site and also have a merchant account, merely log in. Following that, you are able to obtain the Indiana Guaranty with Pledged Collateral design.

Unless you provide an bank account and need to start using US Legal Forms, adopt these measures:

- Discover the type you need and make sure it is for that proper city/state.

- Use the Preview switch to review the shape.

- Browse the outline to ensure that you have selected the right type.

- In the event the type isn`t what you`re trying to find, take advantage of the Research industry to discover the type that meets your needs and demands.

- Once you find the proper type, click Buy now.

- Choose the rates program you need, submit the necessary info to make your money, and buy your order utilizing your PayPal or credit card.

- Select a hassle-free file structure and obtain your version.

Get all of the record web templates you possess purchased in the My Forms menus. You can aquire a additional version of Indiana Guaranty with Pledged Collateral any time, if necessary. Just click the required type to obtain or print the record design.

Use US Legal Forms, the most extensive collection of authorized kinds, to conserve efforts and prevent mistakes. The support gives skillfully created authorized record web templates that you can use for a selection of functions. Generate a merchant account on US Legal Forms and initiate producing your way of life a little easier.

Form popularity

FAQ

Guarantee vs collateral what's the difference? A personal guarantee is a signed document that promises to repay back a loan in the event that your business defaults. Collateral is a good or an owned asset that you use toward loan security in the event that your business defaults.

An agreement typically used to create a security interest in equity interests (including capital stock, LLC interests, and partnership interests) and promissory notes.

A secured line of credit is guaranteed by collateral, such as a home. An unsecured line of credit is not guaranteed by any asset; one example is a credit card.

As nouns the difference between pledge and guaranty is that pledge is a solemn promise to do something while guaranty is (legal) an undertaking to answer for the payment of some debt, or the performance of some contract or duty, of another, in case of the failure of such other to pay or perform; a warranty; a security.

Types of CollateralReal estate.Cash secured loan.Inventory financing.Invoice collateral.Blanket liens.

Pledge Guaranty means that Guaranty of the Debt, dated as of the date hereof, by Pledgor in Lender's favor, as it may be amended, restated, replaced, supplemented or otherwise modified from time to time, and which is secured by the Pledge Agreement.

Collateral is simply an asset, such as a car or home, that a borrower offers up as a way to qualify for a particular loan. Collateral can make a lender more comfortable extending the loan since it protects their financial stake if the borrower ultimately fails to repay the loan in full.

A secured personal loan is backed by collateral. If the borrower defaults, the lender can collect the collateral. For this reason, secured loans tend to offer better rates than unsecured loans.

The purpose of a guarantee or pledge given as collateral for a loan is to safeguard repayment of the loan to the lender, i.e. the creditor. Although the loan decision is primarily based on the loan applicant's ability to pay, the collateral provided as security for the repayment of the loan is also important.

More Definitions of Collateral Guarantee Collateral Guarantee means a guarantee and indemnity to be executed by the Collateral Guarantor in favour of the Lender in form and substance acceptable to the Lender in all respects.