The Indiana Resolution of Meeting of LLC Members to Borrow Specific Money is a legal document that outlines the process and details involved when an LLC decides to borrow a specific amount of money. This resolution is typically adopted during a meeting of the LLC's members and is an important step in obtaining financial resources for the company's operations, investments, or any other legitimate purposes. The resolution begins by stating the name of the LLC, followed by a clear declaration of the intent to borrow a specific sum of money. The amount of money to be borrowed must be specified in both numerical and written formats for clarity and accuracy. It is also crucial to include the purpose for which the funds will be used. Additionally, the resolution should identify the lender or financial institution from which the funds will be borrowed. This includes providing the name, address, and contact information of the lender to ensure the resolution's validity and transparency. The LLC members must ensure that the chosen lender is reputable and offers favorable terms and conditions for borrowing. Furthermore, the resolution must outline any specific terms or conditions agreed upon by the LLC members and the lender. These terms may include interest rates, repayment schedules, any collateral or guarantees required, and deadlines for repaying the borrowed amount. It is vital to carefully review and negotiate the terms to protect the interests of the LLC and its members. Regarding different types of Indiana Resolution of Meeting of LLC Members to Borrow Specific Money, there are no specific subcategories or variants under this name. However, variations may occur based on the unique circumstances of each LLC and the purpose for which the funds are borrowed. For instance, resolutions for short-term working capital loans may differ from those for long-term investments or specialized projects. In conclusion, the Indiana Resolution of Meeting of LLC Members to Borrow Specific Money is a crucial legal document that protects the interests of the LLC and its members when borrowing funds. It ensures transparency, facilitates communication with lenders, and provides clarity on the terms and purpose of the loan.

