Indiana Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Are you currently in the situation where you need files for either organization or specific purposes virtually every working day? There are tons of lawful papers web templates accessible on the Internet, but finding ones you can trust is not effortless. US Legal Forms offers 1000s of develop web templates, like the Indiana Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, which are created to meet state and federal requirements.

Should you be presently acquainted with US Legal Forms internet site and get your account, simply log in. After that, you are able to obtain the Indiana Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse design.

Unless you offer an profile and need to begin using US Legal Forms, adopt these measures:

- Get the develop you will need and make sure it is for that right city/region.

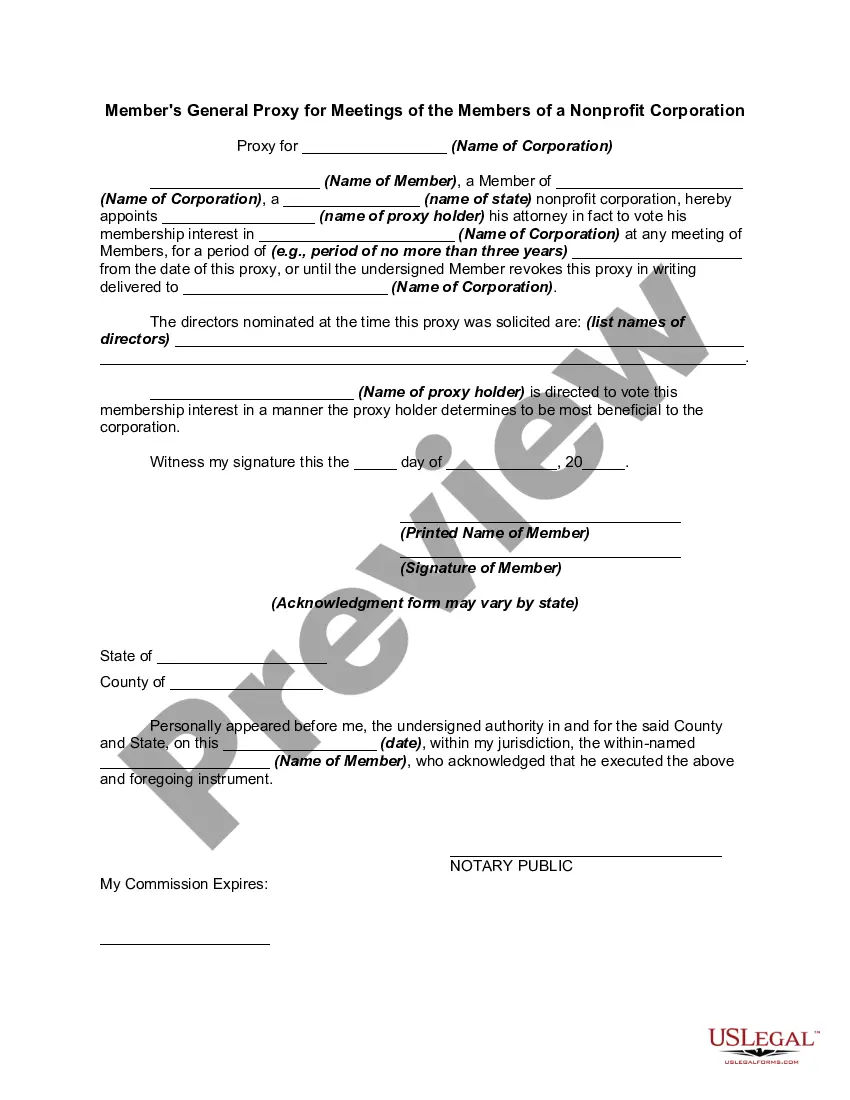

- Utilize the Preview button to analyze the shape.

- Read the information to actually have selected the proper develop.

- In case the develop is not what you are searching for, make use of the Look for field to find the develop that fits your needs and requirements.

- If you get the right develop, click Acquire now.

- Opt for the prices plan you desire, fill in the desired information and facts to generate your bank account, and buy the order utilizing your PayPal or Visa or Mastercard.

- Pick a convenient paper file format and obtain your version.

Discover all the papers web templates you possess bought in the My Forms food selection. You can aquire a extra version of Indiana Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse at any time, if possible. Just go through the necessary develop to obtain or print the papers design.

Use US Legal Forms, the most considerable variety of lawful varieties, to save some time and prevent mistakes. The services offers professionally made lawful papers web templates that you can use for a variety of purposes. Generate your account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

In order to qualify the trust instrument must provide that at least one trustee be a United States citizen or domestic corporation, and that any distribution from the trust principal be subject to the United States trustee's right to withhold the estate tax due on the distribution.

To qualify as a spousal trust, the beneficiary spouse must be entitled to receive all of the income earned in the trust during their lifetime. This means that your spouse must have a legal right to enforce payment of the income and no one can withhold it from them.

An example of when a marital trust might be used is when a couple has children from a previous marriage and wants to pass all property to the surviving spouse upon death, but also provide for their individual children.

Marital deduction refers to exceptions to gift and estate taxes for transfers made to spouses. Almost all property qualifies for this deduction and there is no limit. The deduction does not avoid taxes completely, but rather, the spouse receiving the property must pay the eventual estate taxes.

RESIDUARY TRUST. Unlike the Marital Trust, the Residuary Trust can provide for substantial flexibility and give broader discretion to the Trustee. This trust may be structured as a single trust for the benefit of all your descendants or separate trusts for each of your children (and such child's descendants).

The marital deduction is determinable from the overall gross estate. The total value of the assets passed on to the spouse is subtracted from that amount, giving us the marital deduction. This interspousal transfer can occur during the couple's lifetime or after one spouse's death, ing to a will.

A trust set up in one spouse's name can be considered separate property regardless of whether it is set up before or after marriage.

Terminable interests do not qualify for the marital deduction (Sec. 2056(b)(1)). An example of a terminable interest is where the decedent leaves property to a surviving spouse for the spouse's lifetime, with a remainder interest to the decedent's children.