The Indiana Affidavit of No Coverage by Another Group Health Plan is a crucial document required for individuals seeking health insurance coverage. This affidavit serves as evidence that the individual does not have any existing health insurance coverage under another group health plan. This affidavit is particularly important for those individuals who are enrolling in a new health insurance plan and want to confirm that they are not double-covered. By providing this affidavit, individuals can signify that they are not currently benefiting from any other group health plan, thus avoiding potential conflicts in claims and billing. The Indiana Affidavit of No Coverage by Another Group Health Plan includes several essential details. It requires the individual's personal information such as full name, address, contact details, and social security number. Additionally, the document may request details about the employer or organization offering the group health plan, if applicable. The affidavit may also require the individual to provide information on any previous group health plan coverage they had and specify the termination date. This helps ensure that the individual doesn't have overlapping policies and allows the new health insurance provider to accurately assess their coverage options. It is important to note that there are no specific types of Indiana Affidavit of No Coverage by Another Group Health Plan. However, various insurance providers and organizations may have their own variations or specialized affidavits tailored to their specific requirements. It is advisable to consult with the insurance provider or employer to obtain the correct form needed to fulfill this requirement. In summary, the Indiana Affidavit of No Coverage by Another Group Health Plan is a vital document used during the enrollment process for new health insurance coverage. By providing this affidavit, individuals can affirm that they do not possess any other group health plan coverage, thus avoiding potential conflicts and ensuring accurate billing and claims processing.

Indiana Affidavit of No Coverage by Another Group Health Plan

Description

How to fill out Indiana Affidavit Of No Coverage By Another Group Health Plan?

Choosing the best authorized document web template could be a have difficulties. Obviously, there are a variety of themes accessible on the Internet, but how do you obtain the authorized type you need? Make use of the US Legal Forms website. The service offers thousands of themes, for example the Indiana Affidavit of No Coverage by Another Group Health Plan, that can be used for business and personal needs. Every one of the kinds are checked by specialists and satisfy state and federal needs.

In case you are currently listed, log in to the accounts and then click the Download button to obtain the Indiana Affidavit of No Coverage by Another Group Health Plan. Use your accounts to appear throughout the authorized kinds you may have ordered formerly. Proceed to the My Forms tab of your respective accounts and get one more backup of the document you need.

In case you are a whole new user of US Legal Forms, here are straightforward recommendations that you can stick to:

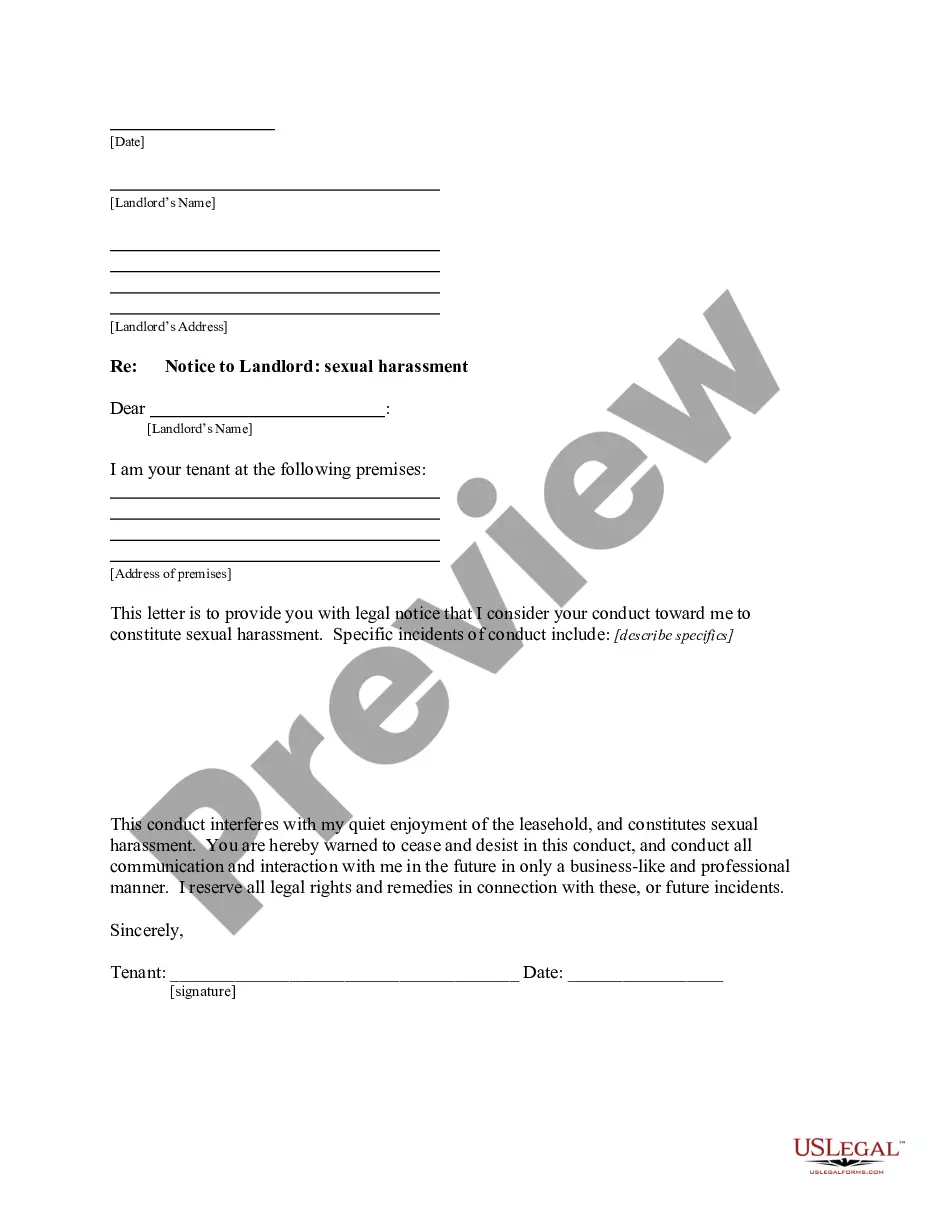

- First, ensure you have selected the proper type to your town/county. You are able to examine the shape making use of the Preview button and read the shape outline to guarantee this is basically the best for you.

- If the type fails to satisfy your preferences, make use of the Seach industry to discover the proper type.

- When you are positive that the shape is suitable, click the Get now button to obtain the type.

- Choose the pricing plan you desire and type in the needed information. Create your accounts and pay money for your order using your PayPal accounts or credit card.

- Opt for the file formatting and acquire the authorized document web template to the product.

- Complete, change and printing and indication the attained Indiana Affidavit of No Coverage by Another Group Health Plan.

US Legal Forms will be the biggest collection of authorized kinds for which you can see numerous document themes. Make use of the company to acquire professionally-produced documents that stick to state needs.