Indiana Resolution of Meeting of LLC Members to Borrow Specific Money

Description

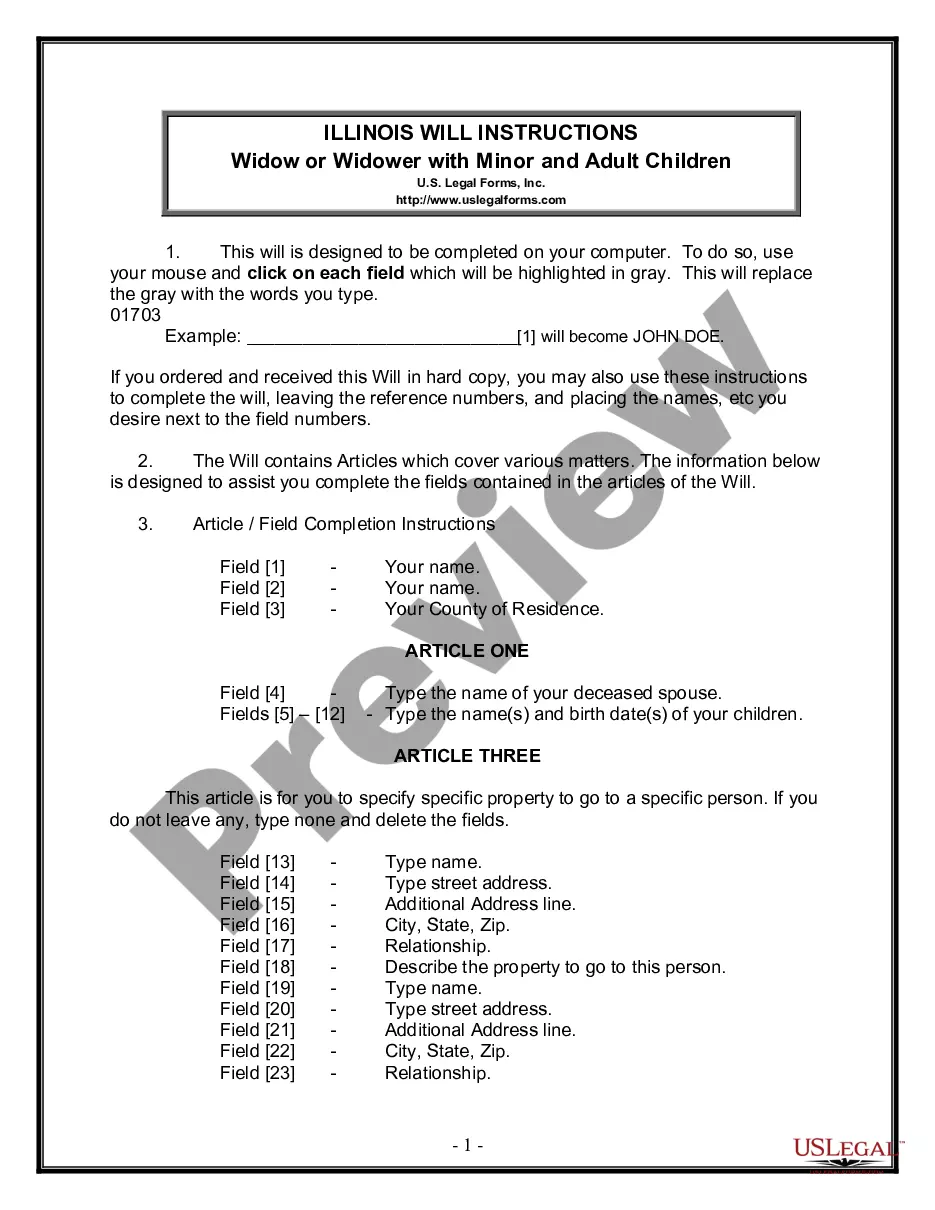

How to fill out Indiana Resolution Of Meeting Of LLC Members To Borrow Specific Money?

You can spend hours on the Internet trying to find the lawful papers format that fits the federal and state demands you need. US Legal Forms supplies a huge number of lawful forms that happen to be examined by professionals. It is possible to acquire or printing the Indiana Resolution of Meeting of LLC Members to Borrow Specific Money from my service.

If you have a US Legal Forms profile, you may log in and click the Obtain option. After that, you may comprehensive, revise, printing, or sign the Indiana Resolution of Meeting of LLC Members to Borrow Specific Money. Every lawful papers format you purchase is yours eternally. To have another backup associated with a purchased kind, proceed to the My Forms tab and click the related option.

If you are using the US Legal Forms site initially, keep to the basic recommendations listed below:

- First, be sure that you have selected the best papers format for your region/town that you pick. Browse the kind outline to make sure you have picked the appropriate kind. If accessible, make use of the Review option to check through the papers format as well.

- If you want to find another model in the kind, make use of the Lookup industry to obtain the format that suits you and demands.

- Upon having discovered the format you need, click Acquire now to proceed.

- Pick the rates strategy you need, key in your credentials, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your Visa or Mastercard or PayPal profile to pay for the lawful kind.

- Pick the structure in the papers and acquire it in your product.

- Make alterations in your papers if possible. You can comprehensive, revise and sign and printing Indiana Resolution of Meeting of LLC Members to Borrow Specific Money.

Obtain and printing a huge number of papers web templates making use of the US Legal Forms Internet site, which provides the biggest collection of lawful forms. Use professional and state-specific web templates to deal with your business or individual requires.

Form popularity

FAQ

A board resolution template is a manner of documenting decisions made by the company's Shareholders or Board of Directors. The decision can cover anything relevant to the affairs of the organization like a decision extending loans to other companies or when voting for a new member to join the board.

The banking resolution document is drafted and adopted by a company's members or Board of Directors to define the relationship, responsibilities and privileges that the members or directors maintain with respect to the company's banking needs.

RESOLVED THAT the company do hereby obtain and avail financial assistance/Credit facility of an amount not exceeding (Loan or Credit/Overdraft amount) from (Name, Branch and Address of the bank) in order to meet the (requirements of the company), and such loan shall be obtained on such terms and conditions as specified

When you create a resolution to authorize borrowing on a line of credit, you need to include the following information:The legal name of the corporation.The name of the bank where the corporation is authorized to borrow from.Maximum loan amount that may be borrowed from the bank.Interest rate (numerical)More items...

It is a legal document adopted by a corporation's board of directors containing information about the parties who may sign checks and borrow money from financial institutions. Borrowing resolutions are more commonly known as corporate resolutions.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

Loan Resolution means that certain Resolution adopted by the Board of the City on November 13, 2017, authorizing a loan under a loan agreement between the Borrower and the Issuer to finance the Project.

Letter of Resolution means a letter advising the party accused, and any person who, in writing informed or complained to the Executive Director concerning any such violation, that the alleged violation has been resolved and the manner by which it was resolved.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.