The Indiana Payroll Deduction Authorization Form is a legal document used by employers in the state of Indiana to obtain written consent from employees, allowing deductions to be made from their wages or salary. This form serves as a written agreement between the employee and the employer, outlining the specific deductions authorized by the employee. Keywords: Indiana, Payroll Deduction Authorization Form, employer, employees, written consent, deductions, wages, salary, written agreement. There are several types of Indiana Payroll Deduction Authorization Forms, depending on the nature of the deductions authorized. Some common types include: 1. Garnishment Deduction Form: This form is used when an employee's wages are being garnished by a court order to pay off debts such as child support, unpaid taxes, or student loans. 2. Retirement Deduction Form: This form is used when an employee elects to have a portion of their wages deducted and allocated towards a retirement savings plan, such as a 401(k) or IRA. 3. Employee Benefit Deduction Form: This form is used to authorize deductions for various employee benefits, such as health insurance premiums, dental or vision coverage, flexible spending accounts, or life insurance premiums. 4. Loan Repayment Deduction Form: This form is used when an employee agrees to have a specific amount deducted from their wages to repay a loan or advance given by the employer. 5. Charitable Contribution Deduction Form: This form is used when an employee wishes to authorize deductions from their wages to support charitable organizations or causes. It is important for both employers and employees to carefully review and understand the terms outlined in the Indiana Payroll Deduction Authorization Form before signing. This ensures that all authorized deductions are accurately and transparently reflected in the employee's paycheck, promoting trust and compliance with state regulations regarding wage deductions.

Indiana Payroll Deduction Authorization Form

Description

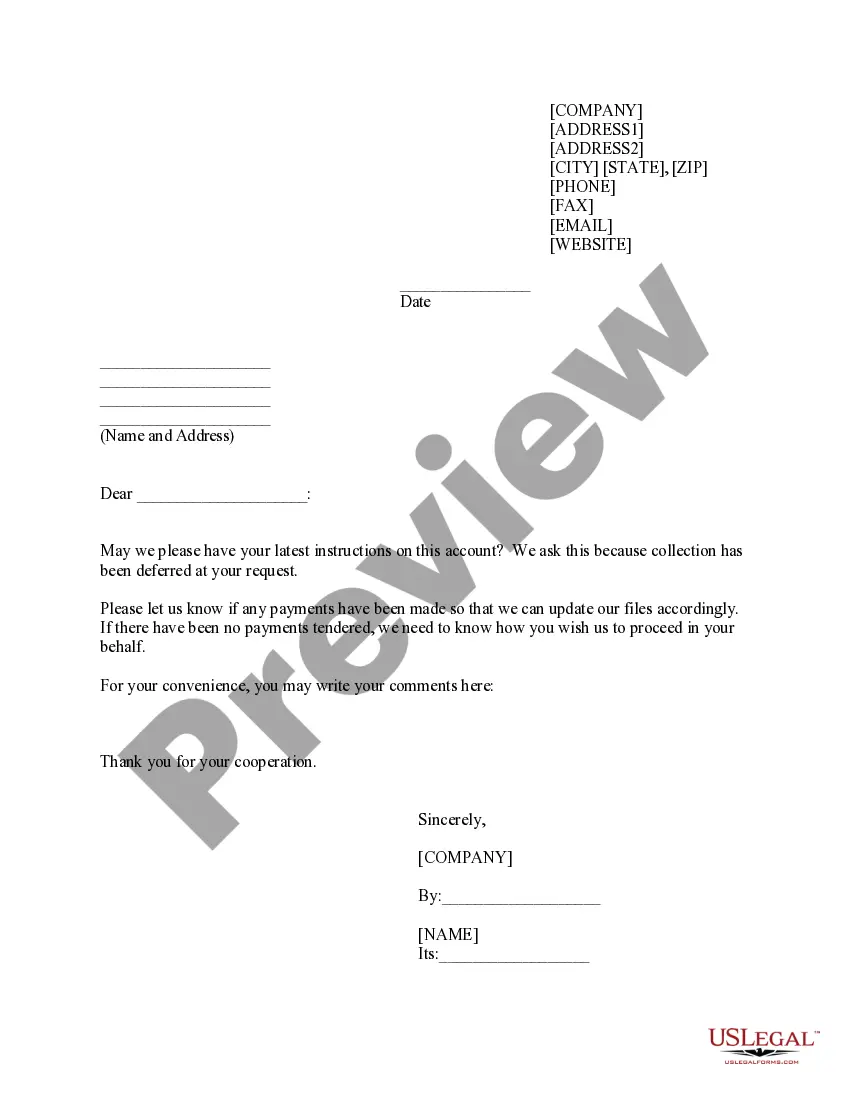

How to fill out Indiana Payroll Deduction Authorization Form?

Are you in the placement that you require paperwork for possibly enterprise or personal reasons nearly every day time? There are tons of lawful record layouts accessible on the Internet, but discovering ones you can depend on is not effortless. US Legal Forms delivers thousands of develop layouts, just like the Indiana Payroll Deduction Authorization Form, that happen to be written to satisfy federal and state specifications.

In case you are already familiar with US Legal Forms web site and have a merchant account, simply log in. Next, you can down load the Indiana Payroll Deduction Authorization Form web template.

Should you not come with an bank account and want to begin to use US Legal Forms, follow these steps:

- Get the develop you require and make sure it is for the appropriate city/region.

- Take advantage of the Preview option to examine the form.

- See the explanation to ensure that you have chosen the right develop.

- If the develop is not what you`re trying to find, utilize the Search area to find the develop that fits your needs and specifications.

- When you get the appropriate develop, click on Get now.

- Pick the pricing prepare you desire, fill in the desired information and facts to produce your bank account, and purchase your order with your PayPal or bank card.

- Decide on a practical data file formatting and down load your copy.

Discover all of the record layouts you may have purchased in the My Forms food selection. You can get a additional copy of Indiana Payroll Deduction Authorization Form whenever, if necessary. Just go through the required develop to down load or produce the record web template.

Use US Legal Forms, probably the most extensive collection of lawful kinds, in order to save time as well as avoid errors. The assistance delivers skillfully produced lawful record layouts that can be used for a variety of reasons. Create a merchant account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

The amount the employer withholds from an employee's gross pay for taxes, wage garnishment and company benefits are called payroll deductions. Some examples include 401(k) contributions, Medicare and Social Security tax, income tax and health insurance premiums.

For payroll purposes, deductions are divided into two types:Voluntary deductions.Involuntary (mandatory) deductions: taxes, garnishments, and fines.

Some of the types of deductions which are authorized under federal and state law include: meals, housing and transportation, debts owed the employer, debts owed to third parties (through the process of garnishment); debts owed to the government (such as back taxes and federally-subsidized student loans), child support

Employees wishing to cancel their deductions should contact their agency payroll office and request the allotment be cancelled.

Authorized deductions are limited to: deductions which the employer is required to withhold by law or court order; deductions for the reasonable cost of board, lodging, and facilities furnished to the employee; and.

Some mandatory payroll tax deductions that employers are required by law to withhold from an employee's paycheck include: Federal income tax withholding. Social Security & Medicare taxes also known as FICA taxes. State income tax withholding.

Examples of Payroll Deduction Plans401(k) plan, IRA, or other retirement savings plan contributions. Medical, dental, or vision health insurance plans. Flexible spending account or pre-tax health savings account contributions. Life insurance premiums (often sponsored by the employer)

Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax. Social security tax. 401(k) contributions.